W2 Form Control Number – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unravel the Mystery: Understanding the W2 Form Control Number!

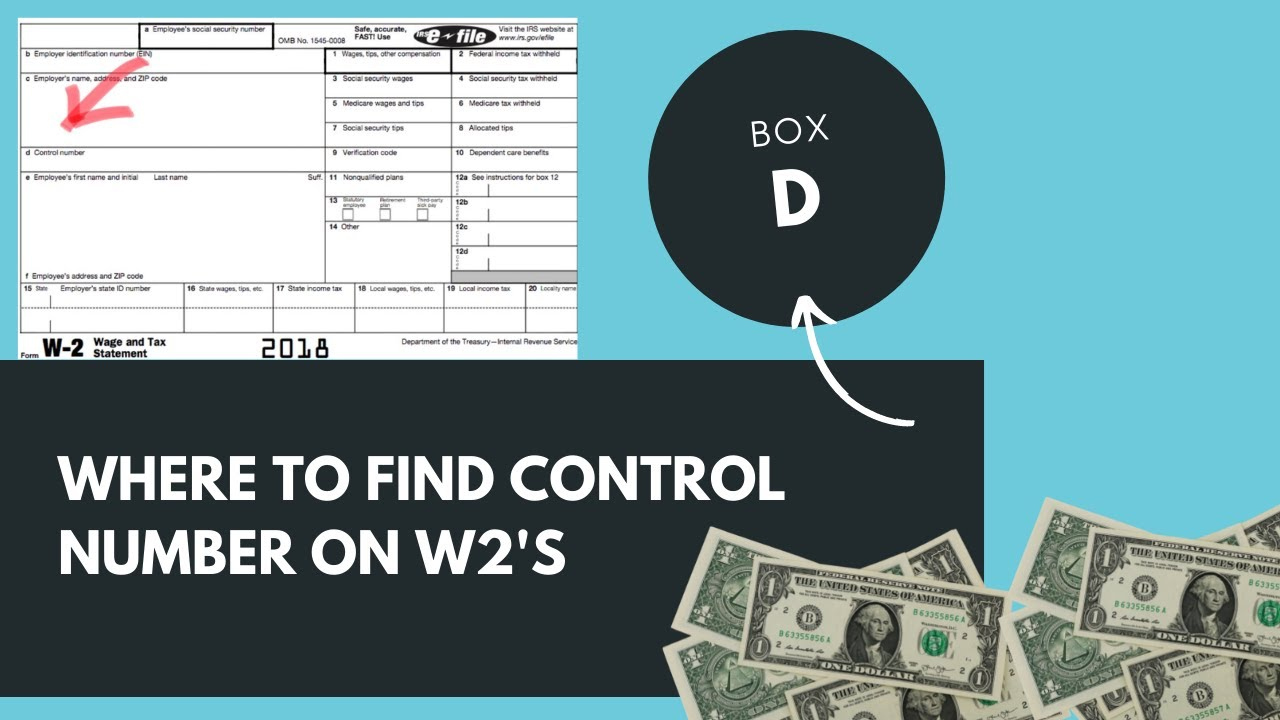

Have you ever received your W2 form and noticed a strange combination of numbers in the top right corner labeled as the control number? Fear not, as this seemingly cryptic code is actually a valuable piece of information that can help you and your employer keep track of your tax documents. The control number is a unique identifier assigned by the company preparing your W2 form and is used to ensure accuracy and prevent duplicate filings. So, let’s dive into the world of W2 form control numbers and unravel the mystery together!

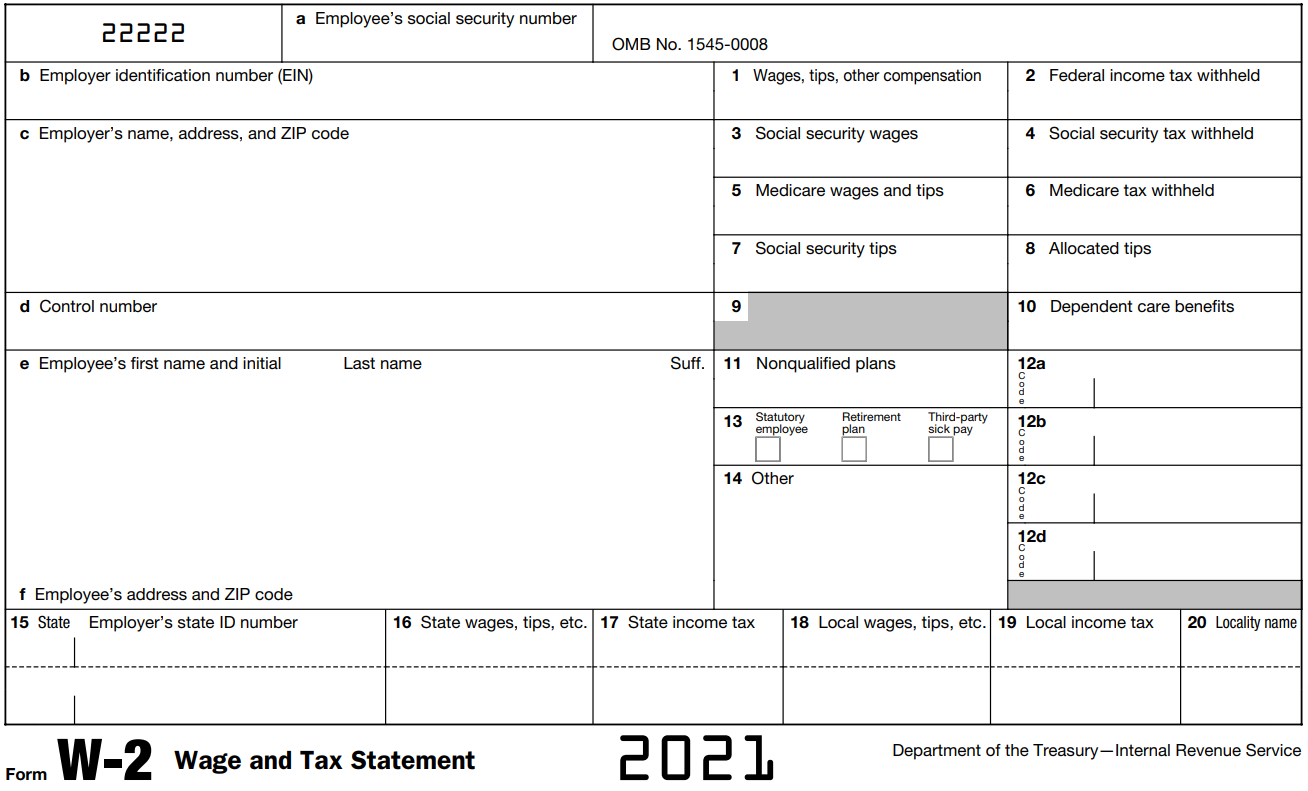

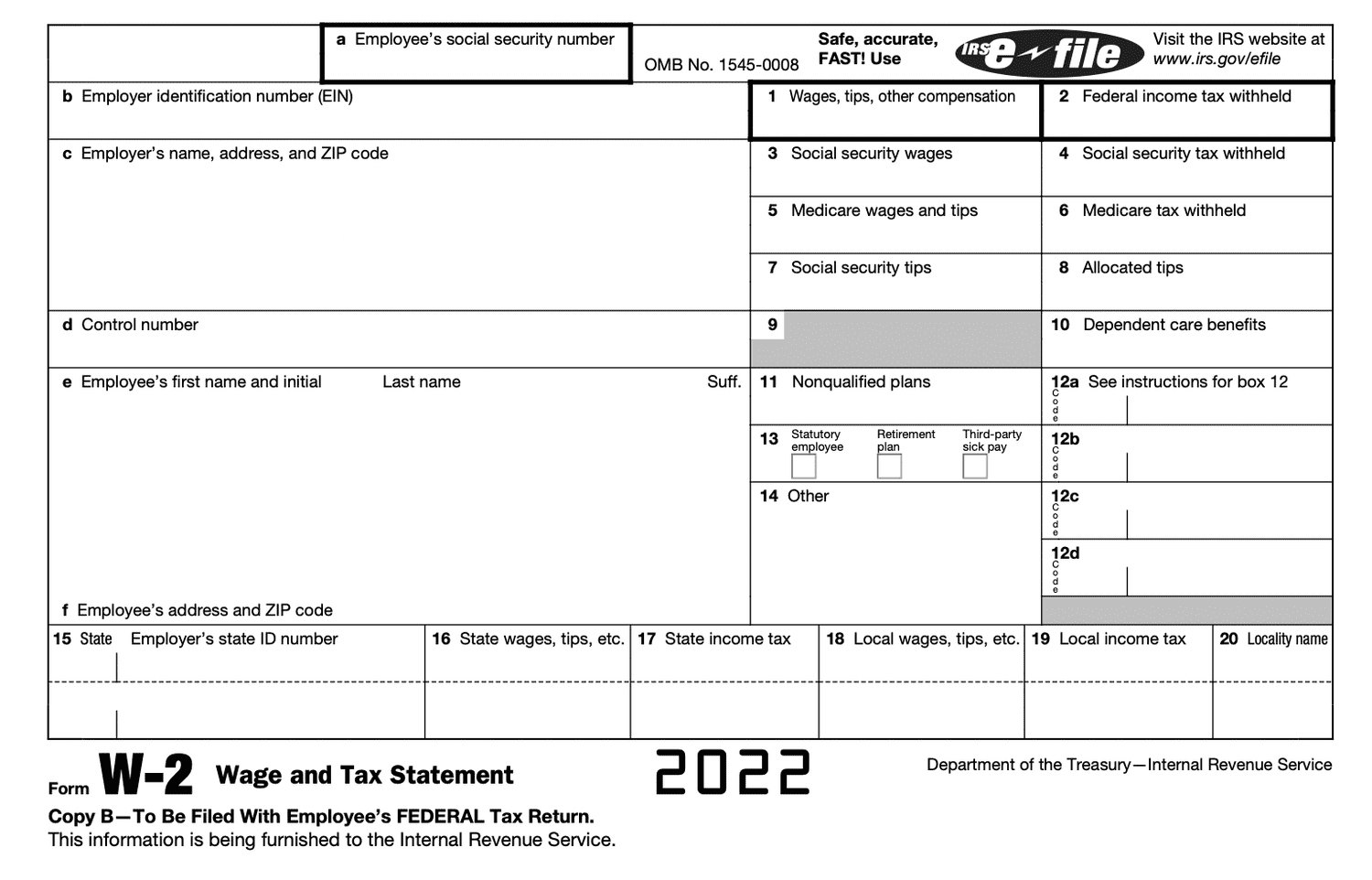

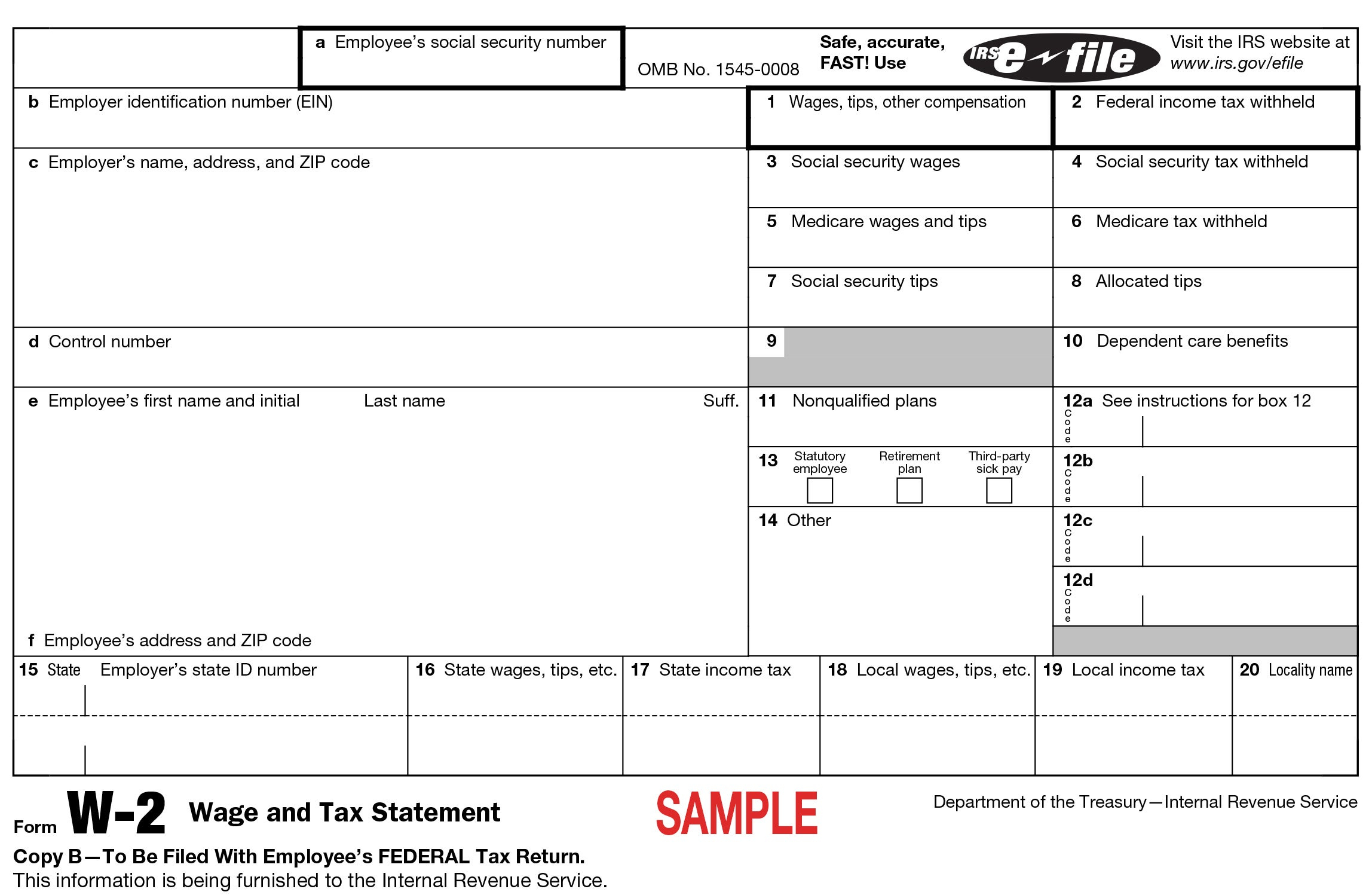

When you receive your W2 form, the control number is typically located in the top right corner, near your employer’s information. This number is not random, as it is generated by your employer’s payroll software to uniquely identify your specific W2 form. By understanding the structure and purpose of the control number, you can easily verify the authenticity of your W2 form and ensure that all the information provided is accurate. So next time you glance at that string of numbers, remember that it serves a crucial role in the tax filing process!

If you ever need to reference your W2 form for tax purposes, the control number can be a lifesaver. Whether you are filing your taxes online or consulting with a tax professional, having the control number handy can streamline the process and ensure that your tax information is easily accessible. By mastering the art of understanding the W2 form control number, you can feel confident in your ability to navigate the tax season with ease and accuracy. So, embrace the control number as your ally in the tax filing journey!

Mastering the Puzzle: Your Comprehensive Guide to the W2 Control Number!

To further decode the control number on your W2 form, it is important to note that each employer may have a different format for generating these unique identifiers. Some companies use a combination of letters and numbers, while others may stick to numerical sequences. Regardless of the format, the control number is designed to be easily distinguishable and should not be confused with any other identification numbers on your W2 form. By familiarizing yourself with your employer’s control number format, you can quickly locate and reference this important piece of information.

In addition to serving as a unique identifier for your W2 form, the control number can also help you track your tax documents more efficiently. If you ever need to request a copy of your W2 form from your employer or the IRS, having the control number readily available can expedite the process and ensure that you receive the correct documentation. By keeping a record of your control numbers from previous years, you can easily reference past tax filings and stay organized throughout the tax season. So, consider the control number as your secret weapon for staying on top of your tax documents!

In conclusion, the W2 form control number may seem like a mysterious code at first glance, but with a little understanding and guidance, you can master this puzzle with ease. By unraveling the mystery of the control number and embracing its role in the tax filing process, you can navigate the tax season with confidence and precision. So, the next time you receive your W2 form, take a moment to appreciate the significance of the control number and use it as a valuable tool in managing your tax documents. Happy filing!

Below are some images related to W2 Form Control Number

how do i get the control number on w2, w2 form control number, what is a control number w2, , W2 Form Control Number.

how do i get the control number on w2, w2 form control number, what is a control number w2, , W2 Form Control Number.