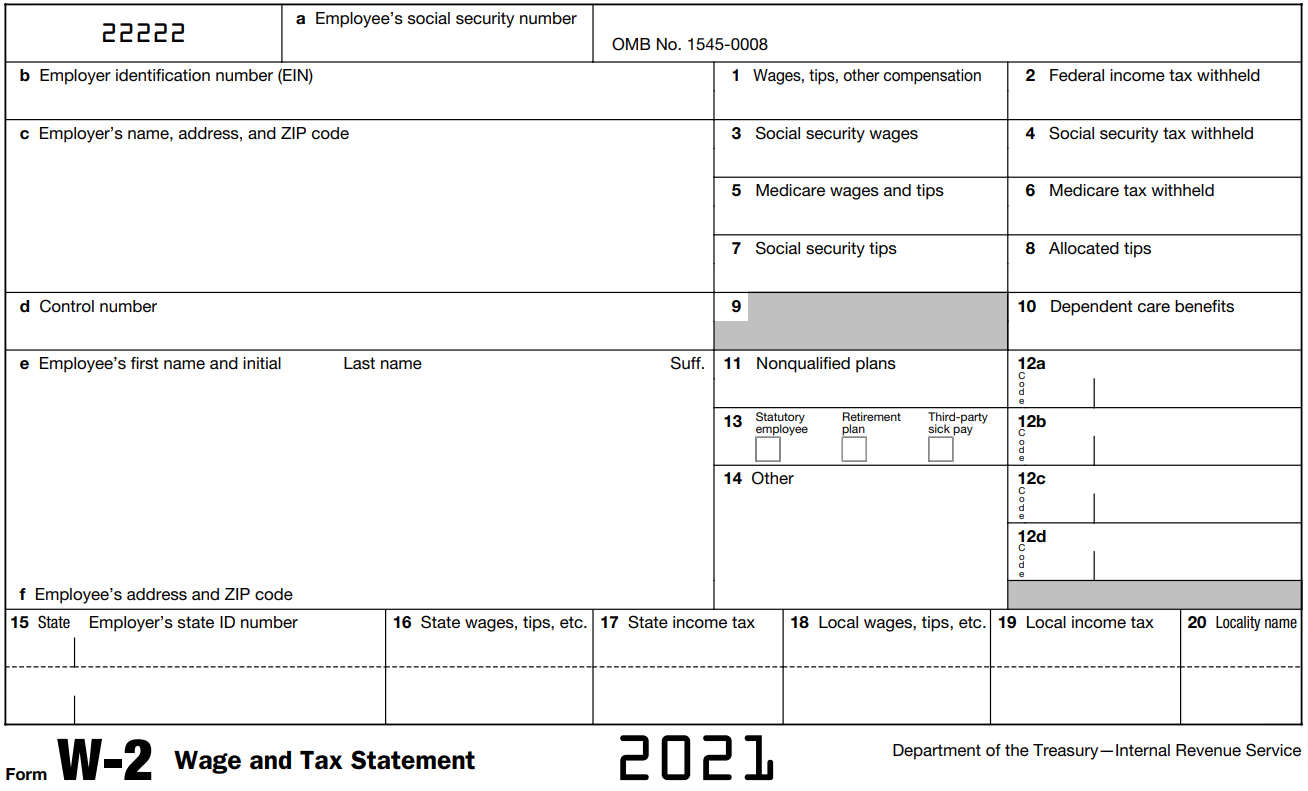

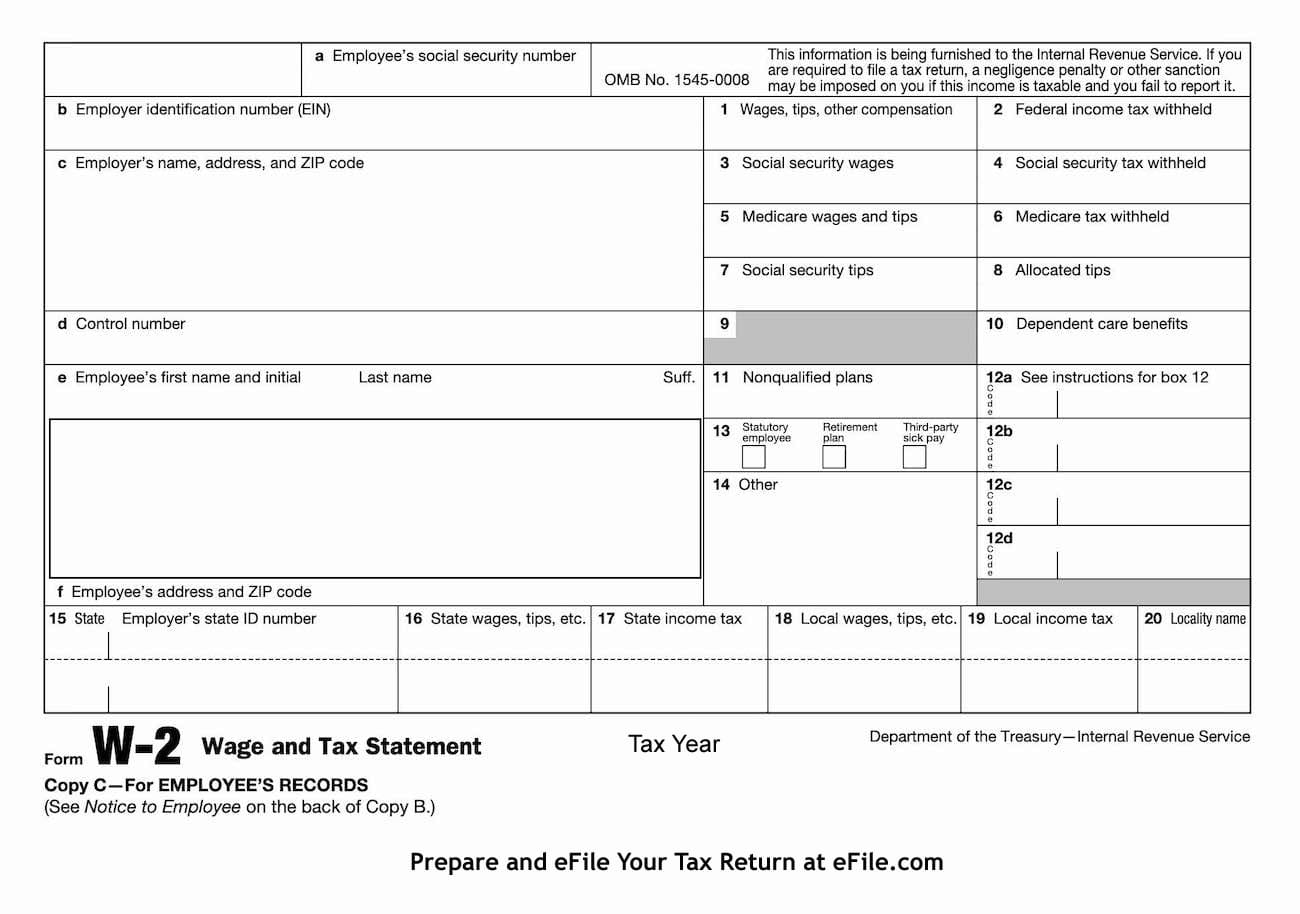

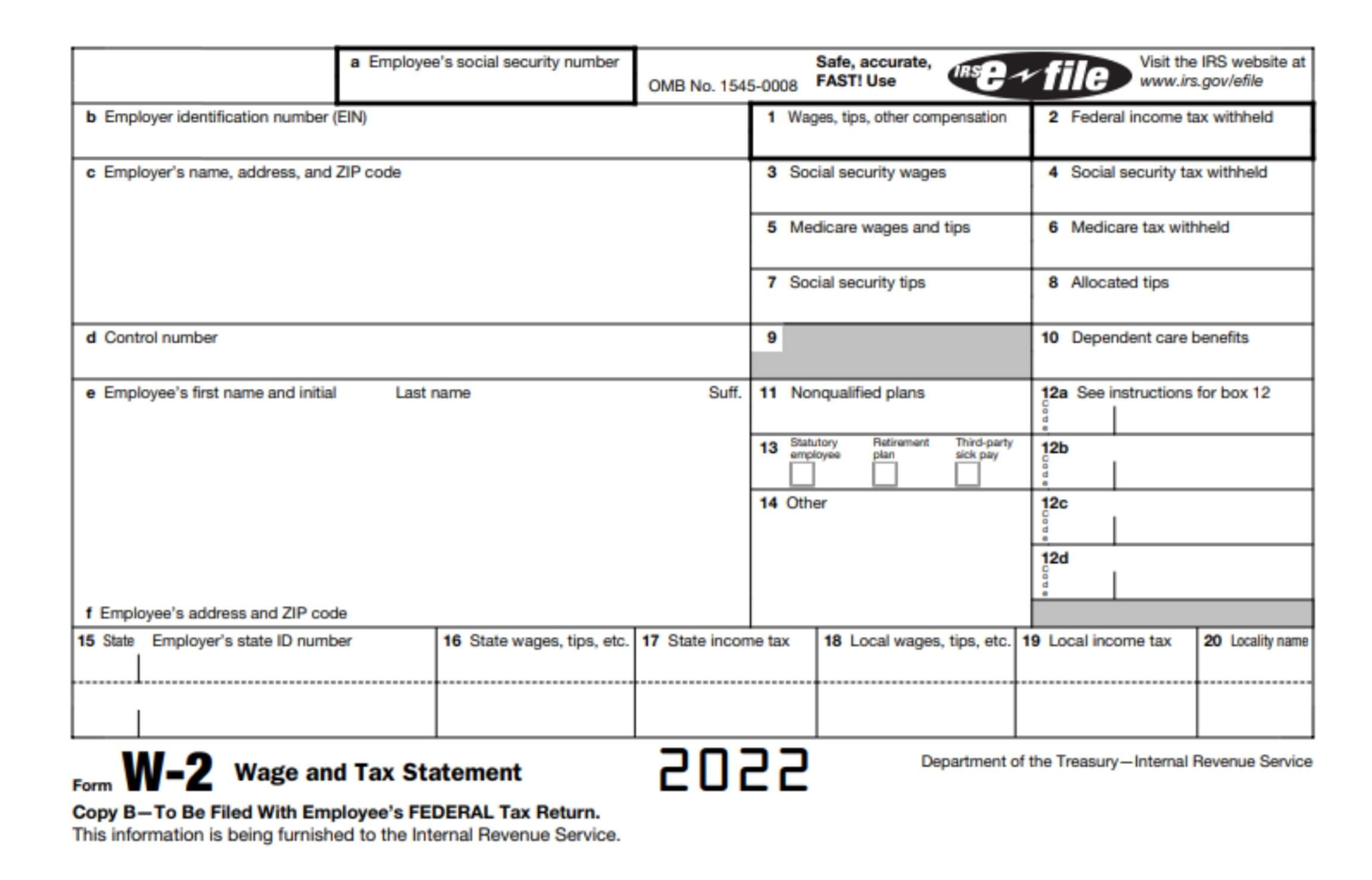

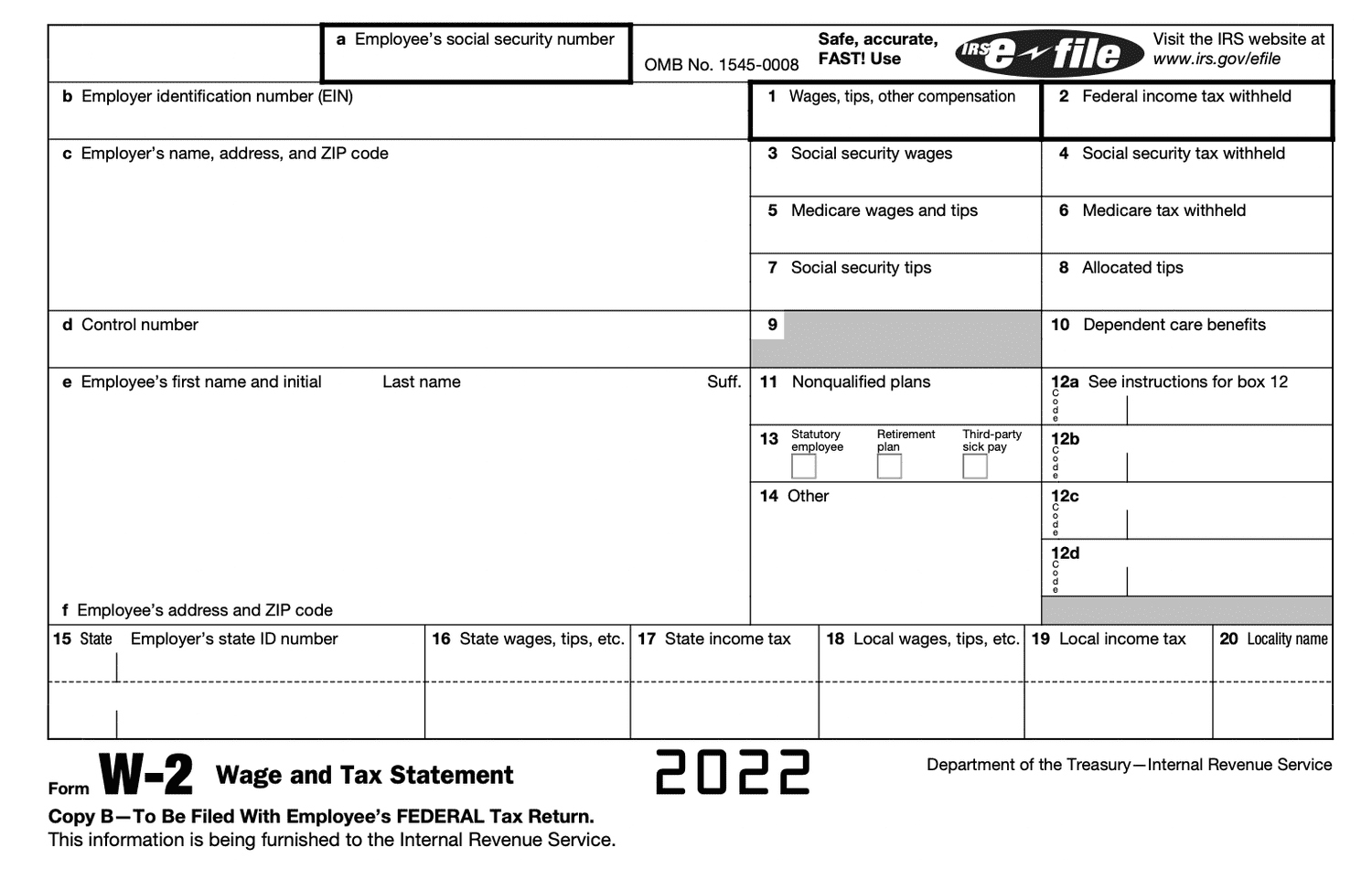

W2 Form Box 12b – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unraveling the Mysteries of Box 12b: Your Guide to Tax Time Joy

Tax season can be a daunting time for many, with the endless forms and confusing jargon leaving even the most organized individuals feeling overwhelmed. However, fear not, for we are here to shed light on one of the most enigmatic sections of your tax documents: Box 12b. This elusive box often leaves taxpayers scratching their heads, but with our guide, you’ll be well on your way to tax time bliss!

Box 12b: The Tax Time Enigma Unraveled

Ah, Box 12b, the source of so much confusion and frustration for taxpayers everywhere. But fear not, for we are here to demystify this enigmatic box once and for all. In Box 12b, you may find a variety of codes that correspond to different types of income or benefits you may have received throughout the year. From retirement plan contributions to health insurance premiums paid by your employer, Box 12b is a treasure trove of valuable information that can have a significant impact on your tax return.

When it comes to decoding the secrets of Box 12b, it’s essential to pay close attention to the codes listed and understand how they may affect your tax liability. Some codes may require you to report additional income, while others could result in valuable deductions or credits. By taking the time to carefully review and understand the information in Box 12b, you can ensure that you are accurately reporting your income and maximizing your tax savings.

Your Roadmap to Tax Time Bliss: Box 12b Explained

Navigating the intricacies of Box 12b may seem like a daunting task, but fear not, for we have created a roadmap to guide you through this tax time enigma. Start by carefully reviewing your W-2 form and locating Box 12b, where you will find a series of codes and corresponding amounts. Next, consult the IRS instructions for Form W-2 to decipher the meaning of each code and determine how it may impact your tax return. Finally, use this information to accurately complete your tax forms and ensure that you are taking full advantage of any deductions or credits associated with the codes in Box 12b.

In conclusion, while Box 12b may initially seem like a perplexing puzzle, with a little guidance and understanding, you can unravel its mysteries and approach tax time with confidence and joy. By taking the time to familiarize yourself with the codes in Box 12b and their implications for your tax return, you can ensure that you are accurately reporting your income and maximizing your tax savings. So fear not, intrepid taxpayer, for with our guide in hand, you’ll be well on your way to tax time bliss!

Below are some images related to W2 Form Box 12b

form w-2 box 12b code d, form w-2 box 12b code w, form w-2 box 12c code w, w 2 form box 12a and 12b, w2 form box 12b, , W2 Form Box 12b.

form w-2 box 12b code d, form w-2 box 12b code w, form w-2 box 12c code w, w 2 form box 12a and 12b, w2 form box 12b, , W2 Form Box 12b.