W2 Form Box 1 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Discover the Secret Power of W2 Form Box 1!

Ah, tax season – a time of confusion and stress for many. But fear not, for I am here to reveal the hidden gem that is W2 Form Box 1! This seemingly ordinary box on your W2 form holds the key to unlocking a world of tax season success. Box 1 contains the total amount of wages that you earned during the year, which is crucial information for accurately filing your taxes.

But wait, there’s more! Box 1 not only shows your total wages, but it also determines your taxable income. This means that the amount in Box 1 is used as the starting point for calculating how much of your income is subject to taxes. By understanding the power of Box 1, you can ensure that you are reporting the correct income to the IRS and maximizing your tax deductions and credits.

So, the next time you receive your W2 form, don’t overlook the magic of Box 1. Embrace this powerful tool and use it to navigate through tax season with confidence and ease. With Box 1 as your guide, you’ll be well on your way to a successful and stress-free tax filing experience.

Unleash Your Tax Season Success with Box 1 Magic!

Now that you’ve unlocked the secrets of W2 Form Box 1, it’s time to put that knowledge to good use. Armed with the information from Box 1, you can accurately report your income to the IRS and ensure that you are taking full advantage of any tax deductions and credits that you may be eligible for. By understanding the significance of Box 1, you can navigate through tax season like a pro and avoid any costly mistakes.

But the magic of Box 1 doesn’t stop there. By keeping track of your total wages throughout the year and comparing them to the amount in Box 1, you can spot any discrepancies and take action to correct them before filing your taxes. This proactive approach can save you time and money in the long run, ensuring that your tax return is accurate and that you are not overpaying or underpaying your taxes.

So, embrace the power of Box 1 and unleash your tax season success. With this valuable tool at your disposal, you can take control of your finances and make the most of tax season. Say goodbye to stress and confusion and hello to a smooth and successful tax filing experience. Here’s to a prosperous and tax-savvy year ahead!

In conclusion, W2 Form Box 1 is truly a magical key to tax season success. By understanding the power of this seemingly ordinary box, you can confidently navigate through tax season and ensure that your tax return is accurate and efficient. So, embrace the magic of Box 1, unleash your tax season success, and enjoy a stress-free tax filing experience. Cheers to a prosperous and tax-savvy year ahead!

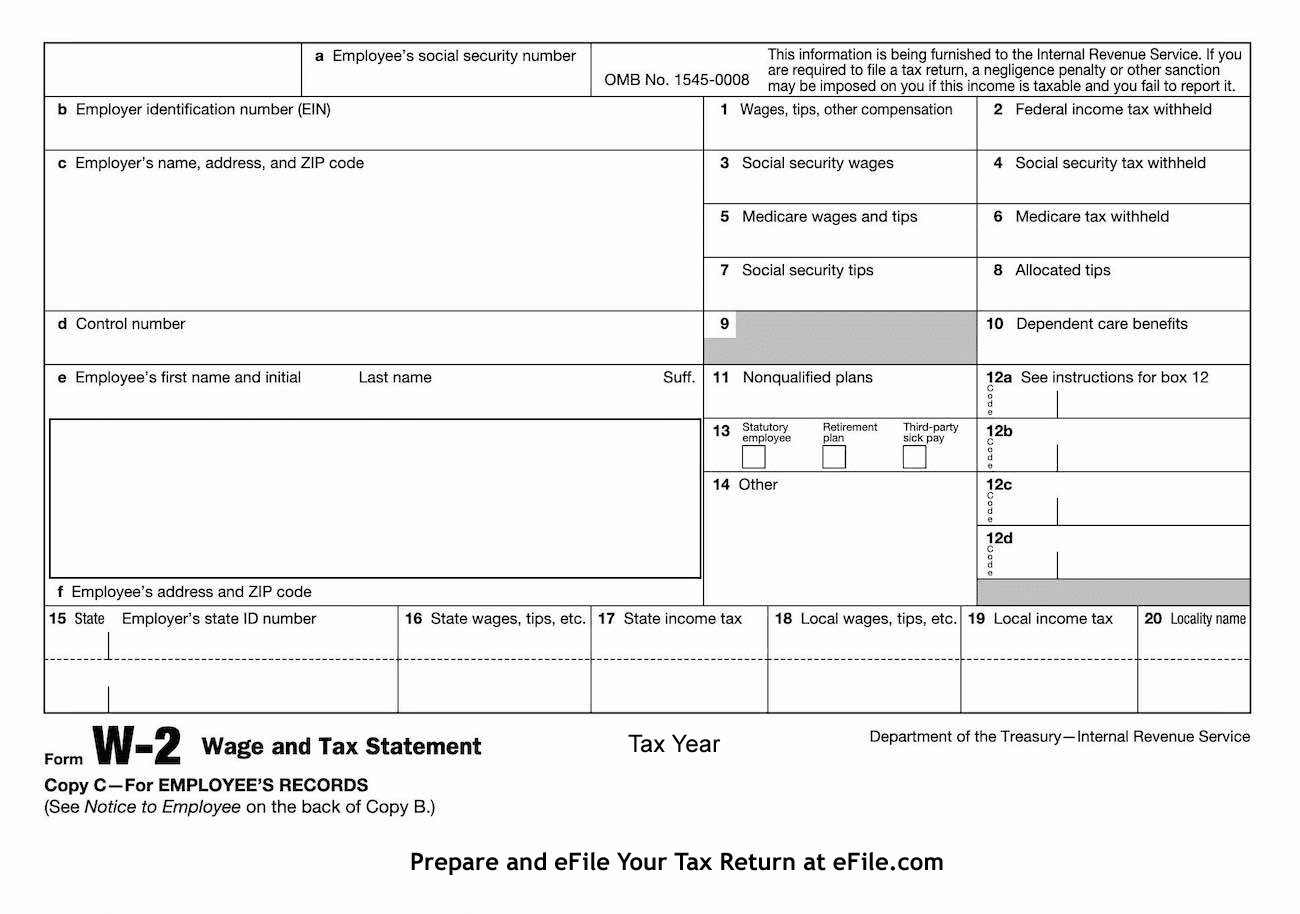

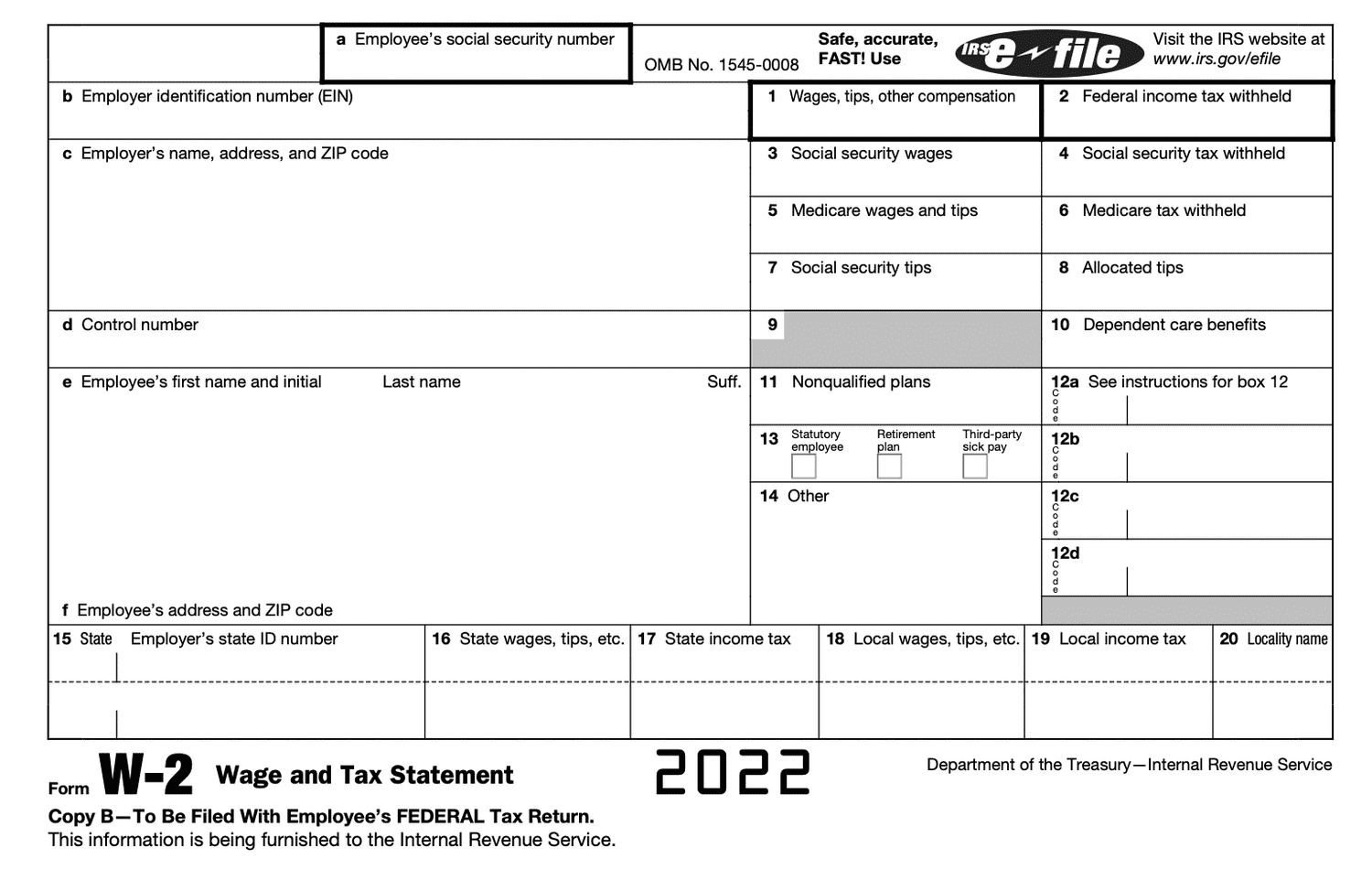

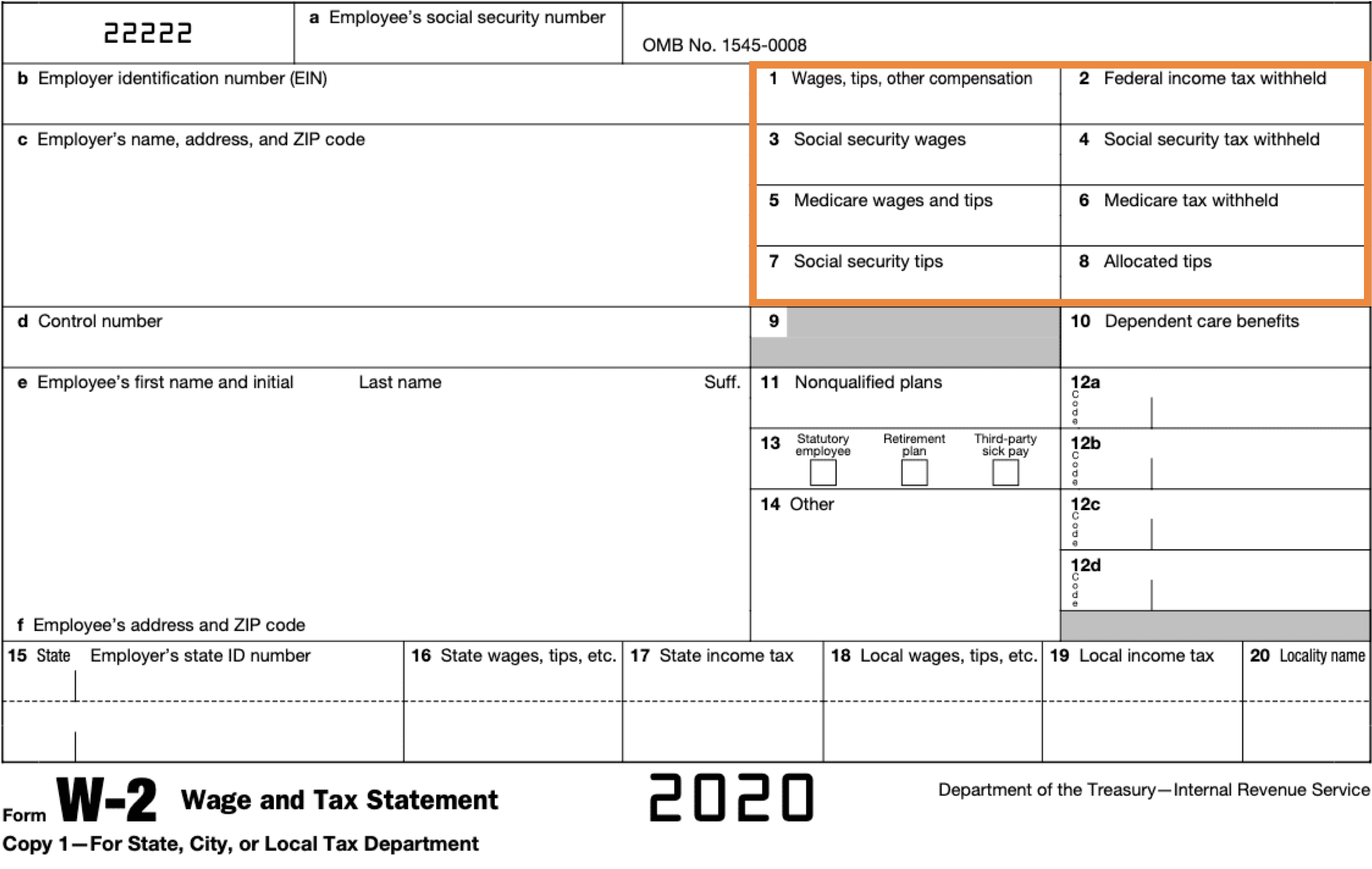

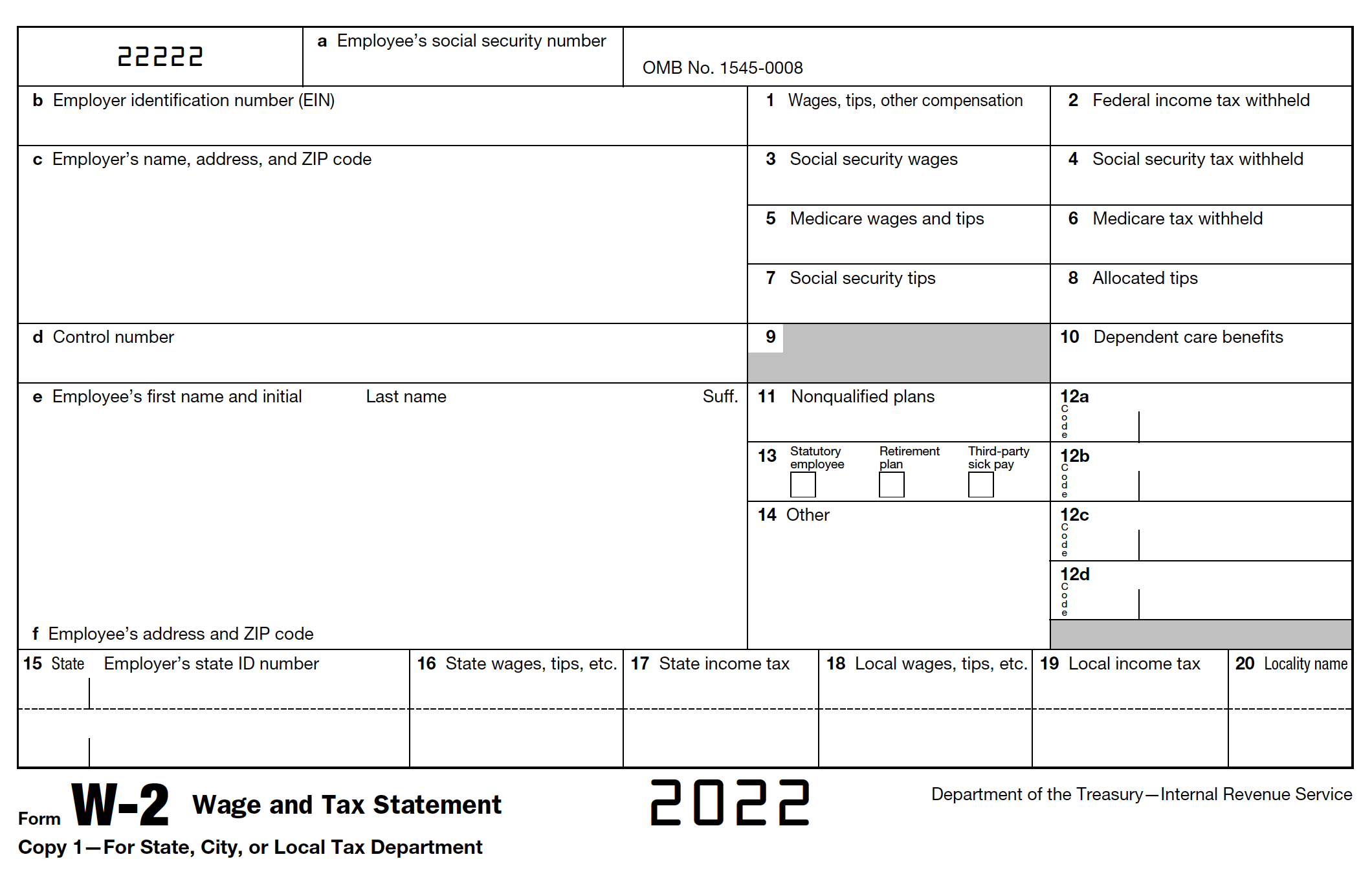

Below are some images related to W2 Form Box 1

w2 form box 1, w2 form box 12, w2 form box 12 code w, w2 form box 12 codes, w2 form box 12 dd, , W2 Form Box 1.

w2 form box 1, w2 form box 12, w2 form box 12 code w, w2 form box 12 codes, w2 form box 12 dd, , W2 Form Box 1.