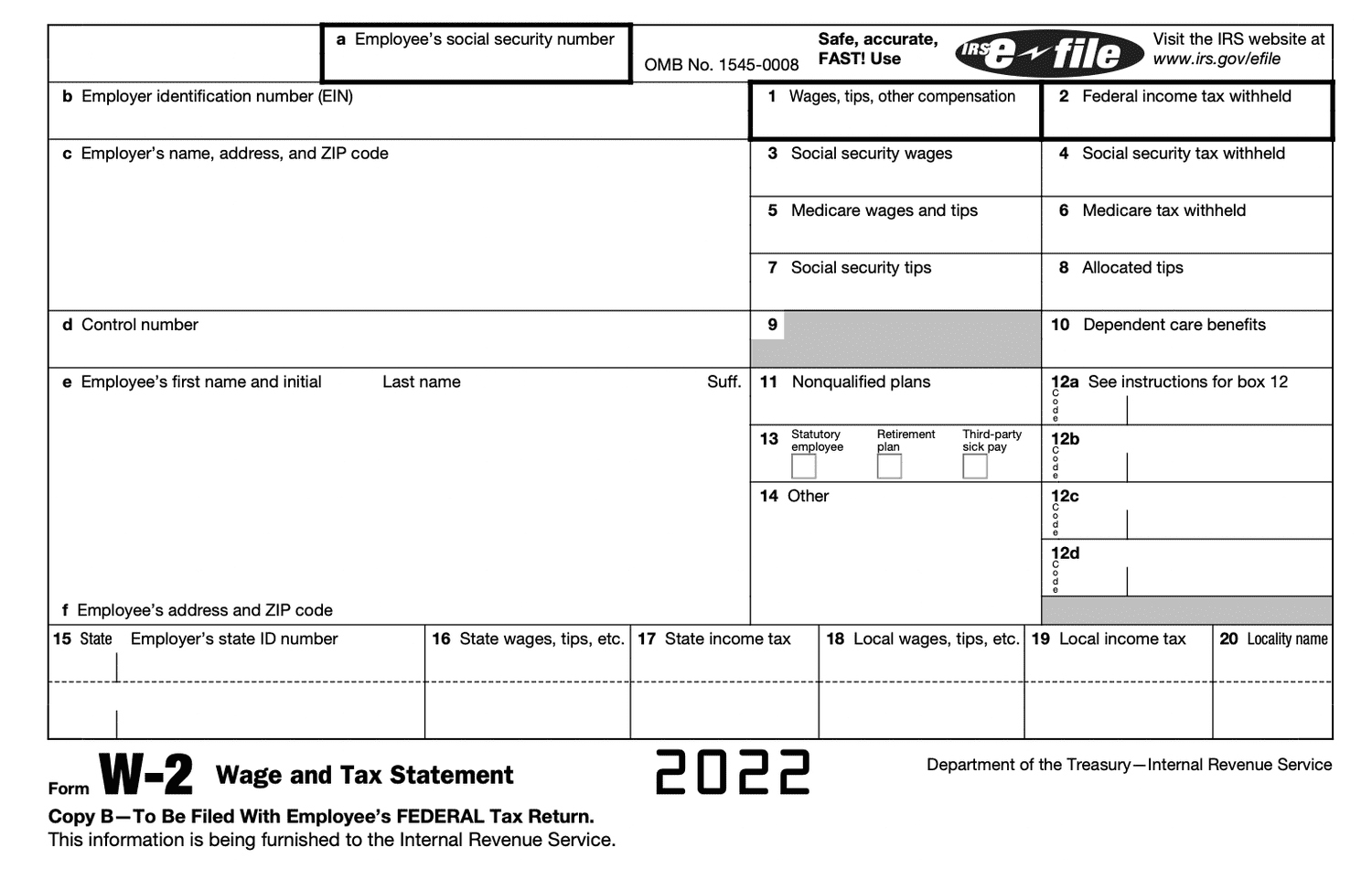

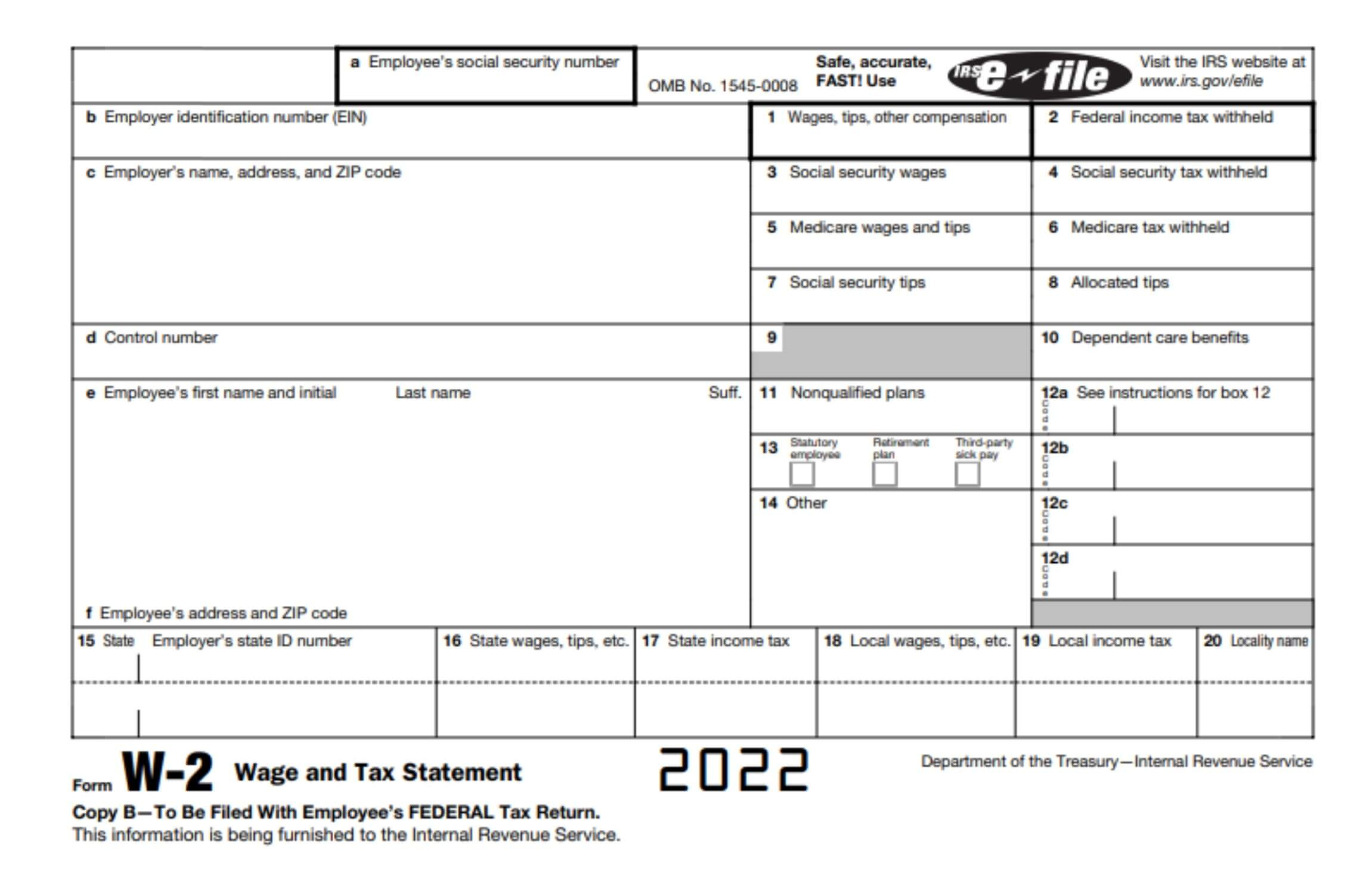

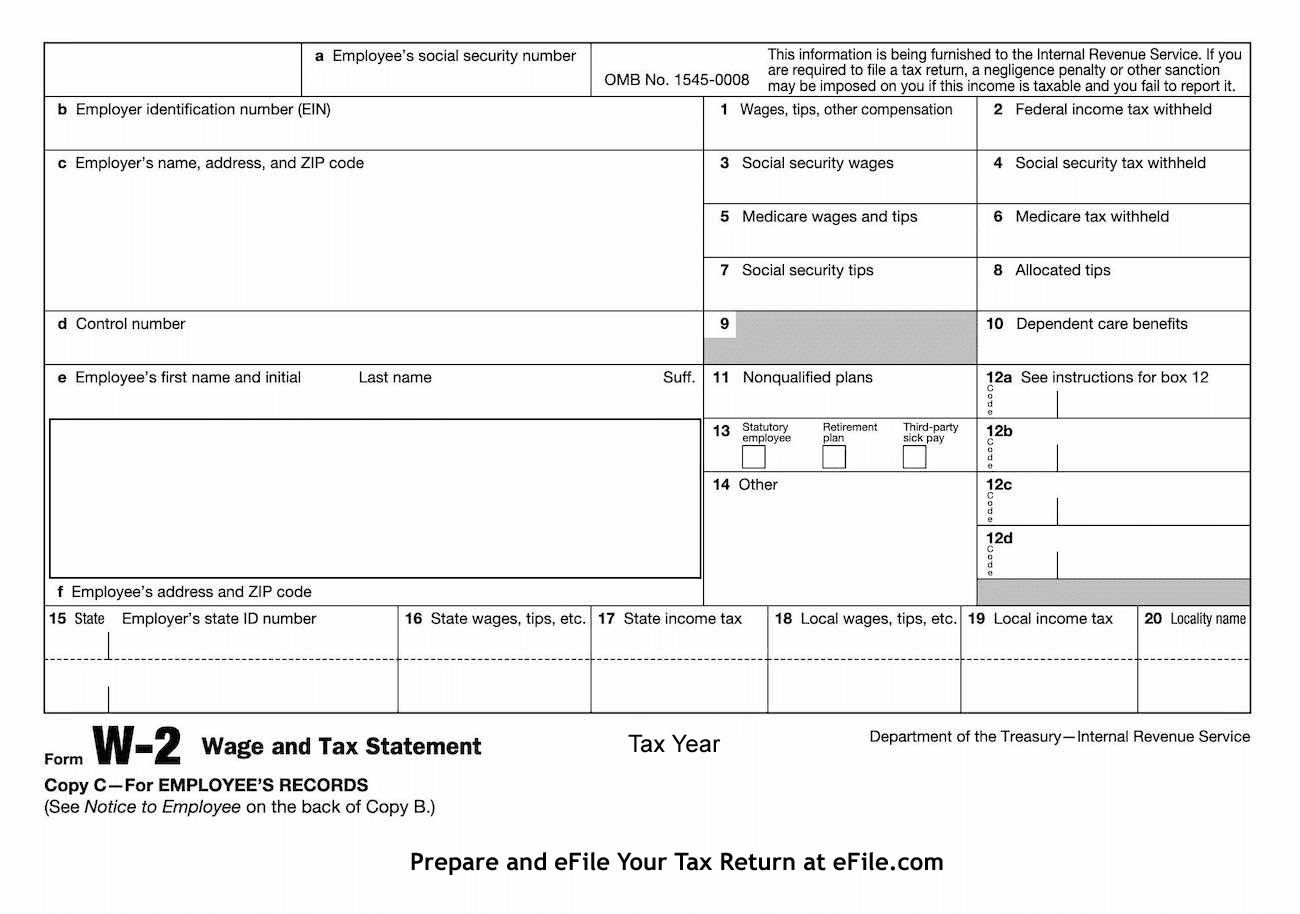

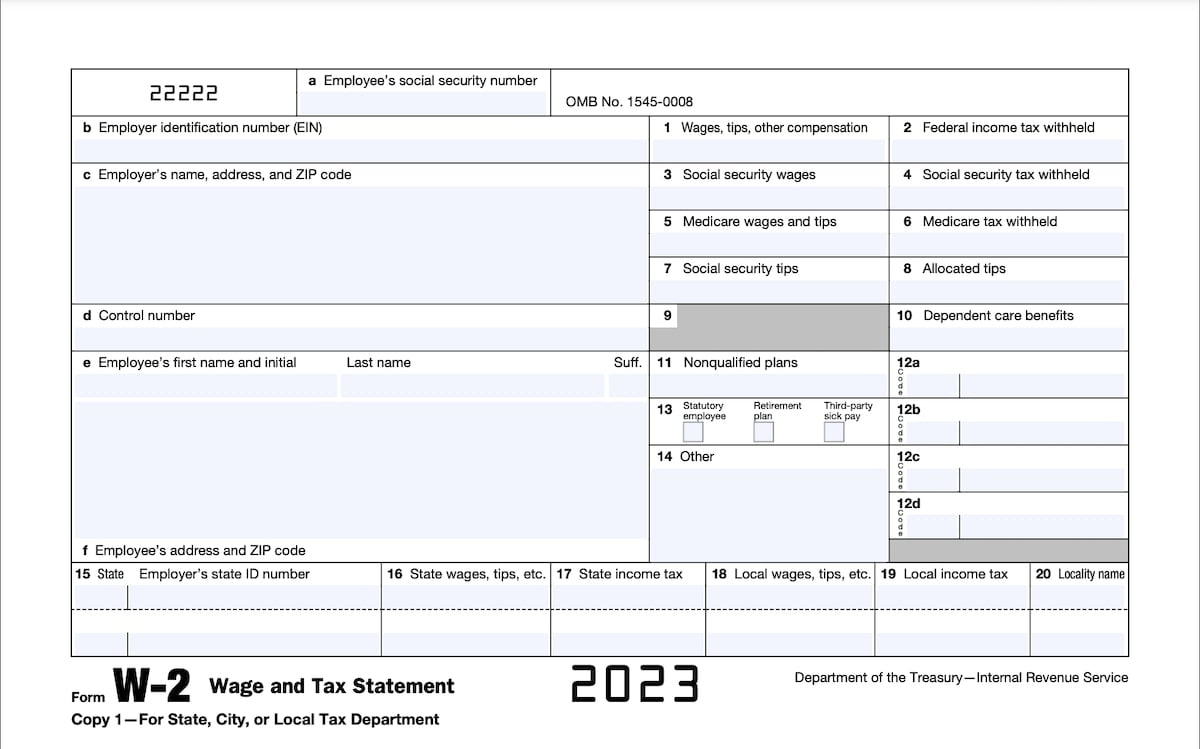

W2 Form 12b – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Uncovering the Magic of W2 Form 12b: Your Ticket to Tax Savings!

Are you ready to uncover the hidden treasure buried within your W2 Form? Look no further than W2 Form 12b! This often overlooked section of your tax documents holds the key to unlocking potential tax savings and maximizing your tax refund. Let’s dive into the mysteries of W2 Form 12b and discover the magic it holds!

Unlocking the Mysteries of W2 Form 12b

W2 Form 12b is where the magic happens when it comes to potential tax savings. This section of your W2 form lists any pre-tax deductions that were withheld from your paycheck throughout the year. These deductions can include contributions to retirement accounts, health savings accounts, and other pre-tax benefits offered by your employer. By understanding and utilizing the information provided in W2 Form 12b, you can potentially lower your taxable income and increase your tax refund.

In addition to pre-tax deductions, W2 Form 12b may also include other valuable information such as employer contributions to retirement accounts. These contributions are not subject to income tax, which means they can further reduce your taxable income and increase your tax refund. By carefully reviewing W2 Form 12b and taking advantage of any tax-saving opportunities it presents, you can make the most of your tax return and keep more money in your pocket.

Discover How W2 Form 12b Can Maximize Your Tax Refund

By understanding the information provided in W2 Form 12b and taking advantage of any tax-saving opportunities it presents, you can potentially maximize your tax refund. Whether it’s contributing to a retirement account, utilizing pre-tax benefits offered by your employer, or taking advantage of other tax-saving strategies, W2 Form 12b is your ticket to saving money on your taxes. So don’t overlook this valuable section of your tax documents – uncover the magic of W2 Form 12b and watch your tax savings grow!

In conclusion, W2 Form 12b is a powerful tool that can help you maximize your tax refund and keep more money in your pocket. By understanding the information provided in this section of your tax documents and taking advantage of any tax-saving opportunities it presents, you can unlock the magic of W2 Form 12b and make the most of your tax return. So don’t delay – dive into the mysteries of W2 Form 12b today and start saving on your taxes!

Below are some images related to W2 Form 12b

w2 form 12a 12b 12c, w2 form 12b, w2 form 12b code, w2 form 12b code dd, w2 form 12b code w, , W2 Form 12b.

w2 form 12a 12b 12c, w2 form 12b, w2 form 12b code, w2 form 12b code dd, w2 form 12b code w, , W2 Form 12b.