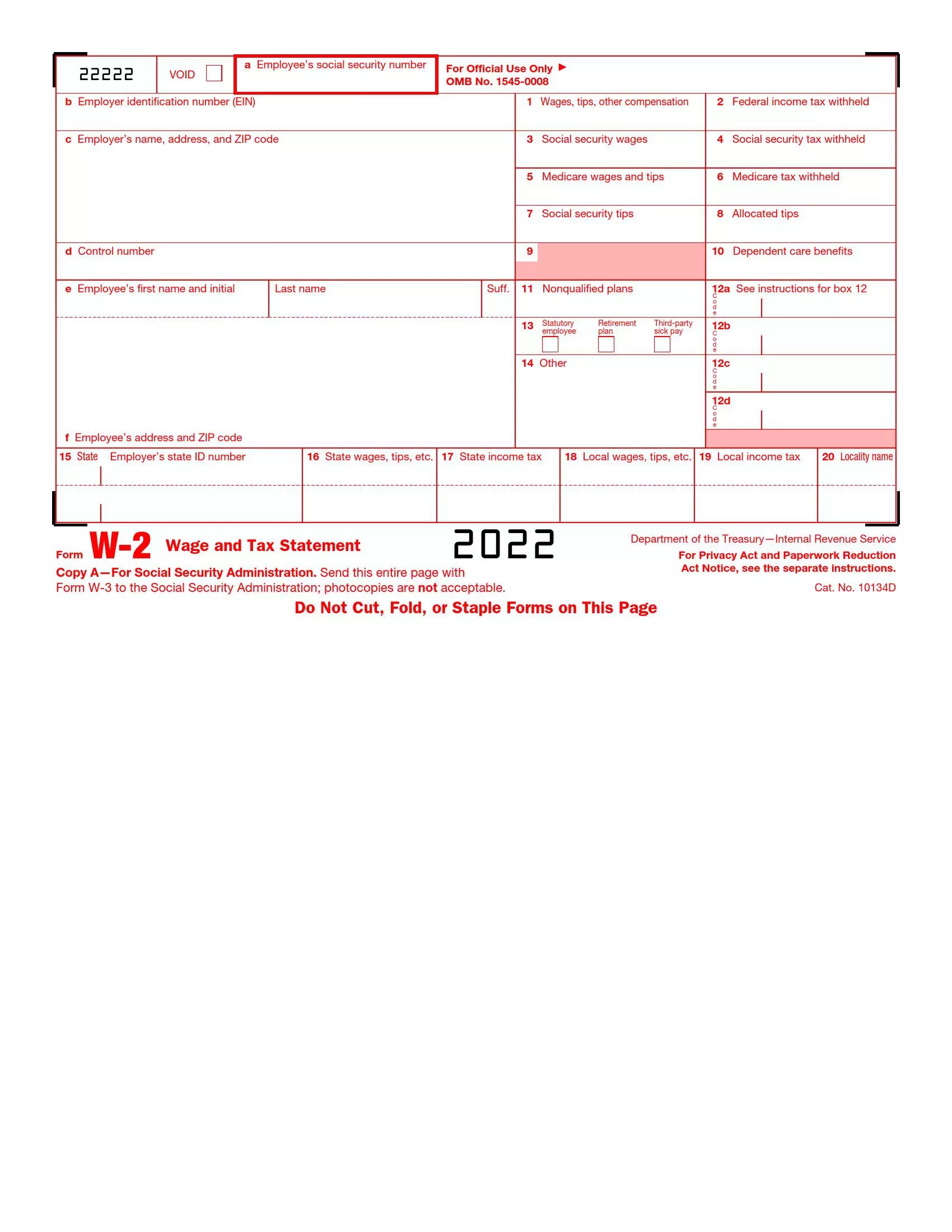

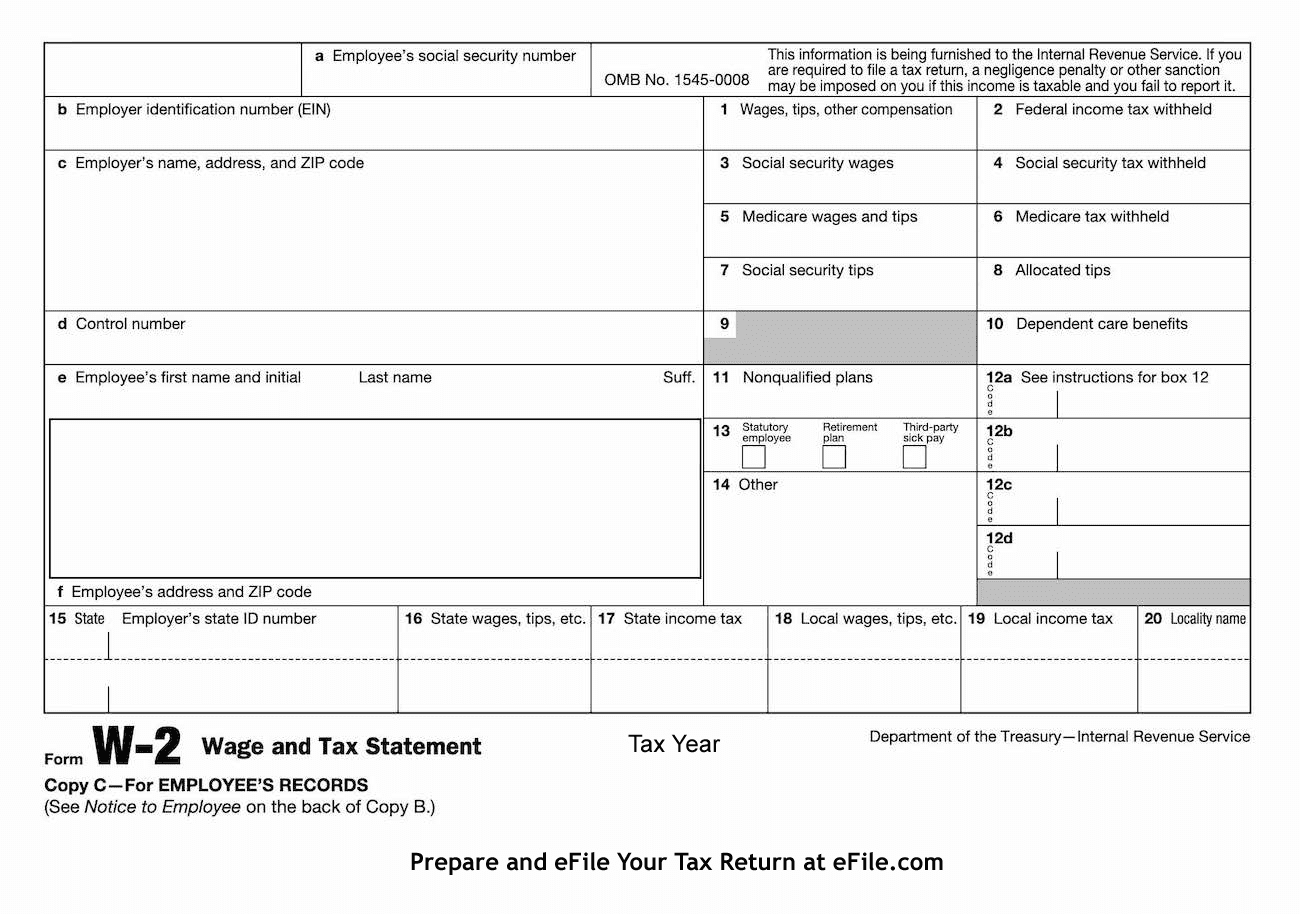

W2 Amendment Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Revamp Your Tax Return!

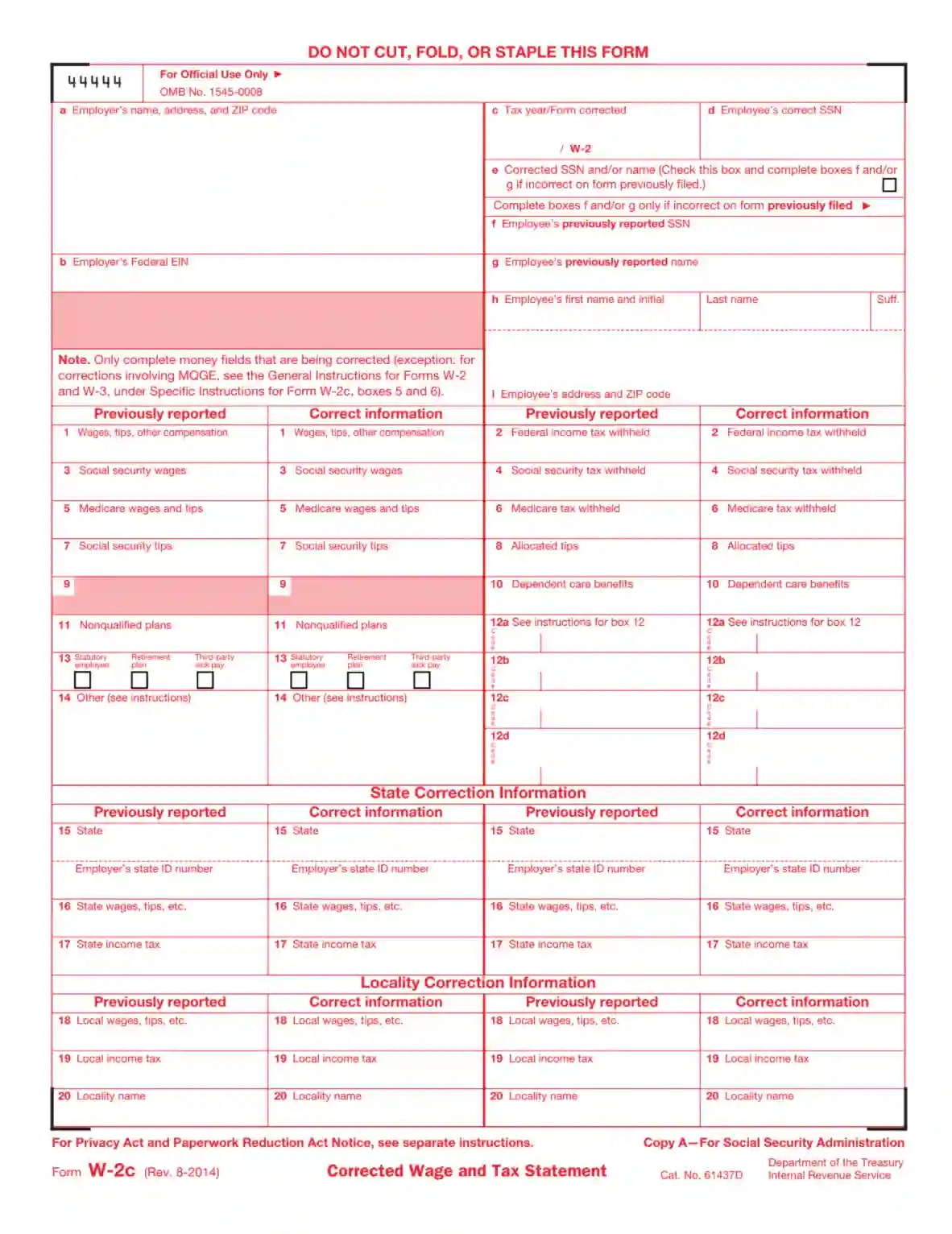

Are you tired of the same old tax return year after year? Do you want to add a little pizzazz to your refund? Look no further than the W2 Amendment Form! This simple form allows you to make changes to your W2 information after you have already filed your taxes. Say goodbye to boring tax returns and hello to a new and improved refund!

With the W2 Amendment Form, you can correct any errors or omissions on your original W2 form. Maybe your employer made a mistake with your earnings, or perhaps you forgot to report some income. Whatever the case may be, the W2 Amendment Form gives you the opportunity to spruce up your taxes and ensure that you are getting the refund you deserve. So why settle for a lackluster tax return when you can revamp it with just a few simple steps?

Add Some Glamour to Your Refund!

Adding some glamour to your refund is easier than you think with the W2 Amendment Form. Not only does this form allow you to correct any mistakes on your original W2, but it also gives you the chance to claim any additional deductions or credits that you may have missed the first time around. Imagine the excitement of receiving a bigger refund simply by filling out a form and submitting it to the IRS. Who knew taxes could be so glamorous?

By taking advantage of the W2 Amendment Form, you can add some sparkle to your tax return and make sure you are getting the most out of your refund. Don’t let mistakes or oversights hold you back from maximizing your tax benefits. With the W2 Amendment Form, you can shine bright like a diamond and make your refund truly shine!

Conclusion

Say goodbye to boring tax returns and hello to a revamped refund with the W2 Amendment Form. Whether you need to correct errors, add deductions, or claim credits, this form is your ticket to a more glamorous tax return. So why settle for the same old tax refund when you can spruce it up with just a few simple steps? Give your taxes a makeover today and watch your refund sparkle like never before!

Below are some images related to W2 Amendment Form

can an employer amend a w2, how do you file an amended w-2, w2 amendment deadline, w2 amendment form, w2 correction form pdf, , W2 Amendment Form.

can an employer amend a w2, how do you file an amended w-2, w2 amendment deadline, w2 amendment form, w2 correction form pdf, , W2 Amendment Form.