Understanding My W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

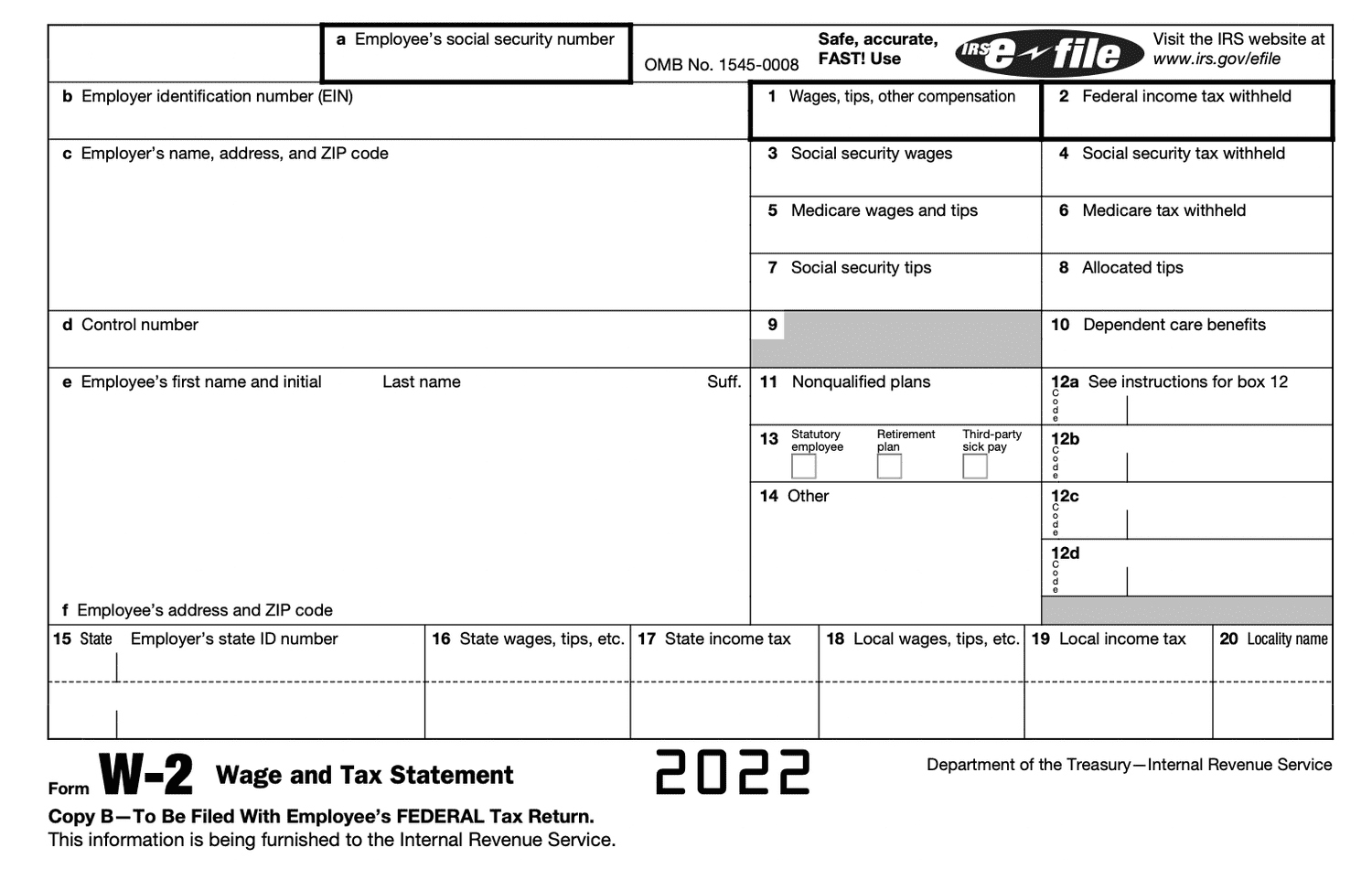

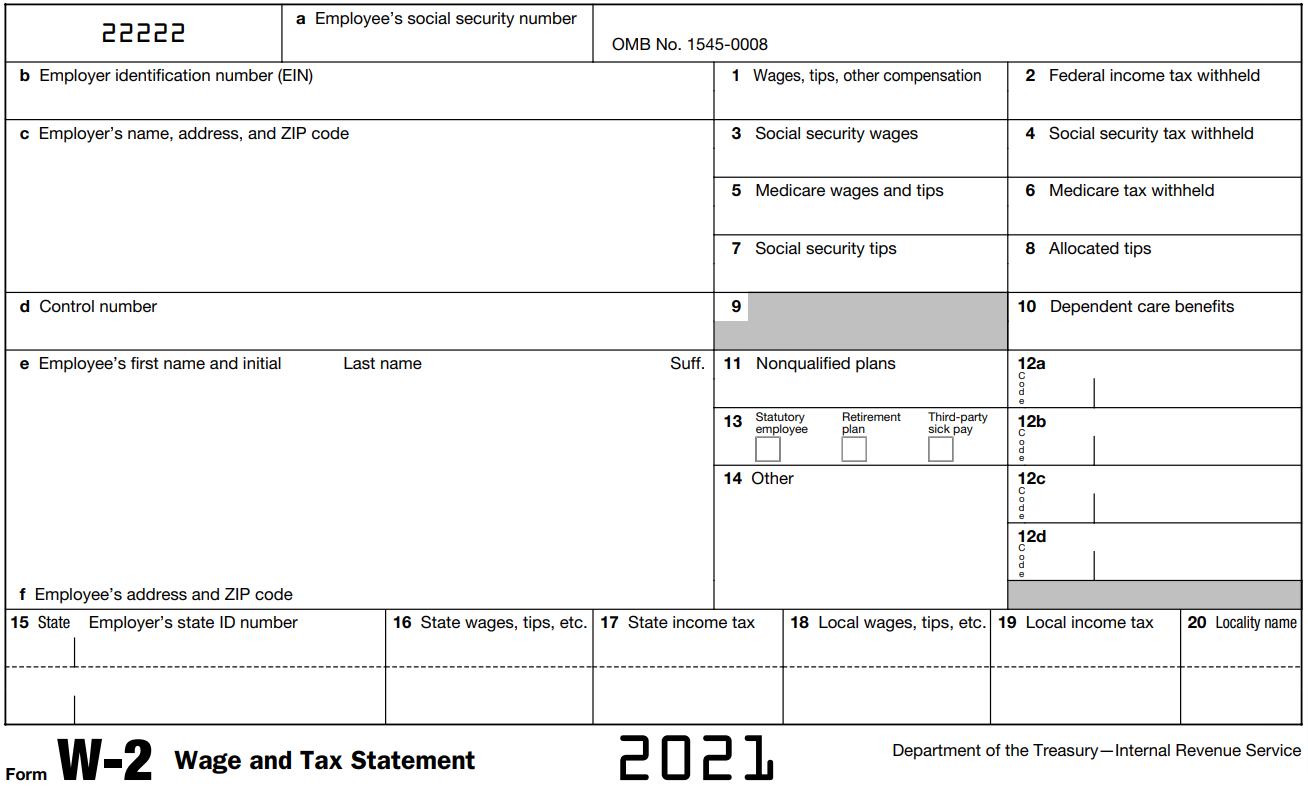

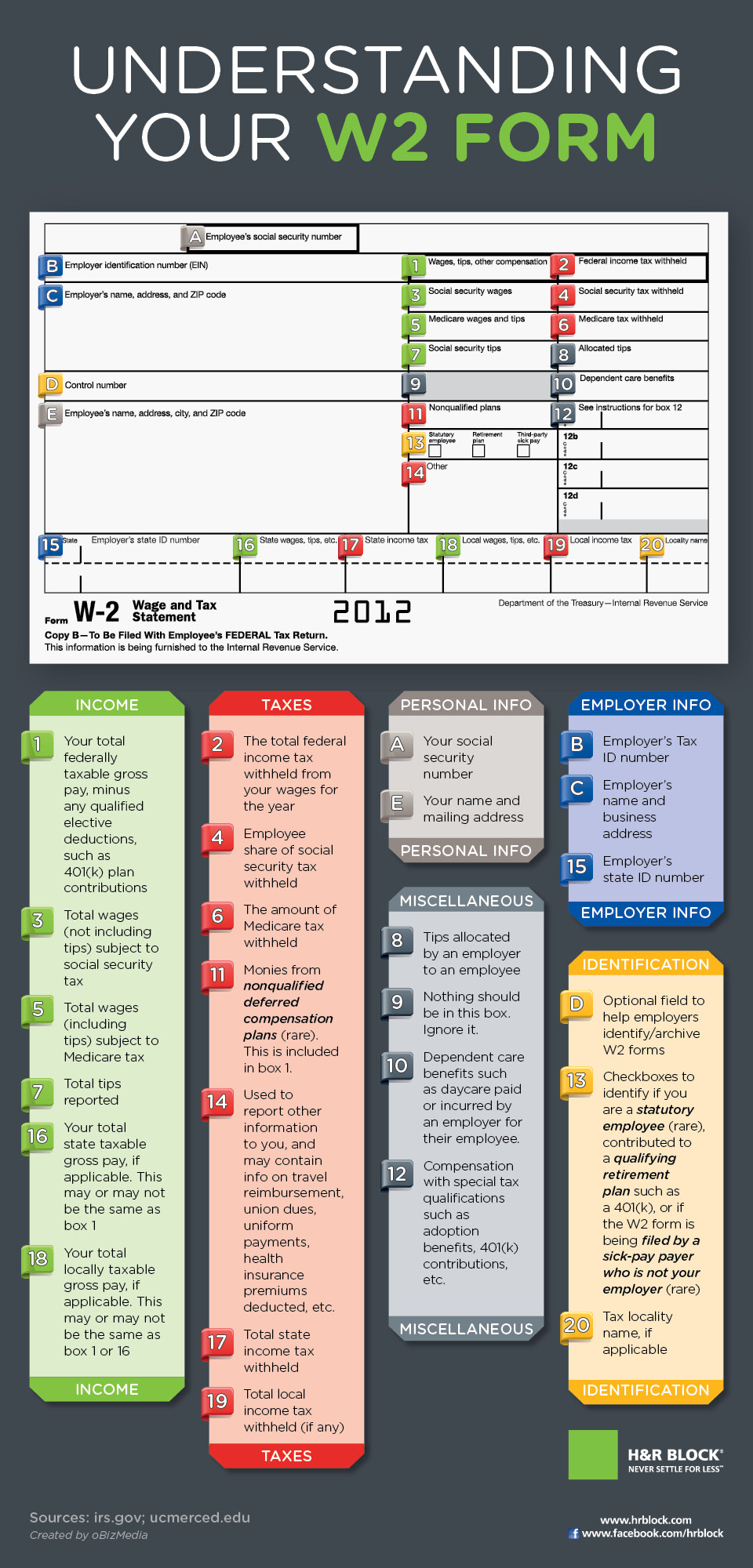

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

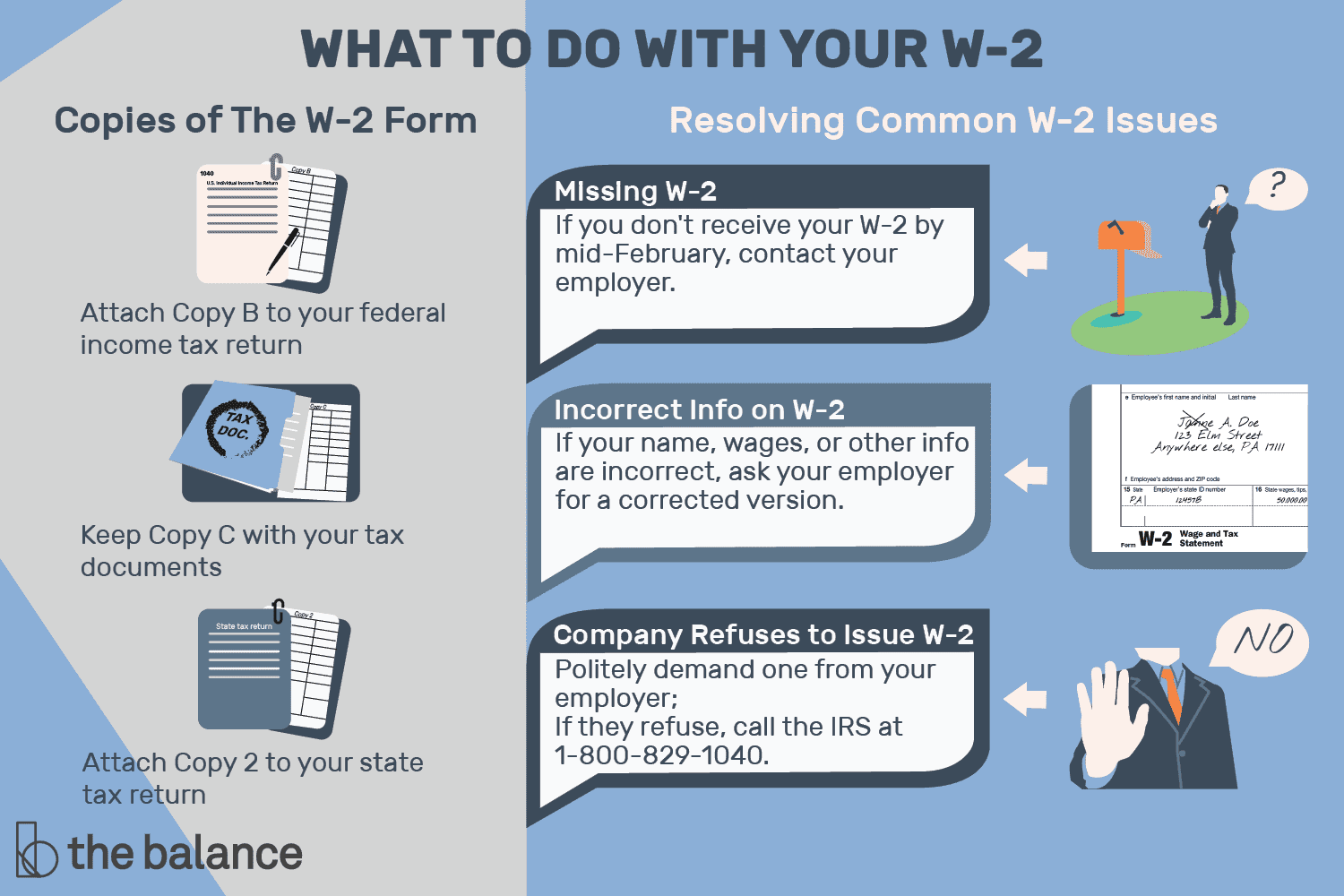

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Decoding Your W2: Uncovering the Secrets to Tax Time Success!

Tax season can be a daunting time of year for many, but fear not! With the right knowledge and understanding of your W2 form, you can navigate through the maze of tax codes and numbers with ease. Your W2 form holds the key to unlocking potential deductions and credits that could save you money and maximize your tax refund. So, let’s dive in and uncover the secrets to tax time success!

Unveiling the Mysteries of Your W2 Form

Your W2 form may seem like a jumble of numbers and letters, but each section holds valuable information about your income and taxes withheld throughout the year. The top section of your W2 includes your personal information, such as your name, address, and Social Security number. The next section breaks down your total wages earned and the taxes withheld, including federal income tax, Social Security, and Medicare. Understanding these numbers can help you calculate your tax liability and determine if you are due a refund.

Moving further down your W2 form, you may come across codes and boxes that may seem confusing at first glance. These codes represent different types of income, deductions, and tax credits that may apply to your tax situation. For example, Box 12 may contain codes for things like retirement plan contributions, health insurance premiums, or other benefits provided by your employer. By decoding these codes and understanding their implications, you can ensure that you are maximizing your tax savings and taking advantage of all available deductions.

Simplifying Tax Season with W2 Secrets

One of the key secrets to tax time success lies in understanding the importance of accuracy and attention to detail when reviewing your W2 form. Any discrepancies or errors could result in delays in processing your tax return or even trigger an audit by the IRS. Take the time to carefully review each section of your W2 form and verify that the information matches your records. If you spot any mistakes, be sure to contact your employer immediately to have them corrected.

In addition to reviewing your W2 form for accuracy, it’s also essential to keep track of any additional income or expenses that may not be listed on your W2. This could include income from freelance work, rental properties, or investment accounts, as well as deductions for things like charitable donations or business expenses. By maintaining detailed records and staying organized throughout the year, you can ensure that you are prepared for tax season and maximize your potential tax savings. So, embrace the challenge of decoding your W2 form and uncover the secrets to tax time success!

Below are some images related to Understanding My W2 Form

understanding my w2 form, understanding the w2 form, what does a w2 form tell you, what does dd mean on my w2 form, what does my w2 mean, , Understanding My W2 Form.

understanding my w2 form, understanding the w2 form, what does a w2 form tell you, what does dd mean on my w2 form, what does my w2 mean, , Understanding My W2 Form.