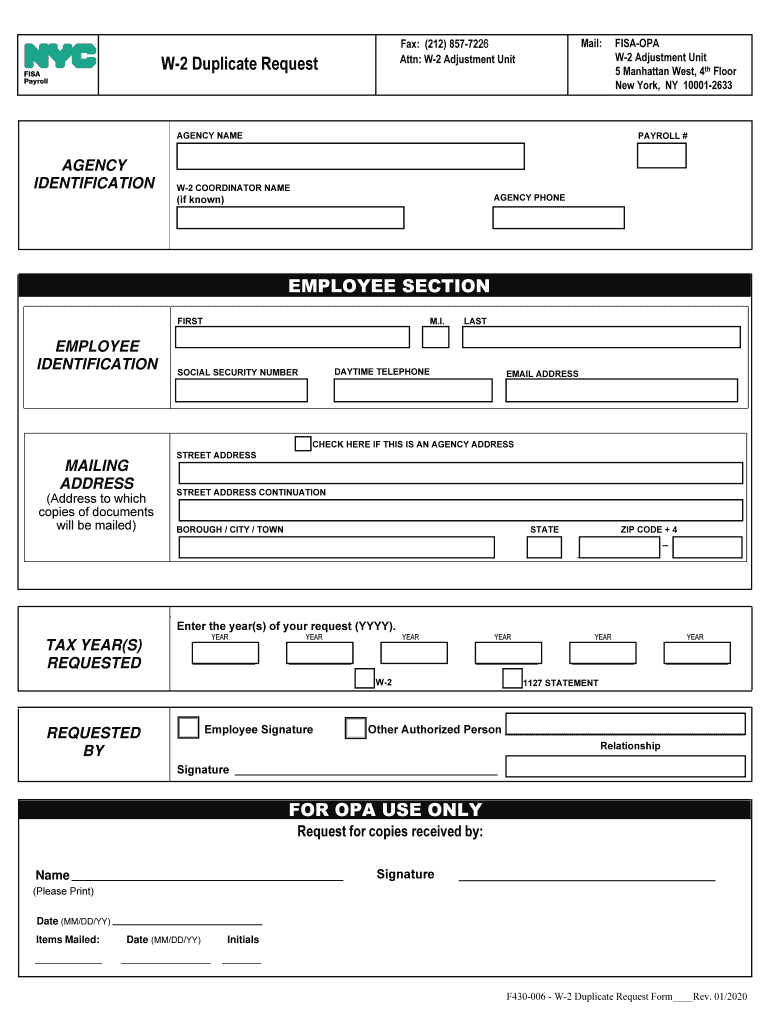

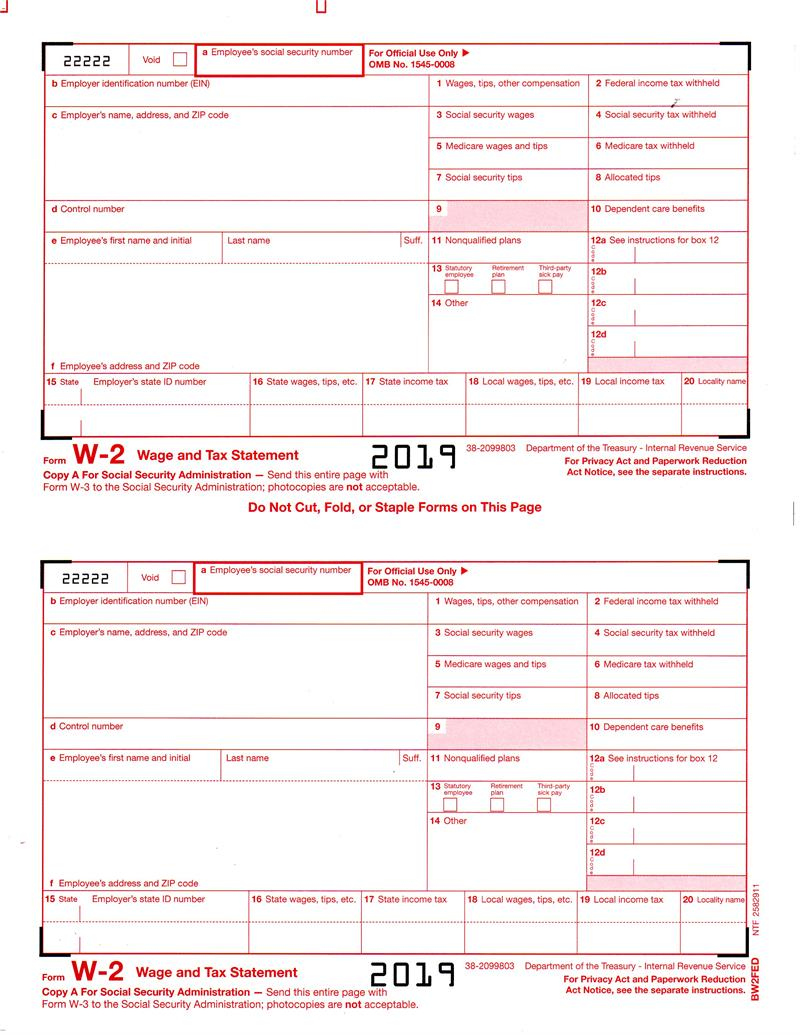

Stanford W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unveiling the Magic of Stanford’s W2 Form!

Do you find yourself scratching your head every time tax season rolls around and you receive Stanford’s W2 form? Fear not, for we are here to help you unravel the mystery and make tax time a breeze! Stanford’s W2 form may seem like a daunting document at first glance, but with a little guidance, you can easily navigate through it and ensure that you are maximizing your tax benefits.

Discover the Secret Behind Stanford’s W2 Form!

Stanford’s W2 form is not just a piece of paper with numbers and codes – it holds the key to unlocking valuable information about your income, taxes withheld, and benefits received throughout the year. By understanding how to read and interpret your W2 form, you can gain insight into your financial situation and make informed decisions when filing your taxes. From deciphering the various boxes and codes to identifying potential deductions and credits, Stanford’s W2 form is a treasure trove of information waiting to be explored.

But wait, there’s more! Stanford’s W2 form also provides important details about your employment status, such as your employer’s identification number, your social security number, and your total wages earned. By familiarizing yourself with the information presented on your W2 form, you can ensure accuracy in reporting your income and avoid any discrepancies that may trigger an IRS audit. So, don’t let Stanford’s W2 form intimidate you – embrace it as a tool to empower yourself and take control of your financial future.

Unleash the Power of Stanford’s W2 Form in 5 Easy Steps!

Ready to conquer Stanford’s W2 form like a pro? Follow these 5 easy steps to unleash its magic and make tax time a breeze! Step 1: Carefully review your W2 form for accuracy, ensuring that your personal information, income, and taxes withheld are all correct. Step 2: Familiarize yourself with the different boxes and codes on your W2 form, understanding what each one represents and how it impacts your tax return. Step 3: Identify any potential deductions or credits that you may be eligible for, such as student loan interest, retirement contributions, or childcare expenses. Step 4: Use the information on your W2 form to accurately complete your tax return, maximizing your refunds and minimizing your tax liability. Step 5: Keep a copy of your W2 form for your records and consult with a tax professional if you have any questions or concerns. By following these steps, you can harness the power of Stanford’s W2 form and make tax season a stress-free experience.

In conclusion, Stanford’s W2 form may seem like a daunting document at first, but with a little knowledge and guidance, you can easily unlock its magic and ensure that you are on the right track when it comes to filing your taxes. By understanding the information presented on your W2 form and following a few simple steps, you can take control of your financial future and make the most of your tax benefits. So, embrace the power of Stanford’s W2 form and make tax time a breeze!

Below are some images related to Stanford W2 Form

can you print out w2 forms, stanford w2 form, stanford w2 former employee, who sends out w2 forms, , Stanford W2 Form.

can you print out w2 forms, stanford w2 form, stanford w2 former employee, who sends out w2 forms, , Stanford W2 Form.