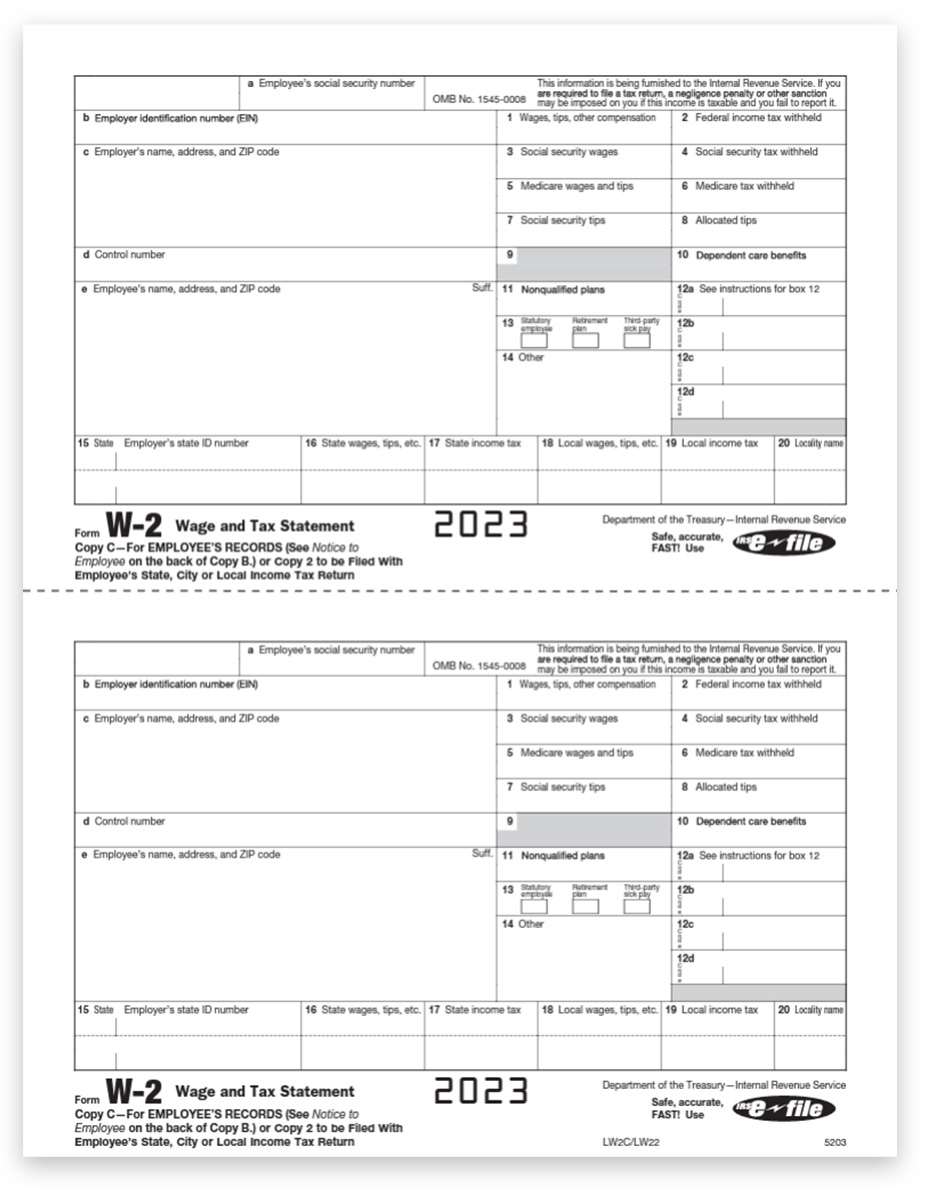

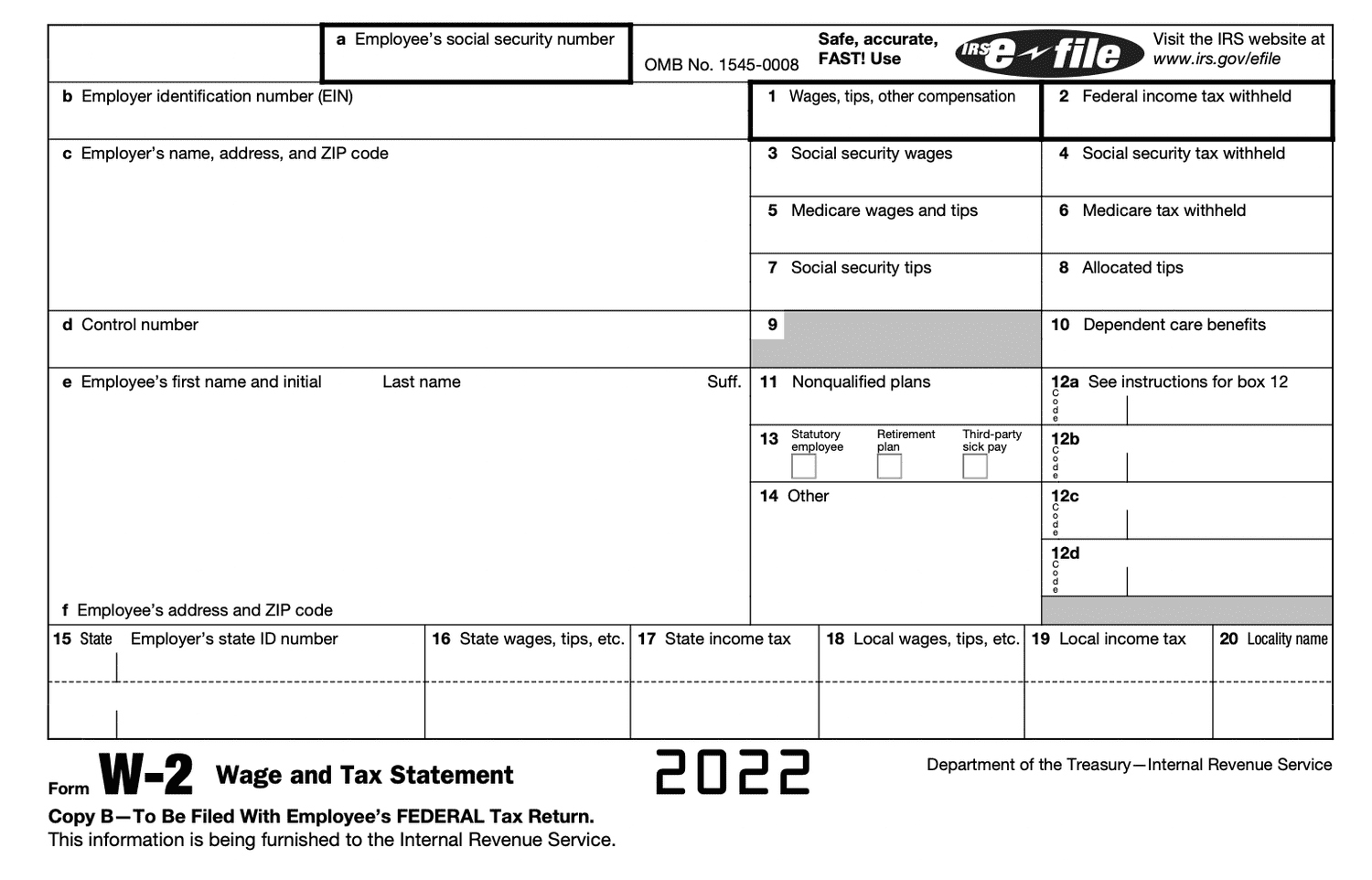

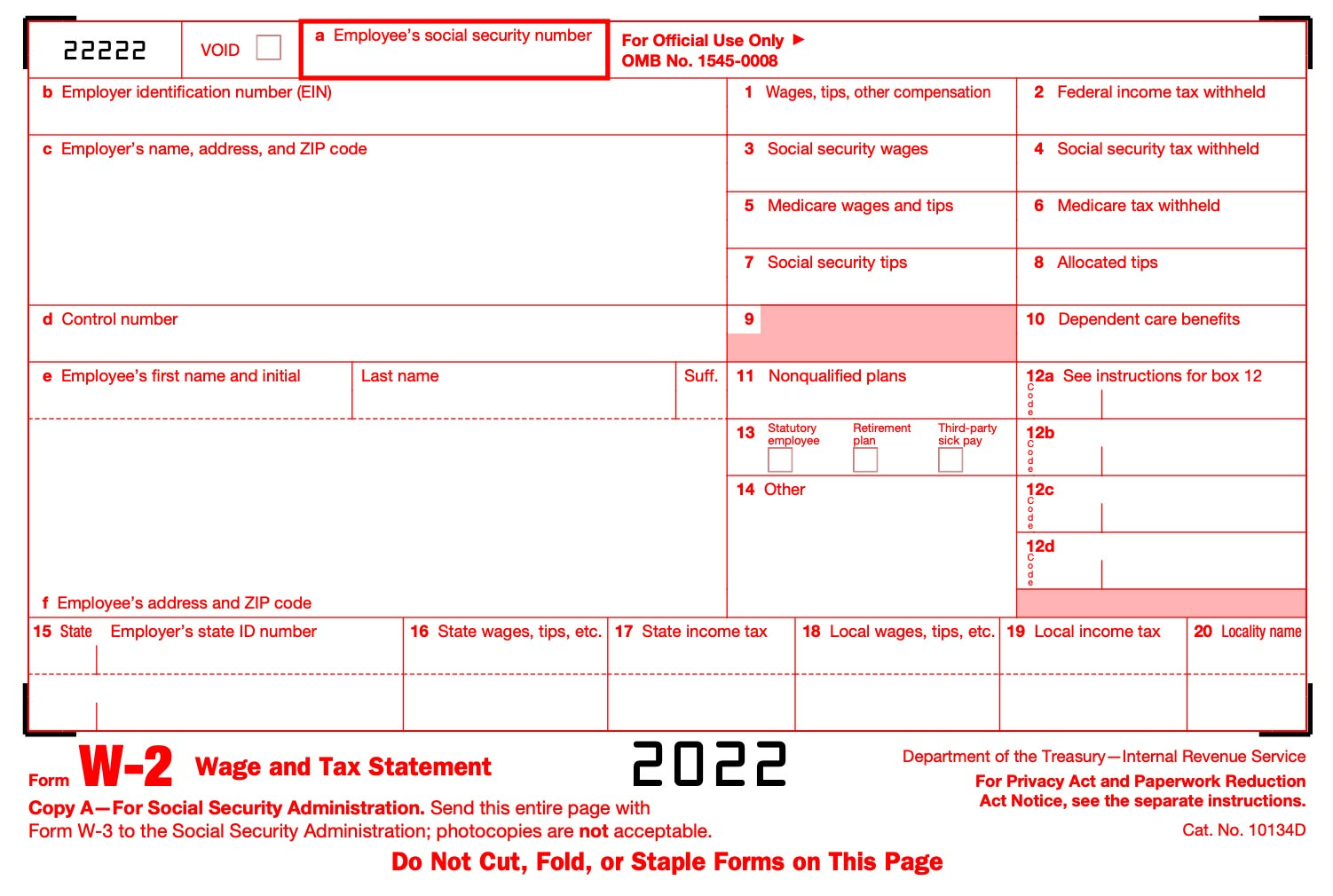

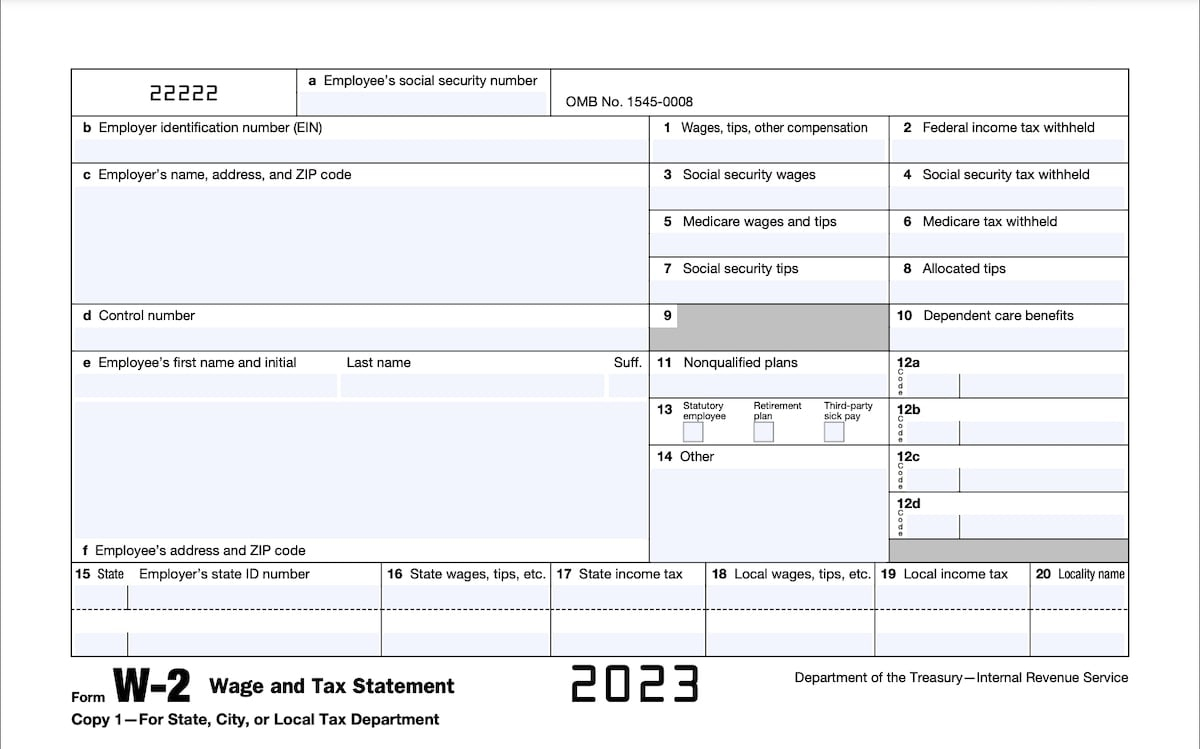

Standard W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Secrets of Your Standard W2 Form

Are you ready to embark on a journey of discovery and unravel the mysteries hidden within your standard W2 form? Fear not, for we are here to guide you through the process of cracking the code and revealing the hidden treasures that lie within this seemingly mundane document. Get ready to unlock the secrets of your financial life and gain valuable insights into your earnings, taxes, and more!

Crack the Code: Understanding Your Standard W2 Form

The first step in unlocking the secrets of your standard W2 form is understanding the various sections and boxes that make up this essential document. From your personal information to your employer’s details, each section plays a crucial role in painting a picture of your financial situation. Take a closer look at Box 1 to see how much you earned in wages, Box 2 for federal income tax withheld, and Box 3 for your Social Security wages. By deciphering these numbers, you can gain a better understanding of your income and tax obligations.

Moving on to Box 12, you may uncover additional insights such as contributions to retirement plans, health savings accounts, or other pre-tax benefits provided by your employer. These hidden treasures can help you plan for the future and make informed decisions about your finances. Don’t forget to review Box 4 for any excess Social Security tax withheld and Box 6 for any tips you reported to your employer. By delving into these details, you can uncover valuable information that may impact your tax returns and financial well-being.

Discover Hidden Treasures: Unveiling Your W2 Form Insights

As you continue to explore your standard W2 form, you may come across valuable insights that can help you make informed decisions about your finances. Look for Box 5 to see how much of your wages were subject to Medicare tax and Box 17 to determine your state income tax withheld. These insights can give you a clearer picture of your tax liabilities and help you plan ahead for the upcoming tax season. By unlocking the secrets of your W2 form, you can take control of your financial future and make empowered choices that align with your goals.

In conclusion, your standard W2 form is not just a piece of paper filled with numbers and codes – it is a key that can unlock a world of valuable insights about your financial life. By cracking the code and discovering the hidden treasures within this document, you can gain a deeper understanding of your earnings, taxes, and benefits. So take a closer look at your W2 form today and embark on a journey of financial discovery that will empower you to make informed decisions and secure a brighter future.

Below are some images related to Standard W2 Form

non standard w2 form means, standard w2 form, what is a standard w2, who sends out w2 forms, , Standard W2 Form.

non standard w2 form means, standard w2 form, what is a standard w2, who sends out w2 forms, , Standard W2 Form.