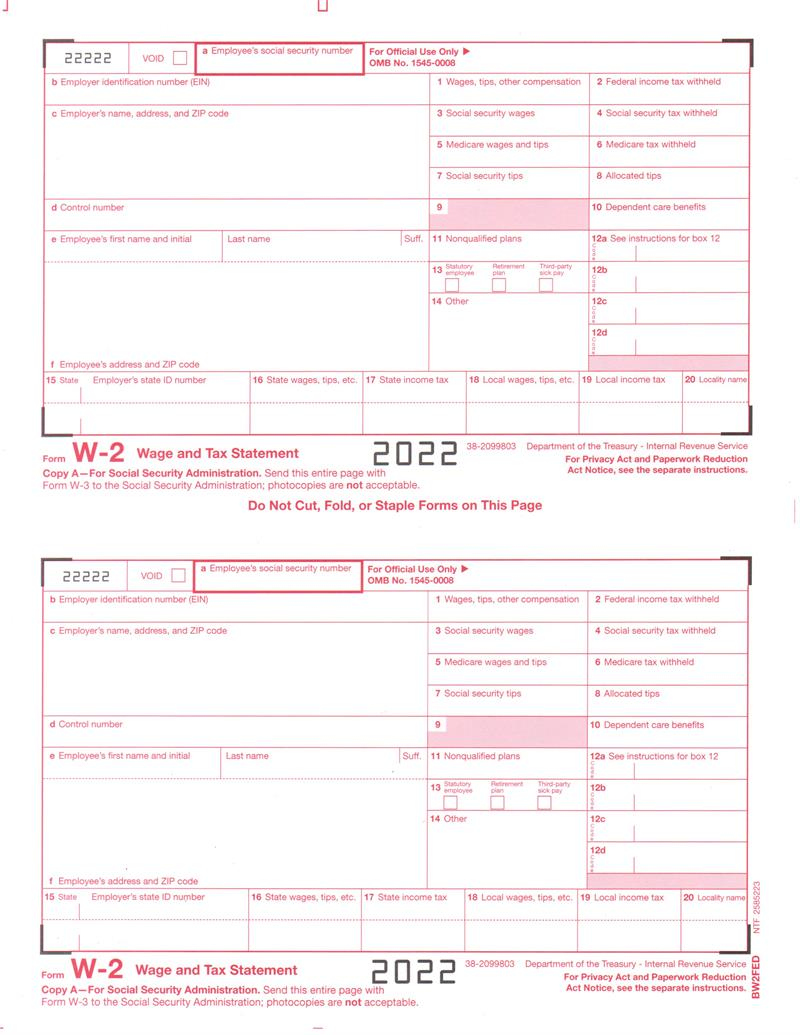

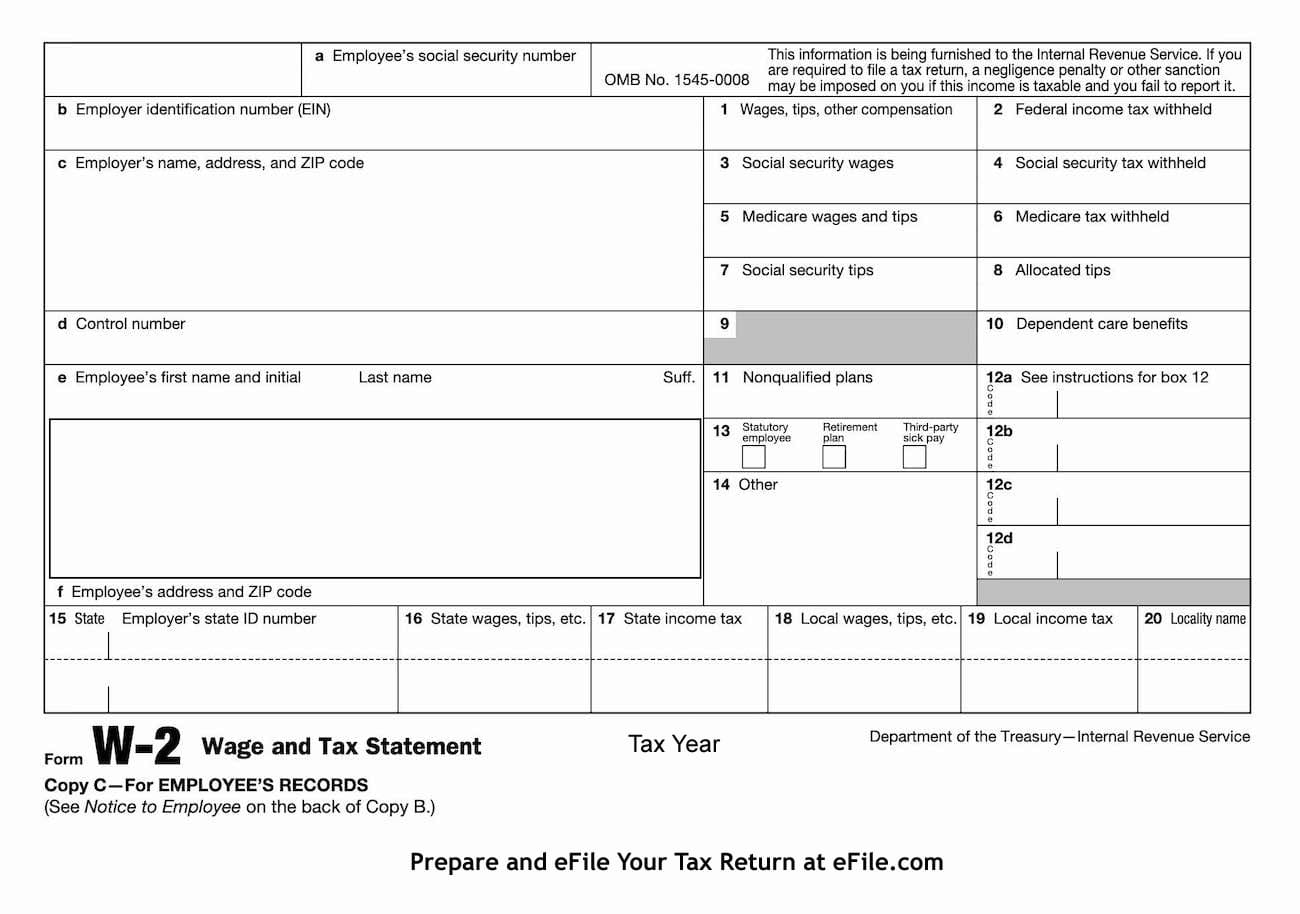

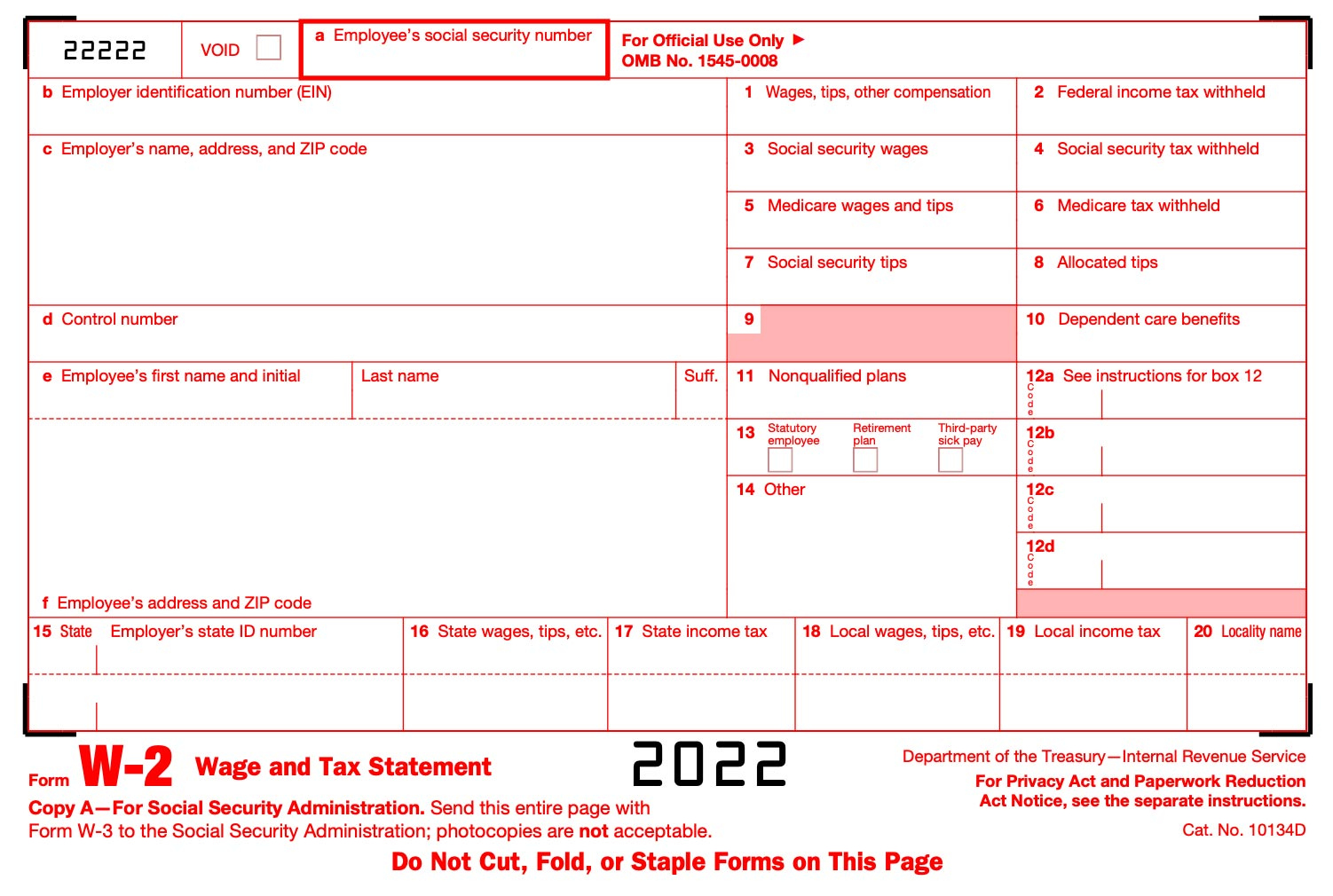

Social Security W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

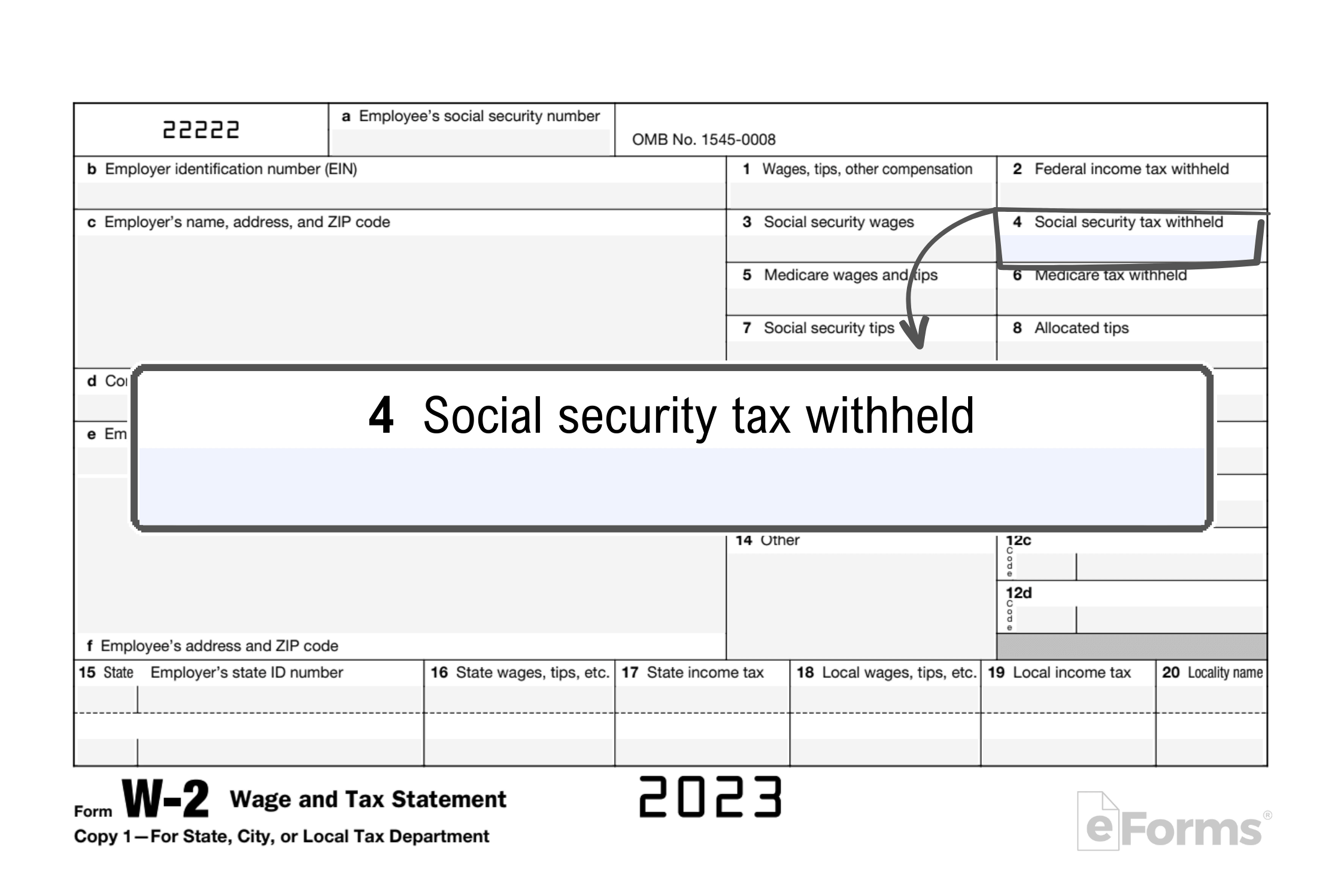

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Discover the Secret to Maximizing Your Social Security Benefits!

Are you ready to unlock the full potential of your Social Security benefits? Your Social Security W2 form holds the key to maximizing your earnings and securing your financial future. By understanding how to interpret and utilize this crucial document, you can take control of your retirement planning and ensure you’re getting the benefits you deserve.

Your Social Security W2 form provides essential information about your earnings history and contributions to the Social Security program. By reviewing this document carefully, you can identify any discrepancies or missing credits that could impact your future benefits. With a clear understanding of your earnings record, you can make informed decisions about when to start claiming Social Security and how to maximize your monthly payments.

When it comes to Social Security benefits, knowledge is power. By unlocking the secrets of your Social Security W2 form, you can take control of your financial future and ensure you’re making the most of this valuable resource. Don’t let your benefits slip through the cracks – empower yourself with the information you need to secure a comfortable retirement.

Unleash Your Earnings Potential with Your Social Security W2 Form!

Your Social Security W2 form isn’t just a piece of paper – it’s a roadmap to maximizing your earnings potential. By understanding how your contributions to the Social Security program impact your benefits, you can make strategic decisions that will enhance your financial security in retirement. Whether you’re just starting your career or nearing retirement age, your Social Security W2 form is a valuable tool for planning your financial future.

Unlocking the full potential of your Social Security benefits starts with understanding your earnings history and contributions. Your Social Security W2 form provides a detailed record of your annual earnings and contributions to the program, giving you insight into how these factors impact your future benefits. By reviewing this information and seeking guidance from a financial advisor, you can develop a plan that maximizes your Social Security benefits and ensures a comfortable retirement.

Don’t let confusion or uncertainty stand in the way of securing the benefits you deserve. With a clear understanding of your Social Security W2 form and how it impacts your benefits, you can take control of your financial future and unlock the full potential of your earnings. Empower yourself with the knowledge and tools you need to make informed decisions and secure a comfortable retirement.

In conclusion, your Social Security W2 form is a valuable resource for maximizing your benefits and securing your financial future. By understanding how to interpret and utilize this document, you can unlock the full potential of your earnings and make informed decisions about your retirement planning. Don’t let confusion or uncertainty hold you back – empower yourself with the knowledge and tools you need to unlock your benefits and achieve financial security in retirement.

Below are some images related to Social Security W2 Form

get social security w2 online, social security office w2 forms, social security tax form w-2, social security w2 file format, social security w2 form, , Social Security W2 Form.

get social security w2 online, social security office w2 forms, social security tax form w-2, social security w2 file format, social security w2 form, , Social Security W2 Form.