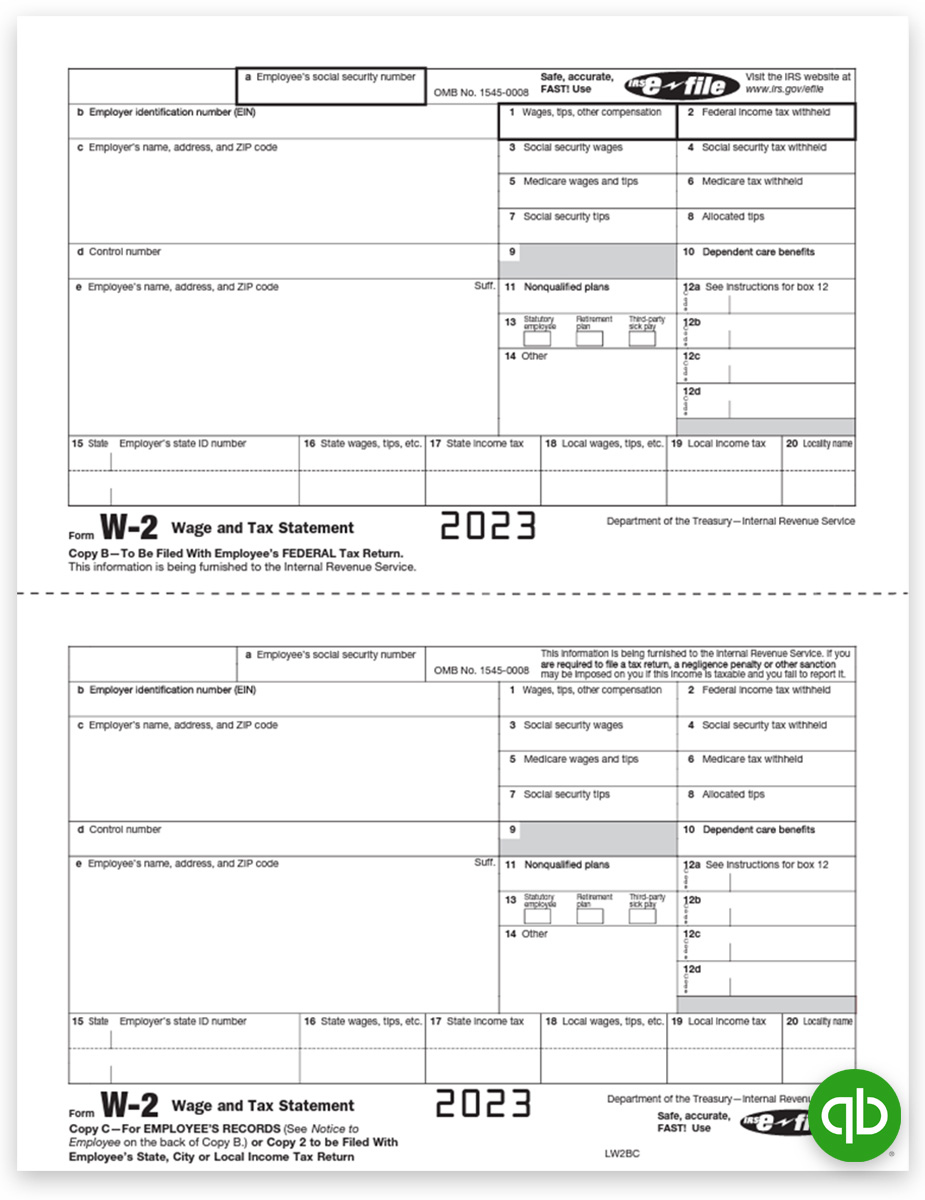

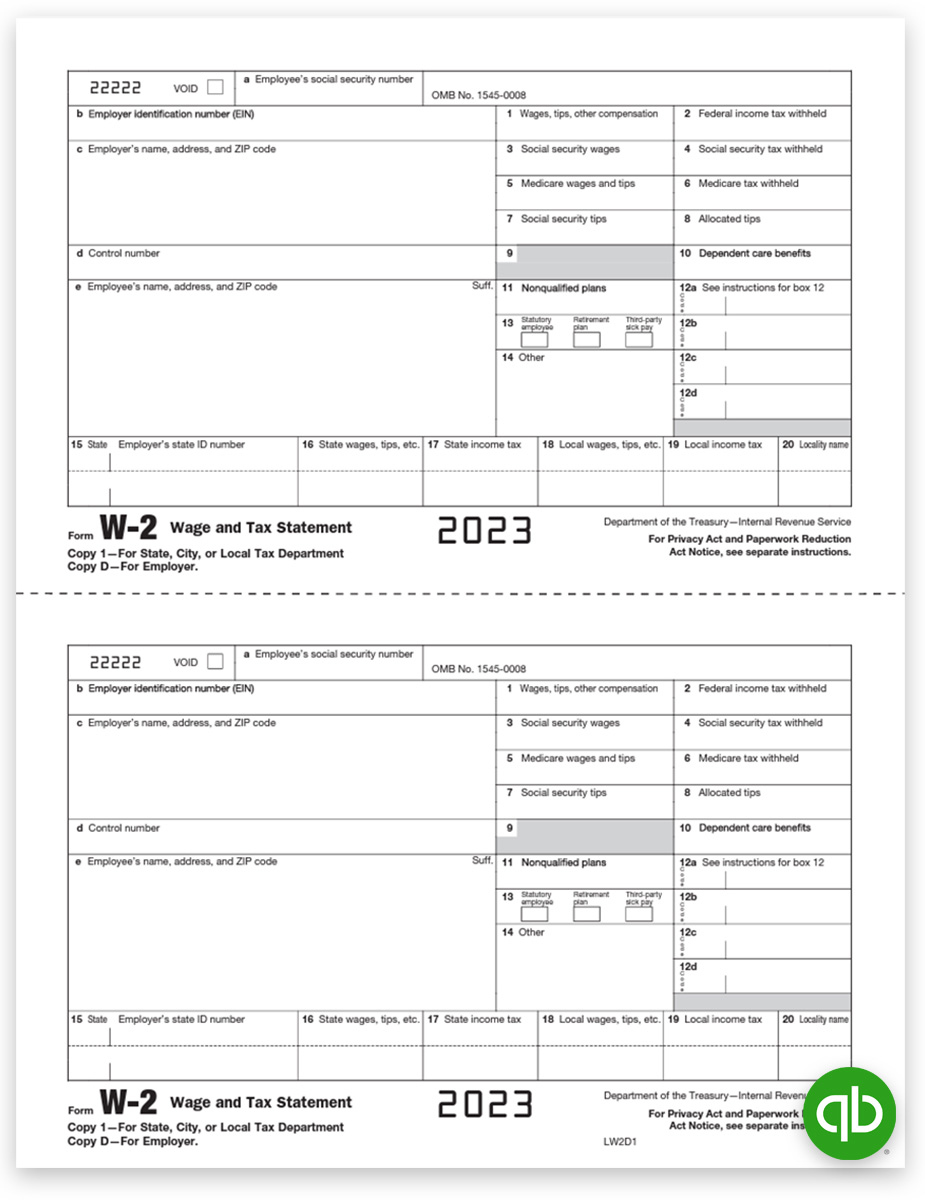

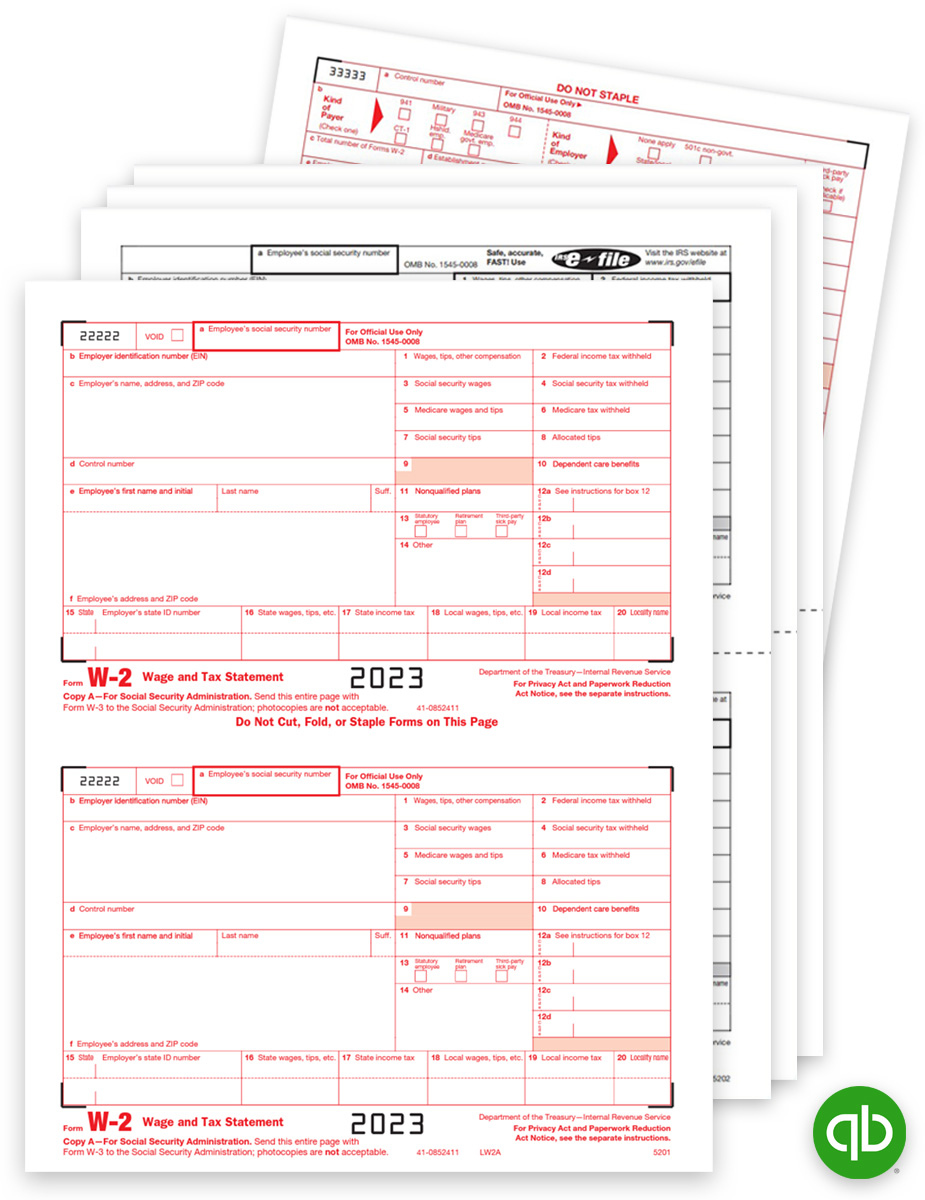

Quickbooks W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unleash Your Inner Tax Pro with QuickBooks W2s!

Tax season can be a daunting time of year for many individuals and businesses, but with the right tools at your disposal, you can breeze through it like a seasoned professional. QuickBooks W2s is one such tool that can make tax preparation a breeze. By mastering the ins and outs of QuickBooks W2s, you can unleash your inner tax pro and tackle tax time with confidence and ease. Say goodbye to the stress and confusion of tax season and hello to a simplified and streamlined process with QuickBooks W2s.

QuickBooks W2s allows you to easily generate and print W2 forms for your employees, making the process of reporting wages and taxes a breeze. With QuickBooks W2s, you can rest assured that all your W2 forms will be accurate and compliant with IRS guidelines, helping you avoid any potential penalties or fines. By mastering QuickBooks W2s, you can save time and effort during tax season, allowing you to focus on more important aspects of your business.

Whether you’re a small business owner or an individual taxpayer, mastering QuickBooks W2s can help you simplify tax time and ensure that you’re fully prepared when it comes time to file your taxes. With QuickBooks W2s, you can say goodbye to the headaches and confusion of tax preparation and hello to a stress-free and efficient process. So why wait? Start mastering QuickBooks W2s today and make tax time a breeze!

In conclusion, mastering QuickBooks W2s is the key to making tax time easy and stress-free. With QuickBooks W2s, you can unleash your inner tax pro and tackle tax season with confidence and ease. So why struggle through tax season when you can simplify the process with QuickBooks W2s? Take the first step towards mastering QuickBooks W2s today and say goodbye to the headaches and confusion of tax preparation. Your future self will thank you come tax time!

Below are some images related to Quickbooks W2 Forms

order quickbooks w2 forms, quickbooks compatible w2 forms, quickbooks online w2 filing, quickbooks online w2 reprint, quickbooks print w2 forms, , Quickbooks W2 Forms.

order quickbooks w2 forms, quickbooks compatible w2 forms, quickbooks online w2 filing, quickbooks online w2 reprint, quickbooks print w2 forms, , Quickbooks W2 Forms.