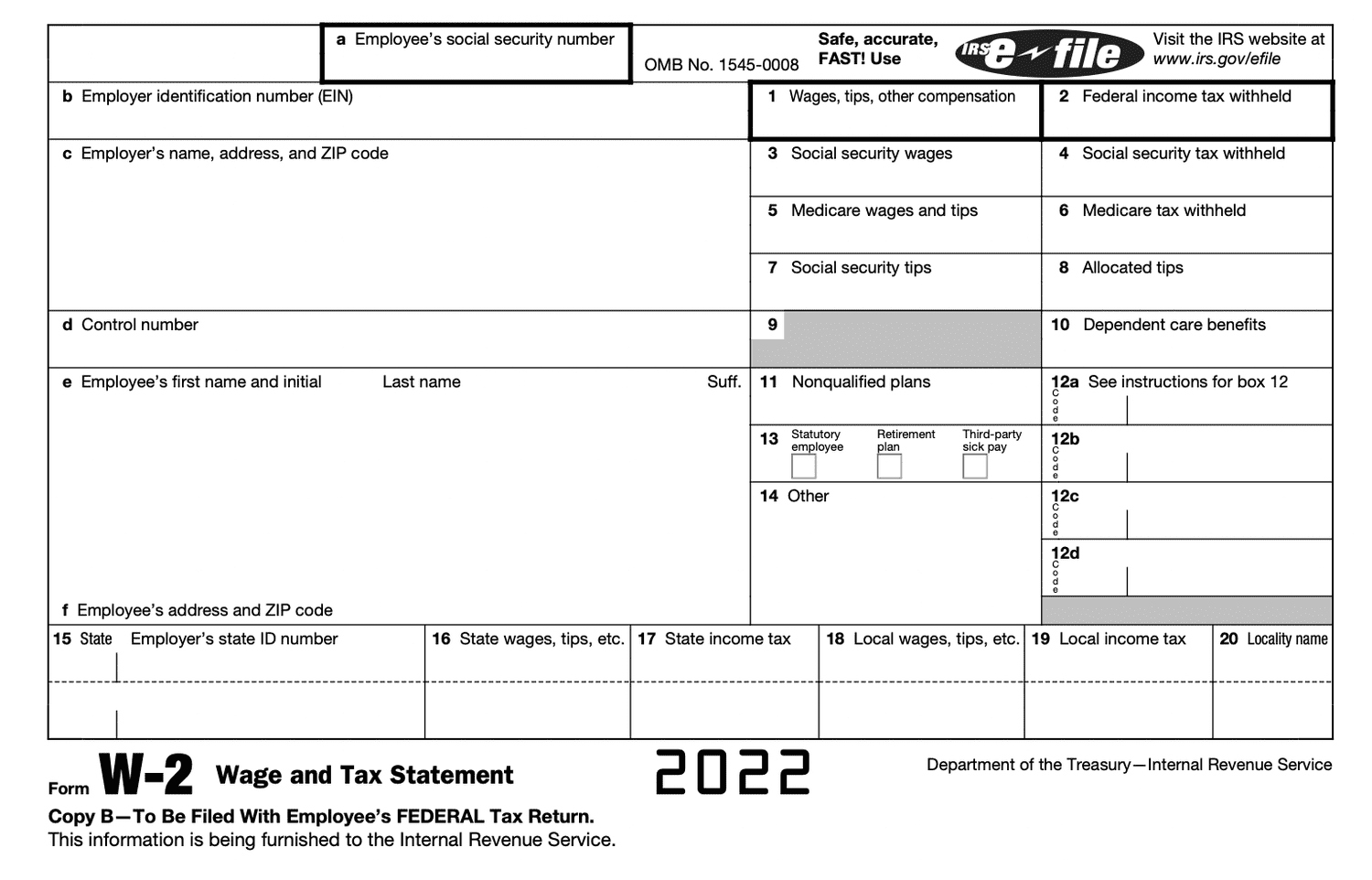

Old W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

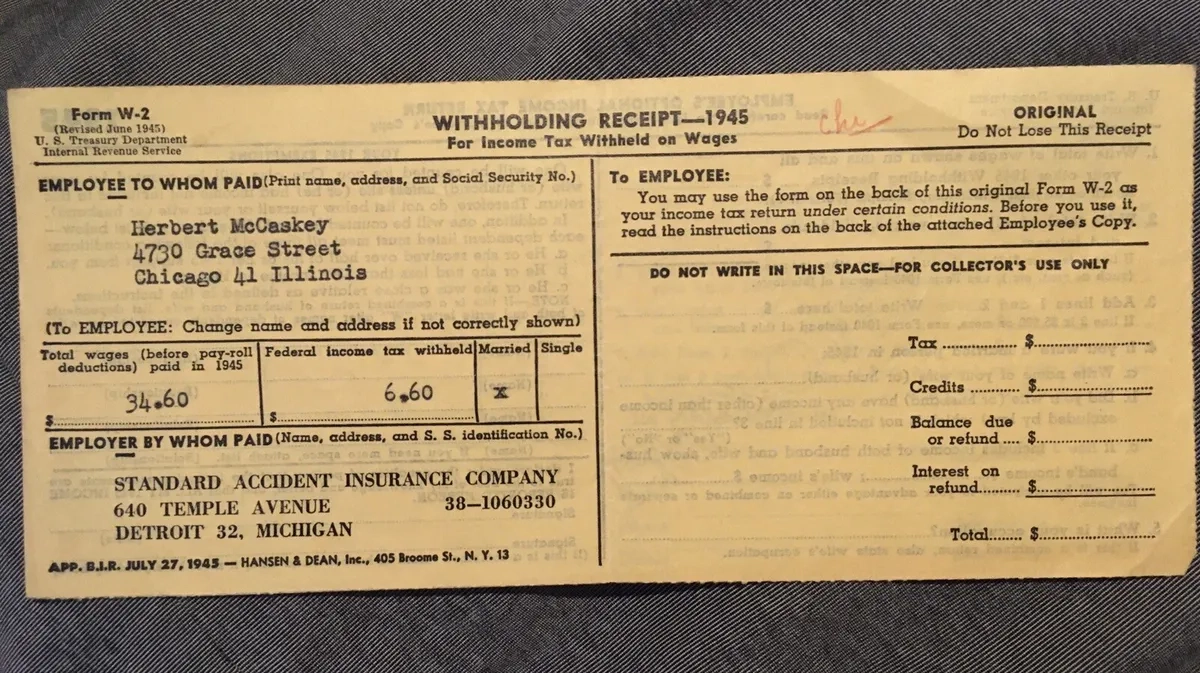

Unearthed Treasures: Discovering Old W2 Forms!

Have you ever stumbled upon a box of old papers tucked away in your attic or basement, only to find a treasure trove of forgotten memories? Well, imagine the excitement of discovering old W2 forms among those papers! These seemingly mundane documents hold hidden gems that can shed light on your past earnings, taxes paid, and even unlock financial secrets you may have long forgotten.

Delving into the Past: Unearthed Treasures

As you sift through the old W2 forms from years past, you may find yourself transported back in time to a different era of your life. Each form tells a story of the work you did, the income you earned, and the taxes you paid during that particular year. You may uncover forgotten jobs, long-lost sources of income, or even surprises like bonuses or unexpected deductions. Delving into these old W2 forms can provide a fascinating glimpse into your financial history and how far you’ve come since then.

Hidden Gems Await: Discovering Old W2 Forms

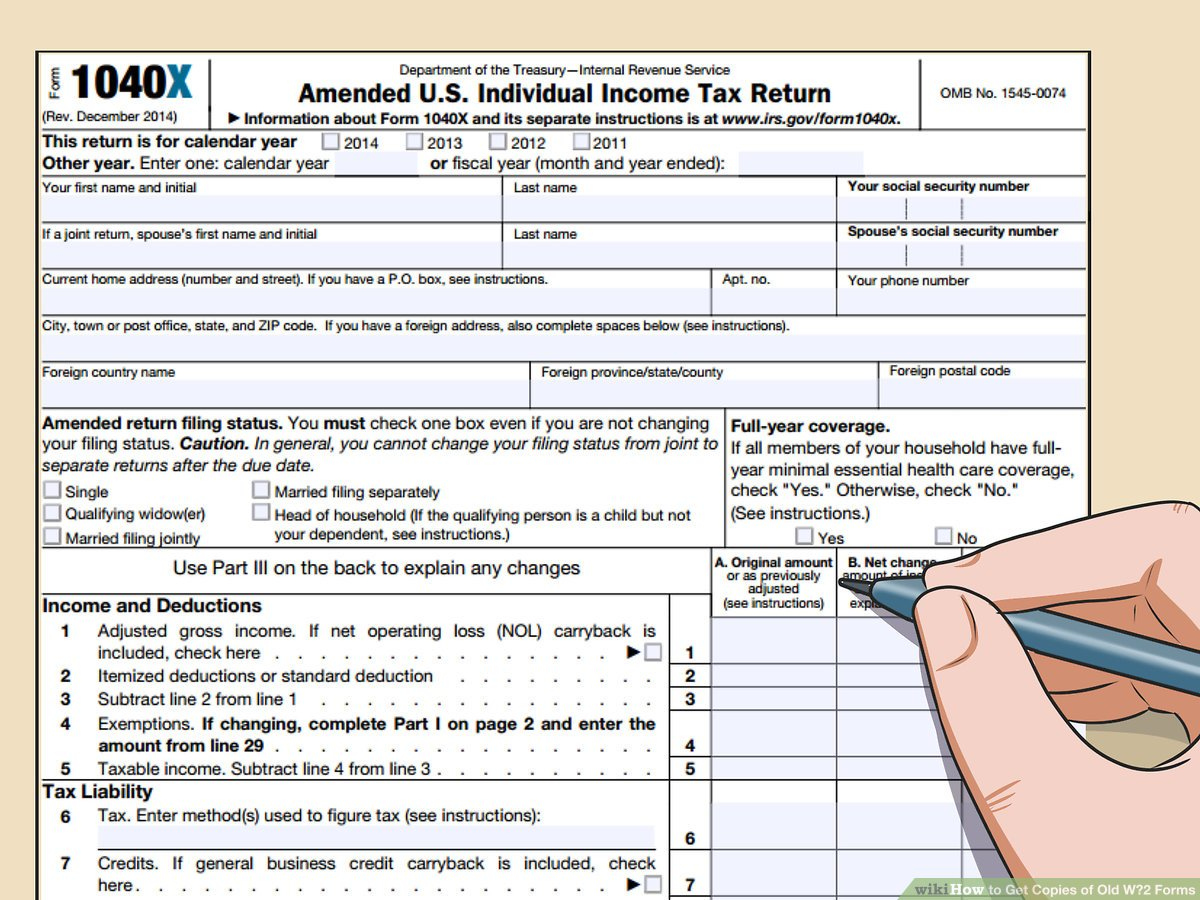

While some may view old W2 forms as just another piece of paperwork to file away, they actually hold valuable information that can help you better understand your financial past and plan for your future. By examining these forms, you can track your earnings and taxes over time, identify patterns in your income sources, and even uncover errors or discrepancies that may need to be corrected. Additionally, having access to old W2 forms can be incredibly useful when applying for loans, filing taxes, or even just reflecting on your journey to financial stability.

Unearthing old W2 forms may seem like a tedious task at first, but the rewards of discovering these hidden treasures can be truly priceless. So next time you come across a box of old papers, don’t overlook those W2 forms – they may hold the key to unlocking valuable insights about your financial past and empowering you to make informed decisions for your future.

Below are some images related to Old W2 Forms

can i file old w2 forms, can you find your old w2 online, how can i retrieve old w2 forms, how do i locate old w2 forms, how do you look up old w2 forms, , Old W2 Forms.

can i file old w2 forms, can you find your old w2 online, how can i retrieve old w2 forms, how do i locate old w2 forms, how do you look up old w2 forms, , Old W2 Forms.