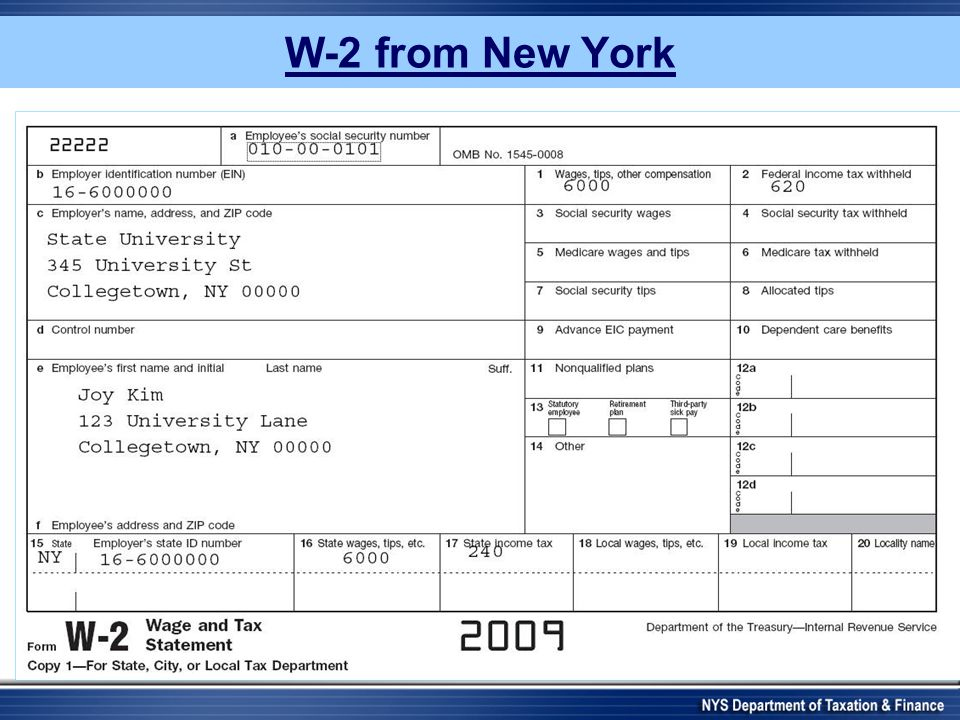

New York W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

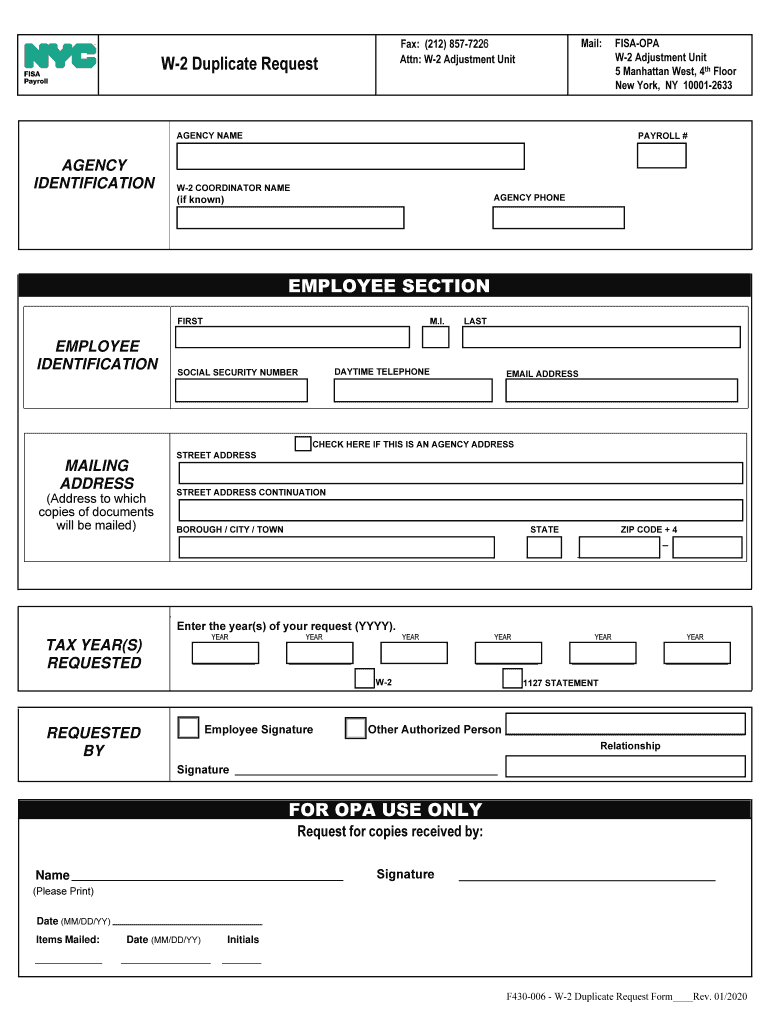

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unveiling the Enchantment: New York W2 Form Explained!

Are you ready to unlock the magic of the New York W2 form? This seemingly mundane piece of paperwork actually holds the key to understanding your income and taxes like never before. The W2 form is a vital document that your employer provides to you at the end of each year, detailing your earnings and taxes withheld. Let’s dive into the secrets that the New York W2 form holds and how you can use it to your advantage!

Discover the Secrets to Mastering Your W2 Magic in New York!

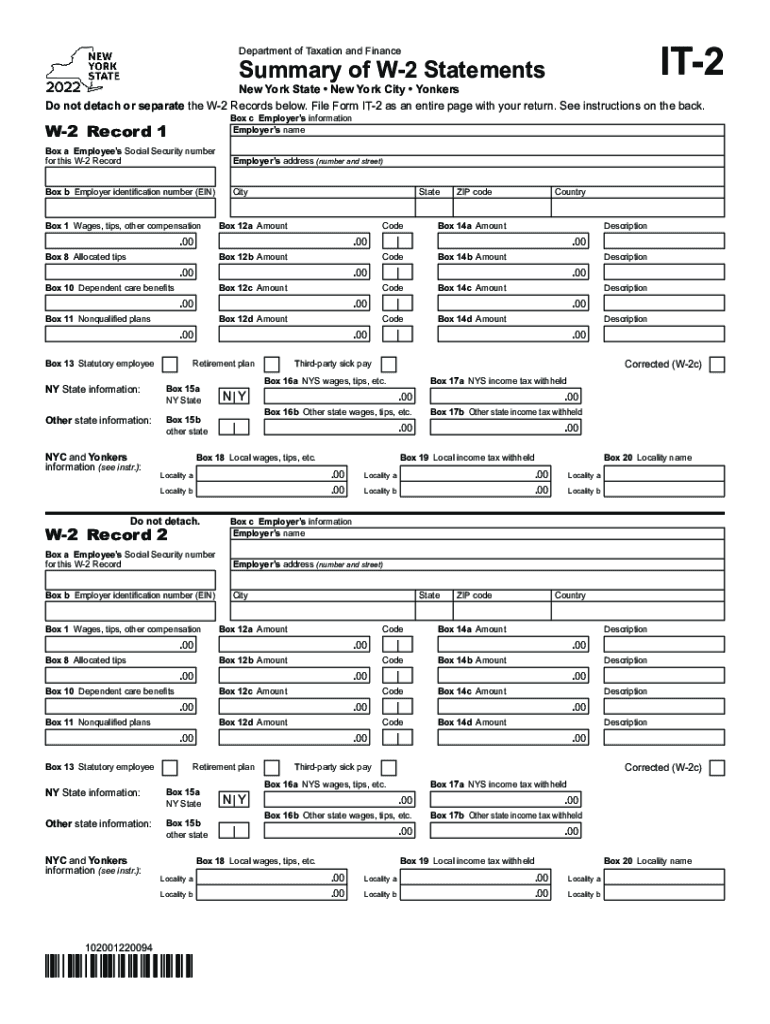

One of the most important sections of the New York W2 form is Box 1, which shows your total wages for the year. This number is crucial for calculating your taxable income and determining how much you owe in taxes. Another key section is Box 2, which displays the federal income tax withheld from your paychecks throughout the year. Understanding these numbers will help you make sense of your tax situation and plan accordingly.

Furthermore, the New York W2 form also includes important information about state income tax withholding in Box 17. This figure is essential for determining your state tax liability and ensuring that you are in compliance with New York tax laws. By carefully reviewing your W2 form and understanding these key sections, you can take control of your finances and make informed decisions about your tax obligations in the Empire State.

In conclusion, the New York W2 form may seem like just another piece of paperwork, but it actually holds a wealth of information that can help you navigate your taxes with confidence. By unlocking the magic of your W2 form and understanding its key sections, you can take control of your financial future and ensure that you are in compliance with New York tax laws. So don’t let this document intimidate you – embrace it as a tool to help you master your finances and unlock the secrets to a successful tax season in the Big Apple!

Below are some images related to New York W2 Form

new york life w2 form, new york state department of labor w2 form, new york state w2 form, new york state w2 form 2022, new york state w2 form 2023, , New York W2 Form.

new york life w2 form, new york state department of labor w2 form, new york state w2 form, new york state w2 form 2022, new york state w2 form 2023, , New York W2 Form.