Military W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

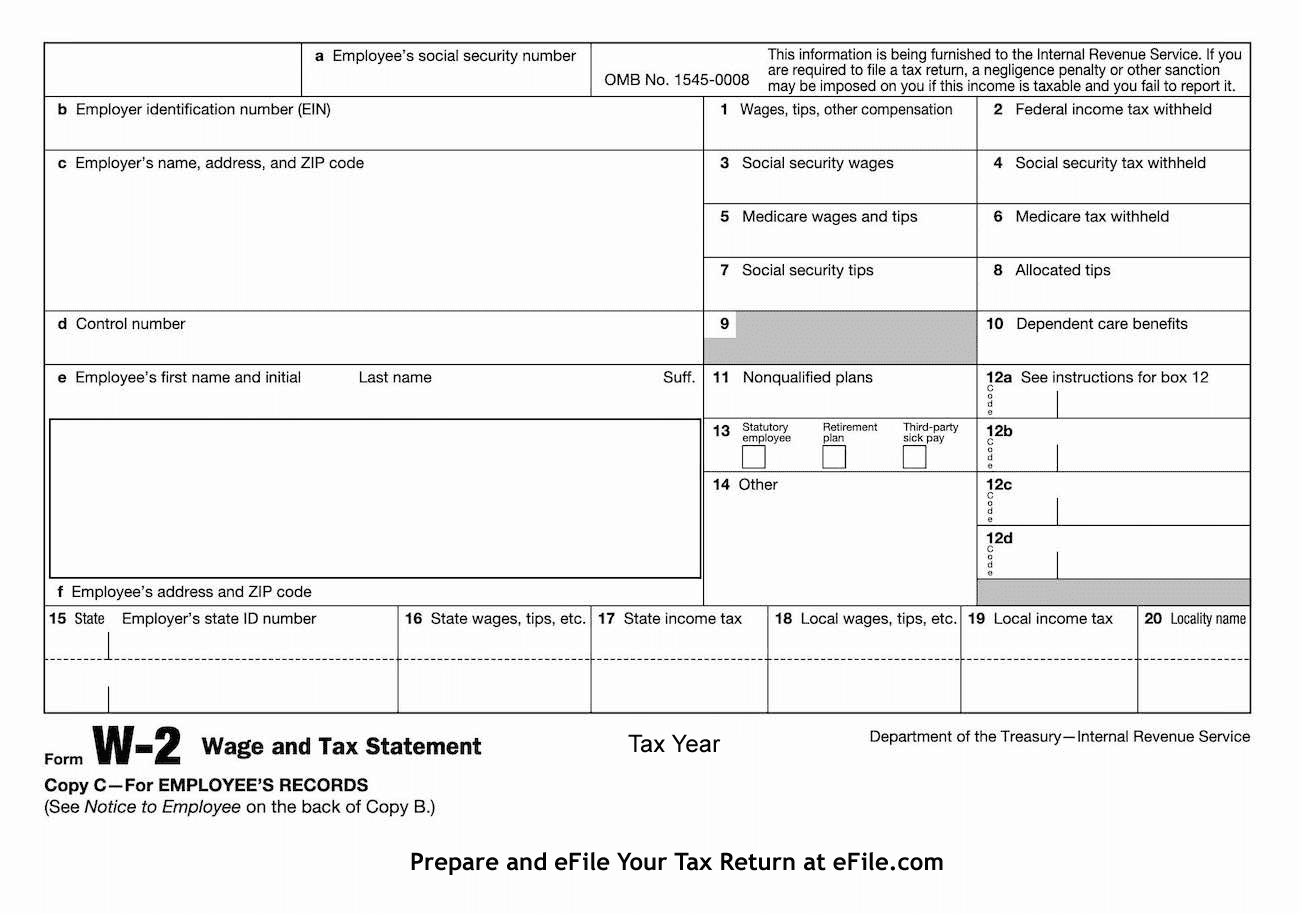

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Marching Towards Savings: Military W2 Forms Explained

Attention all soldiers! It’s that time of year again when tax season is upon us. As a member of the military, understanding your W2 forms can lead to significant savings and benefits. Your W2 form provides a detailed summary of your earnings and taxes withheld throughout the year. This document is crucial for accurately filing your taxes and maximizing your refund. Let’s dive into the world of military W2 forms and uncover the secrets to saving big this tax season.

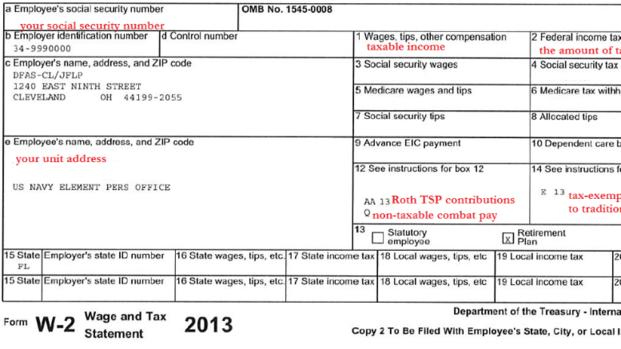

When you receive your military W2 form, take a close look at Box 1, which shows your total wages for the year. This includes not only your base pay but also any bonuses, allowances, and special pays you may have received. In Box 2, you’ll find the total federal income tax withheld from your paychecks. Understanding these numbers is essential for calculating your tax liability and potential refund. Additionally, look out for any deductions or credits specific to military personnel, such as combat pay exclusions or relocation expenses.

Attention Soldiers: How to Maximize Your Tax Benefits

As a member of the military, you may be eligible for a variety of tax benefits and deductions that can help reduce your overall tax burden. One key benefit to be aware of is the Combat Zone Tax Exclusion, which allows you to exclude certain pay earned while serving in a designated combat zone from your taxable income. This can result in significant savings on your tax bill. Additionally, be sure to take advantage of any education credits or deductions available to military personnel, such as the GI Bill and Tuition Assistance programs.

When it comes to filing your taxes, consider using tax software or seeking help from a professional who specializes in military tax preparation. They can help ensure you are taking full advantage of all available deductions and credits. Keep in mind that filing your taxes electronically and opting for direct deposit can expedite your refund and reduce the risk of errors. By staying informed and proactive, you can make the most of your military W2 forms and save big this tax season.

In conclusion, understanding your military W2 forms is essential for maximizing your tax benefits and savings. By familiarizing yourself with the information provided on your W2 form and taking advantage of available deductions and credits, you can ensure you are getting the most out of your tax return. Remember to stay organized, consult with a tax professional if needed, and file your taxes in a timely manner to avoid any penalties. Here’s to a successful tax season and salute to the savings ahead!

Below are some images related to Military W2 Forms

army w2 forms, can i get my military w2 online, military w2 example, military w2 explained, military w2 forms, , Military W2 Forms.

army w2 forms, can i get my military w2 online, military w2 example, military w2 explained, military w2 forms, , Military W2 Forms.