IS Form 1099 A W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

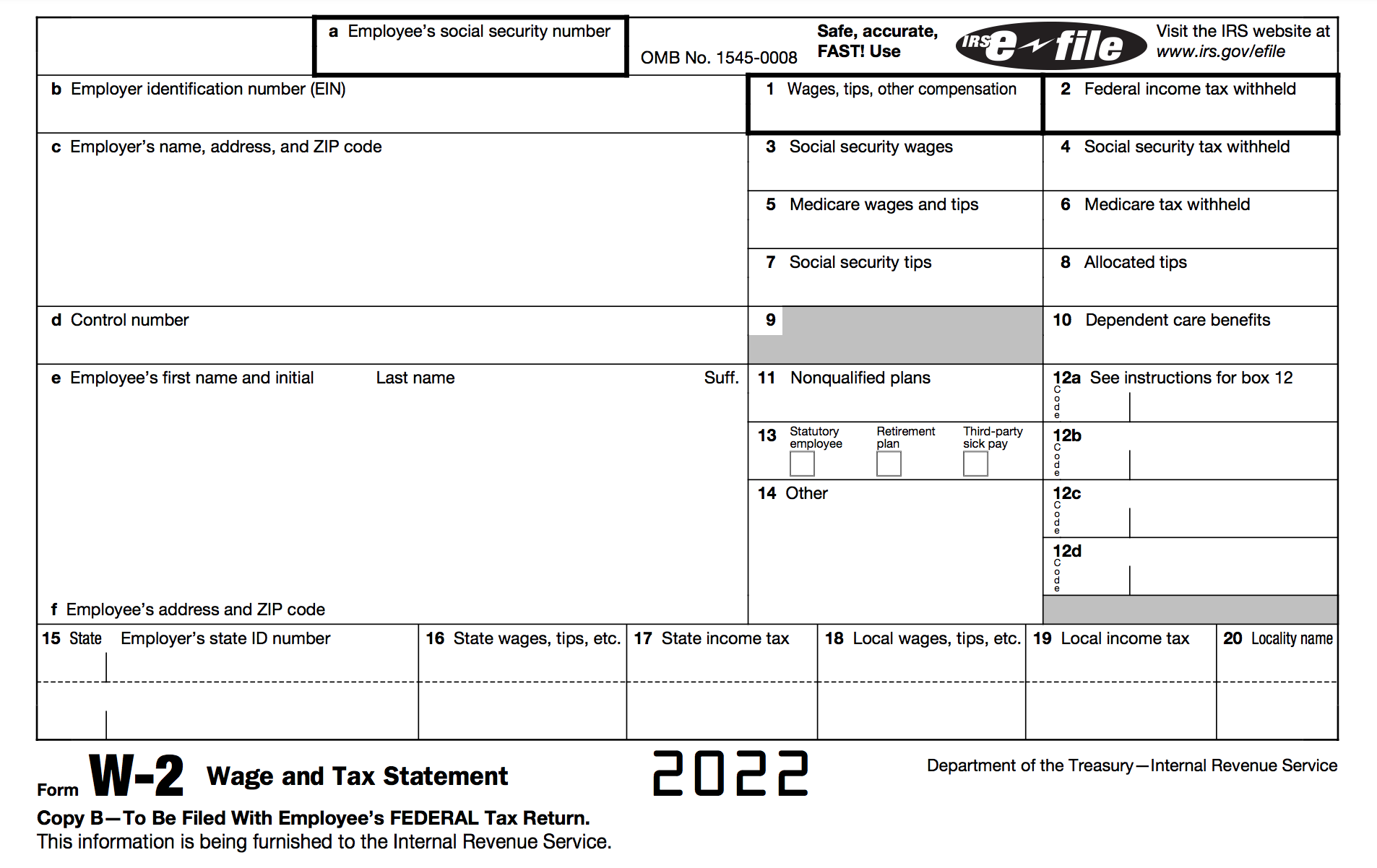

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Below are some images related to Is Form 1099 A W2

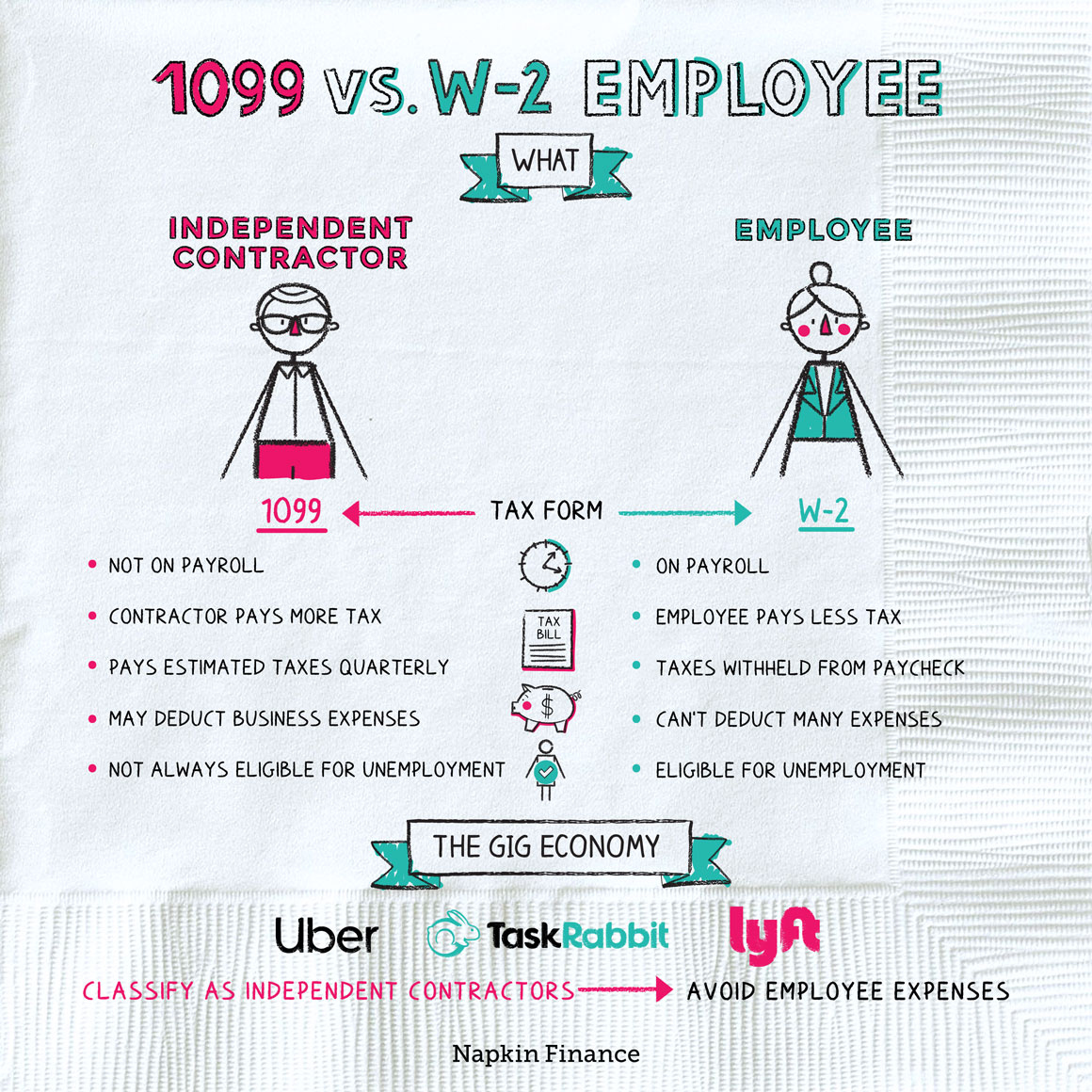

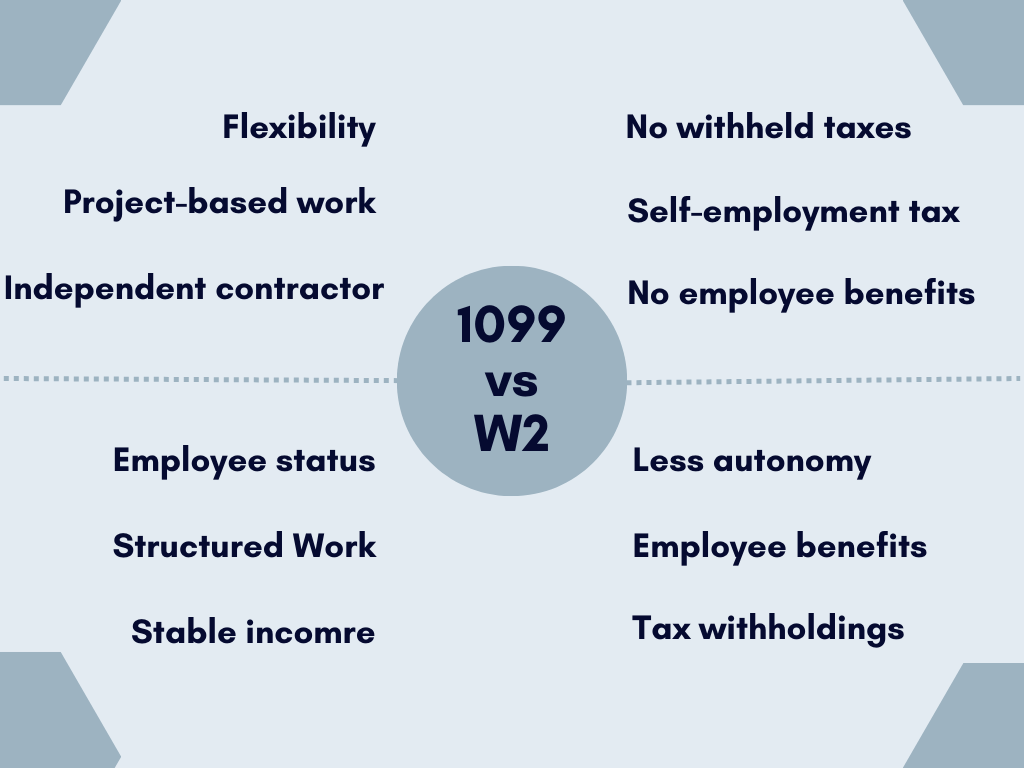

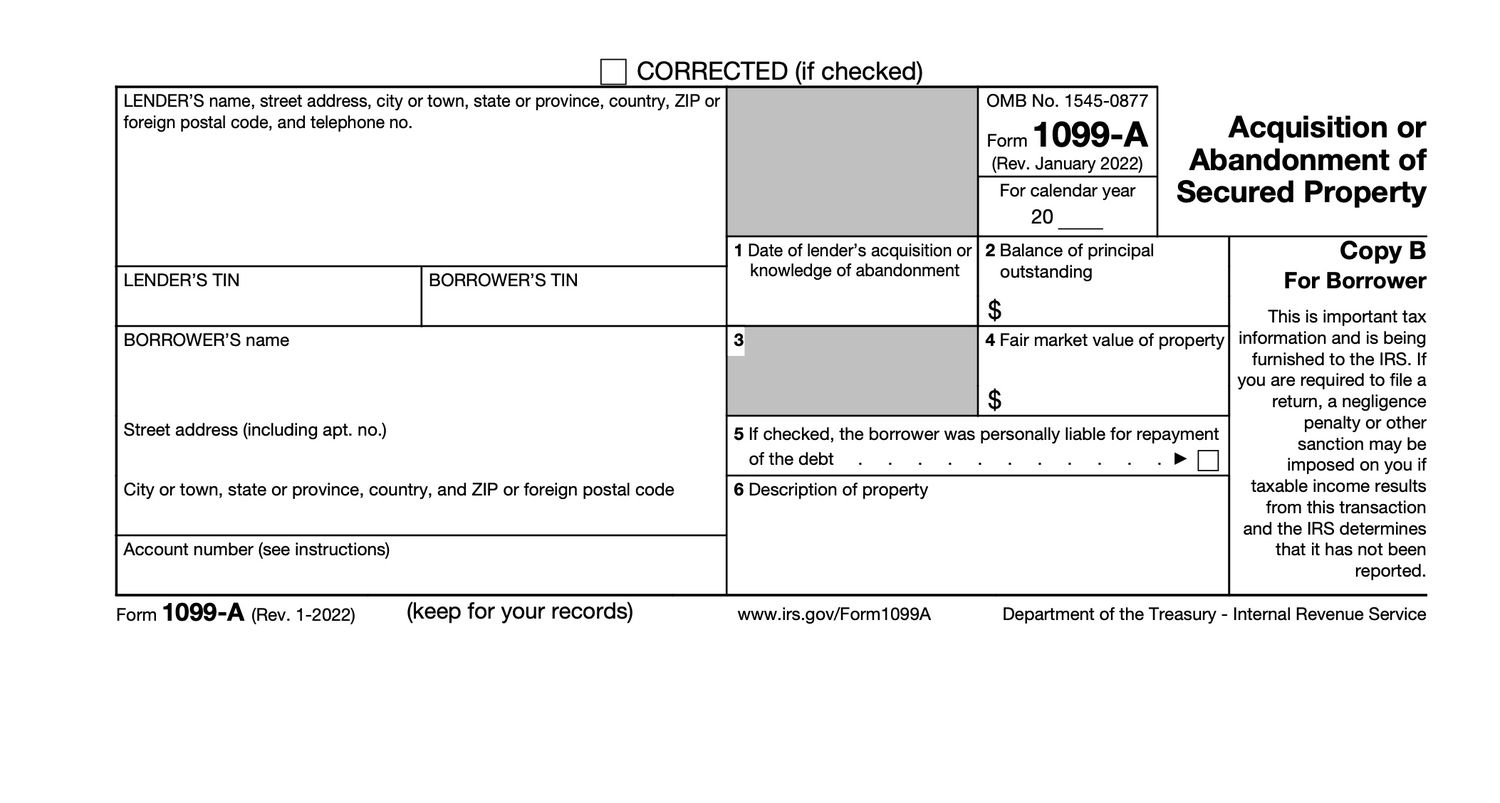

does a 1099 replace a w2, how is a 1099 form different from a w2, is 1099 a tax form, is a 1099 a w2, is a 1099 form a w2, , Is Form 1099 A W2.

does a 1099 replace a w2, how is a 1099 form different from a w2, is 1099 a tax form, is a 1099 a w2, is a 1099 form a w2, , Is Form 1099 A W2.