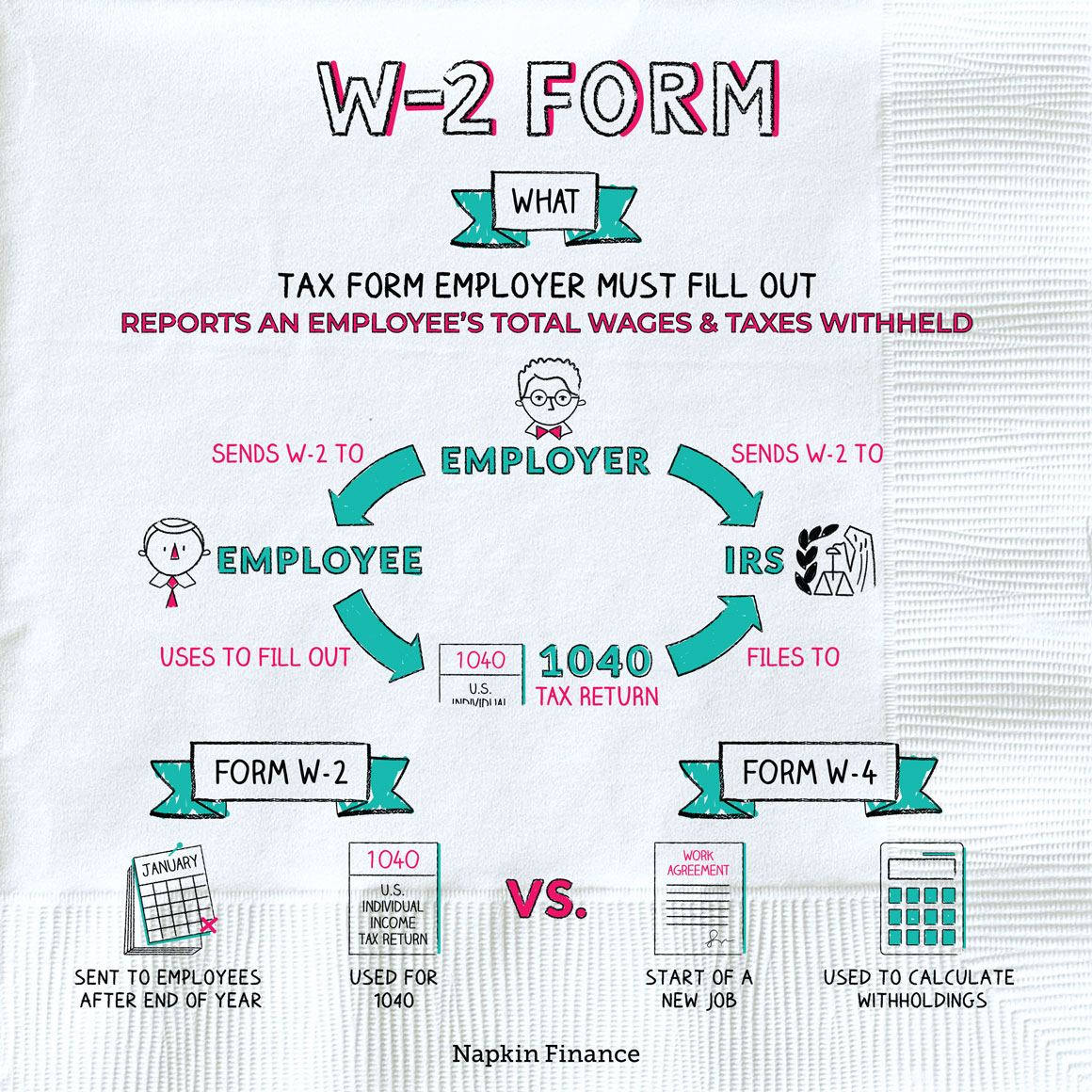

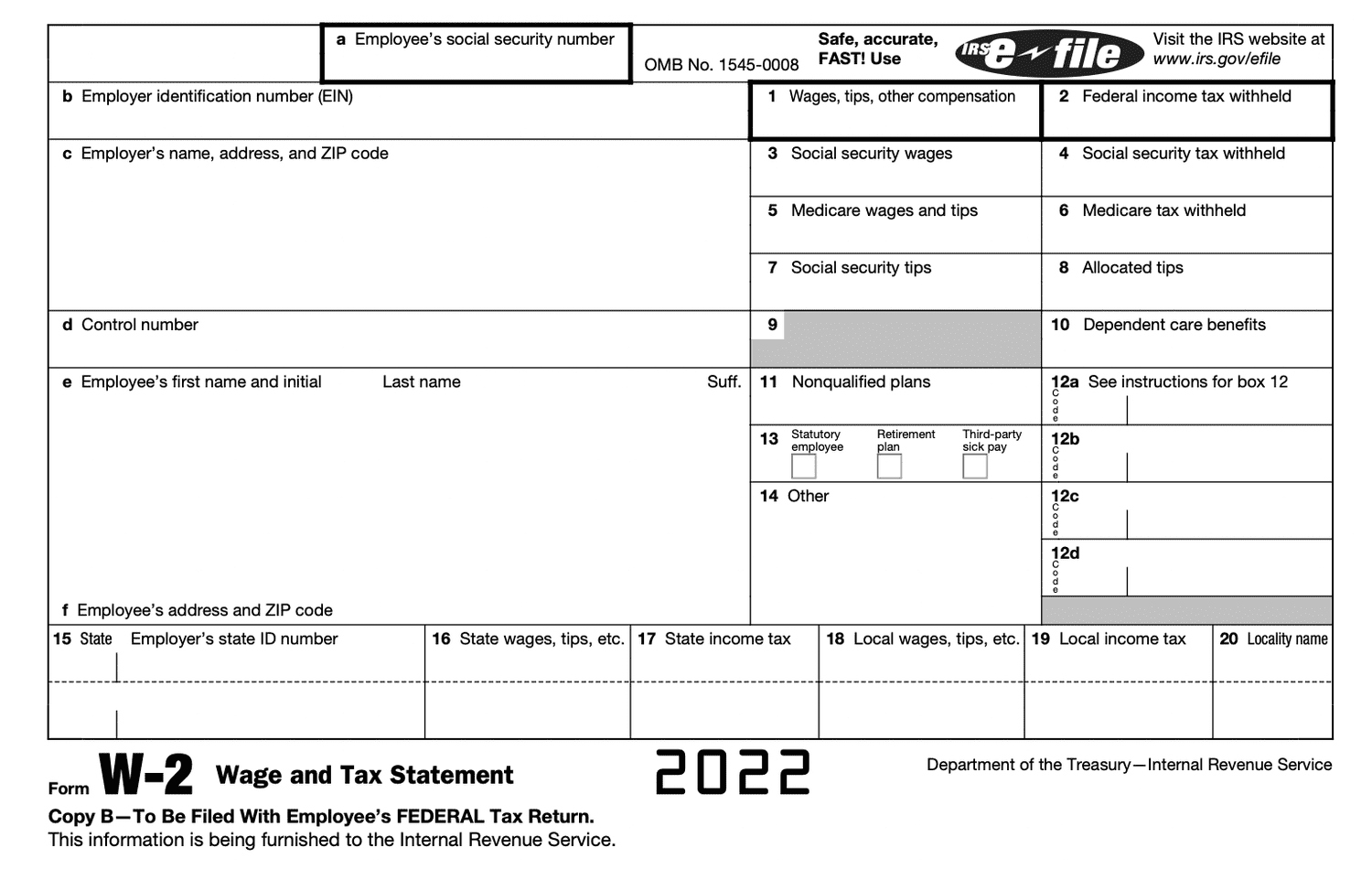

Is Form 1040 The Same As W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Decoding Tax Forms: Are Form 1040 and W2 Twinsies?

Tax season can often leave us feeling like we’re lost in a maze of numbers and forms. As we navigate our way through the world of taxes, two forms that may seem like long-lost twins are the Form 1040 and the W2. These documents play a crucial role in determining our tax liabilities and refunds, but do they really have that much in common? Let’s unravel the mystery and find out if Form 1040 and W2 are indeed twinsies.

Unraveling the Mystery of Tax Forms

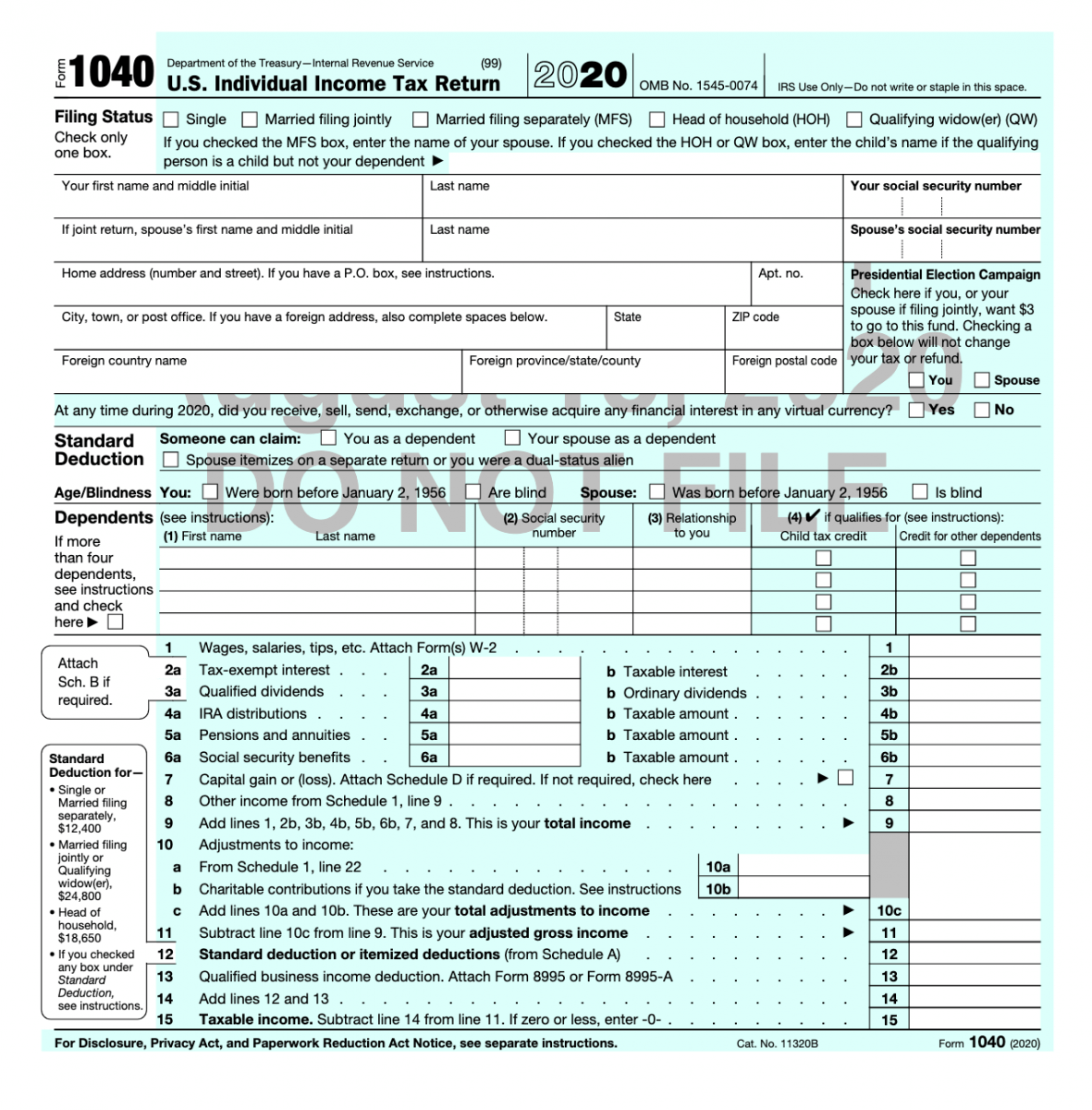

Form 1040, also known as the U.S. Individual Income Tax Return, is the form that most taxpayers use to file their annual income tax returns. It’s a comprehensive document that requires you to report your income, deductions, credits, and tax liability. On the other hand, the W2 form is a statement of wages and taxes withheld that is issued by your employer. It shows how much you earned throughout the year and how much was withheld for federal and state taxes, Social Security, and Medicare.

When comparing Form 1040 and W2, you’ll notice that they have some similarities in terms of the information they provide. Both forms include your personal information, such as your name, Social Security number, and filing status. They also require you to report your income, although the details may vary slightly. While the W2 focuses on your wages and tax withholdings, Form 1040 provides a more comprehensive overview of your income sources, including interest, dividends, and capital gains.

Form 1040 and W2: Uncanny Resemblance?

Despite their differences in terms of purpose and scope, Form 1040 and W2 do share some common traits that make them seem like twinsies. For example, both forms play a key role in determining how much tax you owe or how much of a refund you may be entitled to. They also require you to report accurate and complete information to avoid penalties or audits from the IRS. Additionally, both forms are essential documents that you’ll need to keep on file for future reference or in case of an IRS inquiry.

So, while Form 1040 and W2 may not be identical twins, they certainly have a strong family resemblance. Both forms are integral parts of the tax-filing process and provide valuable information to the IRS about your income and tax obligations. By understanding the similarities and differences between Form 1040 and W2, you can navigate the tax season with confidence and ensure that you’re fulfilling your tax obligations accurately and efficiently.

As you gather your tax documents and prepare to file your taxes, remember that Form 1040 and W2 are there to help you make sense of your financial situation and ensure that you’re in compliance with tax laws. So, embrace the challenge of decoding these tax forms and use them to your advantage to maximize your tax savings and minimize your tax liabilities. With a little patience and a keen eye for detail, you can conquer tax season like a pro and emerge victorious with a hefty tax refund in hand. Happy filing!

Below are some images related to Is Form 1040 The Same As W2

is 1040 tax form same as w2, is a form 1040 the same as a w-2, is a w2 a 1040, is form 1040 the same as w2, is irs 1040 the same as w2, , Is Form 1040 The Same As W2.

is 1040 tax form same as w2, is a form 1040 the same as a w-2, is a w2 a 1040, is form 1040 the same as w2, is irs 1040 the same as w2, , Is Form 1040 The Same As W2.