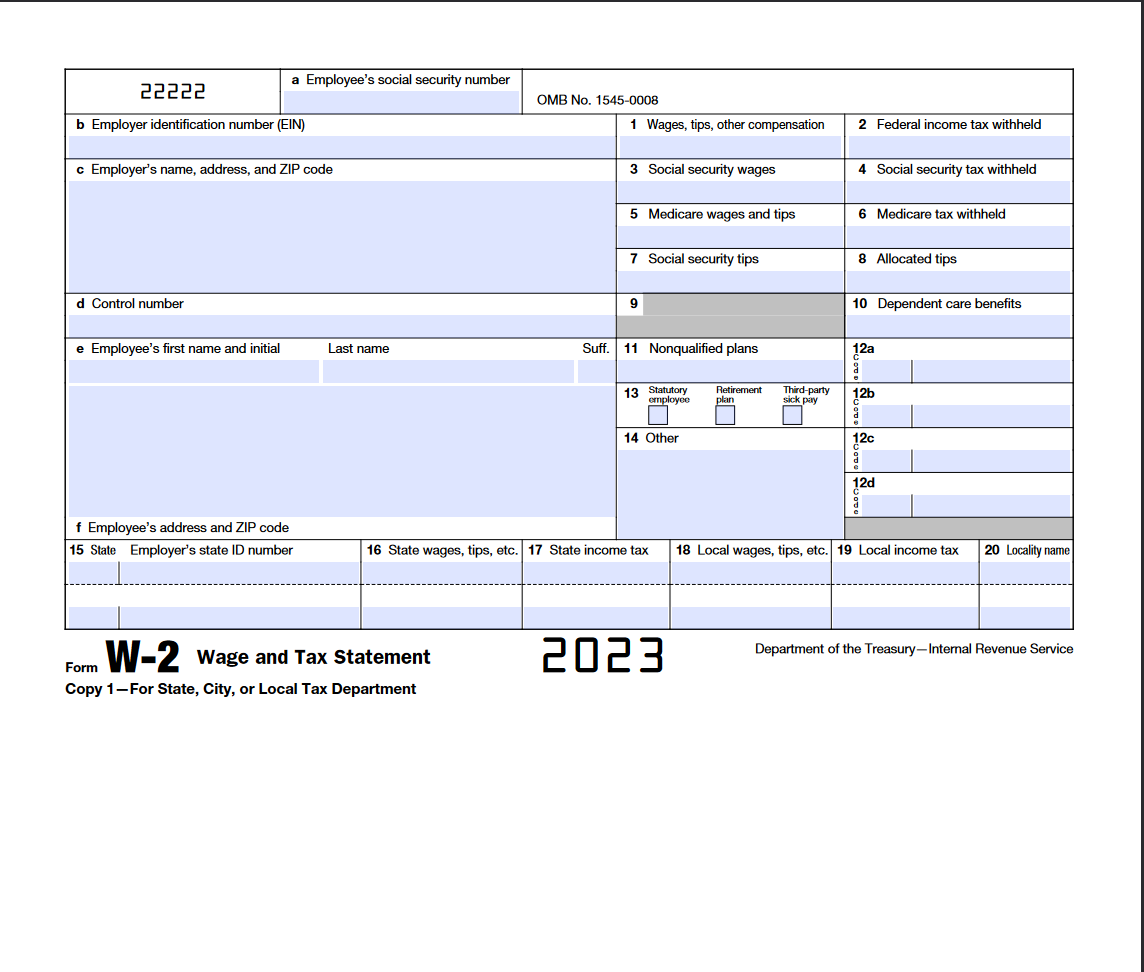

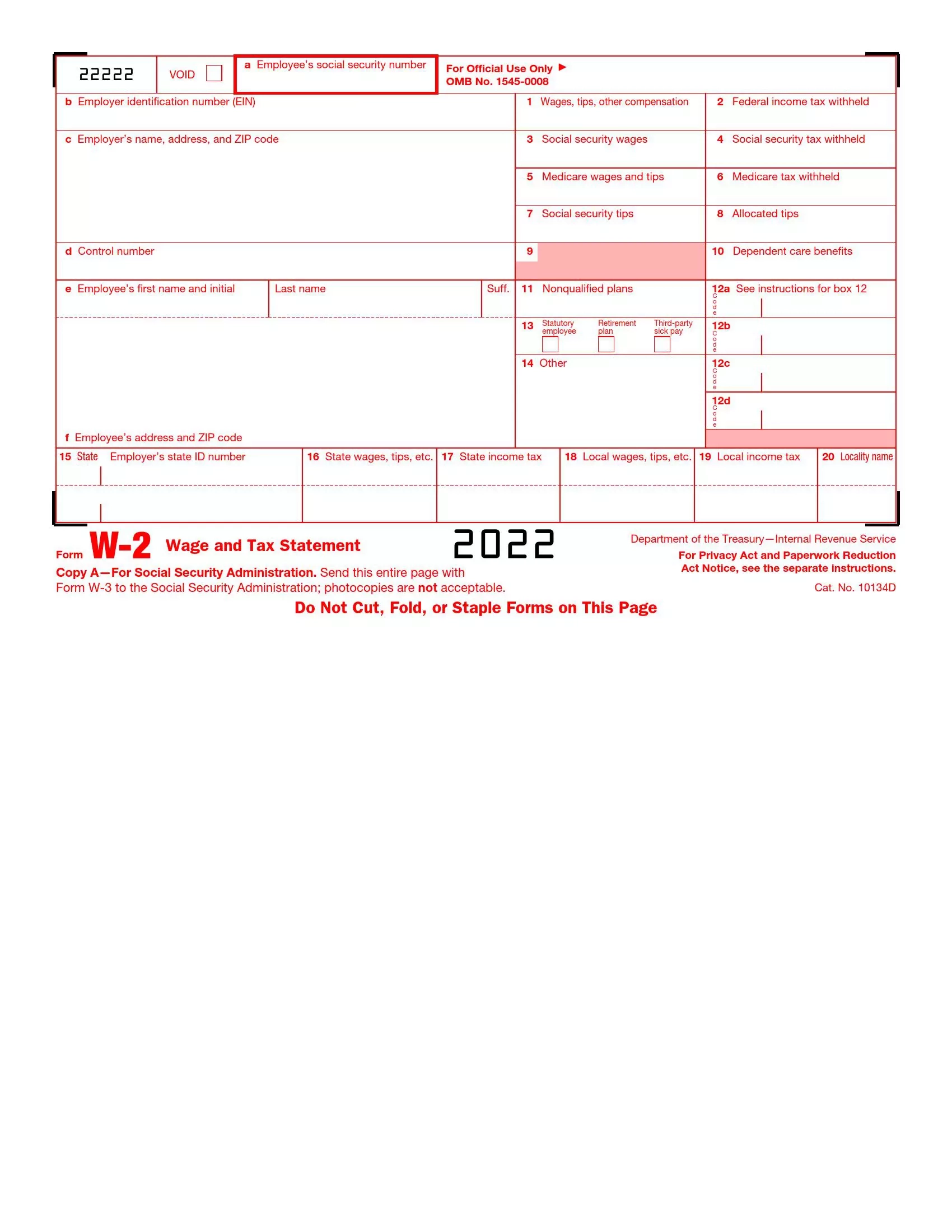

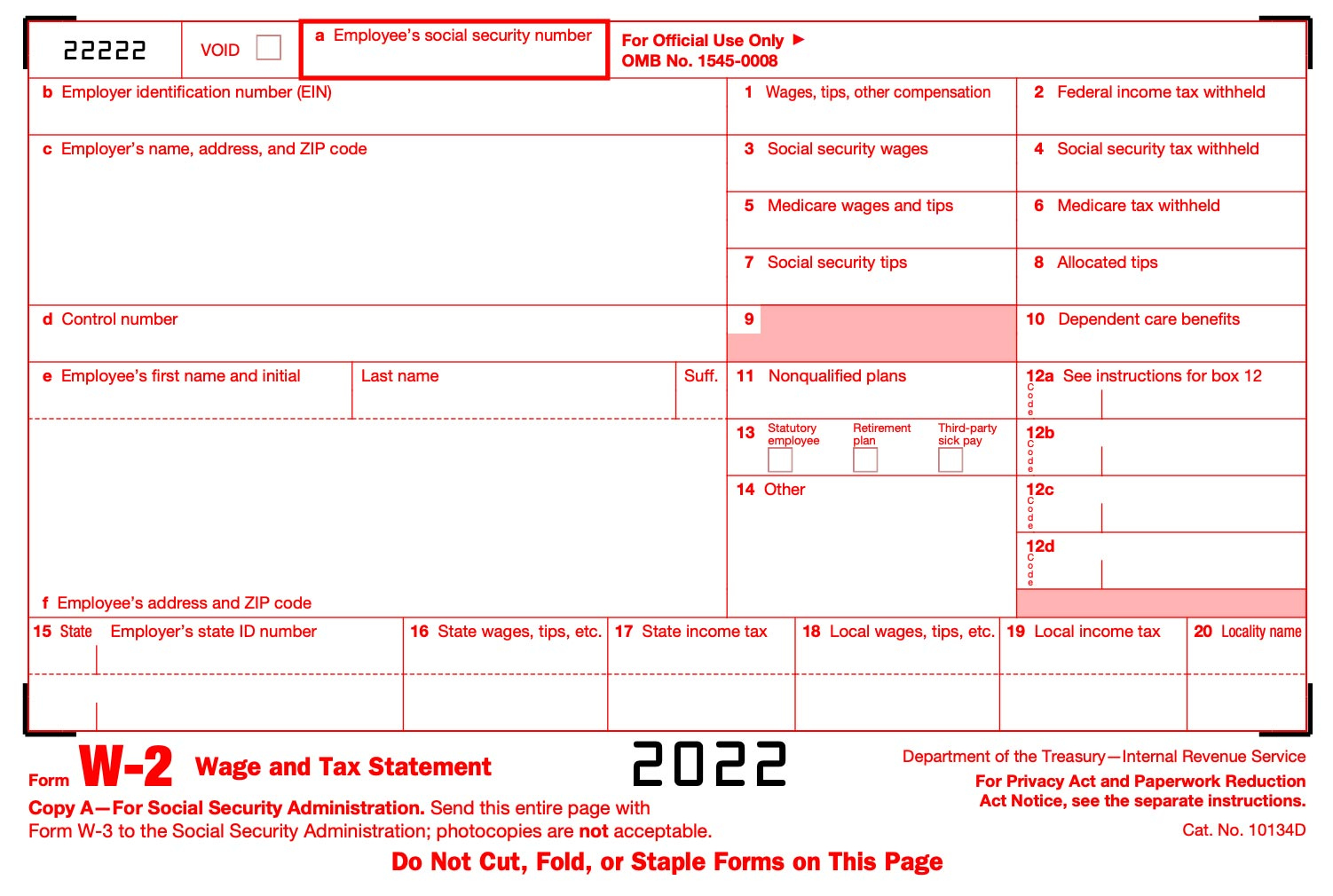

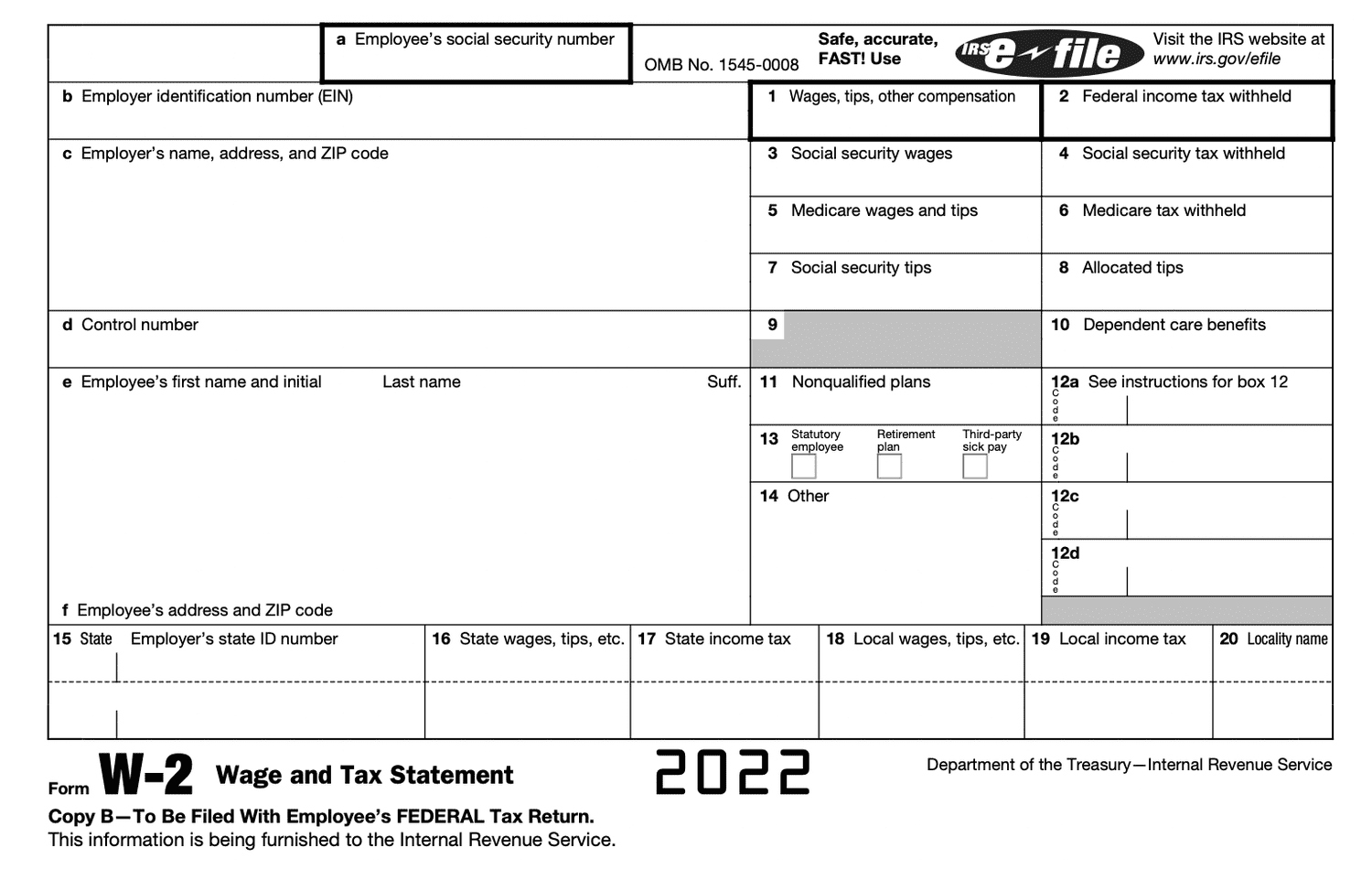

IRS Forms W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unwrapping the Magic of IRS Forms W2!

Have you ever received a mysterious envelope in the mail with the letters IRS stamped on it, only to find a form inside that looks like a jumbled mess of numbers and codes? Fear not, for within that seemingly cryptic document lies the key to understanding your income and taxes like never before – the IRS Form W2! This magical form holds the power to unlock the secrets of your financial year, providing a window into your earnings, deductions, and tax withholdings. Let’s embark on a journey to unravel the enchantment of IRS Forms W2 together!

Discover the Enchantment of IRS Forms W2!

As you gaze upon the intricate details of your W2 form, you may feel like you’re deciphering a hidden language. But fear not, for each box and line on the form has a special meaning that can illuminate your financial picture. From Box 1 showing your total wages to Box 2 revealing your federal income tax withheld, each section of the form plays a vital role in painting a comprehensive picture of your income and tax obligations. By taking the time to unravel the magic of your W2 form, you can gain valuable insights into your financial health and make informed decisions about your tax planning.

The magic of IRS Form W2 doesn’t stop at just providing a summary of your earnings and taxes. It also serves as a tool for unlocking potential tax credits and deductions that could save you money. By carefully reviewing your W2 form, you may discover opportunities to maximize your tax refund or minimize your tax liability. From educational expenses to retirement contributions, the information captured on your W2 form can open doors to valuable tax-saving strategies. So don’t let the complexity of the form intimidate you – embrace the magic of W2 and harness its power to optimize your tax situation.

Dive into the Mystique of W2 Forms!

Delving deeper into the mystique of W2 forms, you’ll find that they not only benefit individual taxpayers but also play a crucial role in ensuring compliance and transparency in the tax system. Employers use W2 forms to report employee earnings and tax withholdings to the IRS, helping to ensure that everyone pays their fair share of taxes. By providing a standardized format for reporting income and taxes, W2 forms promote accuracy and consistency in tax reporting, making it easier for both taxpayers and the IRS to track financial transactions. So next time you receive your W2 form, remember that it’s not just a piece of paper – it’s a vital tool in upholding the integrity of the tax system.

In conclusion, the magic of IRS Forms W2 lies not only in their ability to demystify your income and taxes but also in their role in promoting tax compliance and transparency. By embracing the enchantment of W2 forms and diving into their intricacies, you can gain a deeper understanding of your financial situation and make informed decisions about your tax planning. So the next time you receive that mysterious envelope in the mail, don’t be afraid to unwrap the magic of your W2 form and unlock its hidden treasures. Happy tax season!

Below are some images related to Irs Forms W2

irs form w2 box 12 codes, irs form w2 instructions, irs form w2 pdf, irs form w2c fillable, irs form w2g, , Irs Forms W2.

irs form w2 box 12 codes, irs form w2 instructions, irs form w2 pdf, irs form w2c fillable, irs form w2g, , Irs Forms W2.