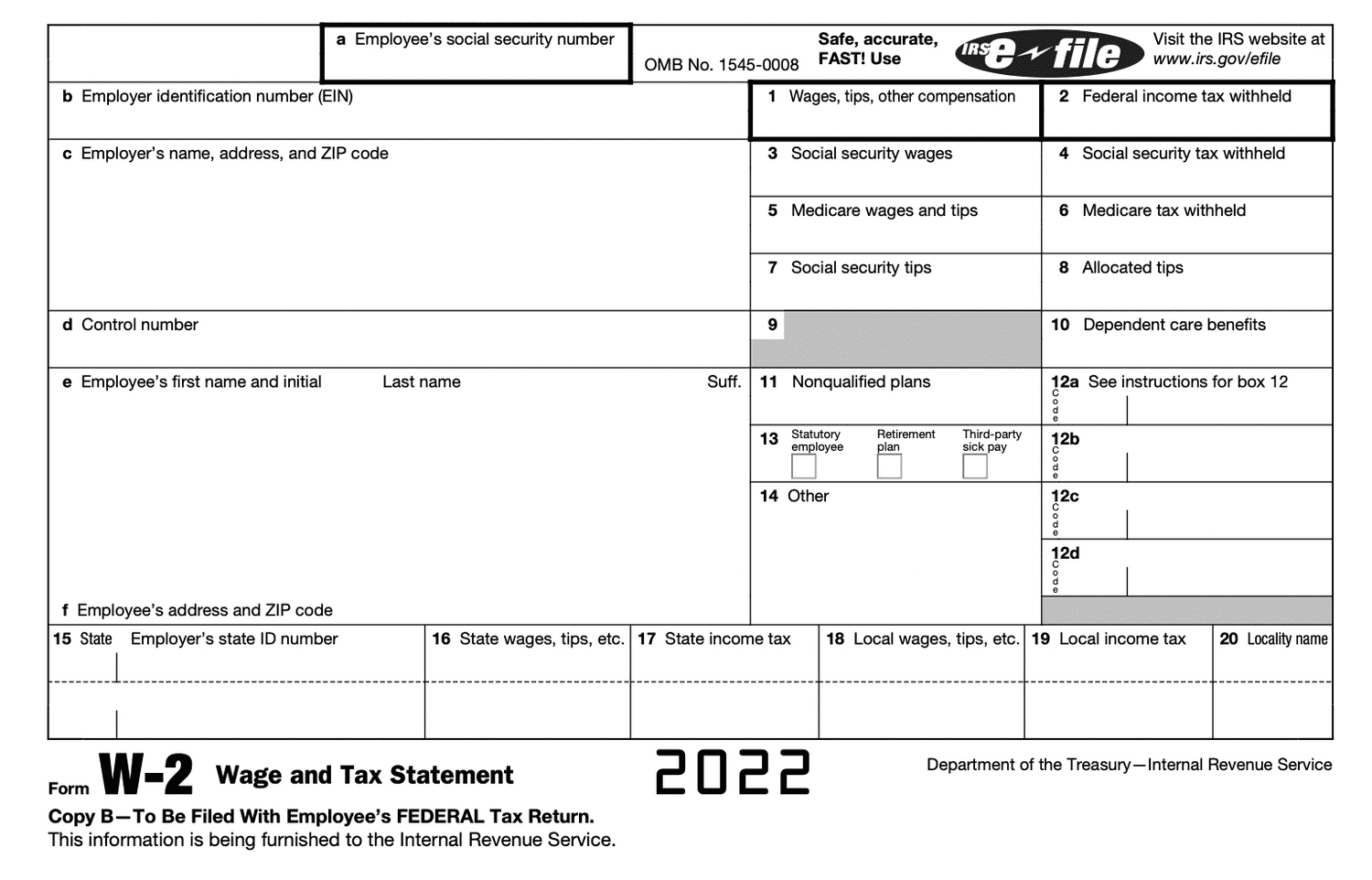

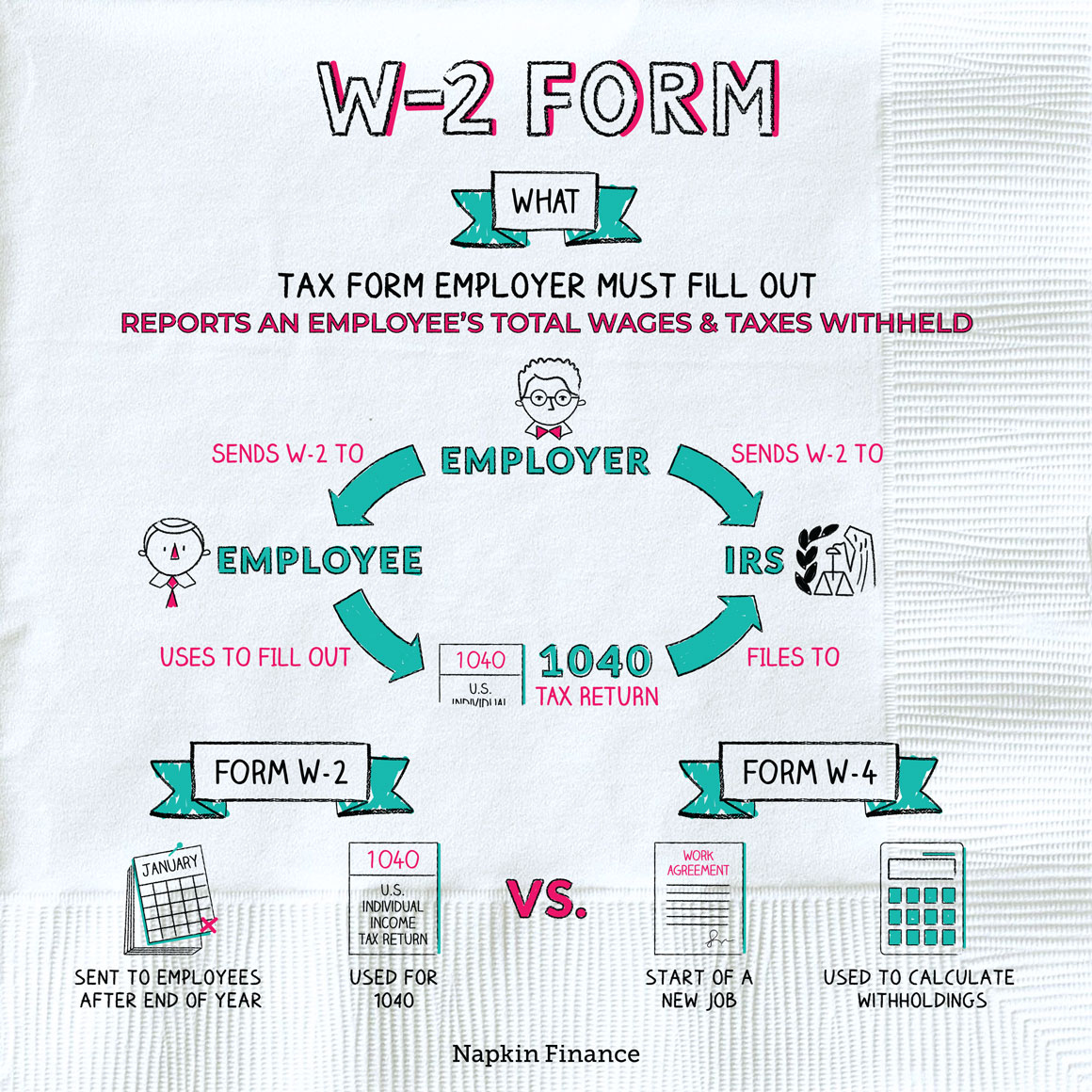

IRS Form 1040 The Same As W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlocking the Mystery: IRS Form 1040 and W2 Decoded!

Tax season can be a daunting time for many Americans, with complex forms like the IRS Form 1040 and W2 causing confusion and stress. But fear not, as we are here to help you unravel the mystery and make tax season a breeze! In this guide, we will demystify the IRS Form 1040 and decode your W2, giving you the knowledge and confidence you need to tackle your taxes like a pro.

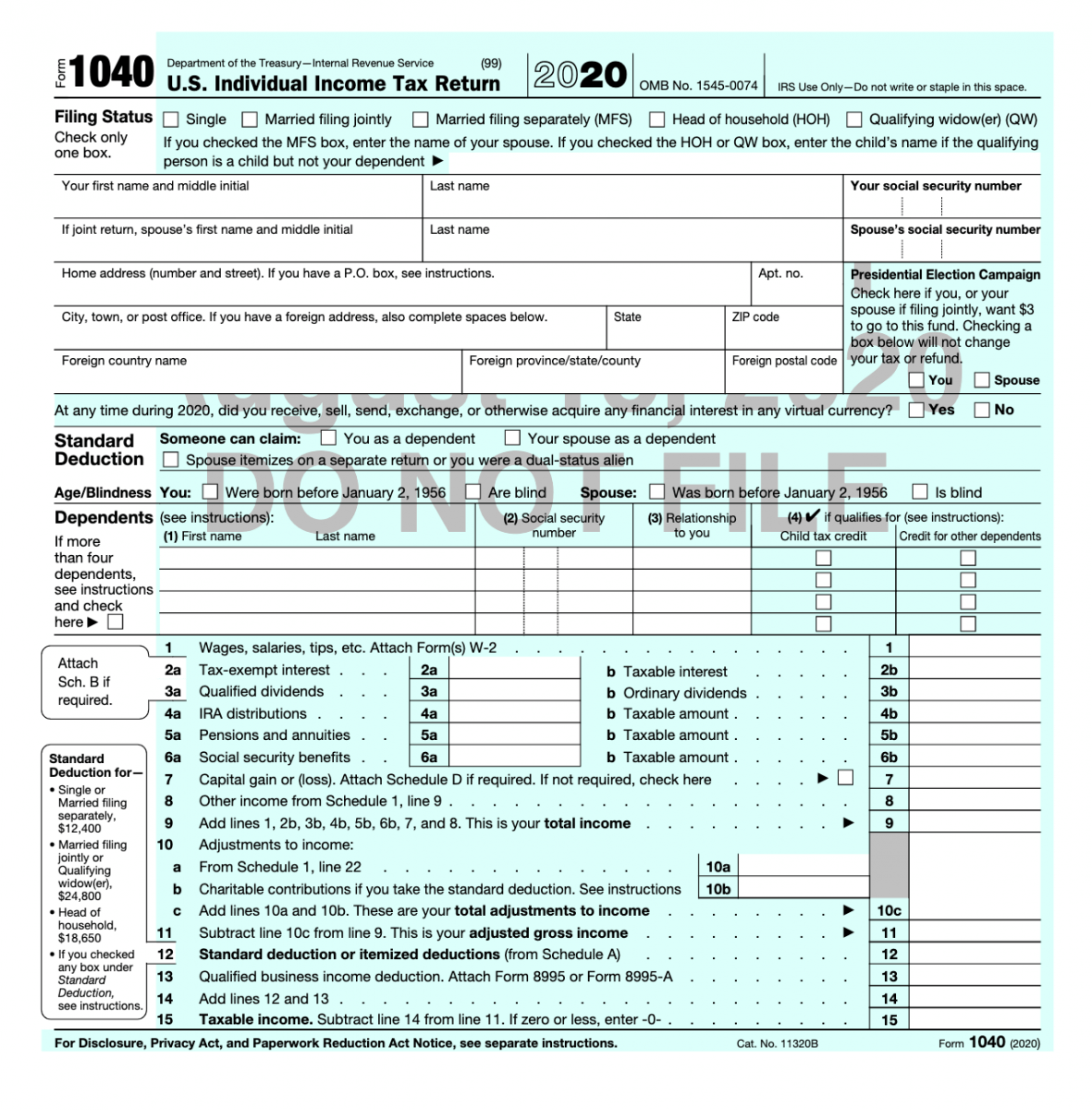

Demystifying IRS Form 1040: Your Guide to Understanding Taxes

The IRS Form 1040 is the most common tax form used by individuals to file their annual income tax return. It may seem intimidating at first glance, but breaking it down into smaller sections can make it much more manageable. The form is divided into various sections, including income, deductions, credits, and taxes owed. By carefully reviewing each section and inputting the correct information, you can ensure that your tax return is accurate and complete.

One of the key sections of the IRS Form 1040 is the income section, where you will report all sources of income earned throughout the year. This includes wages, salaries, tips, interest, dividends, and any other income you may have received. It’s important to accurately report all sources of income to avoid any discrepancies that could lead to penalties or audits. Additionally, be sure to take advantage of any deductions or credits you may be eligible for to reduce your tax liability and maximize your refund.

When completing the IRS Form 1040, it’s important to double-check all information before submitting it to the IRS. Simple mistakes, such as misspelling your name or entering the wrong social security number, can cause delays in processing your return. Take your time to review each section of the form and make sure all calculations are correct. If you’re unsure about any part of the form, don’t hesitate to seek help from a tax professional or use online resources to guide you through the process.

Crack the Code: Deciphering Your W2 for Tax Season Success

Your W2 form is a crucial document that provides information about your income and taxes withheld by your employer throughout the year. Understanding the various boxes and codes on your W2 can help you accurately report your income and maximize your tax refund. The first step in decoding your W2 is to review box 1, which shows your total wages, tips, and other compensation. This amount is used to determine your taxable income and should be reported on your IRS Form 1040.

Box 2 of your W2 contains the total amount of federal income tax withheld from your paychecks by your employer. This amount is crucial for calculating your tax liability and determining if you are entitled to a refund or if you owe additional taxes. It’s important to compare the federal income tax withheld on your W2 with the amount you owe when filing your tax return to avoid any surprises. Additionally, boxes 3 and 5 of your W2 show your wages subject to Social Security and Medicare taxes, respectively.

In conclusion, decoding the IRS Form 1040 and W2 may seem like a daunting task, but with a little guidance and attention to detail, you can navigate tax season with confidence. By understanding the various sections and codes on these forms, you can ensure that your tax return is accurate and complete. So, grab your forms, put on your detective hat, and unlock the mystery of taxes with ease! Happy filing!

Below are some images related to Irs Form 1040 The Same As W2

irs 1040 form vs w2, irs form 1040 the same as w2, is irs 1040 the same as w2, is w2 same as 1040, , Irs Form 1040 The Same As W2.

irs 1040 form vs w2, irs form 1040 the same as w2, is irs 1040 the same as w2, is w2 same as 1040, , Irs Form 1040 The Same As W2.