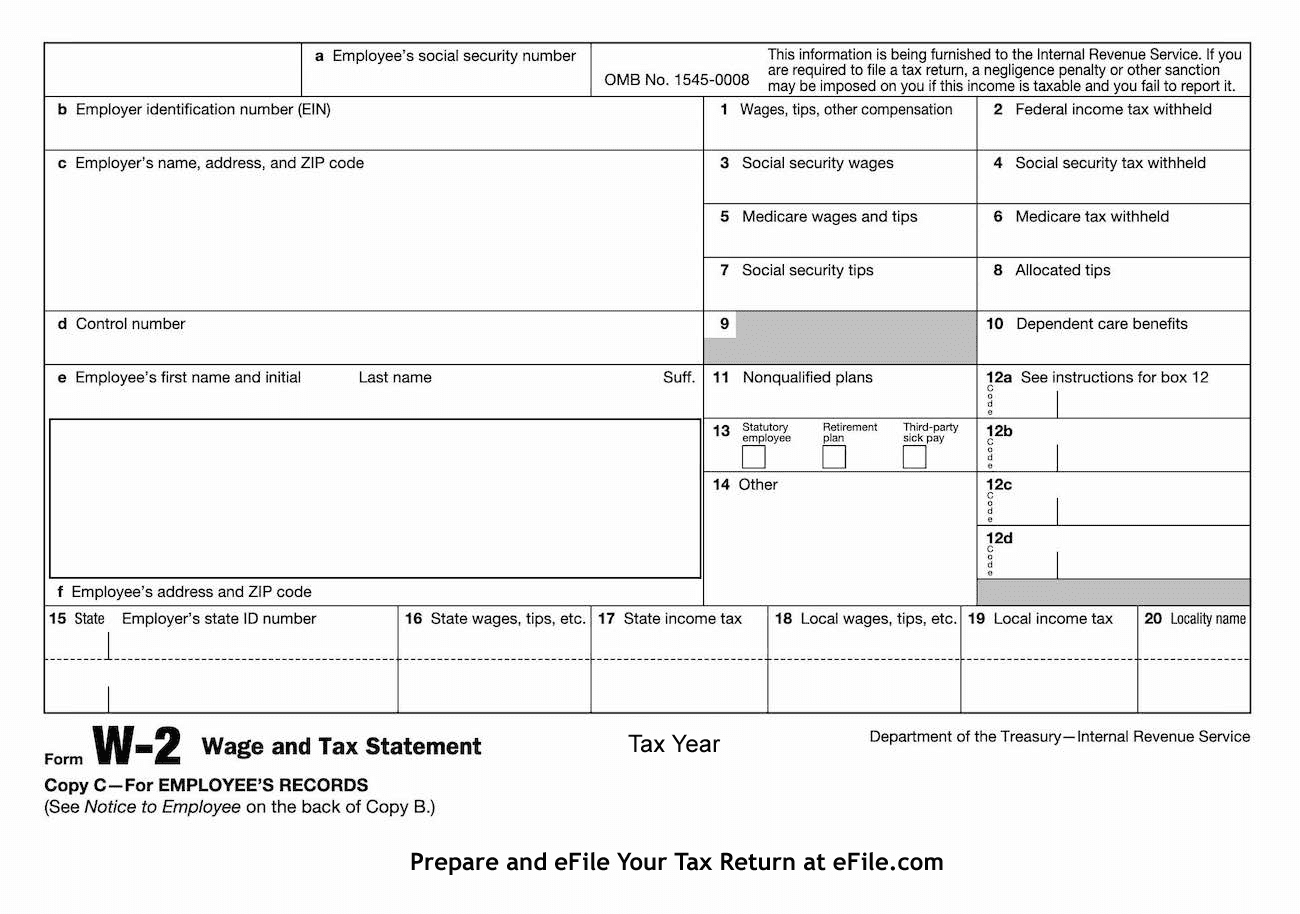

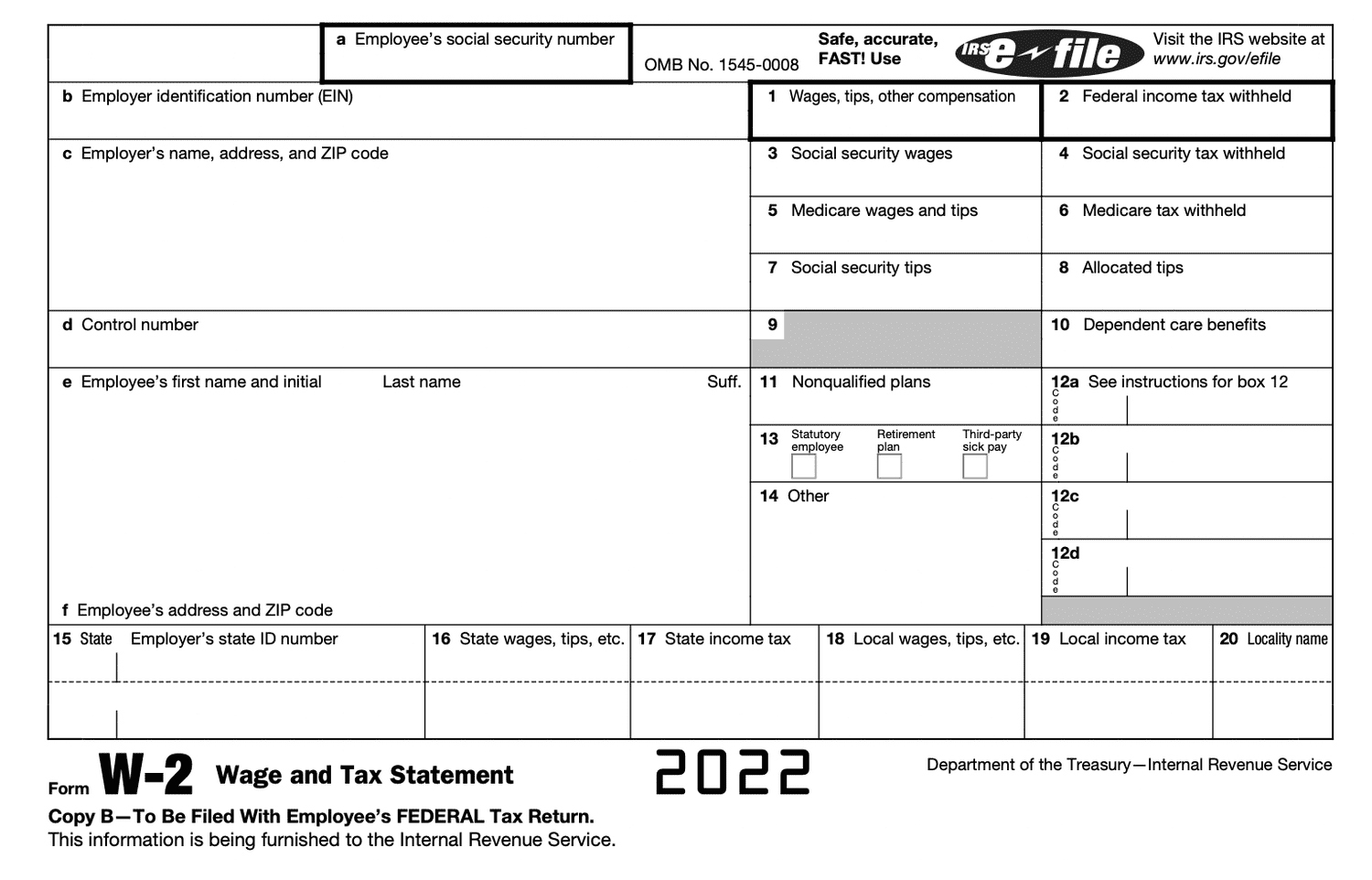

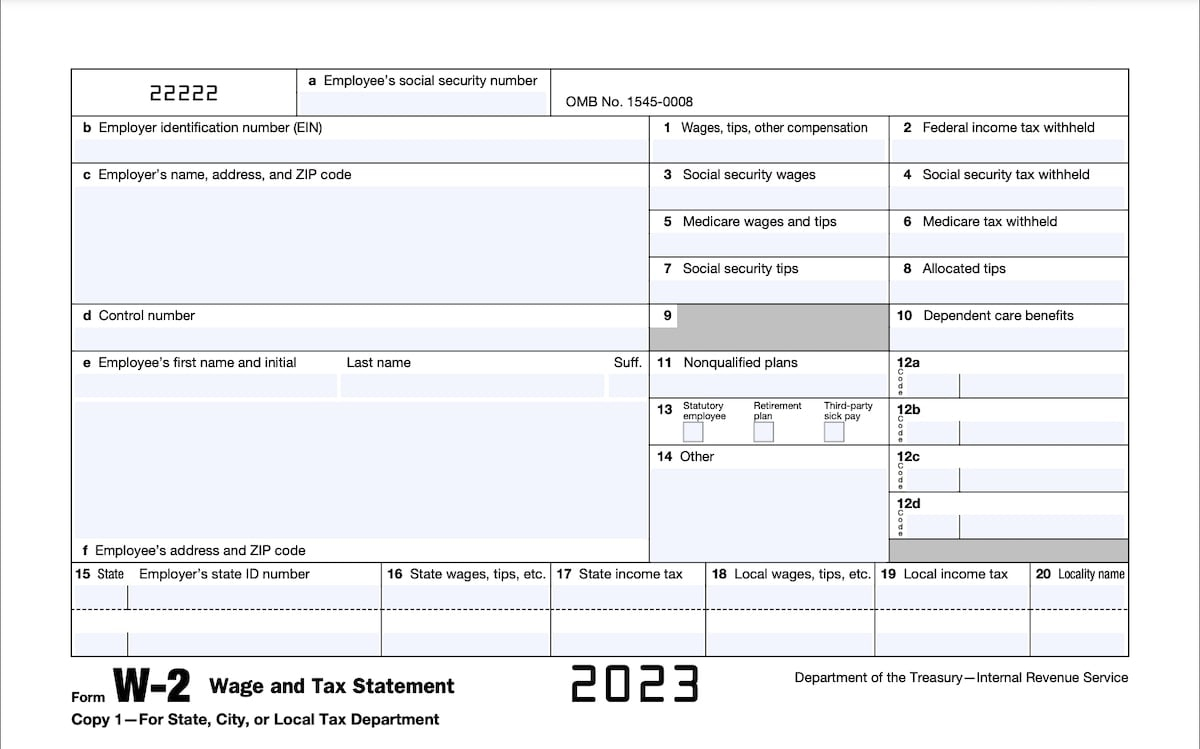

Income Tax W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Mastering Your Money Magic: The W2 Form Wonder

Are you ready to unlock your financial potential and become a money magician? The first step to mastering your money magic is understanding the power of the W2 form. This seemingly ordinary piece of paper holds the key to your financial future, revealing the secrets of your income, taxes, and deductions. By cracking the code of the W2 form, you can take control of your finances and make informed decisions that will lead to financial success.

Unleash Your Financial Wizardry

As you delve into the world of personal finance, you’ll quickly discover that the W2 form is more than just a document required for tax season. It is a roadmap to your financial health, providing valuable insights into your earnings and tax liabilities. By mastering the information contained in your W2 form, you can make strategic decisions about budgeting, saving, and investing. With this knowledge, you can unleash your financial wizardry and create a solid foundation for a prosperous future.

Understanding your W2 form is the first step toward financial empowerment. Take the time to study each section, from your gross income to your withholdings and deductions. By familiarizing yourself with this information, you can identify areas where you may be overspending or missing out on valuable tax breaks. Armed with this knowledge, you can take control of your financial destiny and make informed choices that will help you achieve your money goals.

Crack the Code of the W2 Form

The W2 form may seem like a complex puzzle at first, but with a little guidance, you can crack the code and unlock its secrets. Start by examining each box on the form, paying close attention to your wages, tips, and other compensation. Next, review your federal and state tax withholdings, as well as any deductions for retirement contributions or health insurance. By understanding how each of these elements impacts your overall financial picture, you can make smart decisions about how to manage your money effectively.

In conclusion, mastering your money magic begins with the W2 form. This document holds the key to your financial success, providing valuable insights into your income, taxes, and deductions. By unleashing your financial wizardry and cracking the code of the W2 form, you can take control of your finances and create a path to prosperity. So grab your wand, sharpen your pencils, and get ready to conquer the world of personal finance with the power of the W2 form!

Below are some images related to Income Tax W2 Form

can’t find w2 for taxes, income tax on w2 form fafsa, income tax paid on w2 form, income tax return w2 form, income tax w2 form, , Income Tax W2 Form.

can’t find w2 for taxes, income tax on w2 form fafsa, income tax paid on w2 form, income tax return w2 form, income tax w2 form, , Income Tax W2 Form.