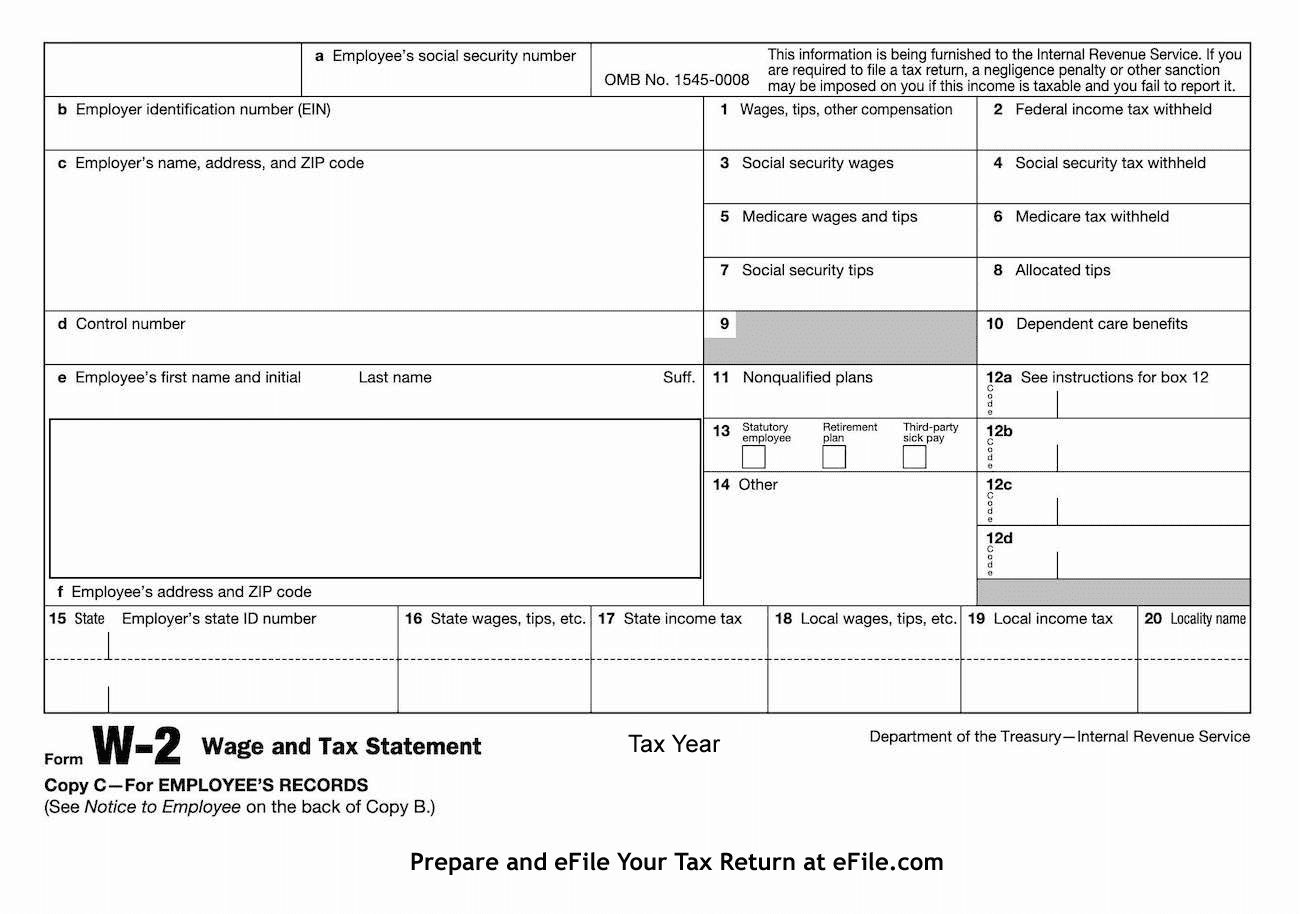

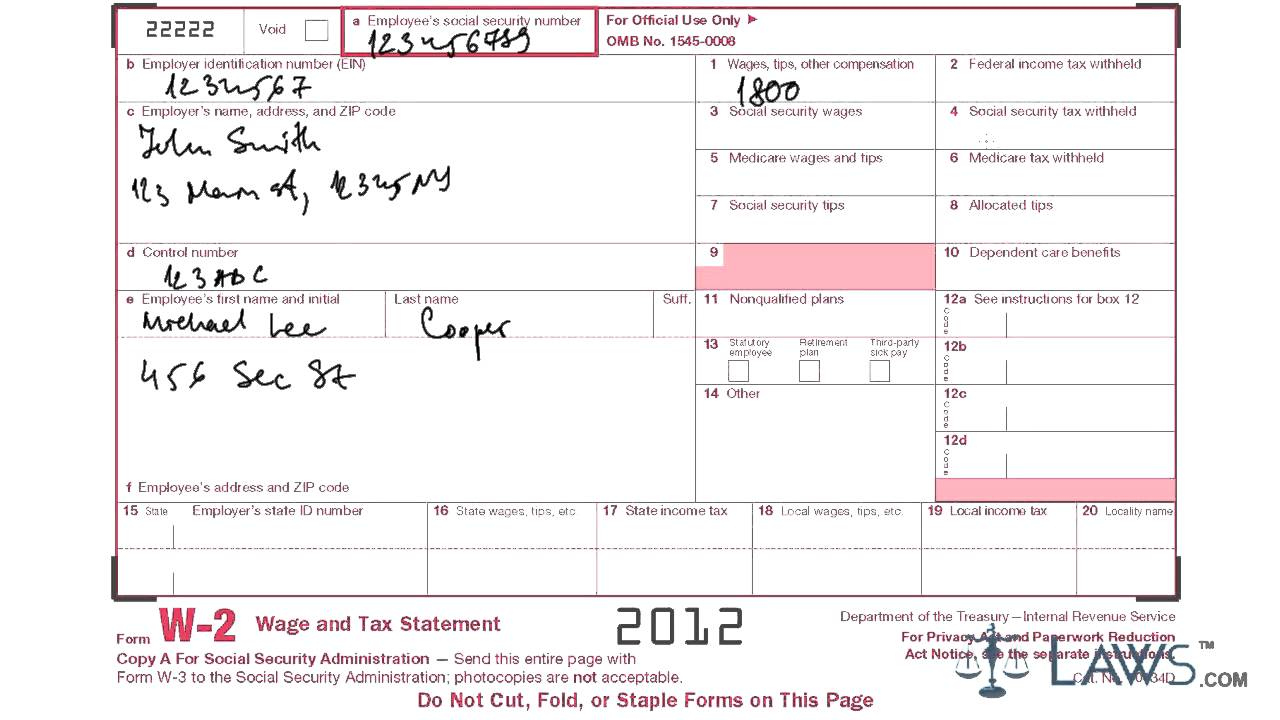

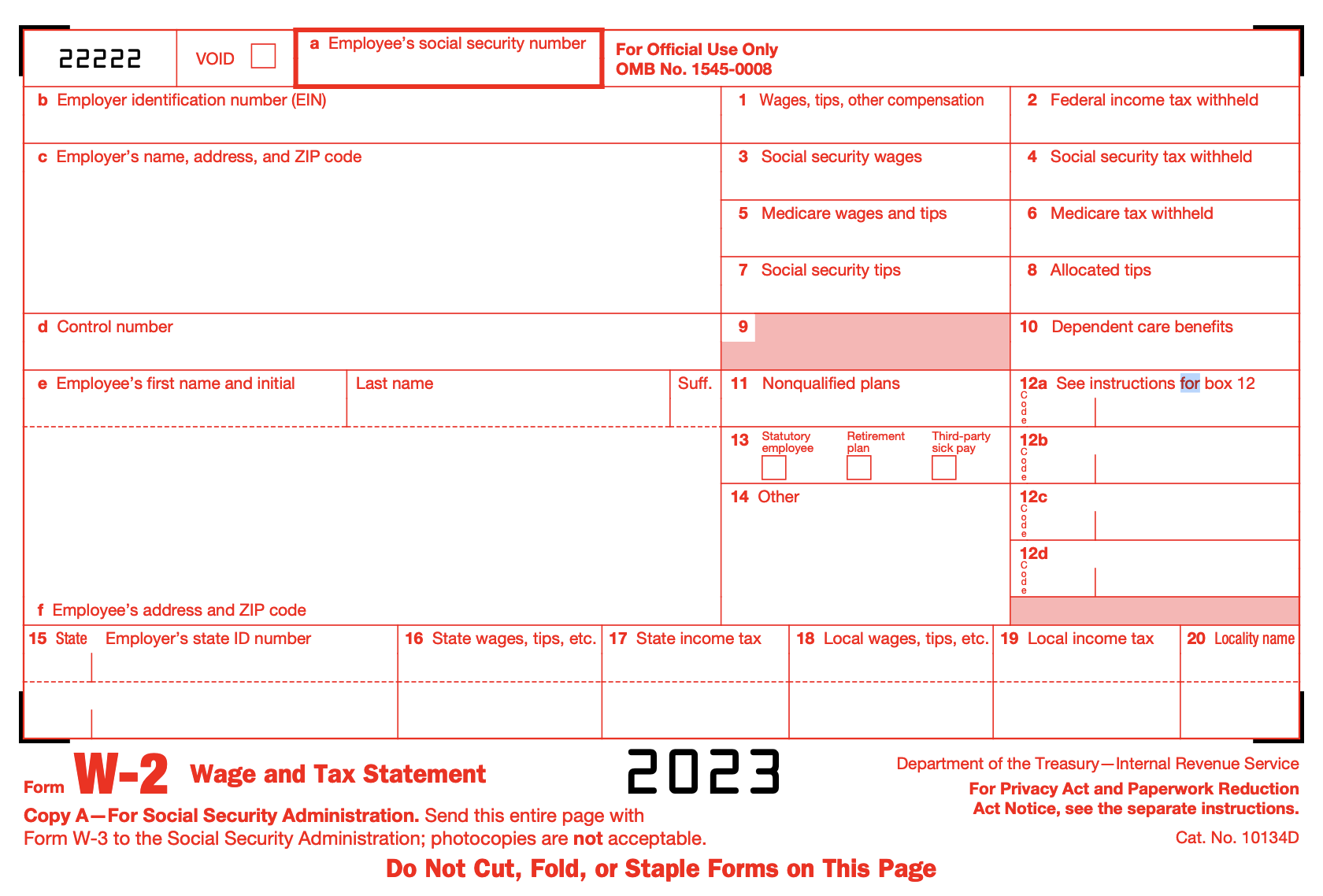

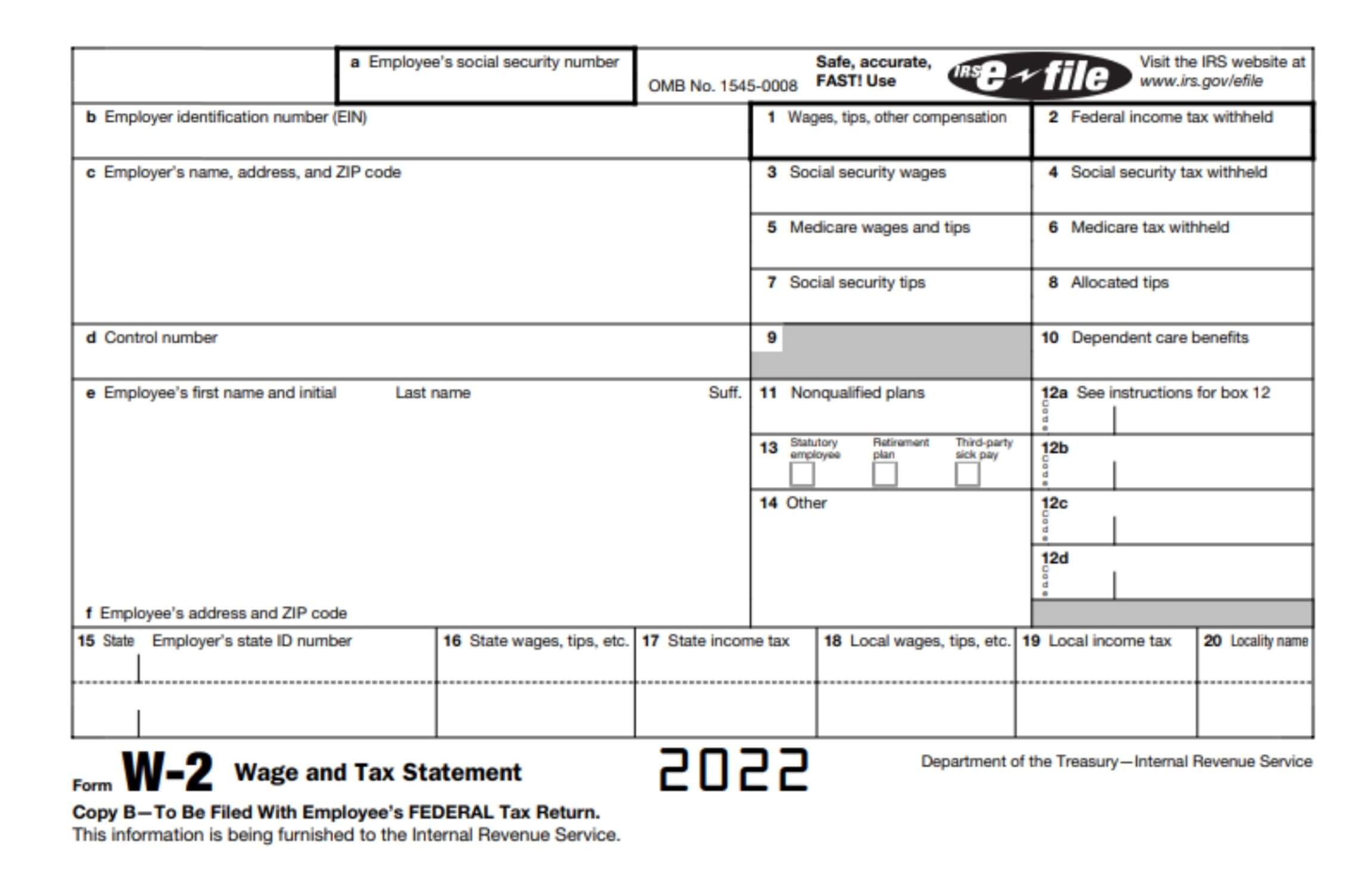

Instructions Form W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Mastering Your W2: The Ultimate Guide to Understanding Your Tax Forms

Tax season is upon us, and for many, it can be a confusing and overwhelming time. One of the most important documents you’ll receive during this time is your W2 form. While it may seem like a complex and daunting piece of paper, fear not! With this ultimate guide, we’ll break down the ins and outs of your W2 form and empower you to take control of your taxes like a pro.

Demystifying Your W2 Form: A Comprehensive Breakdown

Your W2 form is a crucial document that reports your annual wages, as well as any taxes withheld by your employer throughout the year. This form is essential for filing your taxes accurately and ensuring you receive any refunds you’re owed. Let’s start by breaking down the various sections of your W2 form:

– Box 1: This box shows your total taxable wages for the year. It’s important to note that this amount does not include any pre-tax deductions, such as health insurance or retirement contributions.

– Box 2: This box displays the total amount of federal income tax withheld from your paychecks throughout the year. This amount is based on your tax filing status and the number of allowances you claimed on your W4 form.

– Box 3 and Box 5: These boxes show your total wages subject to Social Security and Medicare taxes, respectively. These amounts are calculated based on the Social Security and Medicare tax rates for the year.

Turbocharge Your Tax Knowledge with this Ultimate Guide

Now that you have a better understanding of the different sections of your W2 form, let’s dive deeper into some key terms and concepts that may appear on your form:

– Medicare Wages and Tips: This box shows your total wages and tips subject to Medicare tax. It may differ from your total wages in Box 1, as some wages may be exempt from Medicare tax.

– State and Local Taxes: Depending on where you live and work, you may see additional boxes on your W2 form for state and local taxes withheld. These amounts are important for filing your state and local tax returns accurately.

– Employer Information: Your W2 form will also include your employer’s name, address, and Employer Identification Number (EIN). This information is crucial for ensuring your taxes are filed correctly and can be used for verification purposes.

In conclusion, mastering your W2 form is essential for navigating tax season with confidence and ease. By understanding the various sections and terms on your form, you can ensure that your taxes are filed accurately and efficiently. So grab your W2 form, follow this ultimate guide, and take control of your tax destiny like a boss!

Below are some images related to Instructions Form W2

form w2 instructions 2021, form w2 instructions 2022 pdf, instructions for form w2 2022, instructions form w2, instructions form w2c, , Instructions Form W2.

form w2 instructions 2021, form w2 instructions 2022 pdf, instructions for form w2 2022, instructions form w2, instructions form w2c, , Instructions Form W2.