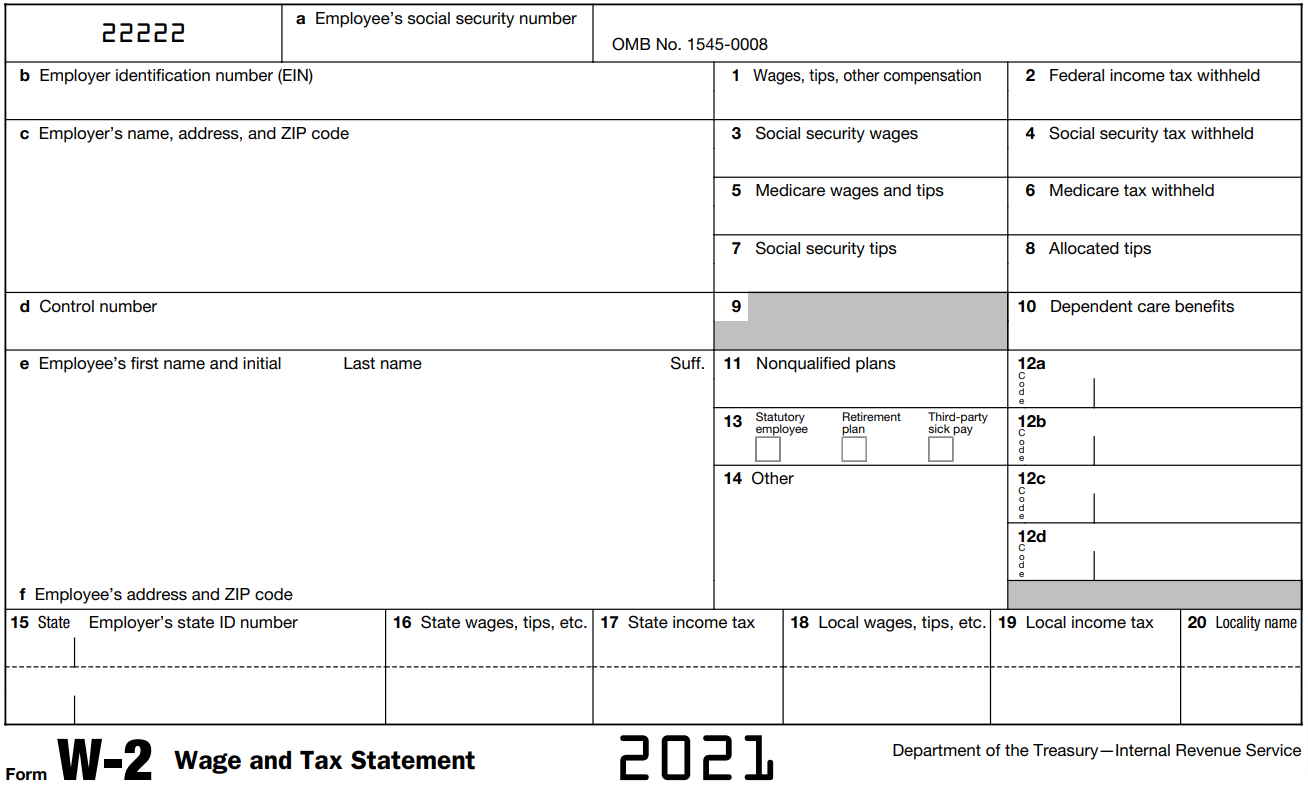

Illinois W2 Form 2022 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Tax Season is Here

It’s that time of year again – tax season is upon us! As you gather your documents and prepare to file your taxes, don’t forget about the importance of the Illinois W2 Form 2022. This form is a crucial piece of information that outlines your earnings and taxes withheld for the previous year. By having this form handy, you’ll be able to accurately report your income and ensure you’re not missing out on any potential deductions or credits.

With tax laws constantly changing and evolving, it’s more important than ever to stay organized and on top of your financial documents. The Illinois W2 Form 2022 is a key component in ensuring you have all the necessary information to accurately file your taxes. By taking the time to gather all your important paperwork, including your W2 form, you’ll be setting yourself up for success when it comes time to file.

Get Organized with the Illinois W2 Form 2022

The Illinois W2 Form 2022 provides a detailed breakdown of your earnings, taxes withheld, and other important information that will be crucial for accurately filing your taxes. By having this form on hand, you’ll be able to easily reference and input the necessary information into your tax return. Organizing your financial documents, including your W2 form, will make the tax filing process smoother and more efficient.

In addition to helping you accurately report your income, the Illinois W2 Form 2022 can also help you identify any potential errors or discrepancies in your tax documents. By reviewing your W2 form carefully, you can ensure that all the information is correct and that you’re not missing out on any tax deductions or credits. Taking the time to review and organize your W2 form will pay off in the long run when it comes time to file your taxes.

Conclusion

As tax season approaches, it’s important to get organized and prepared with the Illinois W2 Form 2022. This form is a crucial piece of information that will help you accurately report your income and ensure you’re not missing out on any potential deductions or credits. By taking the time to review and organize your W2 form, you’ll be setting yourself up for success when it comes time to file your taxes. So gather your documents, stay organized, and get ready to tackle tax season with confidence!

Below are some images related to Illinois W2 Form 2022

how to submit w2 to illinois, il w2 form 2022, illinois w2 form 2022, , Illinois W2 Form 2022.

how to submit w2 to illinois, il w2 form 2022, illinois w2 form 2022, , Illinois W2 Form 2022.