How To Order W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

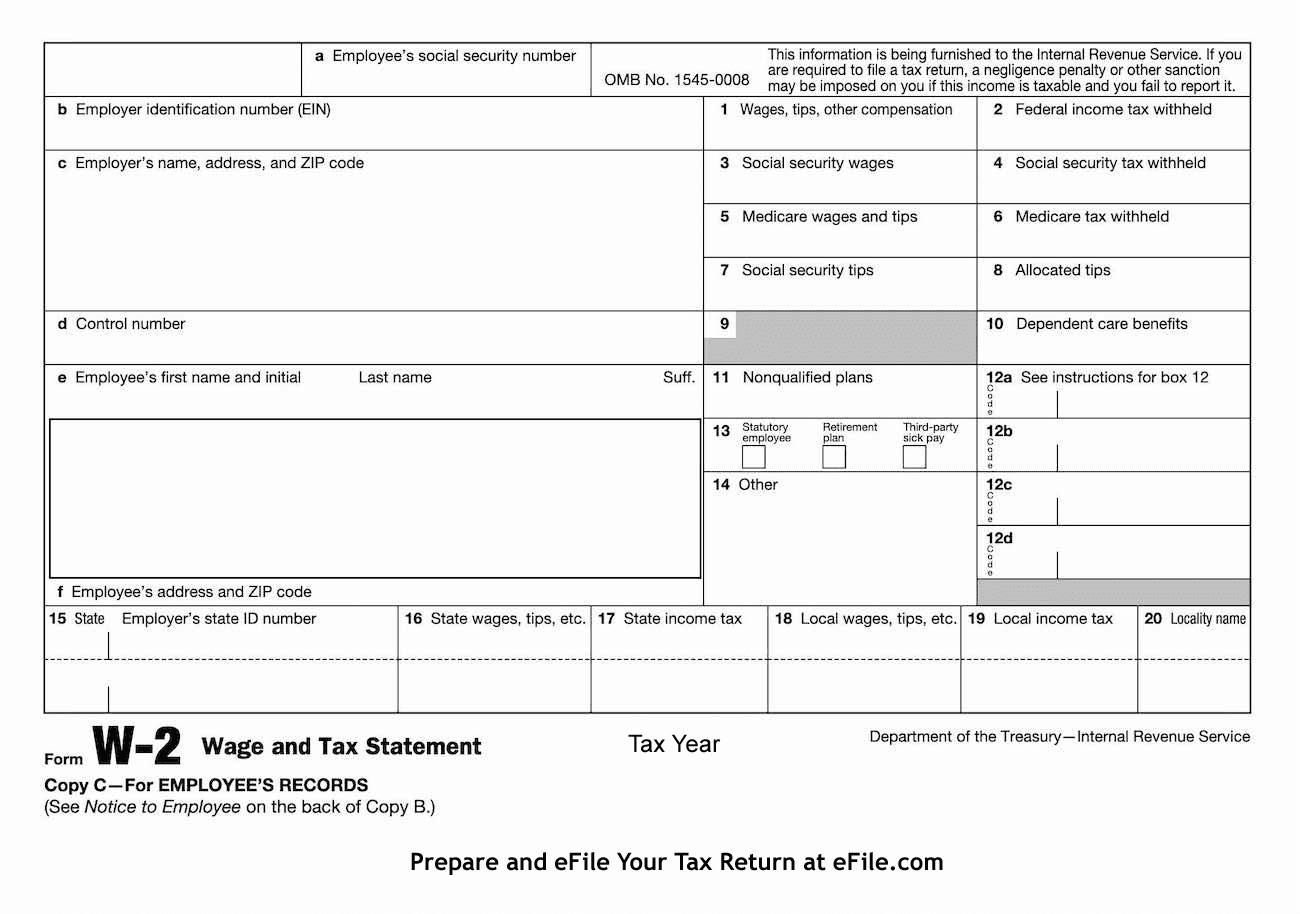

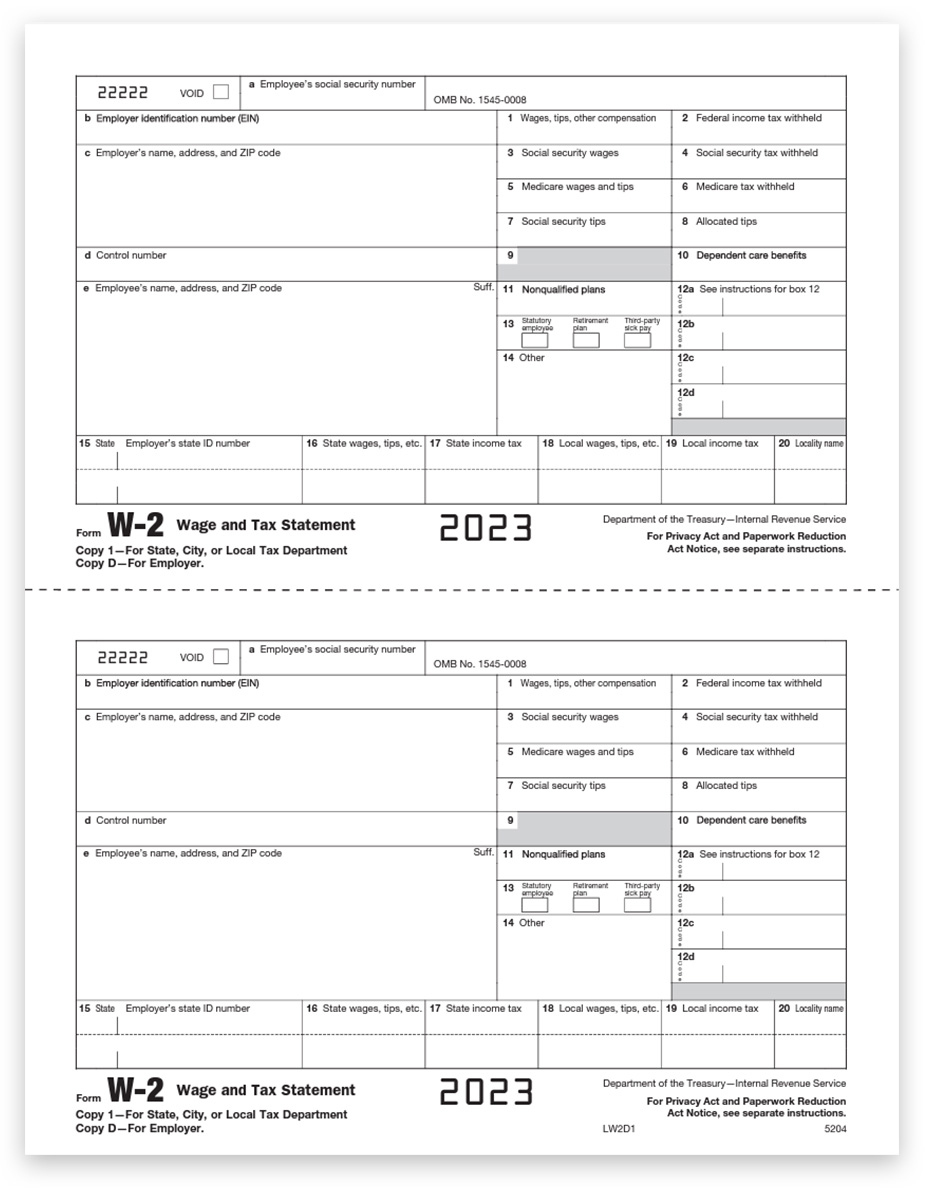

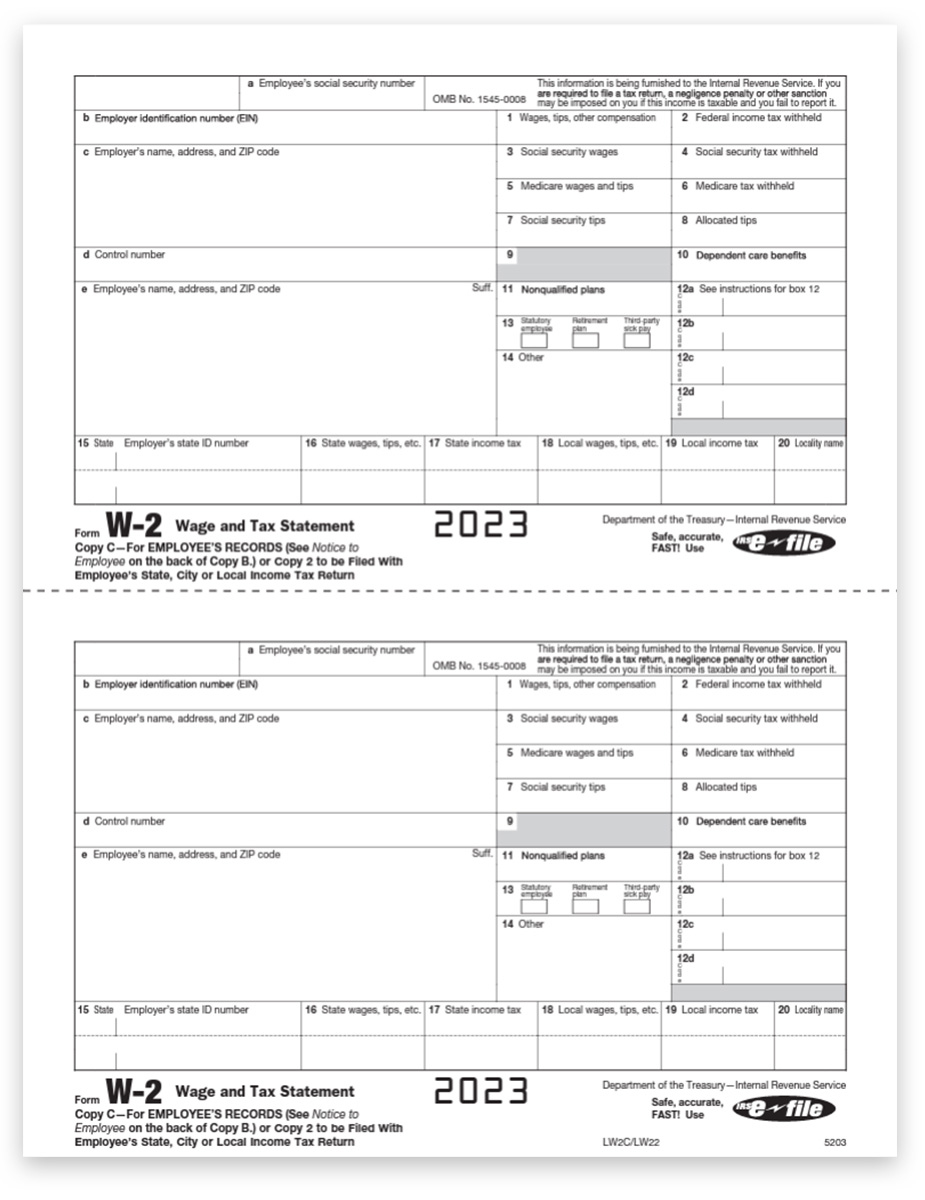

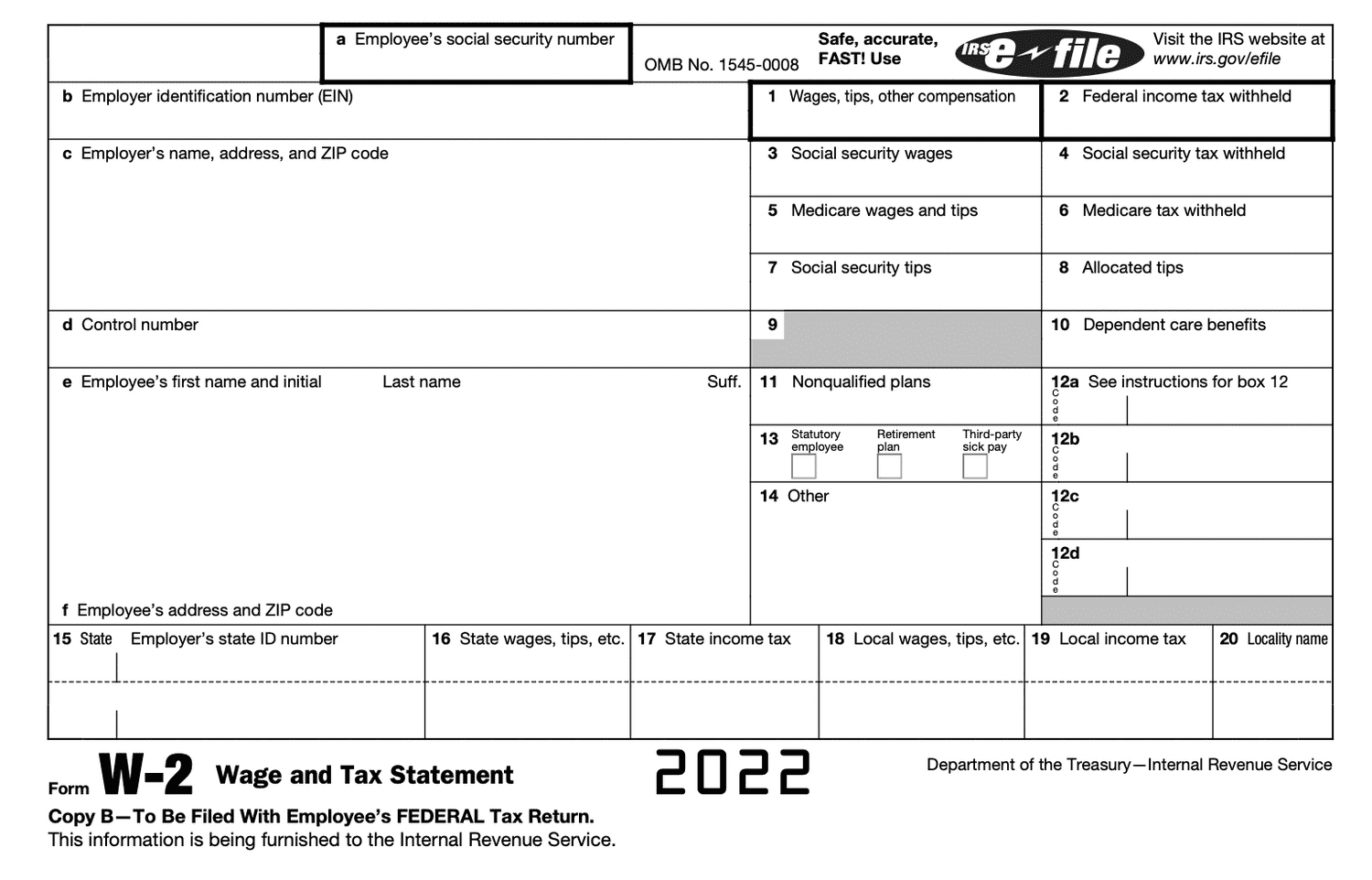

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unleash the Power of Your W2 Form

Are you ready to unlock the magic hidden within your W2 form? Your W2 holds the key to understanding your income, taxes, and potential refunds. By learning how to navigate this important document, you can take control of your financial future and make informed decisions about your money. With just a little bit of knowledge and organization, you can transform your W2 from a confusing piece of paper into a valuable tool for financial success.

The first step in unleashing the power of your W2 form is to familiarize yourself with the different sections and boxes. Your W2 includes important information such as your total wages, federal and state income taxes withheld, and any deductions or credits you may be eligible for. By understanding each section of your W2, you can better grasp how much money you earned, how much was withheld for taxes, and whether you are entitled to a refund. This knowledge is crucial for making smart financial decisions and planning for the future.

Once you have a good grasp of the basic information on your W2 form, it’s time to start using it to your advantage. You can use your W2 to file your taxes accurately and on time, ensuring that you receive any refunds you are owed and avoid penalties for late filing. Additionally, you can use the information on your W2 to create a budget, track your income and expenses, and set financial goals for the future. By taking control of your finances and using your W2 as a tool for financial success, you can unlock a world of possibilities and pave the way for a brighter financial future.

Navigate Your Way to Financial Success

Navigating your way to financial success with your W2 form is easier than you might think. By following a few simple steps, you can use your W2 to make informed decisions about your money and take control of your financial future. Start by organizing your W2 and other financial documents in a safe and secure location, such as a filing cabinet or digital folder. This will make it easier to access your information when you need it and ensure that you don’t lose track of important documents.

Next, take the time to review your W2 form carefully and double-check all the information for accuracy. Make sure that your name, address, and social security number are correct, and verify that the income and tax withholding amounts match your records. If you notice any discrepancies or errors on your W2, contact your employer or tax preparer as soon as possible to get them resolved. By staying on top of your financial information and making sure everything is accurate, you can avoid costly mistakes and ensure that you are making the most of your money.

Finally, use the information on your W2 form to create a financial plan that works for you. Whether you are saving for a big purchase, paying off debt, or planning for retirement, your W2 can provide valuable insights into your income and expenses. By setting financial goals and tracking your progress, you can make sure that you are on the right path to achieving your dreams. With a little bit of organization, knowledge, and determination, you can unlock the magic of your W2 form and navigate your way to financial success.

Below are some images related to How To Order W2 Forms

how to get w-2 form from adp, how to get w2 form from amazon, how to get w2 form from doordash, how to get w2 form from employer, how to get w2 form from uber eats, , How To Order W2 Forms.

how to get w-2 form from adp, how to get w2 form from amazon, how to get w2 form from doordash, how to get w2 form from employer, how to get w2 form from uber eats, , How To Order W2 Forms.