How To Find W2 Form On Dayforce – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Uncovering Your W2 Treasure on Dayforce

Are you ready to discover the hidden riches waiting for you on Dayforce? Your W2 forms hold the key to unlocking your financial fortune, and with just a few clicks, you can uncover all the treasures they have to offer. Say goodbye to the days of searching through piles of paperwork – Dayforce makes it easy to access and manage your W2s in one convenient location.

Discover the Hidden Riches of Your W2 on Dayforce!

With Dayforce, you can say goodbye to the stress and hassle of tracking down your W2 forms. Simply log in to your account and navigate to the W2 section to access all of your important tax documents. No more waiting for snail mail or worrying about lost paperwork – everything you need is right at your fingertips. Plus, with Dayforce’s user-friendly interface, you can easily view, download, and print your W2s with just a few clicks.

Uncovering your W2 treasure on Dayforce is like finding a pot of gold at the end of a rainbow. Not only can you access your W2 forms quickly and easily, but you can also take advantage of valuable tools and resources to help you better understand your tax situation. Whether you’re looking to maximize your deductions, plan for the future, or simply stay organized, Dayforce has everything you need to unlock your financial fortune and take control of your finances.

Unlock Your Financial Fortune with Dayforce W2s!

Don’t let your W2 forms gather dust in a forgotten drawer – unlock your financial fortune with Dayforce! By using this powerful platform, you can take the guesswork out of tax season and ensure that you’re making the most of your hard-earned money. With Dayforce, managing your W2s has never been easier, so why wait any longer? Log in today and start uncovering the treasures that await you on Dayforce.

In conclusion, Dayforce is your key to unlocking the hidden riches of your W2 forms. With its convenient access, user-friendly interface, and valuable resources, you can take control of your finances and make the most of tax season. Say goodbye to the stress and hassle of managing your W2s – with Dayforce, you’ll discover a world of financial possibilities right at your fingertips. So why wait? Log in today and start uncovering your W2 treasure on Dayforce!

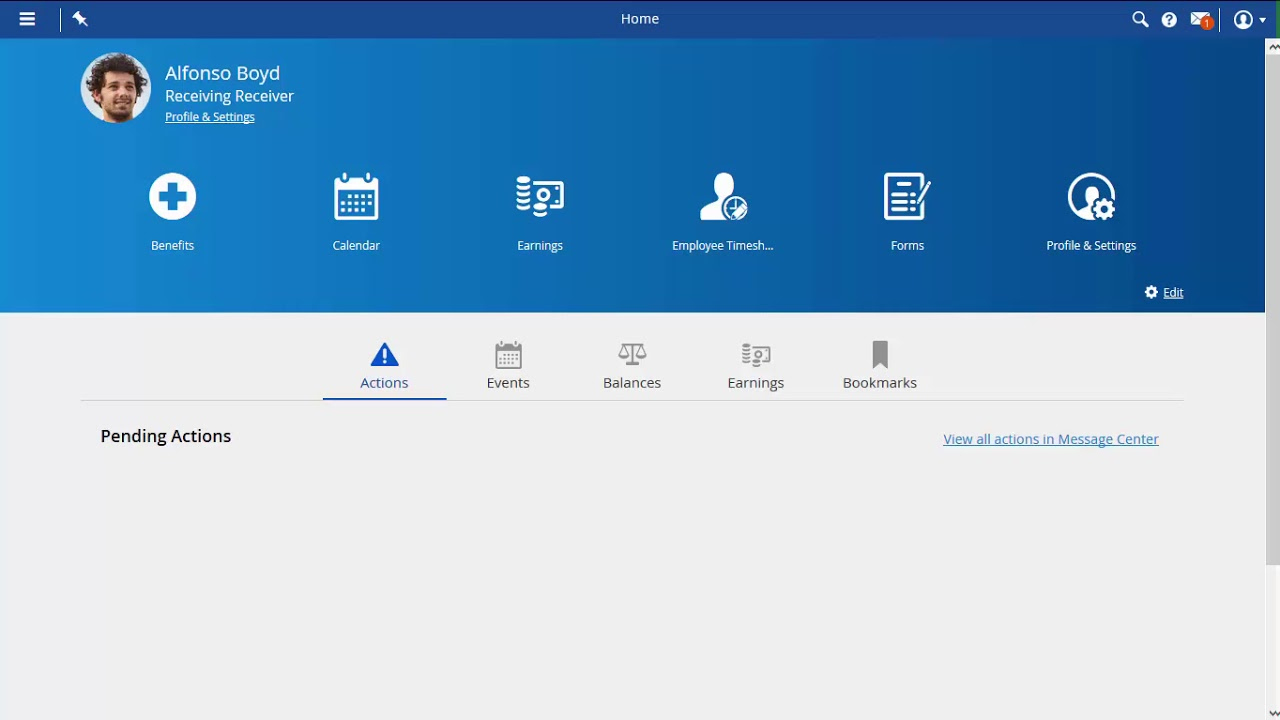

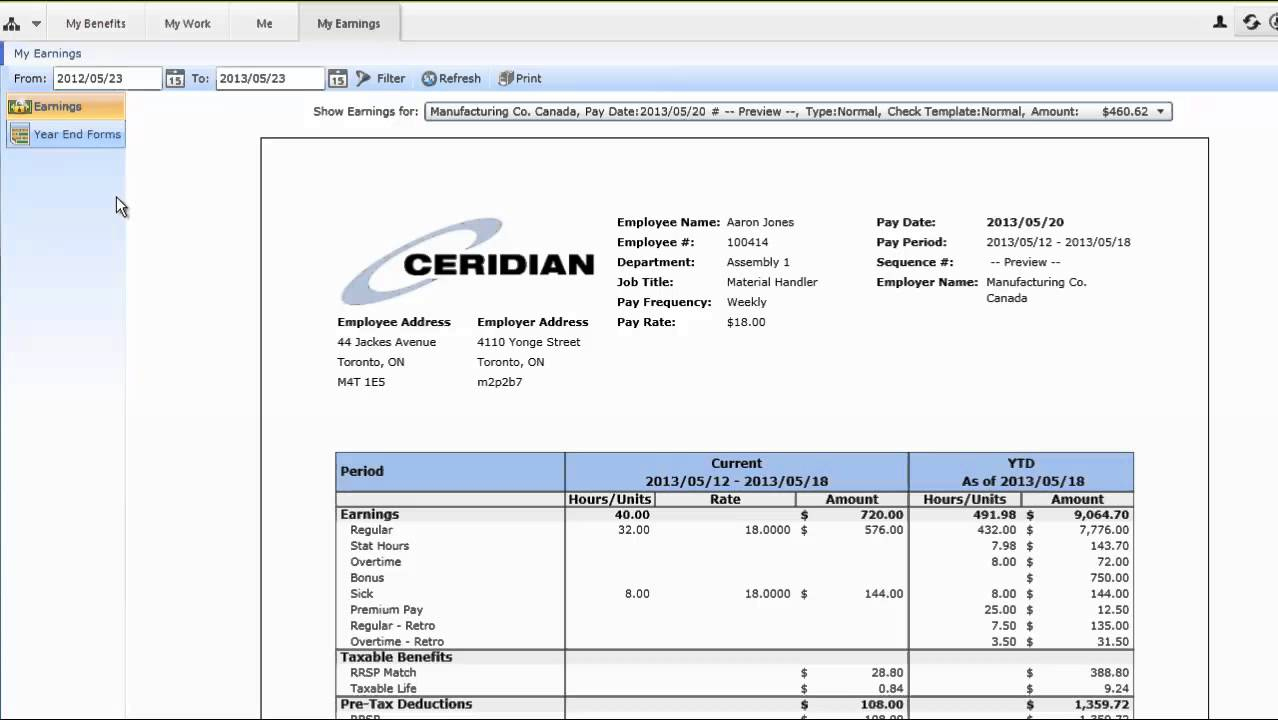

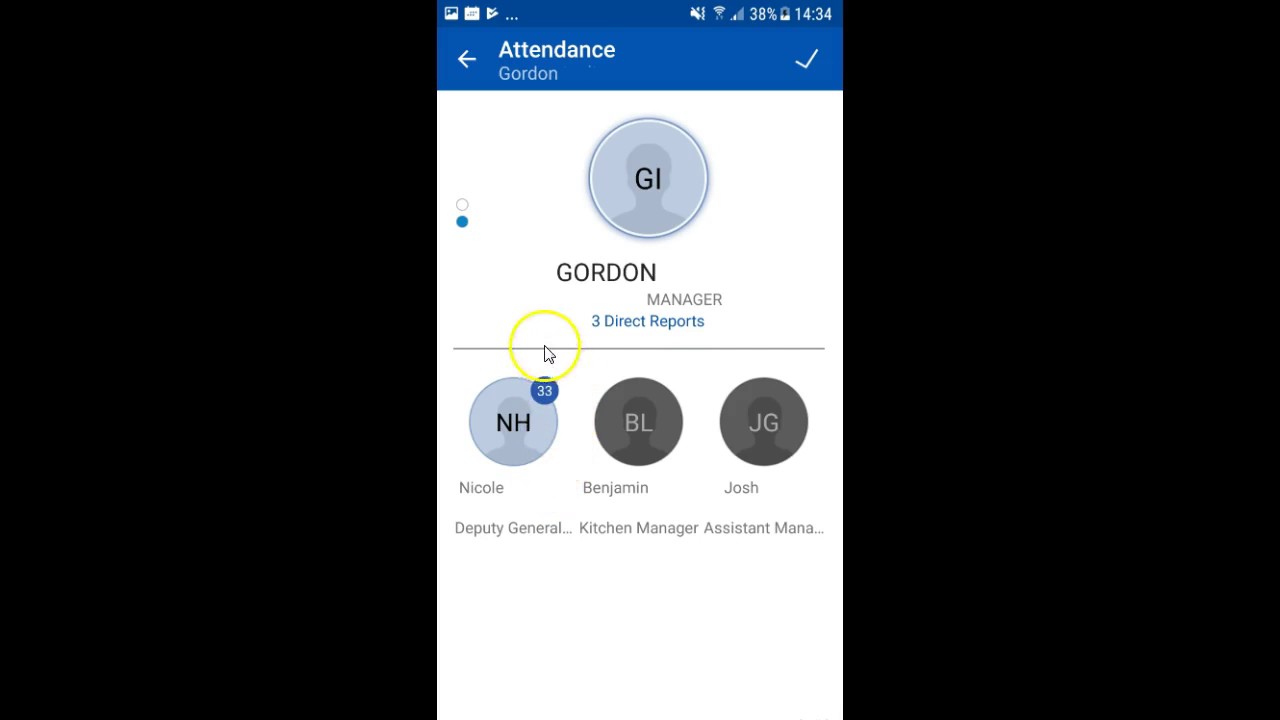

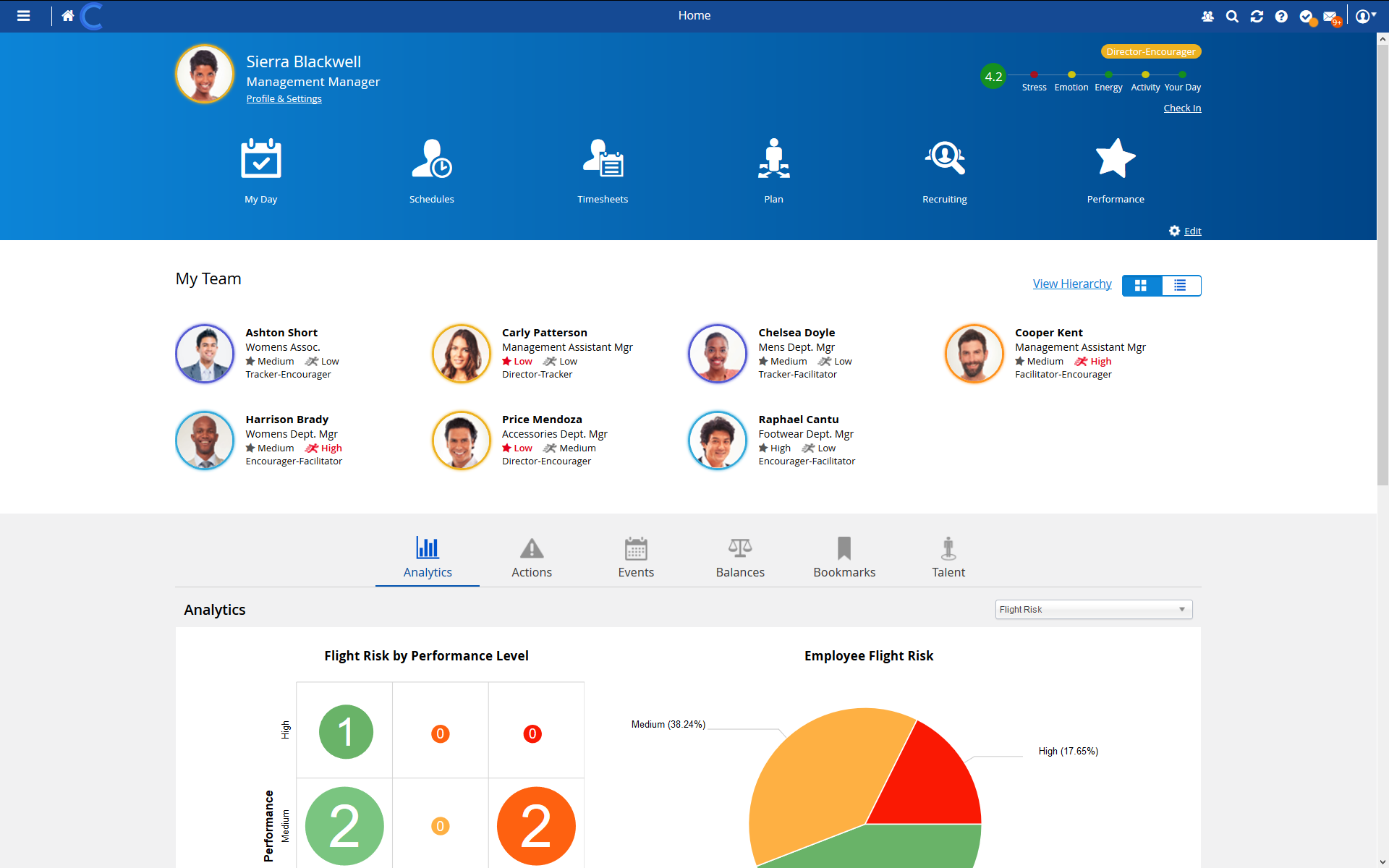

Below are some images related to How To Find W2 Form On Dayforce

how to find w2 form on dayforce, how to get w2 from dayforce, how to view w2 on dayforce, where to find w2 in dayforce, , How To Find W2 Form On Dayforce.

how to find w2 form on dayforce, how to get w2 from dayforce, how to view w2 on dayforce, where to find w2 in dayforce, , How To Find W2 Form On Dayforce.