How To Fill Out A W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Welcome to W2 Wonderland!

Welcome to W2 Wonderland, where completing your tax form can be as easy as a walk in the park! Filling out your W2 form may seem like a daunting task, but with the right tips and tricks, you’ll breeze through it in no time. Say goodbye to stress and confusion, and hello to a smooth and effortless tax season. Let’s dive in and discover how you can navigate W2 Wonderland with ease!

Tips and Tricks for Filling Out Your Form Effortlessly

1. **Gather all necessary documents:** Before you begin filling out your W2 form, make sure you have all the necessary documents on hand. This includes your social security number, income statements, and any other relevant tax documents. Having everything in one place will make the process much smoother and prevent you from having to hunt down missing information later on.

2. **Double-check your information:** One of the most common mistakes people make when filling out their W2 form is entering incorrect information. Before submitting your form, double-check all the details you’ve entered, such as your name, address, and social security number. Even a small typo can cause delays or errors in processing your taxes, so it’s worth taking the extra time to ensure everything is accurate.

3. **Seek help if needed:** If you come across any confusing or unfamiliar sections on your W2 form, don’t hesitate to seek help. Whether you ask a knowledgeable friend, consult a tax professional, or utilize online resources, getting assistance can save you time and prevent costly errors. Remember, it’s better to ask for help and get it right the first time than to struggle on your own and potentially make mistakes.

In conclusion, completing your W2 form doesn’t have to be a stressful or overwhelming experience. By following these tips and tricks, you can navigate W2 Wonderland with ease and confidence. With a little preparation, attention to detail, and willingness to ask for help when needed, you’ll breeze through your tax form and be one step closer to a successful tax season. So put on your tax-filing hat and get ready to conquer W2 Wonderland like a pro!

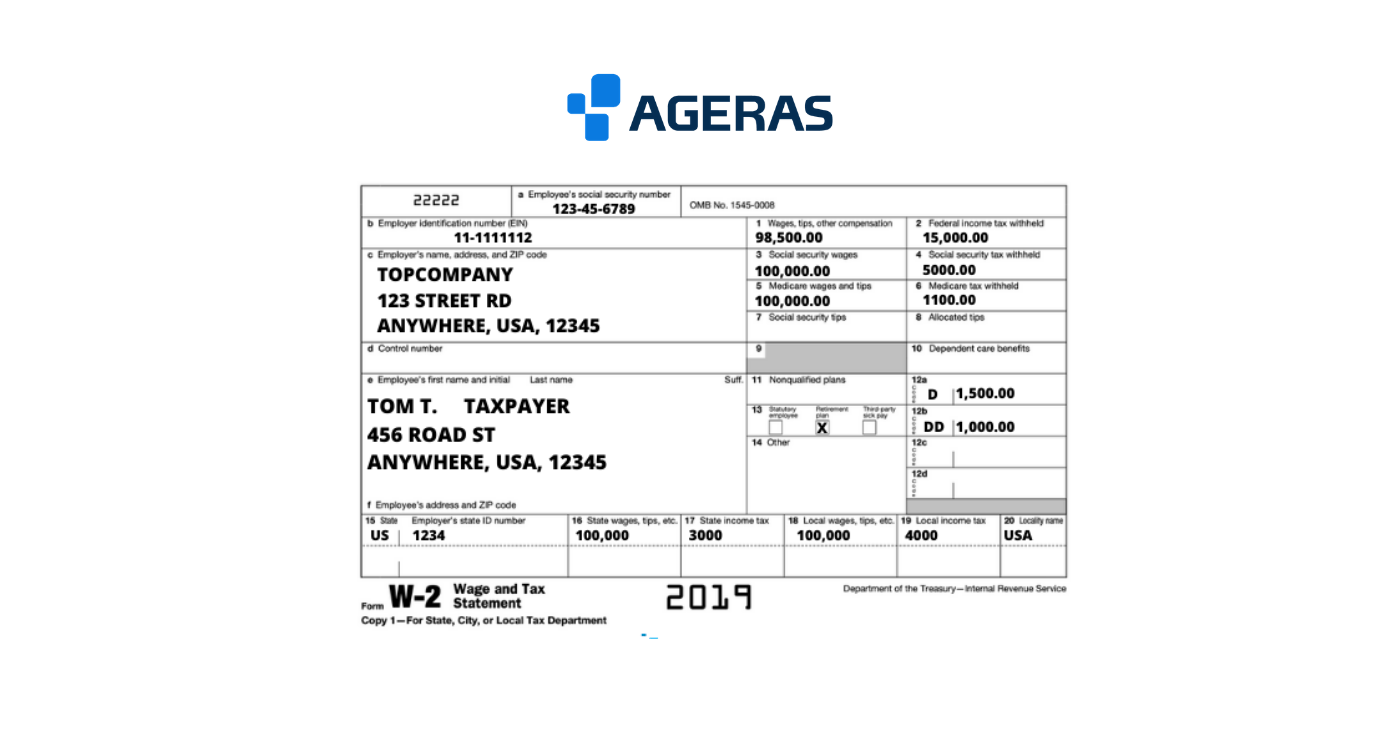

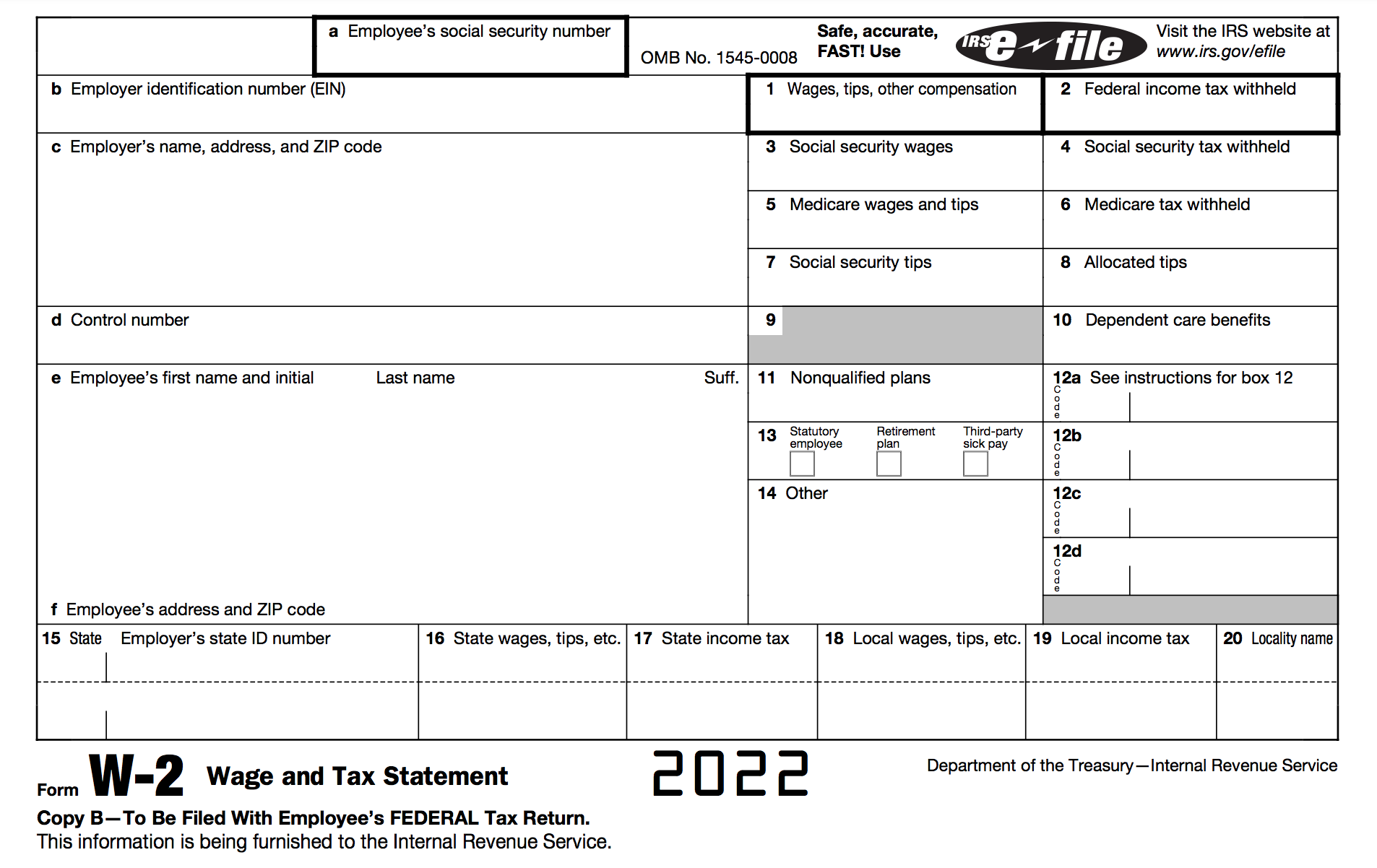

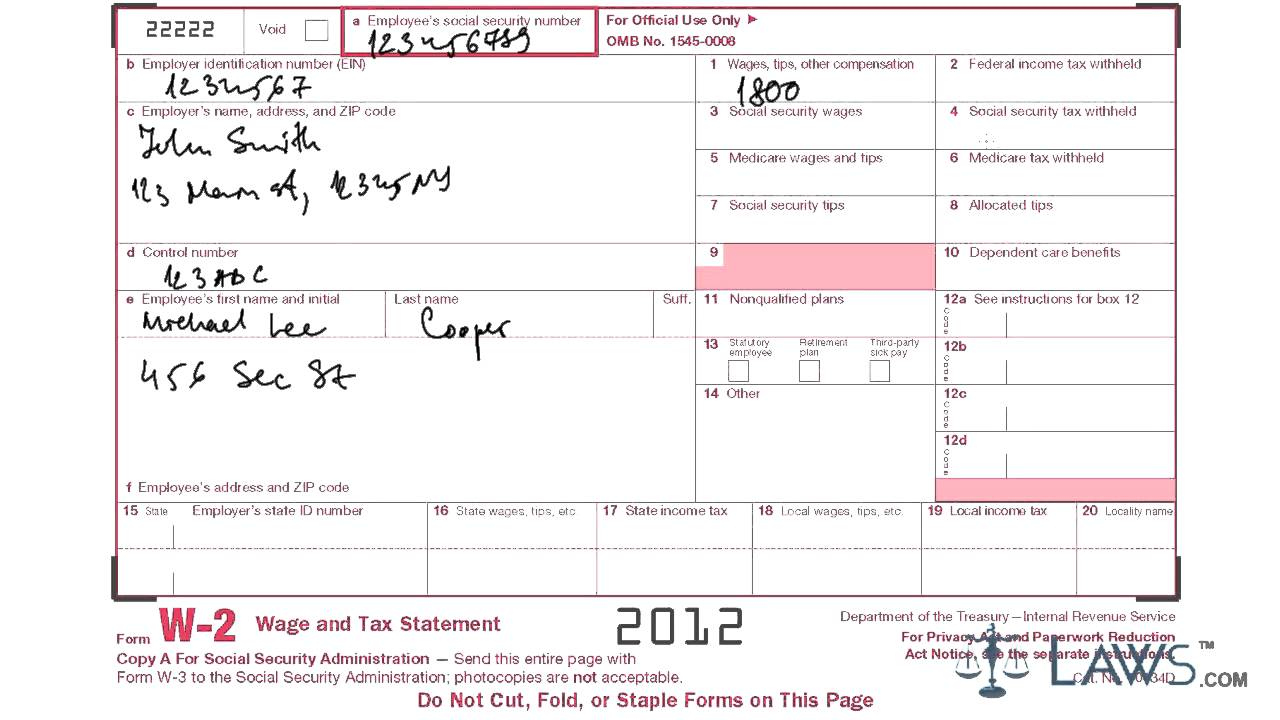

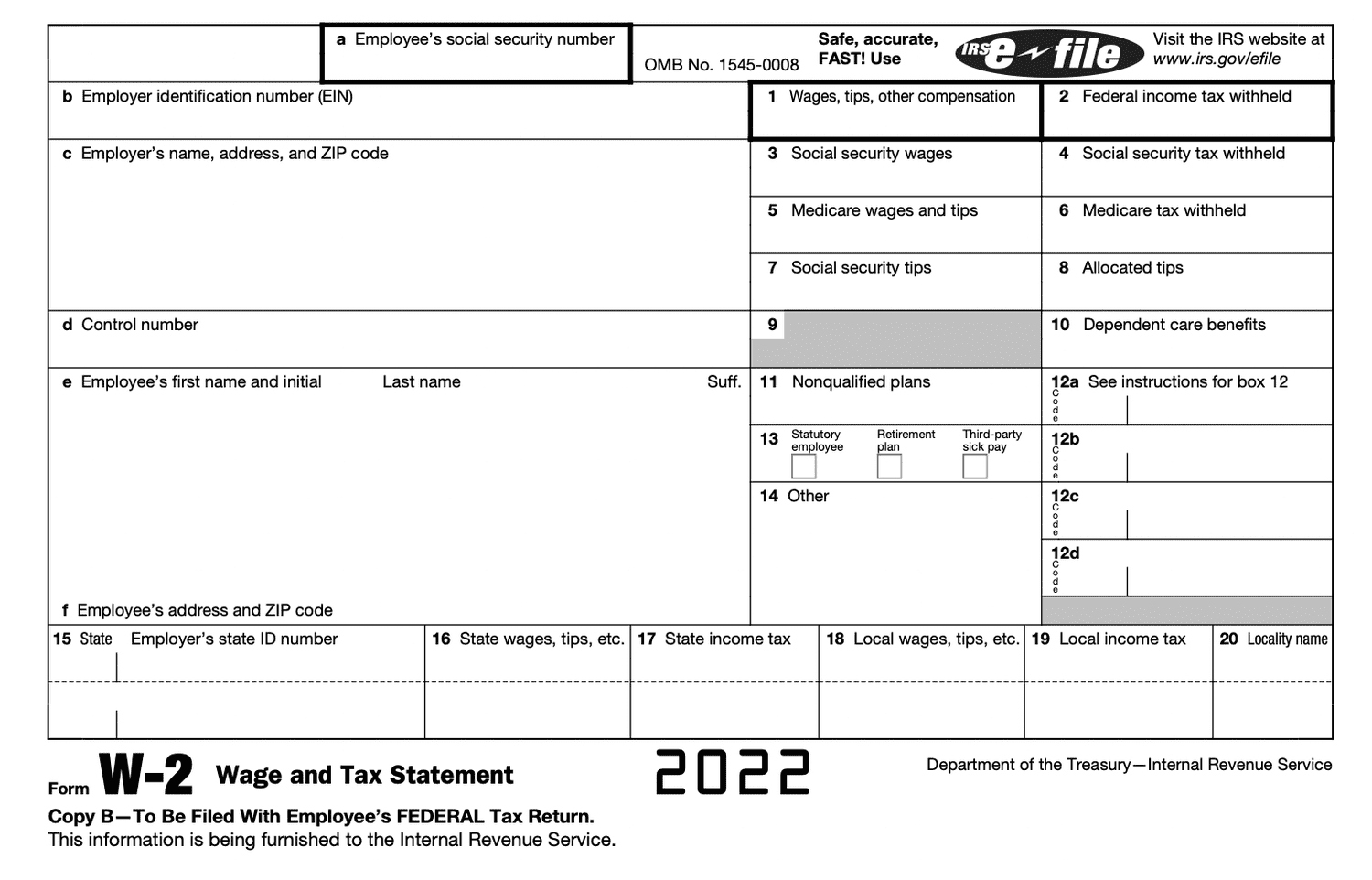

Below are some images related to How To Fill Out A W2 Form

how do you fill out the new w2 form, how to fill out a w2 form, how to fill out a w2 form 2022, how to fill out a w2 form 2023, how to fill out a w2 form as an employer, , How To Fill Out A W2 Form.

how do you fill out the new w2 form, how to fill out a w2 form, how to fill out a w2 form 2022, how to fill out a w2 form 2023, how to fill out a w2 form as an employer, , How To Fill Out A W2 Form.