How To Complete A W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Mastering the W2: Your Guide to Form Completion!

Tax season can often be a stressful time for many individuals, especially when it comes to deciphering the infamous W2 form. However, fear not! With the right guidance and knowledge, you can easily master the art of completing your W2 form with confidence and ease. In this guide, we will break down the process step by step, helping you unravel the mystery of the W2 form and ensuring you are well-equipped to conquer it like a pro!

Unraveling the Mystery of the W2 Form!

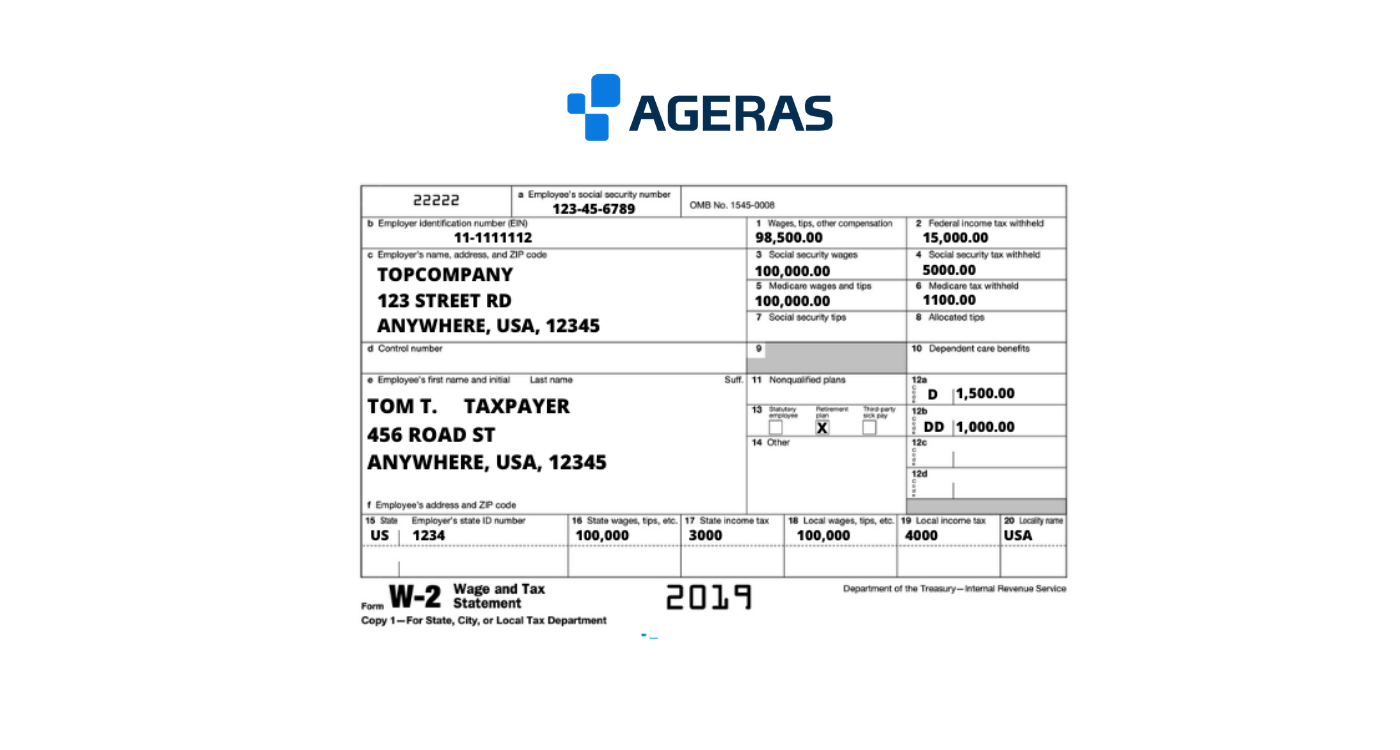

The W2 form is a crucial document that outlines an individual’s earnings and taxes withheld by their employer throughout the year. It is essential for filing your tax return accurately and avoiding any potential discrepancies with the IRS. The form may seem overwhelming at first glance, with its various boxes and codes, but fear not – we are here to help you navigate through it. By understanding each section of the form and what information to input, you can ensure that your tax return is completed correctly and efficiently.

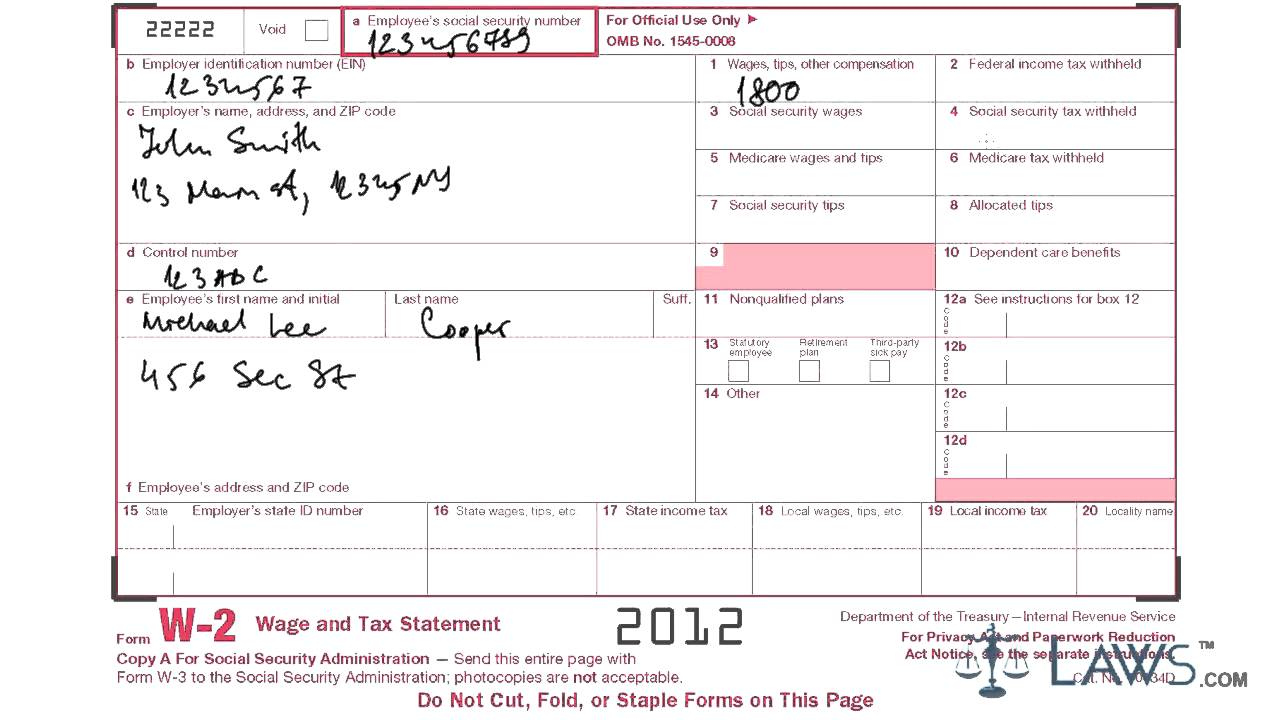

When completing your W2 form, it is important to pay attention to details such as your name, social security number, and address, as any errors in these fields can lead to delays in processing your tax return. Additionally, you will need to accurately report your wages, tips, and other compensation in the designated boxes. Make sure to double-check your entries to avoid any mistakes that could potentially trigger an audit. By taking the time to review each section of the form carefully, you can confidently submit your W2 with peace of mind, knowing that you have completed it accurately and efficiently.

Step-by-Step Guide to Conquering Your W2!

To begin completing your W2 form, start by gathering all the necessary information, including your employer’s details, your earnings, and any taxes withheld. Next, carefully review each section of the form and ensure that you accurately input the required information. Pay close attention to any additional income, such as bonuses or commissions, that may need to be reported separately. Once you have filled in all the necessary fields, double-check your entries to ensure accuracy before submitting your form to the IRS.

As you progress through each section of the W2 form, be sure to follow the instructions provided and refer to any guidance or resources available to you. If you encounter any unfamiliar terms or codes, don’t hesitate to seek clarification from your employer or a tax professional. By taking a systematic approach and tackling each section one at a time, you can simplify the process of completing your W2 form and feel confident in your ability to do so accurately. Remember, practice makes perfect, and with each year that you complete your W2, you will become more adept at navigating its intricacies.

In conclusion, mastering the W2 form is a manageable task when approached with patience and attention to detail. By following this step-by-step guide and taking the time to understand each section of the form, you can confidently complete your W2 with ease. Remember, tax season doesn’t have to be daunting – with the right tools and knowledge, you can conquer your W2 like a pro! So, roll up your sleeves, gather your documents, and embark on the journey to mastering the W2 form with confidence and proficiency. You’ve got this!

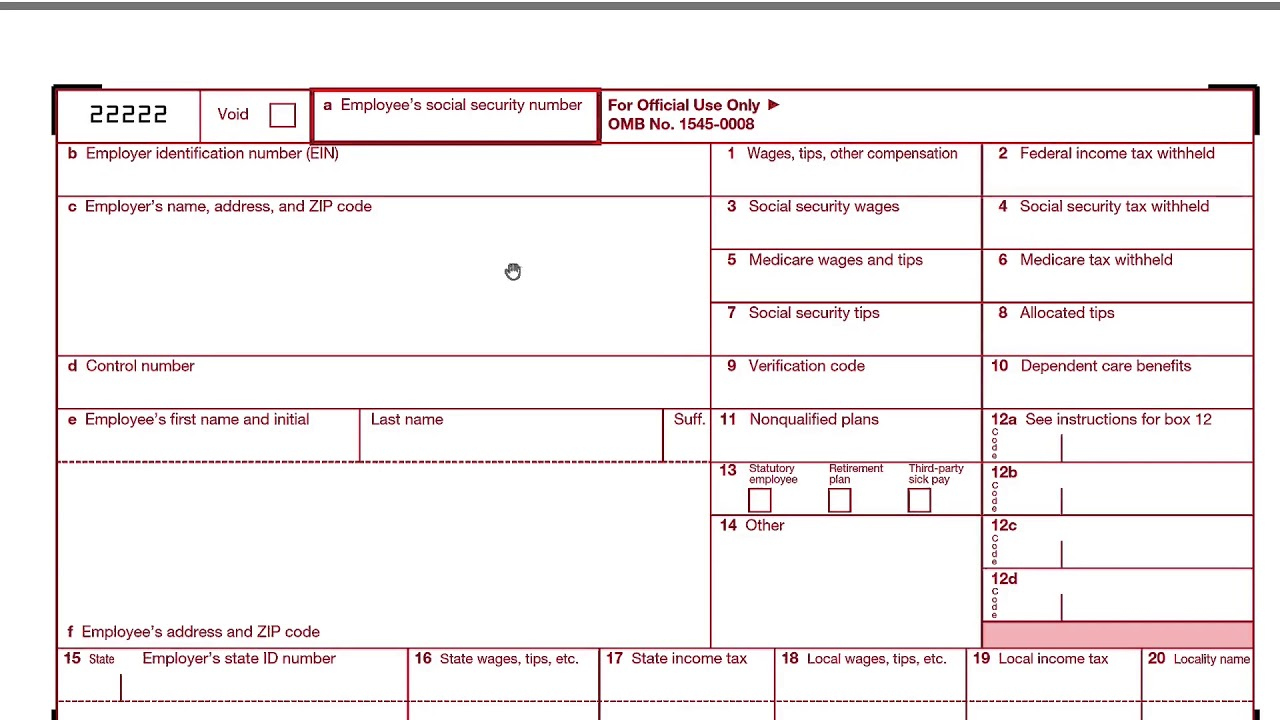

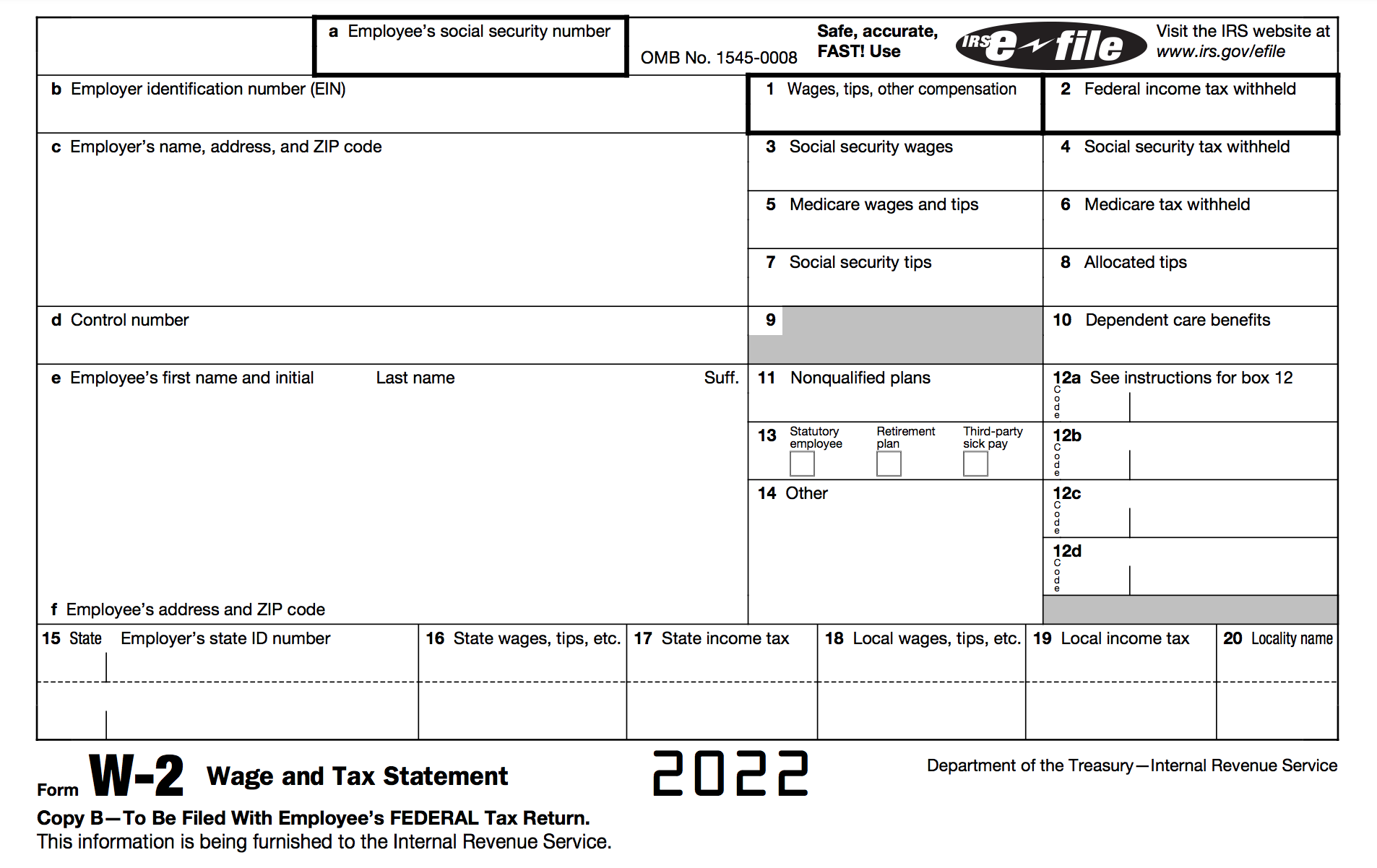

Below are some images related to How To Complete A W2 Form

how do you fill out a w-2 form, how to complete a w2 form, how to do a w2 form, how to file a w2 form, how to fill out a w-2 form for an employee, , How To Complete A W2 Form.

how do you fill out a w-2 form, how to complete a w2 form, how to do a w2 form, how to file a w2 form, how to fill out a w-2 form for an employee, , How To Complete A W2 Form.