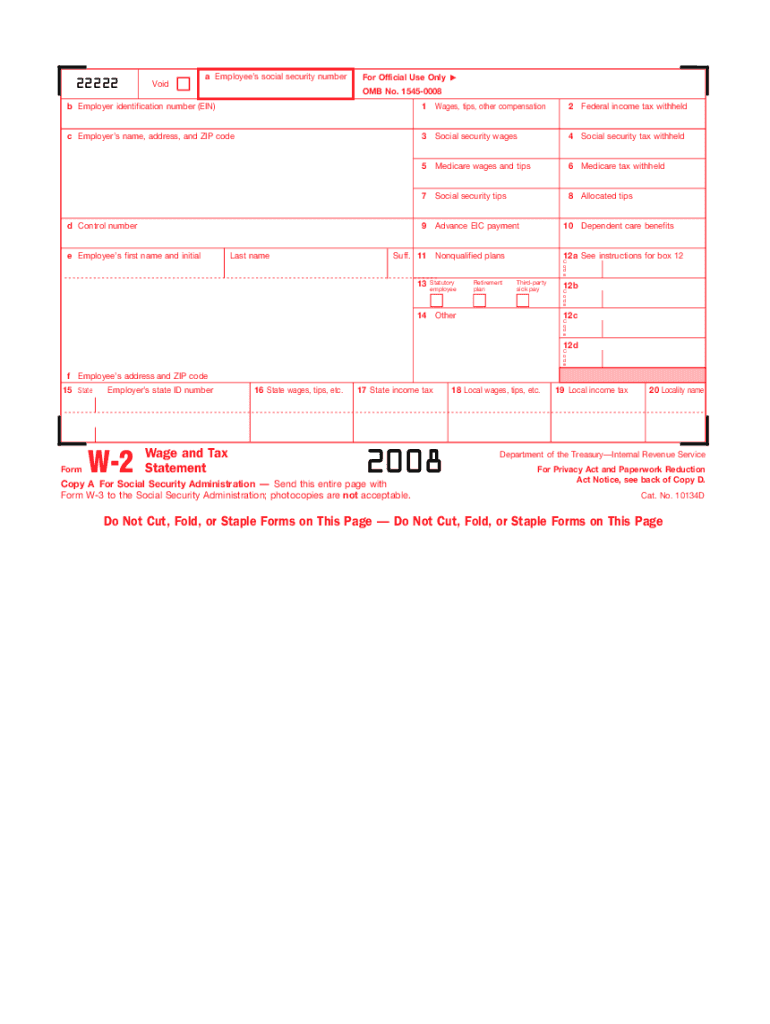

Former Verizon Employee W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Dive into the Mysteries of Your Old Verizon W2!

Have you ever found yourself staring at your old Verizon Employee W2, wondering what secrets it holds? Well, wonder no more, because we’re here to help you unlock the mysteries that lie within! Your W2 holds valuable information about your time as a Verizon employee, from your earnings and deductions to important tax details. Let’s embark on a journey of discovery and unearth the hidden treasures that your W2 has to offer!

Discover Hidden Treasures in Your Former Employee W2!

As you delve deeper into your old Verizon W2, you’ll uncover a wealth of information that may have gone unnoticed before. Take a closer look at your earnings and deductions to gain a better understanding of your financial situation during your time at Verizon. Did you receive any bonuses or incentives that you had forgotten about? Were there any deductions that you were unaware of? By exploring these hidden treasures, you can paint a clearer picture of your financial history and make more informed decisions moving forward.

Unravel the Tax Mysteries of Your Verizon W2

One of the most important aspects of your old Verizon Employee W2 is the tax information it contains. From your federal and state tax withholdings to any retirement contributions, your W2 provides a detailed breakdown of how your income was taxed during your time at Verizon. By unraveling these tax mysteries, you can gain valuable insights into your tax obligations and make sure you’re taking advantage of any available deductions or credits. So grab your old W2, put on your detective hat, and start unraveling the tax mysteries that lie within!

In conclusion, your former Verizon Employee W2 is more than just a piece of paper – it’s a treasure trove of information waiting to be discovered. By diving into the mysteries of your old W2, you can uncover hidden treasures that will help you better understand your financial history and tax obligations. So don’t let your old W2 collect dust in a drawer – unlock its secrets and reap the rewards of your newfound knowledge!

Below are some images related to Former Verizon Employee W2

former verizon employee w2, how can i get my w2 from former employer, how do former employees get w2, how do i get my w2 from walmart as a former employee, how to get w2 from former employee, , Former Verizon Employee W2.

former verizon employee w2, how can i get my w2 from former employer, how do former employees get w2, how do i get my w2 from walmart as a former employee, how to get w2 from former employee, , Former Verizon Employee W2.