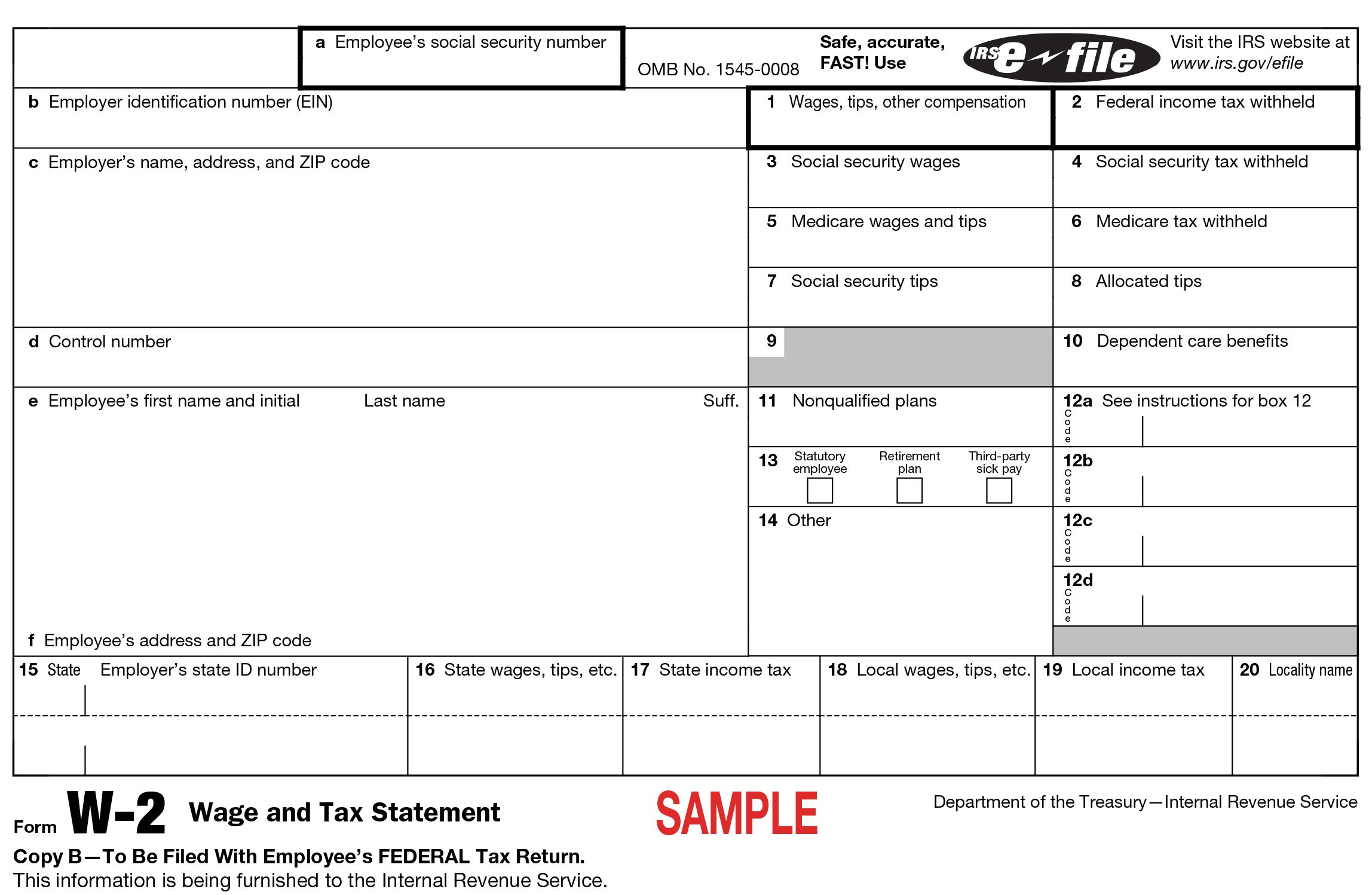

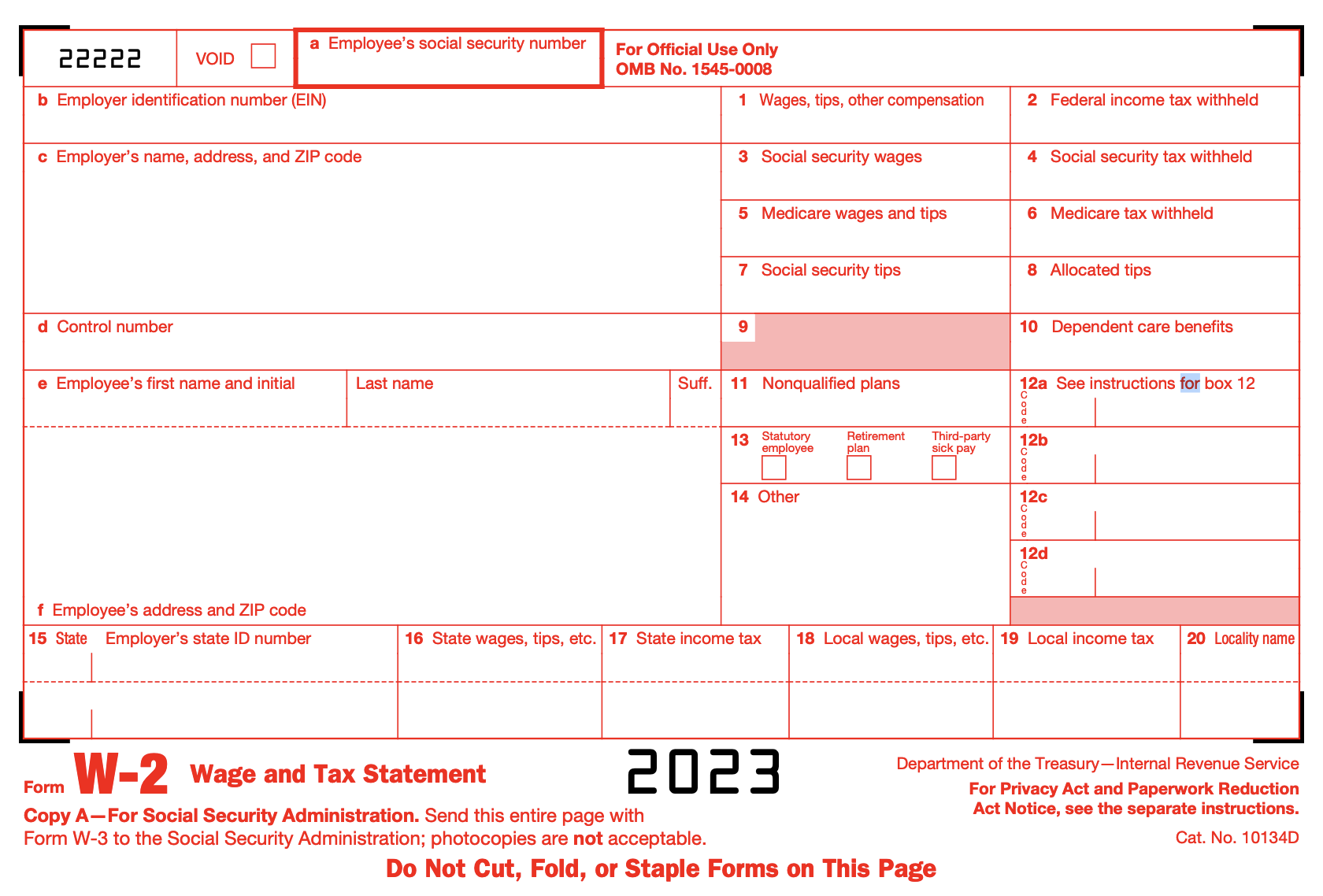

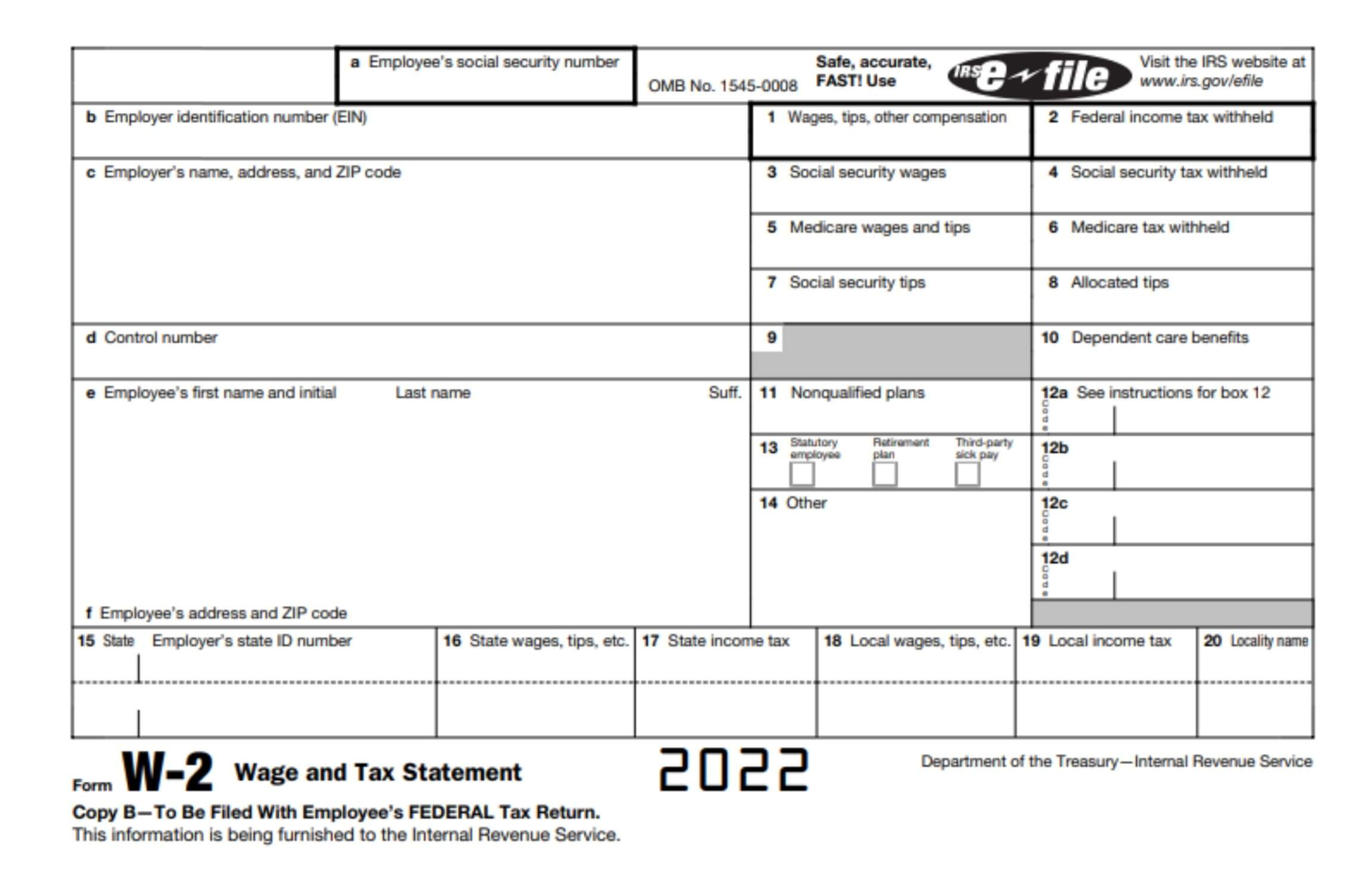

Form W2 Instructions – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unraveling the Mystery of Your W-2 Form

Ah, tax season – a time that often brings stress and confusion for many. But fear not, for your trusty W-2 form is here to save the day! This seemingly cryptic piece of paper holds the key to understanding your income and taxes withheld throughout the year. By taking the time to unravel the mystery of your W-2, you can gain a clearer understanding of your financial situation and approach tax season with confidence.

First things first, let’s break down the basics of your W-2 form. This important document, provided by your employer, outlines crucial information such as your total earnings, taxes withheld, and contributions to retirement accounts. Understanding each section of your W-2 will not only help you accurately file your taxes, but it will also empower you to take control of your financial well-being. So grab a cup of coffee, cozy up with your W-2, and let’s dive into the world of taxes together!

Now that you have a better grasp of your W-2 form, it’s time to embrace tax season with confidence and ease.

Embrace Tax Season with Confidence and Ease

Gone are the days of feeling overwhelmed and defeated by tax season. Armed with your newfound knowledge of your W-2 form, you can approach this time of year with a sense of empowerment and assurance. Take the time to review your W-2 carefully, double-checking each section for accuracy and completeness. If you have any questions or concerns, don’t hesitate to reach out to your employer or a tax professional for guidance.

With a clear understanding of your W-2 form, you can now tackle your taxes with ease. Whether you choose to file them yourself or seek assistance from a tax preparer, having a solid grasp of your financial information will make the process smoother and more efficient. Remember, tax season doesn’t have to be a source of stress – with the right tools and knowledge, you can navigate it with confidence and even a touch of excitement!

In conclusion, demystifying your W-2 form is the first step towards a stress-free tax season. By taking the time to understand this essential document, you can equip yourself with the knowledge and confidence needed to tackle your taxes with ease. So grab your W-2, put on your favorite playlist, and get ready to conquer tax season like a pro! Remember, you’ve got this!

Below are some images related to Form W2 Instructions

form w-2 instructions 2018, form w-2 instructions 2019, form w-2 instructions 2020, form w-2 instructions 2021 pdf, form w-2 instructions box 12a, , Form W2 Instructions.

form w-2 instructions 2018, form w-2 instructions 2019, form w-2 instructions 2020, form w-2 instructions 2021 pdf, form w-2 instructions box 12a, , Form W2 Instructions.