Fill Out W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unleash Your Tax Potential: Mastering Your W2!

Are you ready to take control of your tax destiny? Your W2 form holds the key to unlocking your tax success and maximizing your refund. By mastering your W2, you can ensure that you are taking advantage of all available deductions and credits, ultimately putting more money back in your pocket. So grab your favorite beverage, grab your W2 form, and let’s dive into the ultimate guide to tax success!

The Ultimate Guide to Tax Success Using Your W2 Form

Your W2 form is like a treasure map, guiding you through the complex world of taxes and helping you navigate the waters of deductions, credits, and refunds. To truly master your W2, start by familiarizing yourself with each box and what it represents. Box 1 shows your total wages, while Box 2 displays the federal income tax withheld. Understanding these basic elements will set the foundation for a successful tax season.

Next, take a closer look at Box 12, which lists any additional information related to your income, such as retirement plan contributions or health insurance premiums. These can have a significant impact on your tax liability, so be sure to review them carefully. Additionally, don’t forget about Box 14, which can include a variety of other deductions or information that may apply to your specific situation. By mastering each section of your W2 form, you can ensure that you are maximizing your tax potential and setting yourself up for success.

In conclusion, mastering your W2 form is the key to achieving tax success and maximizing your refund. By understanding each section of your W2 and leveraging the information it provides, you can make informed decisions that will benefit your bottom line. So don’t let tax season overwhelm you – grab your W2 form, unleash your tax potential, and take control of your financial future! With a little bit of knowledge and a positive attitude, you can conquer your taxes and come out on top. Cheers to a successful tax season!

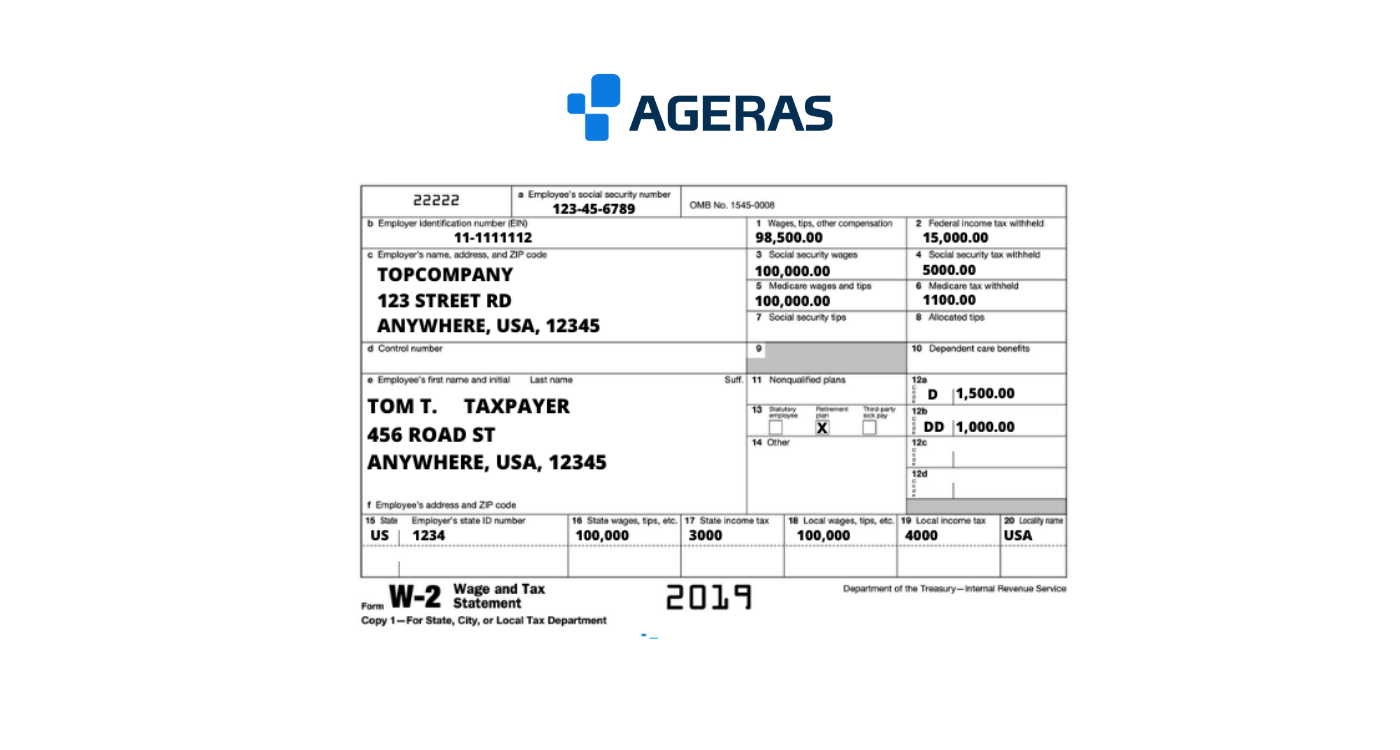

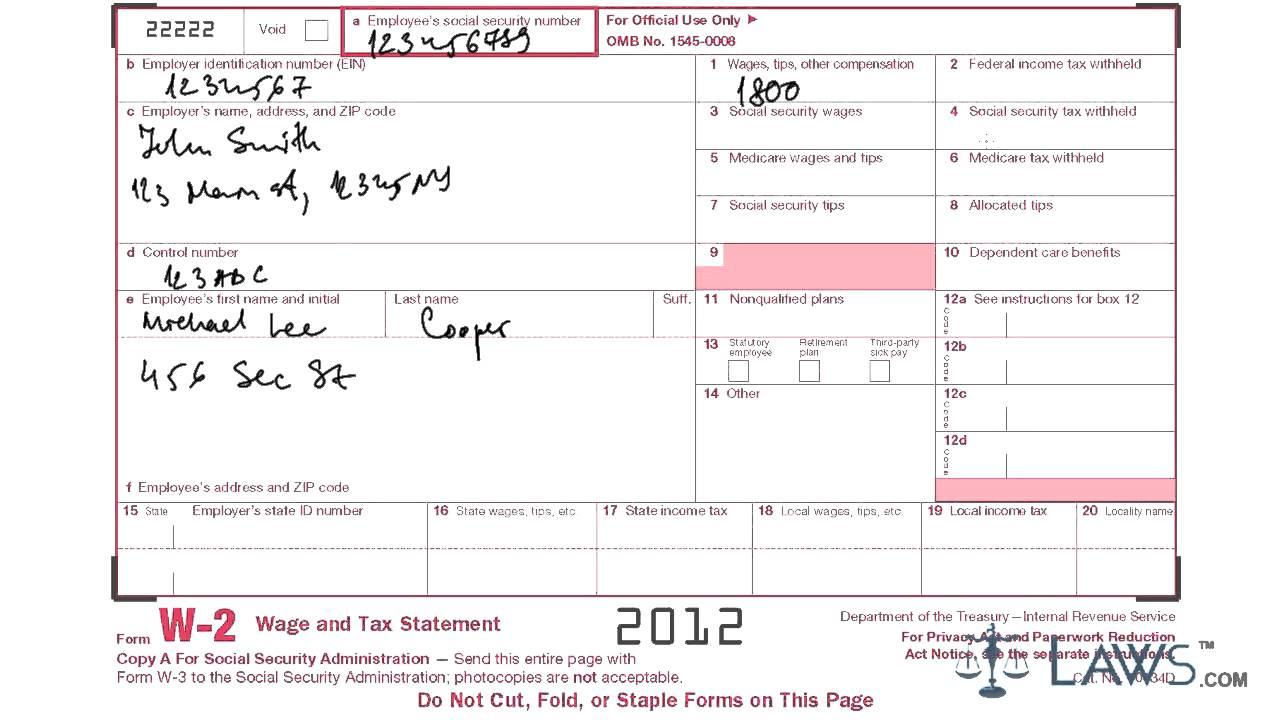

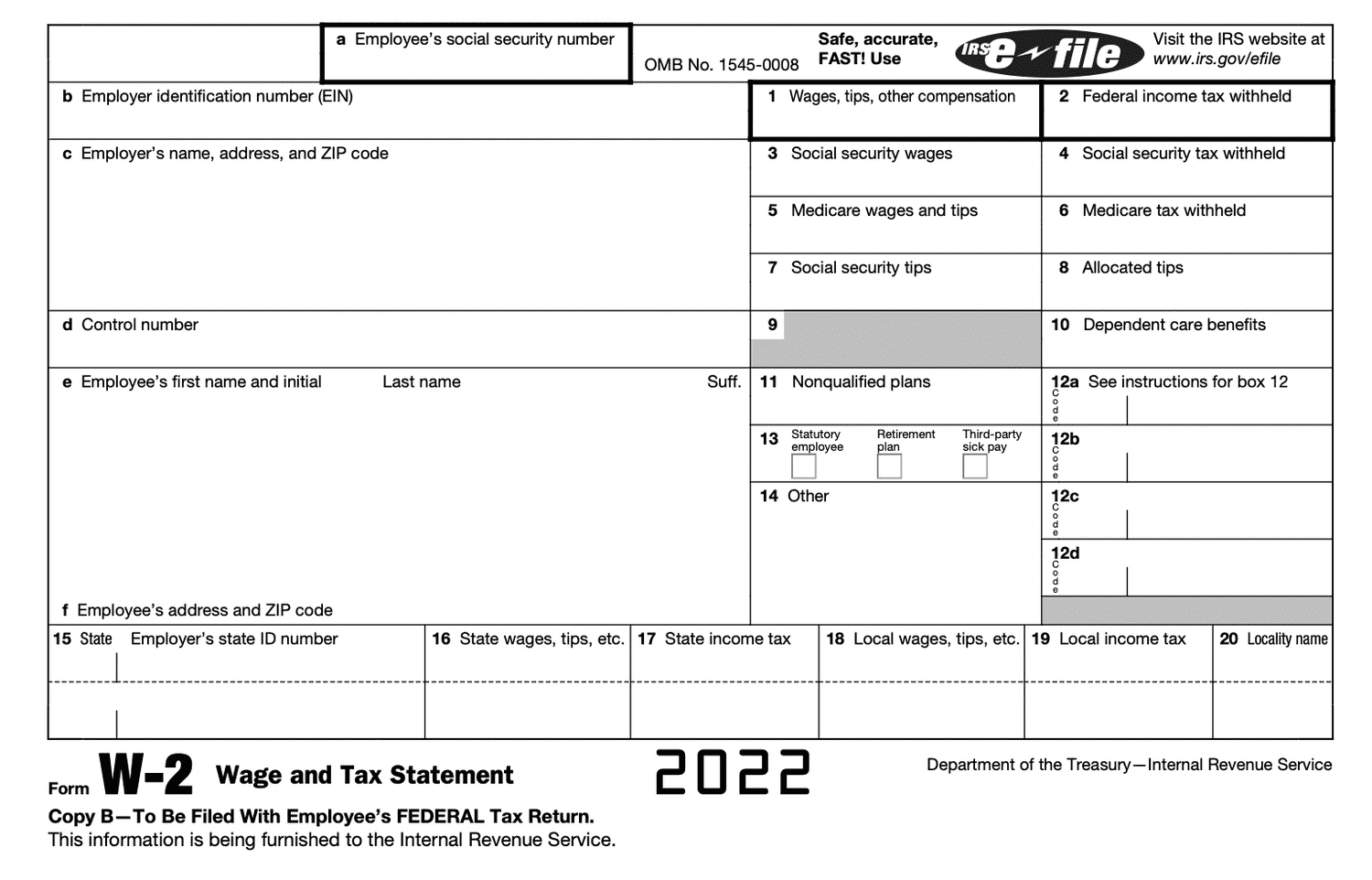

Below are some images related to Fill Out W2 Form

fill out w2 form, fill out w2 form online, fill out w2 form online free, filling out w-2 form when married, filling out w2 form married, , Fill Out W2 Form.

fill out w2 form, fill out w2 form online, fill out w2 form online free, filling out w-2 form when married, filling out w2 form married, , Fill Out W2 Form.