Explain A W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

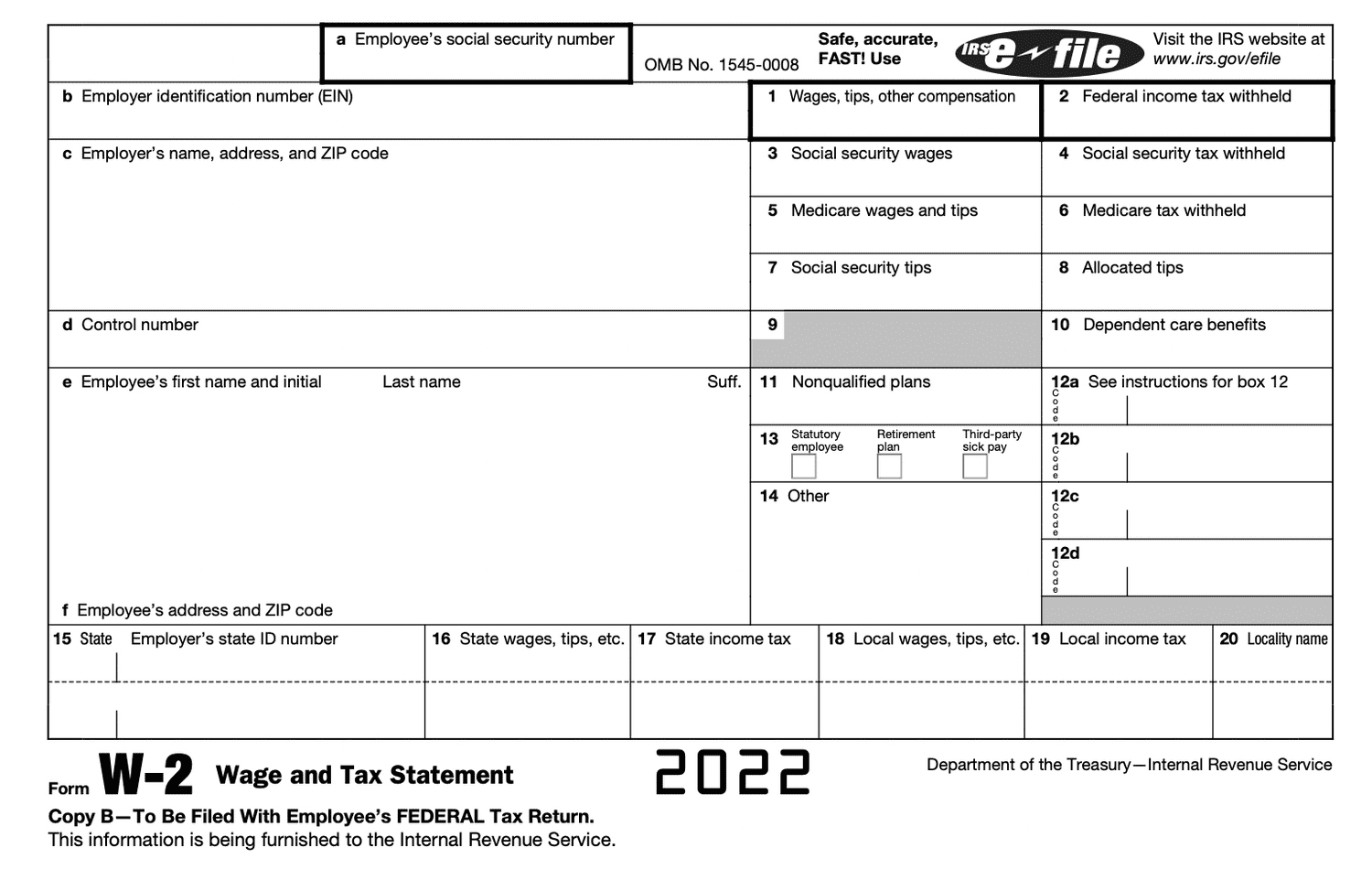

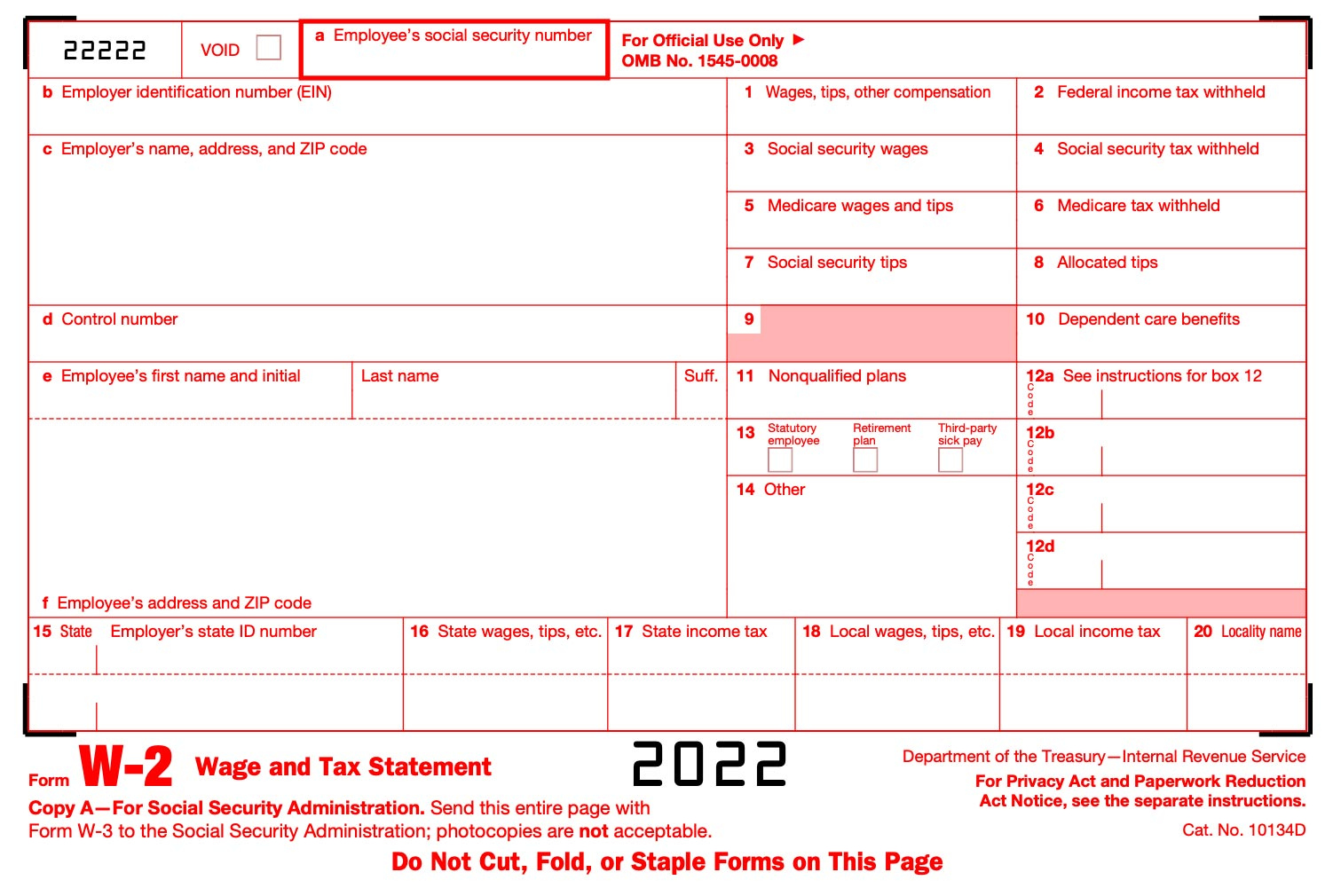

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

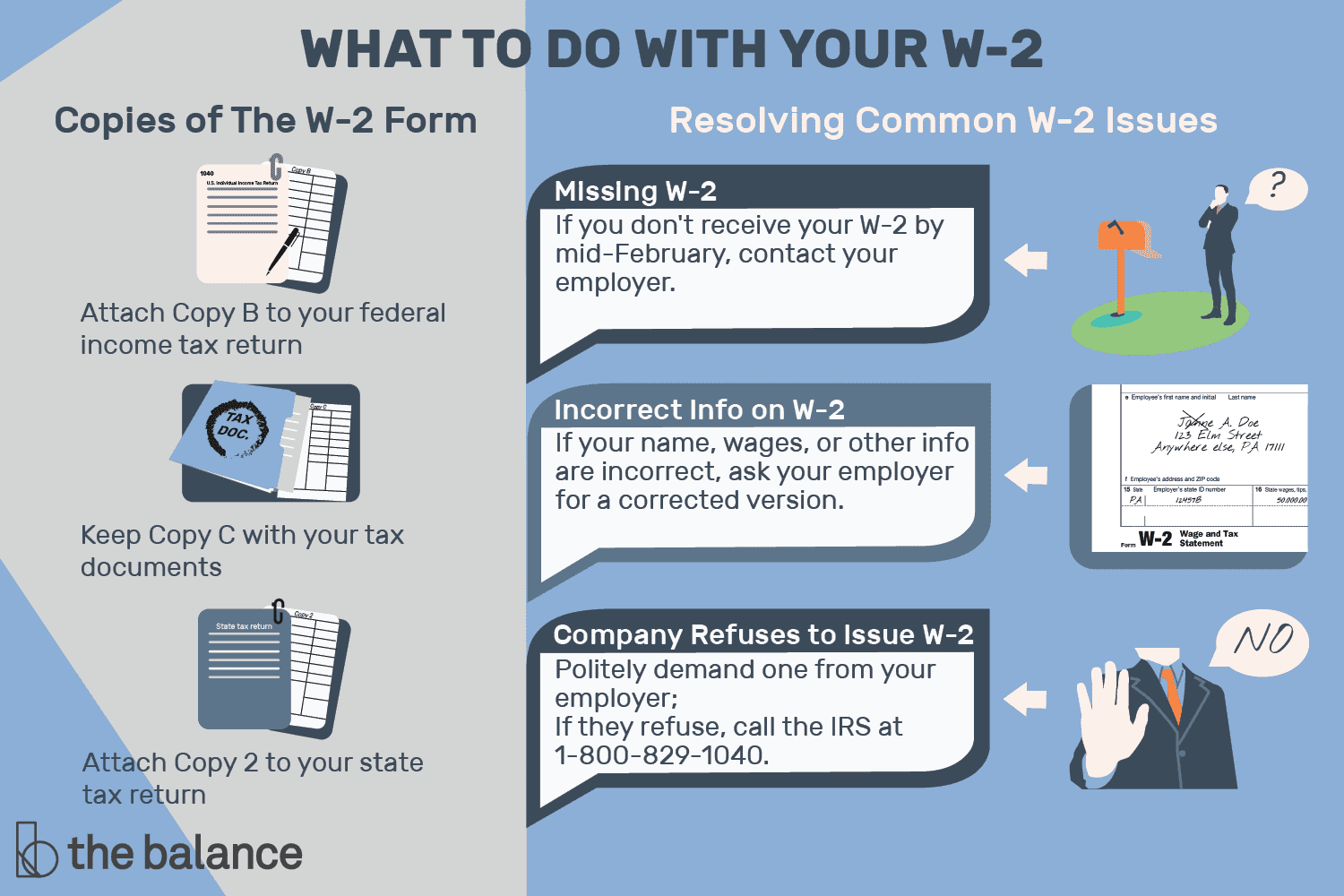

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

The Wondrous World of W2 Forms: Decoding Your Tax Info!

Tax season can often feel like navigating a maze of paperwork and confusion, but fear not! Your trusty W2 form is here to save the day. This seemingly mysterious document holds the key to unlocking vital information about your income and taxes, helping you file your taxes with confidence and ease. So sit back, relax, and let’s dive into the wondrous world of W2 forms!

Unlocking the Mysteries of Your W2 Form!

Ah, the humble W2 form – a treasure trove of information just waiting to be decoded. From your total earnings to the amount of taxes withheld, your W2 form provides a comprehensive snapshot of your financial year. But fear not, deciphering this document is easier than you think! Simply break down each section, from box 1 (wages, tips, and other compensation) to box 20 (local wages, tips, and other compensation), and you’ll have a clearer understanding of your tax info in no time.

Not sure what to do with all those numbers and boxes on your W2 form? Don’t worry, help is at hand! Online resources and tax professionals are readily available to guide you through the process and ensure you’re filling out your tax return correctly. Remember, knowledge is power, and the more you understand your W2 form, the better equipped you’ll be to navigate tax season like a pro.

Navigate Tax Season with Confidence and Ease!

Armed with your newfound knowledge of W2 forms, you’ll breeze through tax season with confidence and ease. Gone are the days of feeling overwhelmed by stacks of paperwork and complicated tax jargon – now, you can tackle your taxes like a champ! So grab your W2 form, pour yourself a cup of coffee, and get ready to conquer tax season with a smile on your face. You’ve got this!

In conclusion, the wondrous world of W2 forms is not as daunting as it may seem. With a little bit of patience and a willingness to learn, you can decode your tax info with ease and take control of your financial future. So embrace your W2 form, embrace tax season, and embrace the peace of mind that comes with knowing you’re on top of your taxes. Happy filing!

Below are some images related to Explain A W2 Form

explain a w2 form, what is a w2 form, what is a w2 form and what does it tell, what is a w2 form called, what is a w2 form definition, , Explain A W2 Form.

explain a w2 form, what is a w2 form, what is a w2 form and what does it tell, what is a w2 form called, what is a w2 form definition, , Explain A W2 Form.