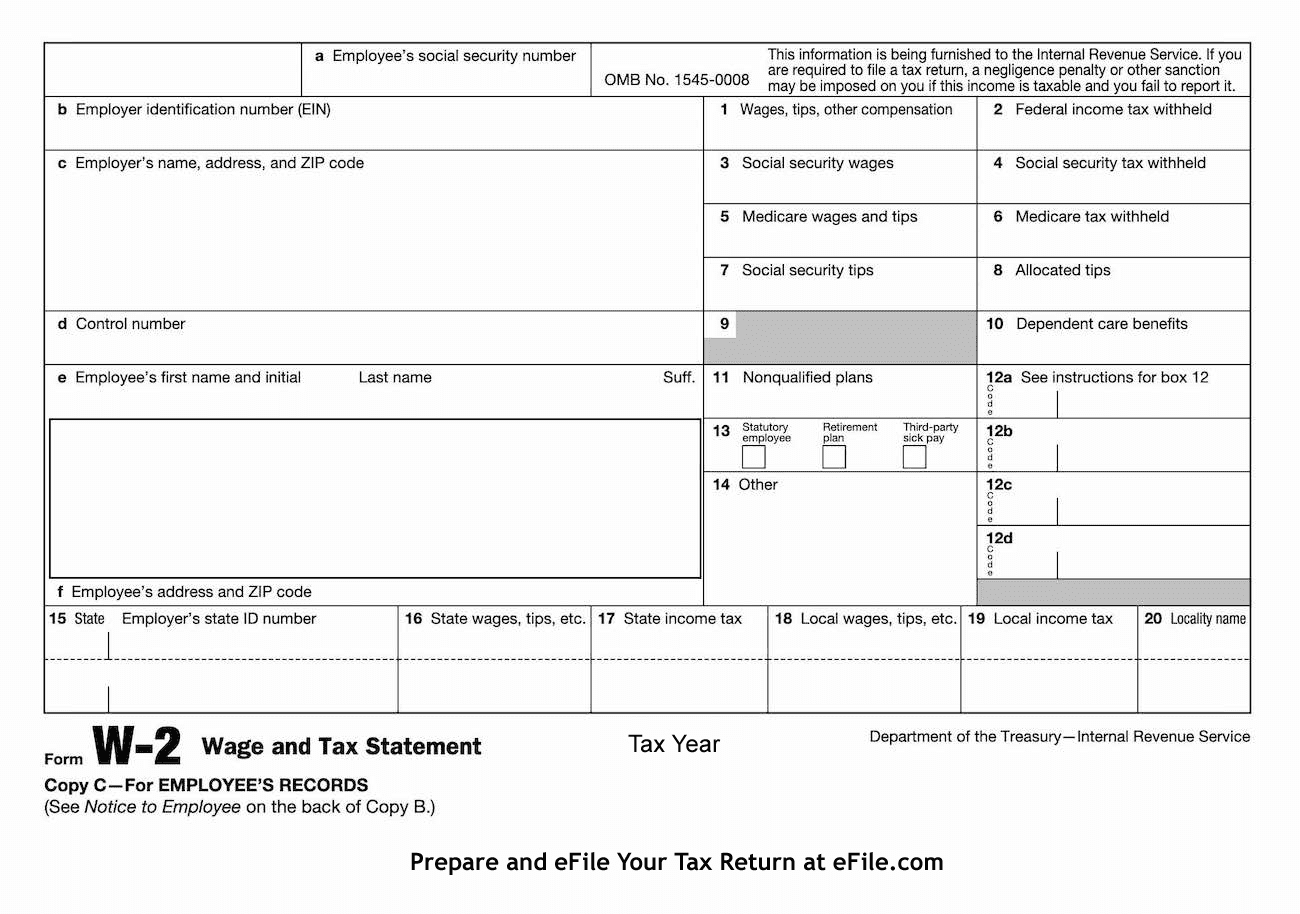

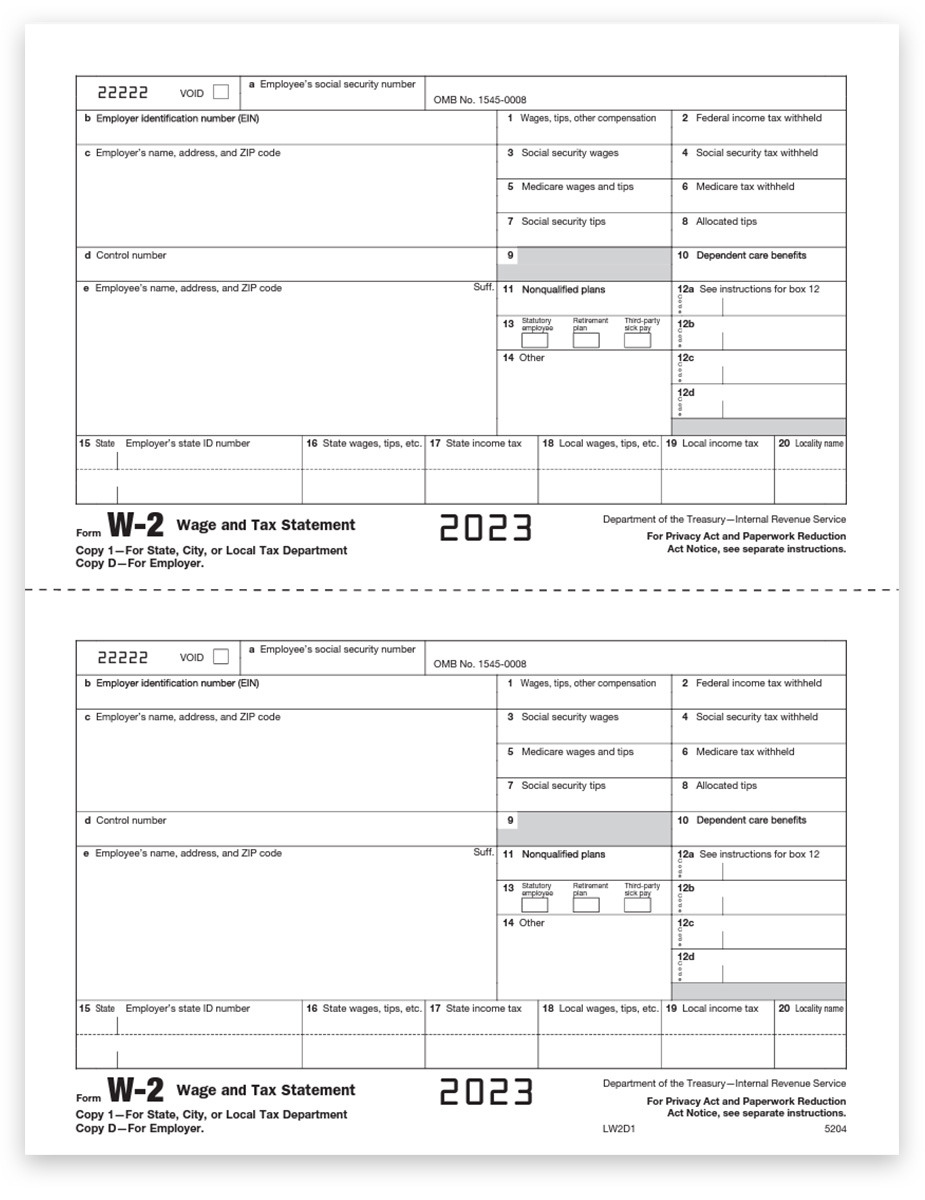

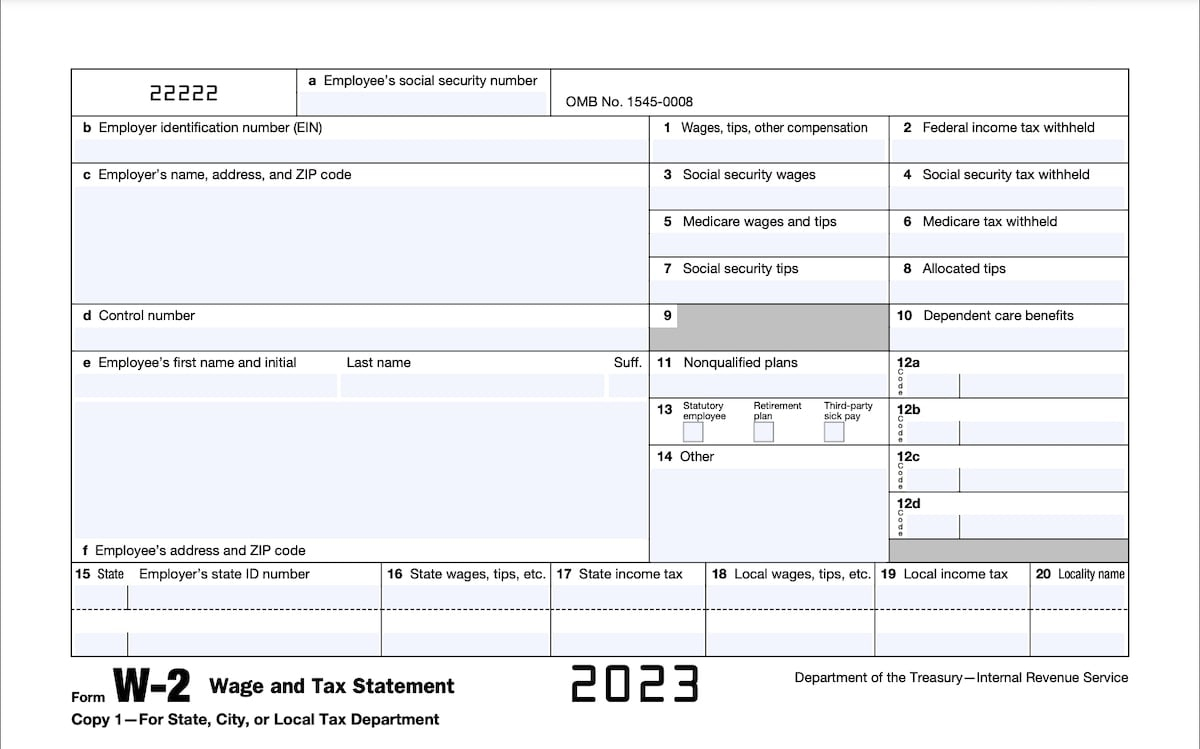

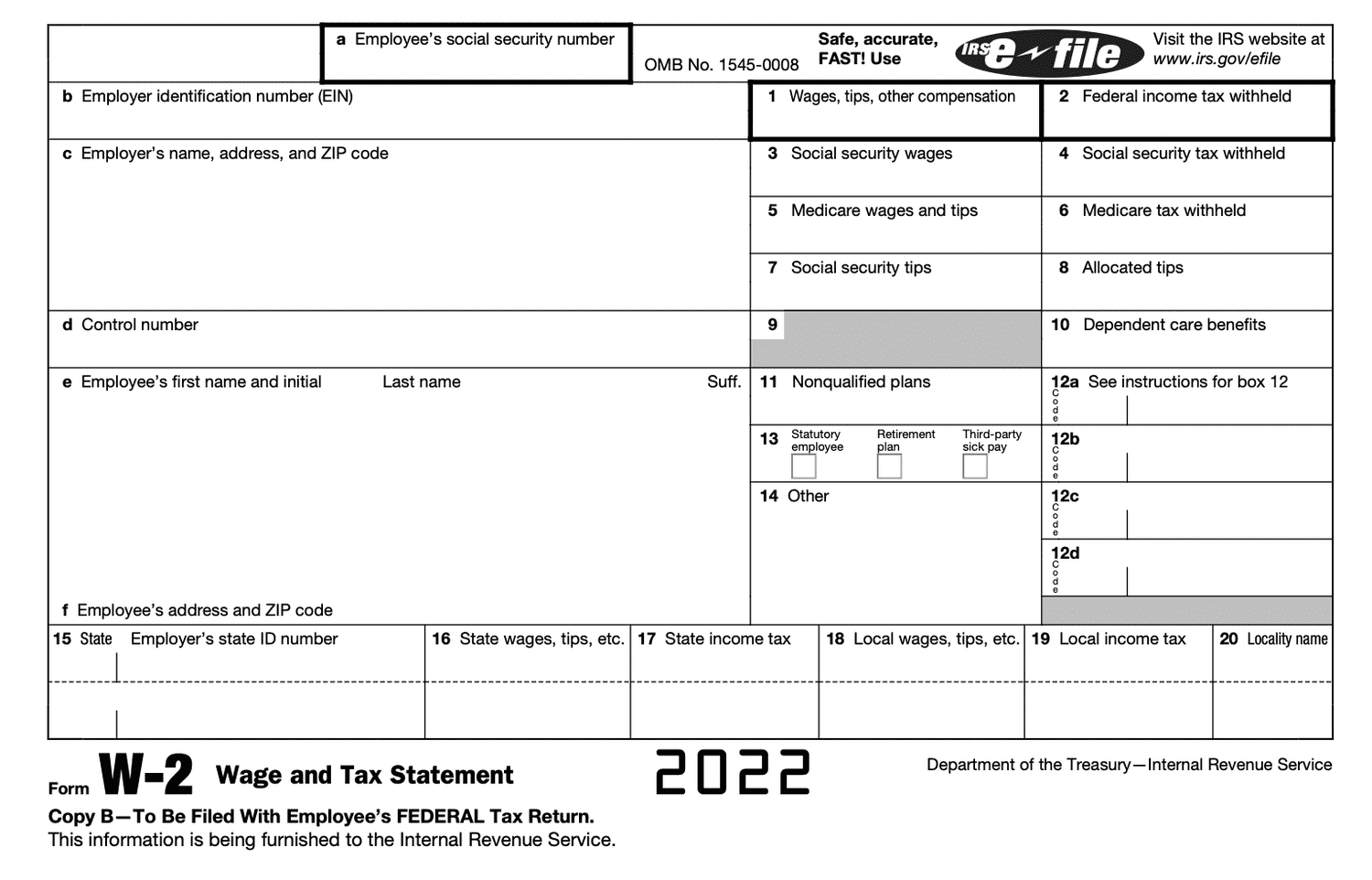

Employer W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlock Your Tax Potential with Your Employer’s W2 Form!

Taxes can be a daunting topic for many people, but they don’t have to be! Your employer’s W2 form is a powerful tool that can help you maximize your tax benefits and get the most out of your tax return. By understanding how to effectively utilize your W2 form, you can unlock your tax potential and potentially save yourself a significant amount of money. So let’s dive in and discover how you can make the most out of this important document!

Maximize Your Tax Benefits!

One of the key benefits of your W2 form is that it provides you with a detailed summary of your earnings and tax withholdings for the year. This information is crucial when it comes to filing your taxes, as it helps ensure that you are reporting your income accurately and taking advantage of all available deductions and credits. By carefully reviewing your W2 form, you can identify areas where you may be able to reduce your tax liability and potentially increase your tax refund.

In addition to providing information on your income and tax withholdings, your W2 form also includes important details about any benefits you may have received from your employer, such as retirement contributions or health insurance coverage. By taking the time to review this information, you can ensure that you are maximizing the tax benefits associated with these benefits and potentially saving yourself even more money come tax time. So don’t overlook the valuable information that your W2 form provides – it could make a big difference in your overall tax situation!

Get the Most Out of Your W2 Form!

When it comes to getting the most out of your W2 form, organization is key. Make sure to keep all of your tax documents, including your W2 form, in a safe and easily accessible place. This will make it much easier to reference your W2 form when you are preparing your taxes and ensure that you are not missing any important information. Additionally, consider using tax software or consulting with a tax professional to help you navigate the complexities of the tax code and maximize your tax benefits.

Another important tip for getting the most out of your W2 form is to take advantage of any available tax credits and deductions. This could include things like the Earned Income Tax Credit, student loan interest deduction, or child tax credit. By carefully reviewing your W2 form and understanding how these credits and deductions apply to your specific situation, you can potentially save yourself hundreds or even thousands of dollars on your tax bill. So be proactive and make sure you are taking full advantage of all the tax benefits available to you through your W2 form!

In conclusion, your employer’s W2 form is a valuable resource that can help you unlock your tax potential and save yourself money on your taxes. By maximizing your tax benefits and getting the most out of your W2 form, you can ensure that you are taking full advantage of all available deductions and credits, potentially increasing your tax refund or reducing your tax liability. So don’t overlook the power of your W2 form – take the time to understand it and use it to your advantage when filing your taxes. With a little effort and knowledge, you can make tax season a little less stressful and a lot more rewarding!

Below are some images related to Employer W2 Form

employer id number w2 form, employer send w-2 forms out, employer w2 form, employer w2 form download, employer w2 online, , Employer W2 Form.

employer id number w2 form, employer send w-2 forms out, employer w2 form, employer w2 form download, employer w2 online, , Employer W2 Form.