Employee W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unwrapping the W2: Your Ticket to Tax Time Fun!

Tax season can often be a daunting time of year for many people, but it doesn’t have to be! In fact, with your trusty W2 in hand, you’ll be well on your way to making tax time a breeze. So grab a cup of coffee, put on your favorite cozy sweater, and get ready to unwrap the W2 – your ticket to tax time fun!

Get ready to unwrap the W2 and dive into tax season!

As you eagerly tear open that envelope and lay eyes on your W2 for the first time, you may feel a mix of excitement and trepidation. But fear not! Your W2 is your key to unlocking all the information you need to file your taxes accurately and efficiently. From your total earnings to the amount of taxes withheld, your W2 provides a comprehensive snapshot of your financial year. So take a deep breath, gather your documents, and let the tax time adventure begin!

Now that you have your W2 in hand, it’s time to dive into the world of tax deductions and credits. Your W2 not only provides you with information about your income and taxes paid, but it also gives you the opportunity to take advantage of valuable deductions and credits that can help lower your tax bill. From education expenses to charitable donations, there are many ways to maximize your tax savings. So grab your calculator and start unraveling the mystery of tax deductions – you may be surprised at how much you can save!

Discover how your W2 can make tax time a breeze!

With your W2 in hand and a clear understanding of your financial situation, you’ll find that tax time can actually be quite enjoyable. Whether you choose to tackle your taxes solo or enlist the help of a professional, having your W2 at the ready will make the process smooth and efficient. So put on your favorite playlist, pour yourself another cup of coffee, and let the tax time fun begin!

In conclusion, don’t let tax season overwhelm you – embrace it as an opportunity to take control of your finances and maximize your savings. Your W2 is not just a piece of paper, but a valuable tool that can help you navigate the ins and outs of tax season with confidence and ease. So unwrap that W2, grab a seat at your designated tax-filing station, and get ready to embark on a journey towards financial success. Tax time can be fun – all you need is your W2 and a positive attitude!

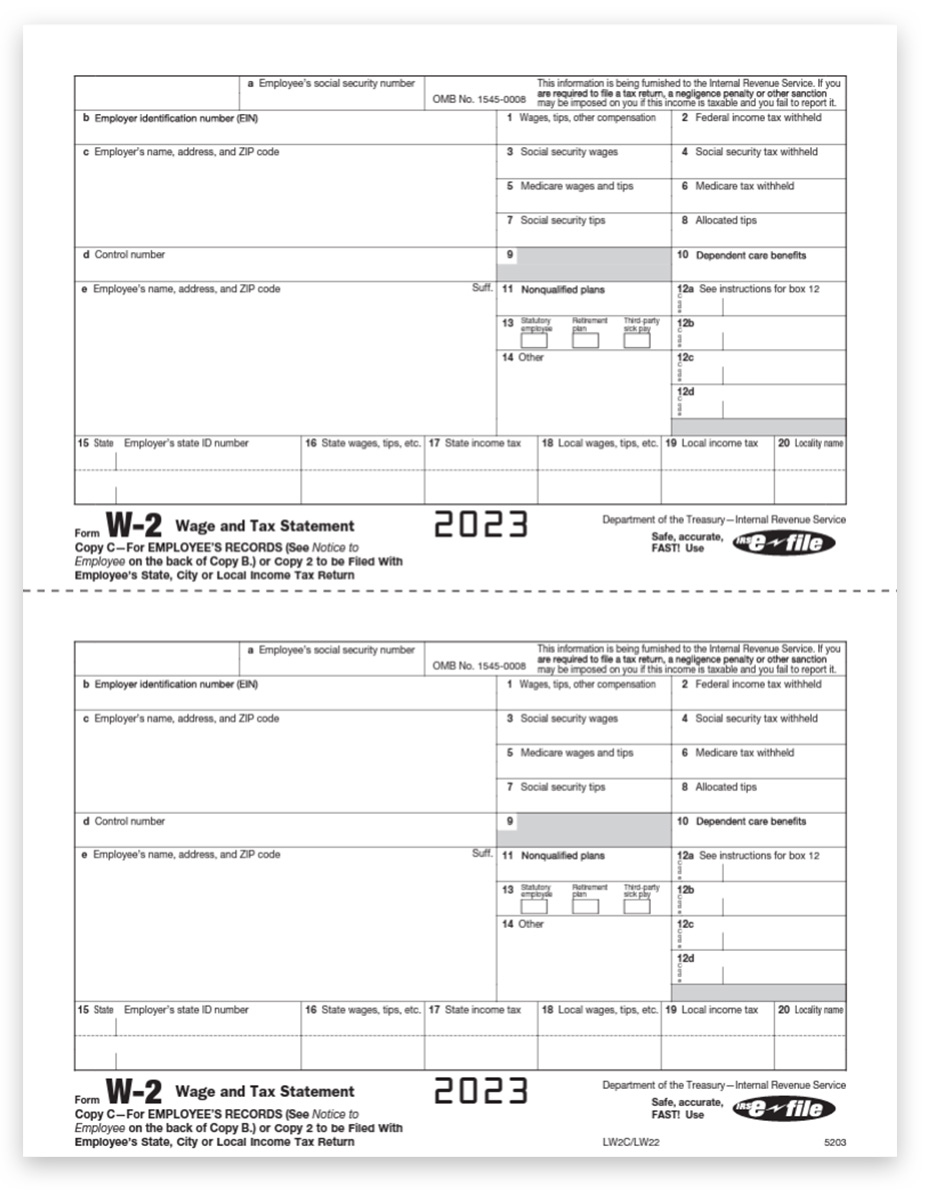

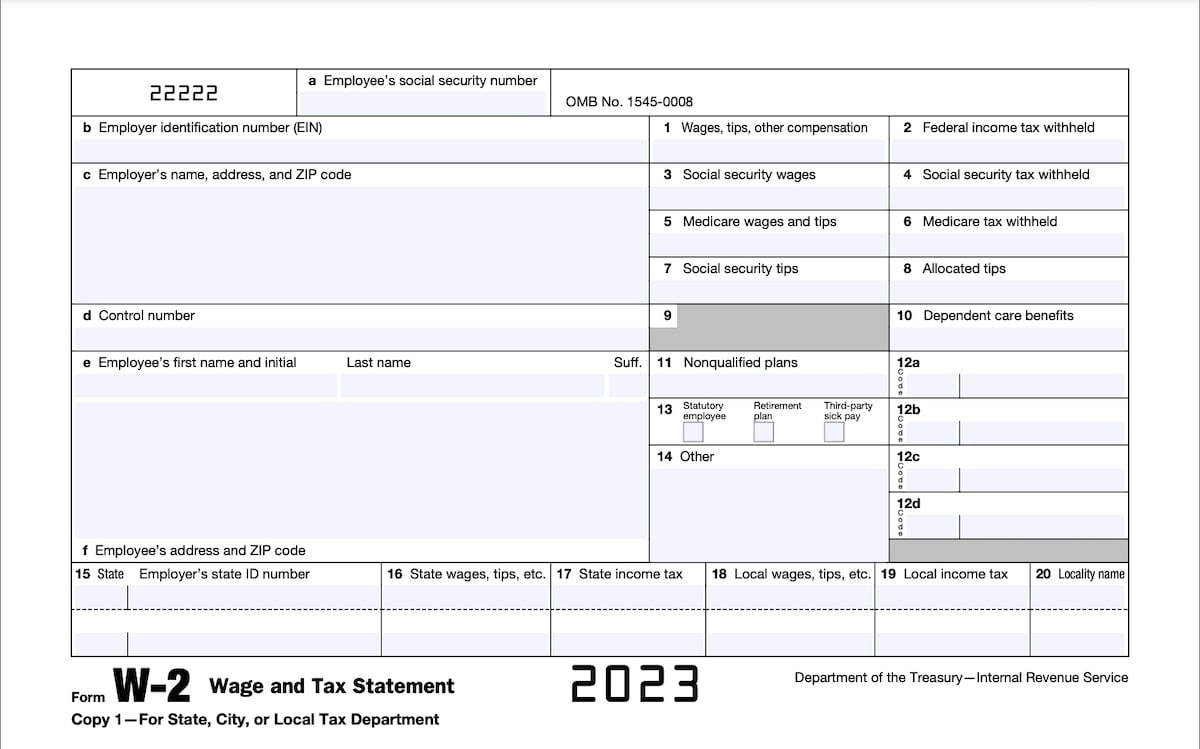

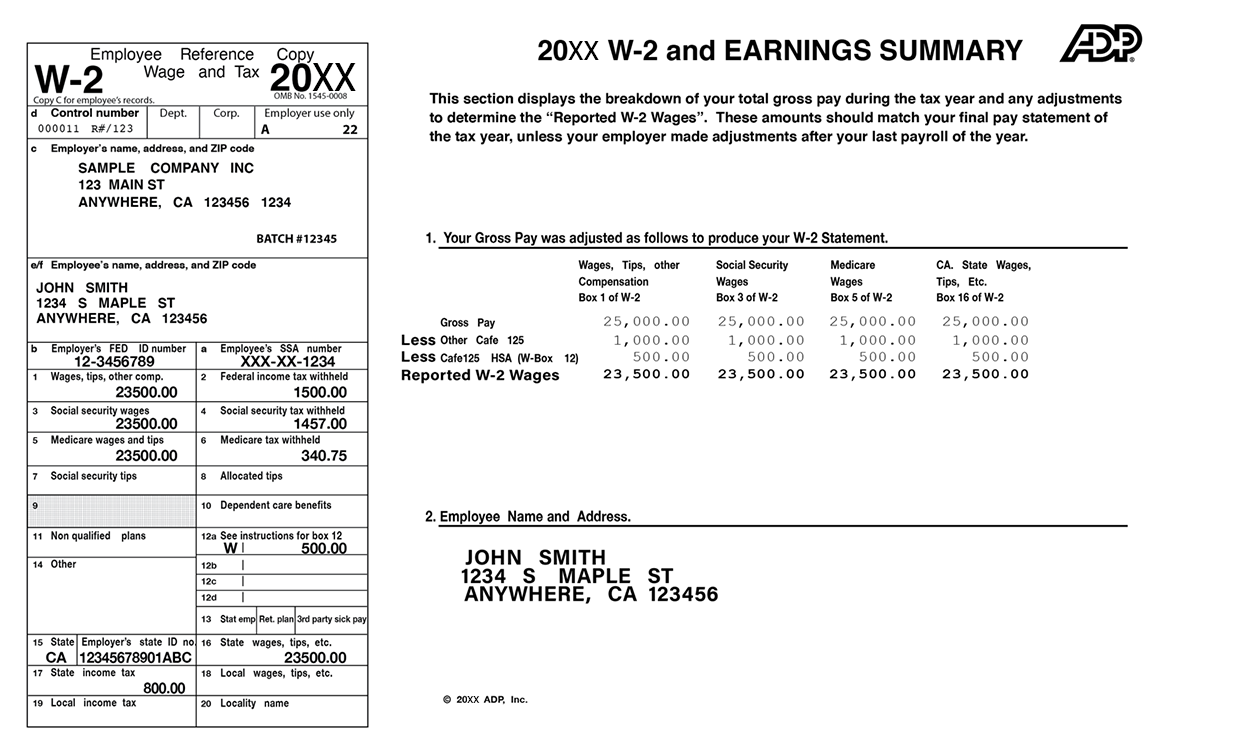

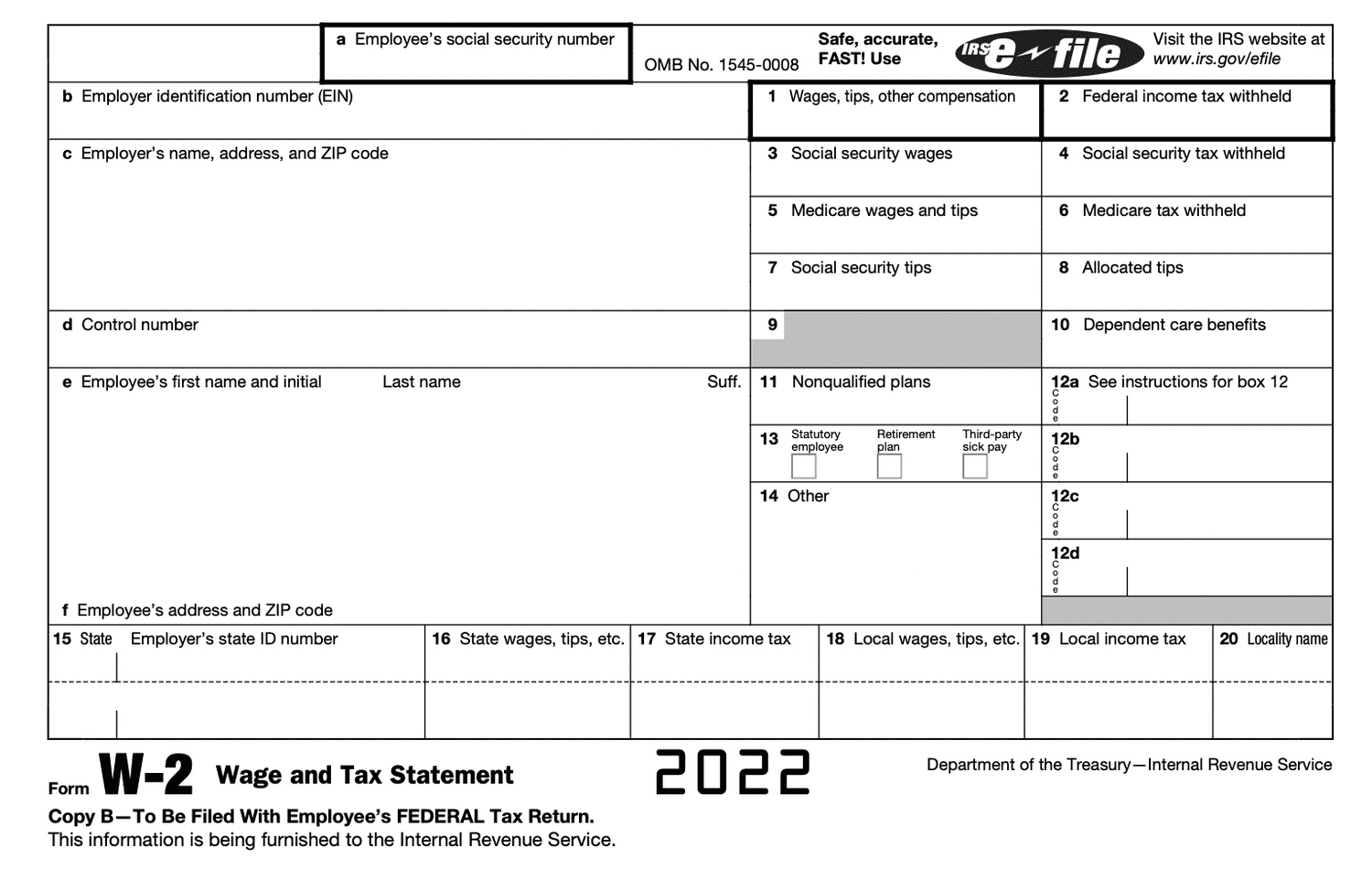

Below are some images related to Employee W2 Form

employee w2 form, employee w2 form 2022, employee w2 form 2023, employee w2 form 2024, employee w2 form 2024 pdf, , Employee W2 Form.

employee w2 form, employee w2 form 2022, employee w2 form 2023, employee w2 form 2024, employee w2 form 2024 pdf, , Employee W2 Form.