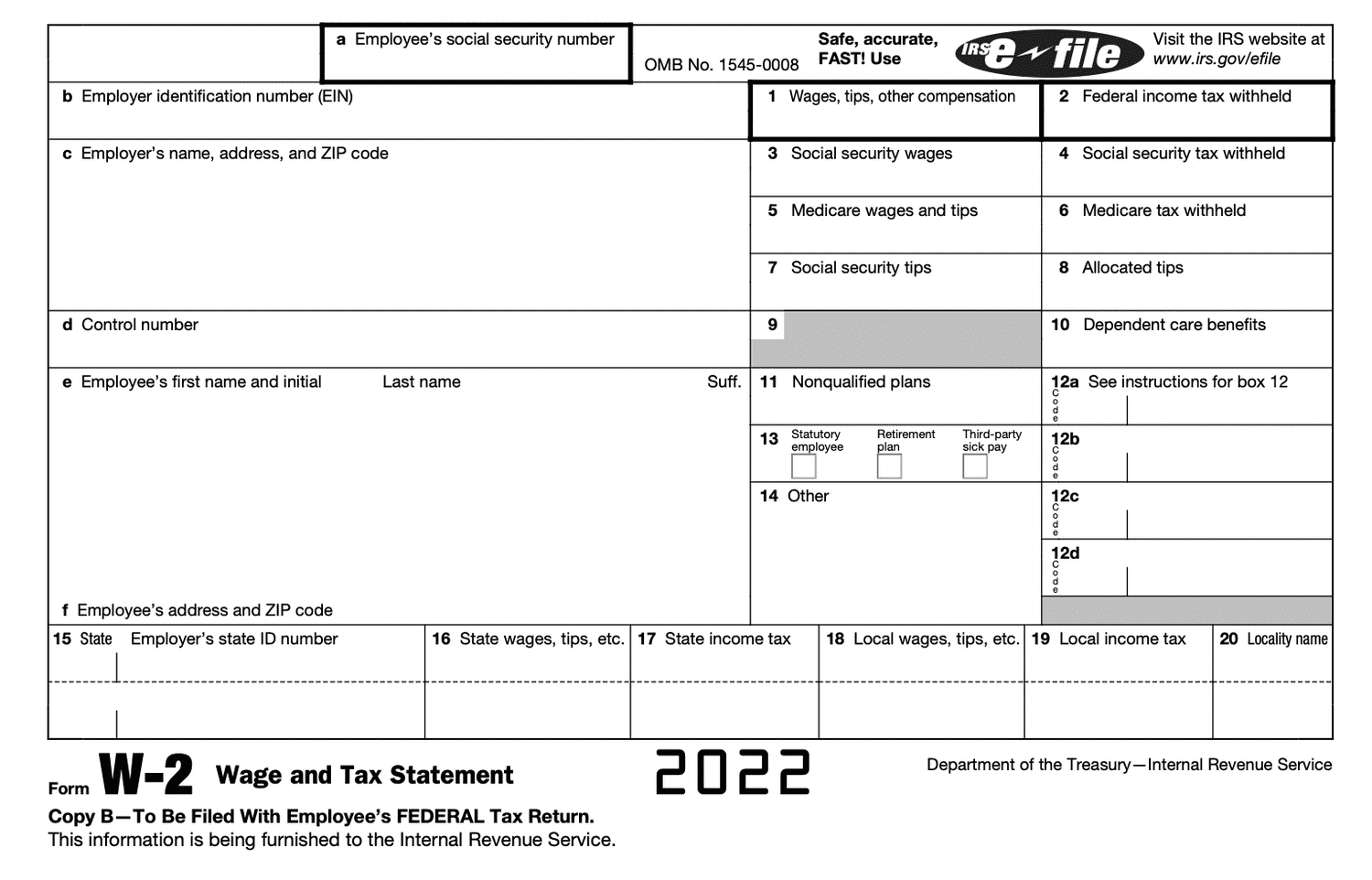

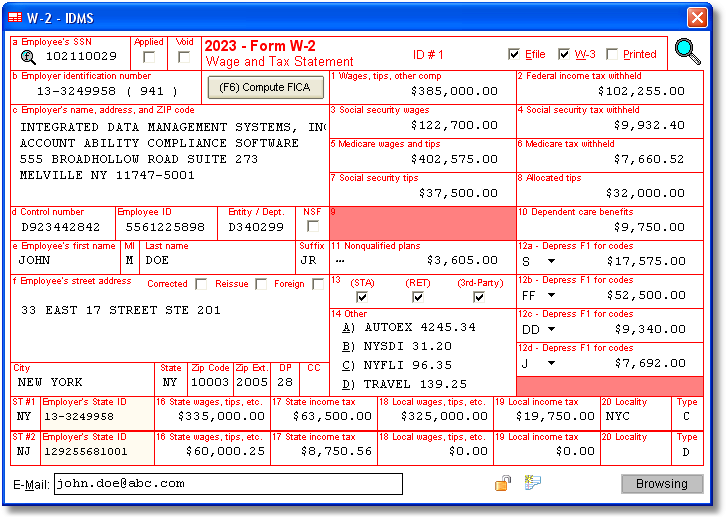

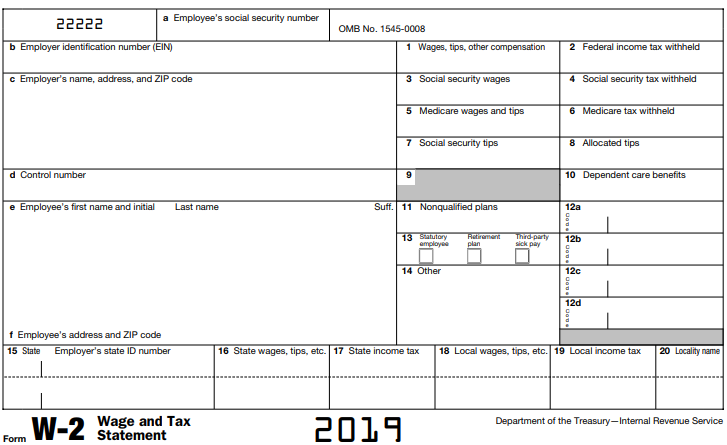

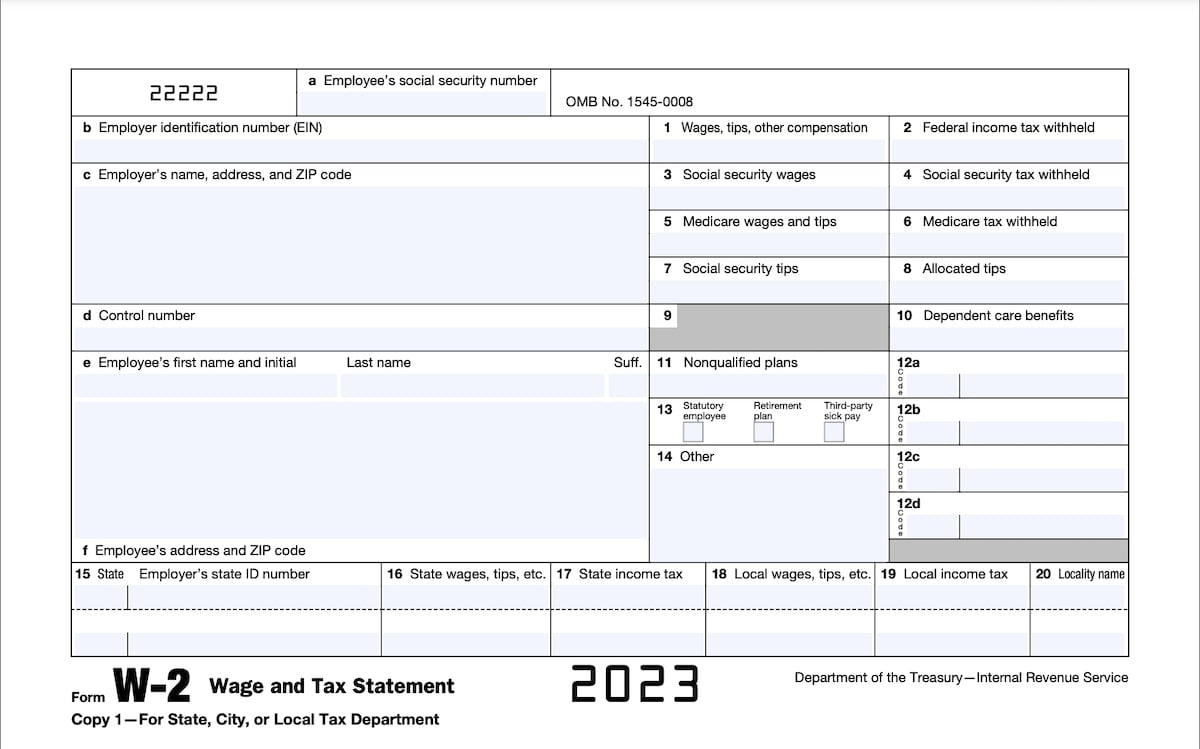

Electronic W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Say Goodbye to Paper: The Rise of Electronic W2s!

Gone are the days of rifling through piles of paper to find that elusive W2 form come tax season. With the rise of electronic W2s, tax documents have entered the digital age, making the process of filing taxes more convenient and efficient than ever before. No more waiting for snail mail delivery or worrying about losing important paperwork – everything you need is now just a click away.

Electronic W2s not only save time and hassle for taxpayers, but they also have a positive impact on the environment. By reducing the need for paper forms, we are taking a step towards a more sustainable future. Plus, with electronic documents, there’s no need to worry about storing and organizing physical copies – everything is neatly filed away in your online account, ready to access whenever you need it.

The transition to electronic W2s is not just a trend – it’s a movement towards a more streamlined and efficient tax system. With the majority of employers now offering electronic W2s to their employees, it’s easier than ever to access and manage your tax documents. Say goodbye to the days of paper clutter and hello to a more organized and eco-friendly way of handling your taxes.

Embracing the Digital Era: A Bright Future for Tax Documents!

As technology continues to advance, the future of tax documents is looking brighter than ever. From mobile apps that allow you to access your W2s on the go to online platforms that simplify the filing process, the digital era has revolutionized the way we handle our taxes. With electronic W2s, you can say goodbye to the stress and confusion that often comes with tax season and hello to a more seamless and efficient experience.

The benefits of electronic W2s extend beyond just convenience – they also offer enhanced security measures to protect your sensitive information. With encryption protocols and secure login processes, you can rest assured that your tax documents are safe from prying eyes. Plus, with the ability to easily track and monitor your financial information online, you can take control of your tax situation like never before.

So, as we look towards the future of tax documents, let’s embrace the digital era and all the possibilities it brings. From reducing paper waste to simplifying the filing process, electronic W2s are paving the way for a more efficient and environmentally friendly tax system. Say goodbye to the old way of doing things and hello to a brighter future for tax documents!

In conclusion, the future of tax documents is undoubtedly electronic. With the rise of electronic W2s, taxpayers can enjoy a more convenient, efficient, and secure way of handling their taxes. Embracing the digital era not only simplifies the filing process but also contributes to a more sustainable future. So let’s say goodbye to paper clutter and welcome the bright future of electronic tax documents with open arms!

Below are some images related to Electronic W2 Forms

can i get an electronic copy of my w2, can i get my w2 electronically, electronic w2 forms, what is electronic w2, , Electronic W2 Forms.

can i get an electronic copy of my w2, can i get my w2 electronically, electronic w2 forms, what is electronic w2, , Electronic W2 Forms.