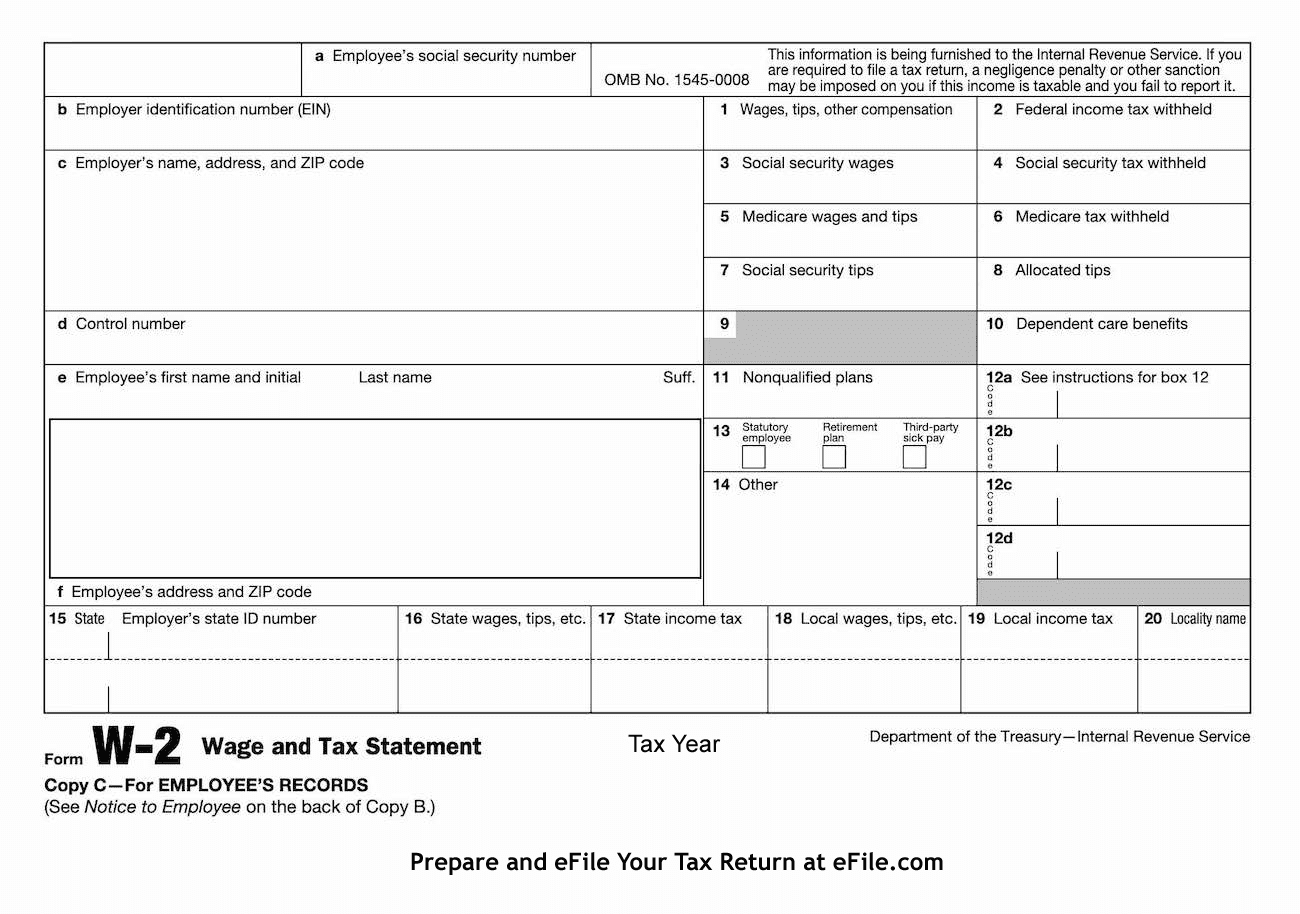

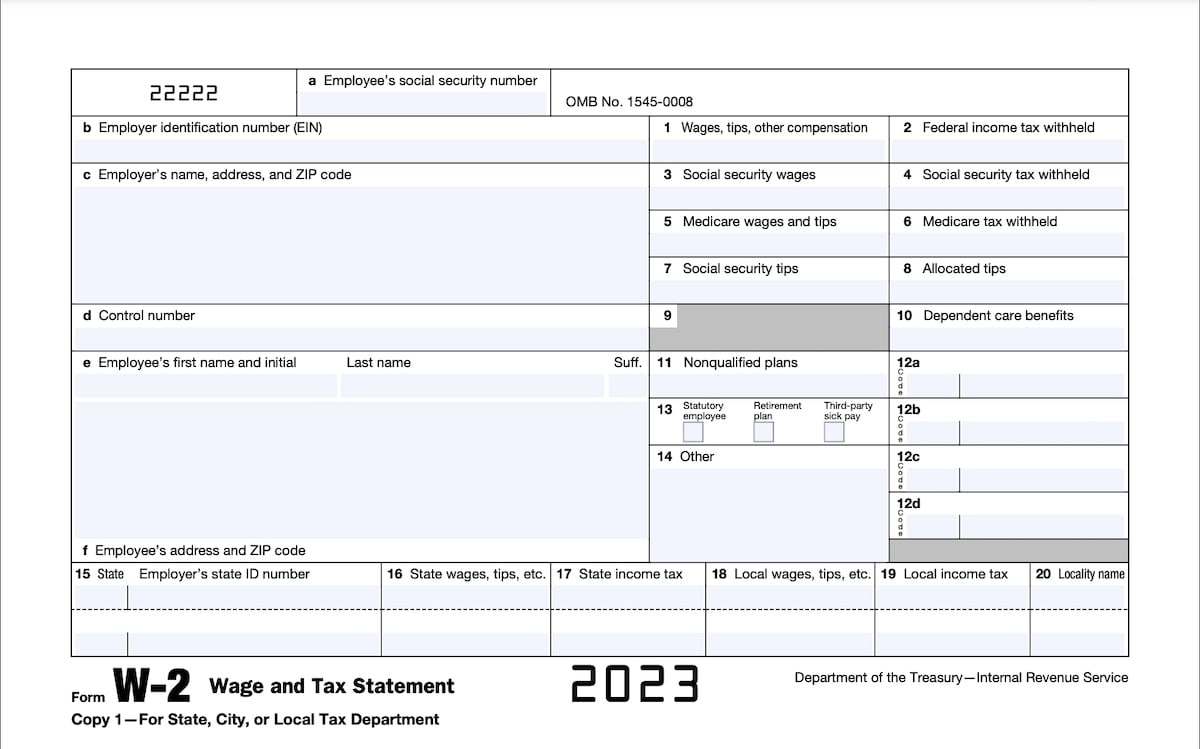

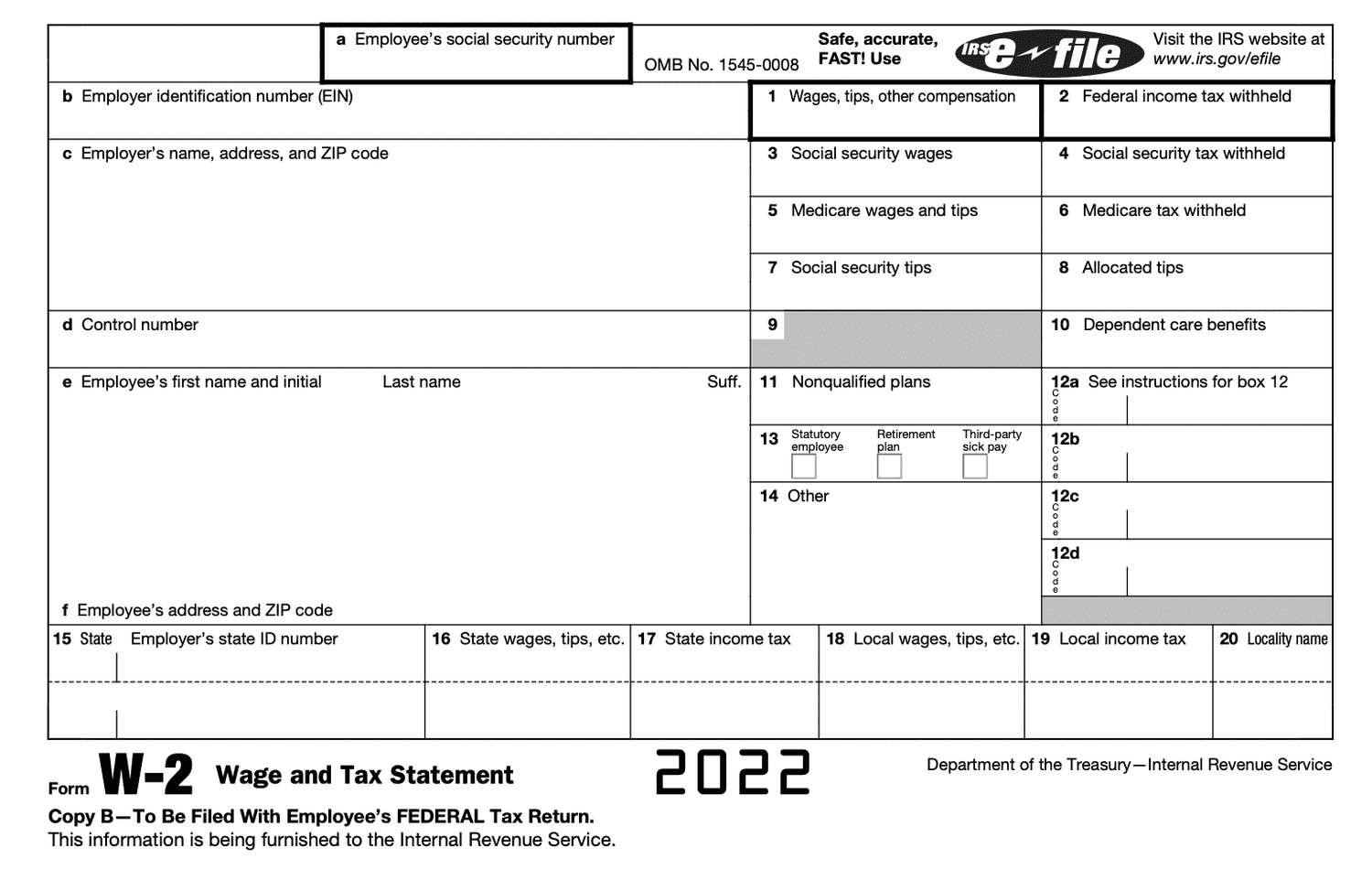

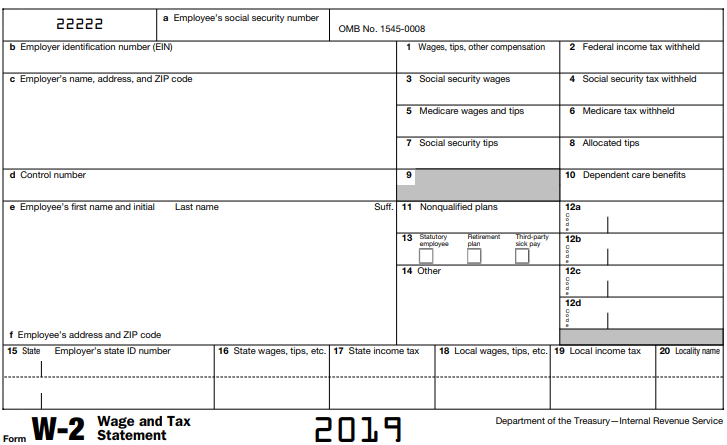

Electronic W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Say Goodbye to Paper!

Are you tired of sifting through piles of paper every tax season just to find your W2 form? Say goodbye to the hassle of paper forms and embrace the electronic W2 form! With the rise of technology, many companies are now offering employees the option to receive their W2 forms electronically. This not only saves time and reduces clutter, but it also helps the environment by reducing paper waste. So why not make the switch to electronic W2 forms and make your life a little bit easier?

Embrace the Electronic W2 Form!

Embracing the electronic W2 form is not only convenient, but it also provides added security for your sensitive financial information. Electronic forms are encrypted and password-protected, making them more secure than traditional paper forms that can easily get lost or stolen. With electronic forms, you can access your W2 anytime, anywhere, without having to worry about misplacing it. So why not take advantage of this modern technology and make the switch to electronic W2 forms today?

Conclusion

In conclusion, saying goodbye to paper and embracing the electronic W2 form is a win-win situation. Not only does it save you time and reduce clutter, but it also provides added security for your financial information. Making the switch to electronic forms is easy and convenient, so why not make the change today? Say goodbye to paper and embrace the electronic W2 form – your taxes will thank you!

Below are some images related to Electronic W2 Form

can i get an electronic copy of my w2, can i get my w2 electronically, digital w2 form, electronic w2 consent form, electronic w2 form, , Electronic W2 Form.

can i get an electronic copy of my w2, can i get my w2 electronically, digital w2 form, electronic w2 consent form, electronic w2 form, , Electronic W2 Form.