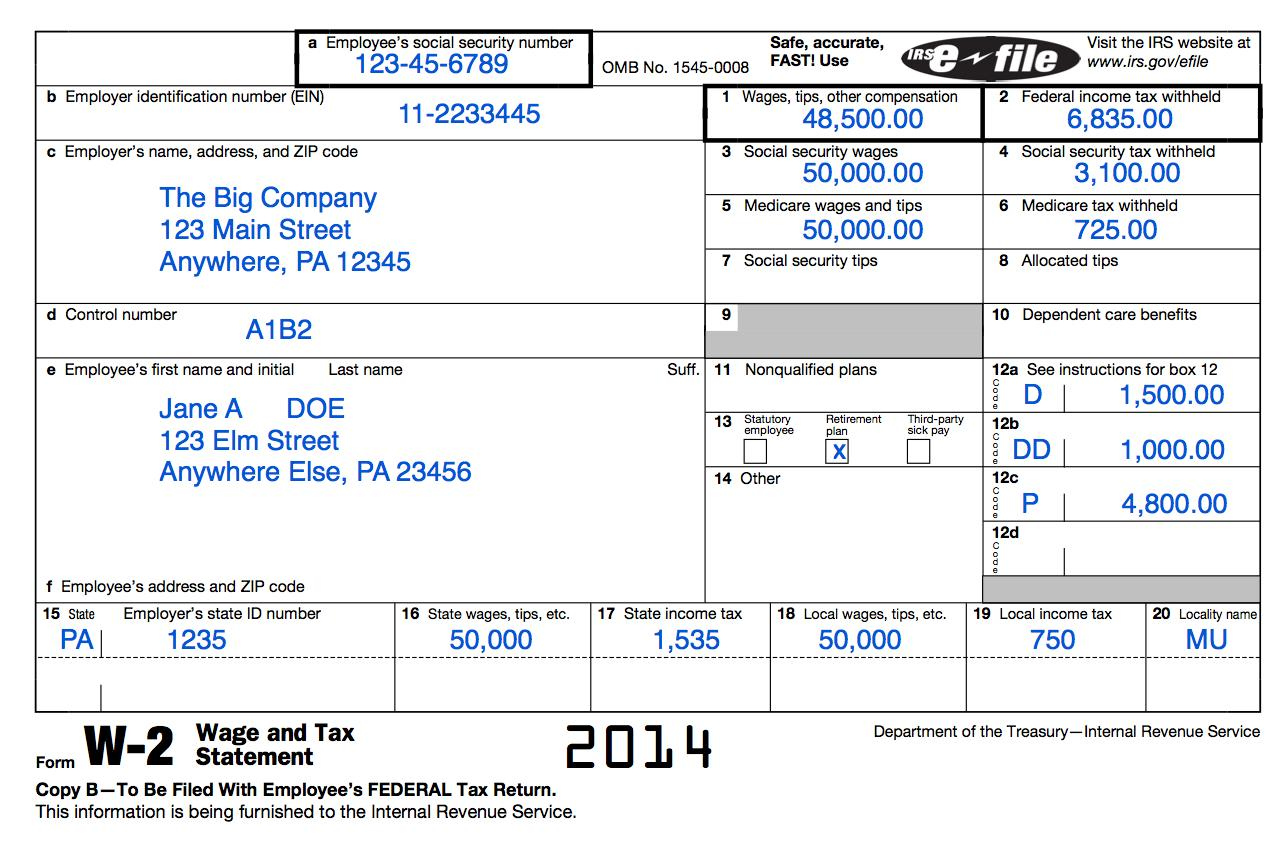

Chipotle W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Discover the Hidden Tastiness of Your Chipotle W2 Form

Ah, tax season – a time most of us dread, filled with confusing forms and endless numbers. But fear not, Chipotle lovers, for your W2 form holds more than just financial information! It’s like unwrapping a burrito to reveal all the delicious ingredients inside. So, grab a metaphorical fork and knife, and let’s savor each flavorful detail on your Chipotle W2 form.

The Earnings Section:

This section is like the juicy steak in your burrito bowl – substantial and satisfying. It details all the money you earned from slinging burritos and bowls at Chipotle throughout the year. Take a moment to appreciate your hard work and dedication reflected in those numbers. Whether you were a line cook, cashier, or manager, each dollar represents a sprinkle of salt in the guacamole of your success.

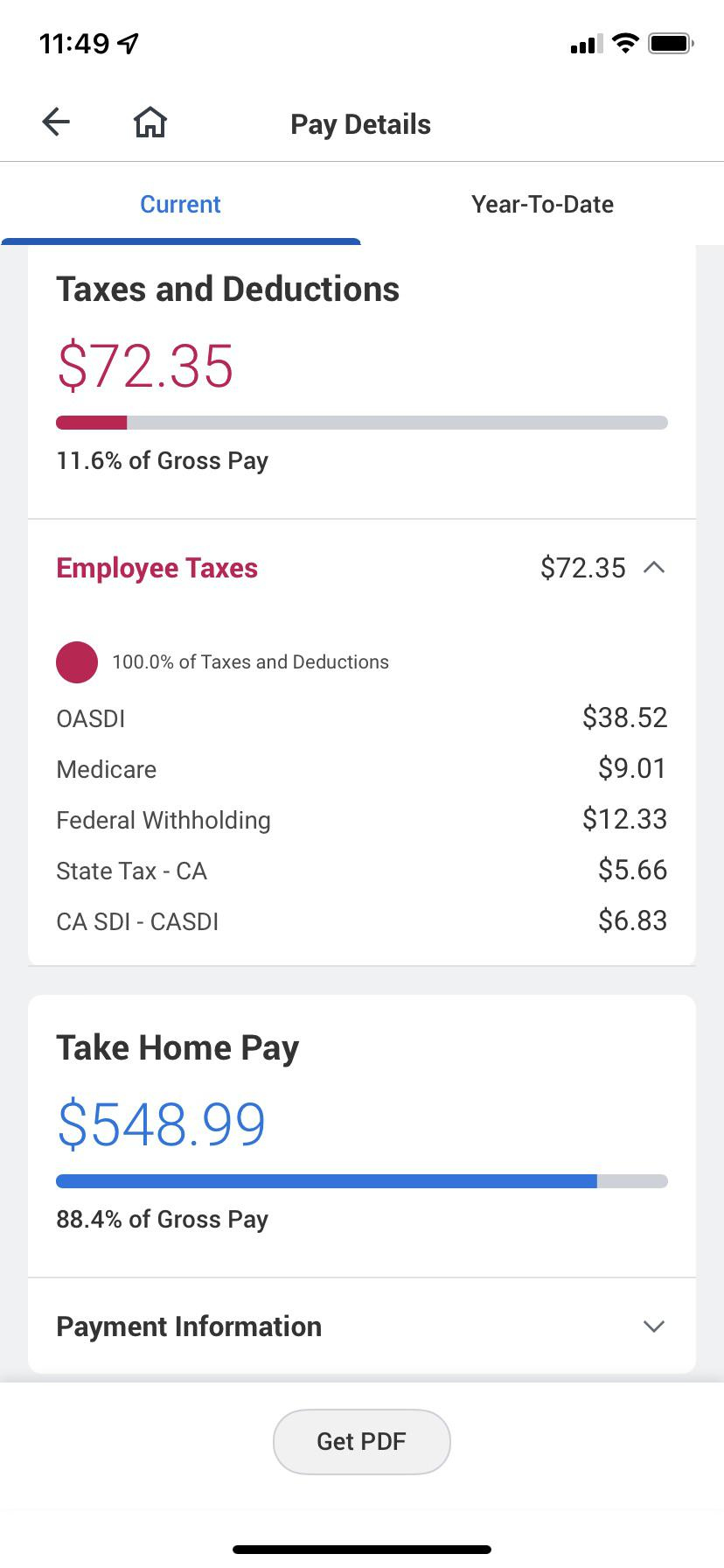

The Deductions Section:

Think of this section as the perfectly roasted veggies in your Chipotle creation – essential and flavorful. Here, you’ll find details on any taxes withheld, retirement contributions, and other deductions. While it may seem like a bitter bite to lose some of your earnings to taxes, remember that it’s all part of the process of being a responsible citizen. Plus, these deductions can help reduce your overall tax liability, leaving more money in your pocket – or should I say, salsa in your burrito?

Savor Each Flavorful Detail on Your Chipotle W2 Form

The Benefits Section:

Just like the creamy queso on top of your bowl, the benefits section of your W2 form adds an extra layer of richness to your Chipotle experience. Here, you’ll find information on any health insurance, retirement savings, or other perks provided by Chipotle. These benefits not only contribute to your overall well-being but also show that Chipotle values its employees and their long-term success. So, savor each detail and appreciate the company’s commitment to your growth and stability.

The Year-to-Date Totals:

This section is like the final bite of your burrito – bittersweet yet satisfying. It summarizes all your earnings, deductions, and benefits for the year, giving you a clear picture of your financial journey at Chipotle. Take a moment to reflect on your accomplishments, challenges, and growth throughout the year. Whether you’re planning for your next career move or simply enjoying the fruits of your labor, the year-to-date totals on your W2 form serve as a reminder of all the hard work and dedication you put into your job.

The Bottom Line:

As you unwrap the delicious details of your Chipotle W2 form, remember that it’s more than just a piece of paper – it’s a reflection of your dedication, hard work, and success. So, savor each flavorful detail, from the earnings section to the benefits section, and appreciate all the ingredients that make up your Chipotle experience. And as you file your taxes and move forward into the next year, carry with you the lessons learned and the achievements earned, knowing that you’re one step closer to achieving your goals. Happy tax season, Chipotle enthusiasts!

Below are some images related to Chipotle W2 Form

chipotle w2 form, does chipotle mail w2, how do i get copies of my w2 forms, how to get chipotle w2 online, how to get w2 from chipotle, , Chipotle W2 Form.

chipotle w2 form, does chipotle mail w2, how do i get copies of my w2 forms, how to get chipotle w2 online, how to get w2 from chipotle, , Chipotle W2 Form.