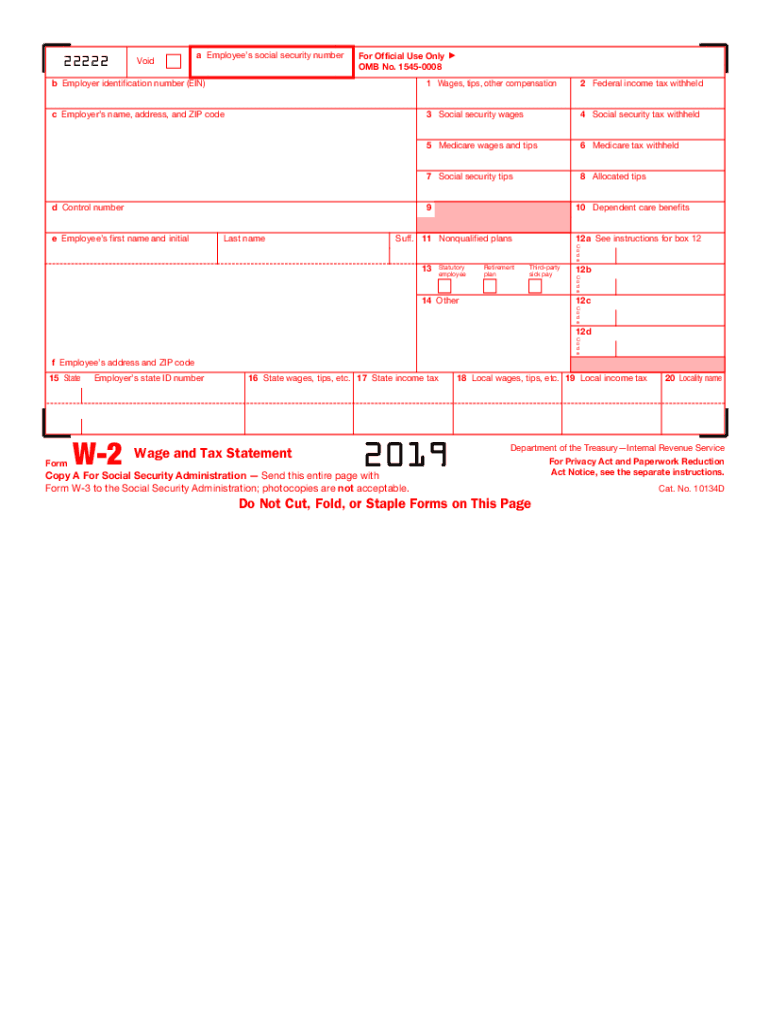

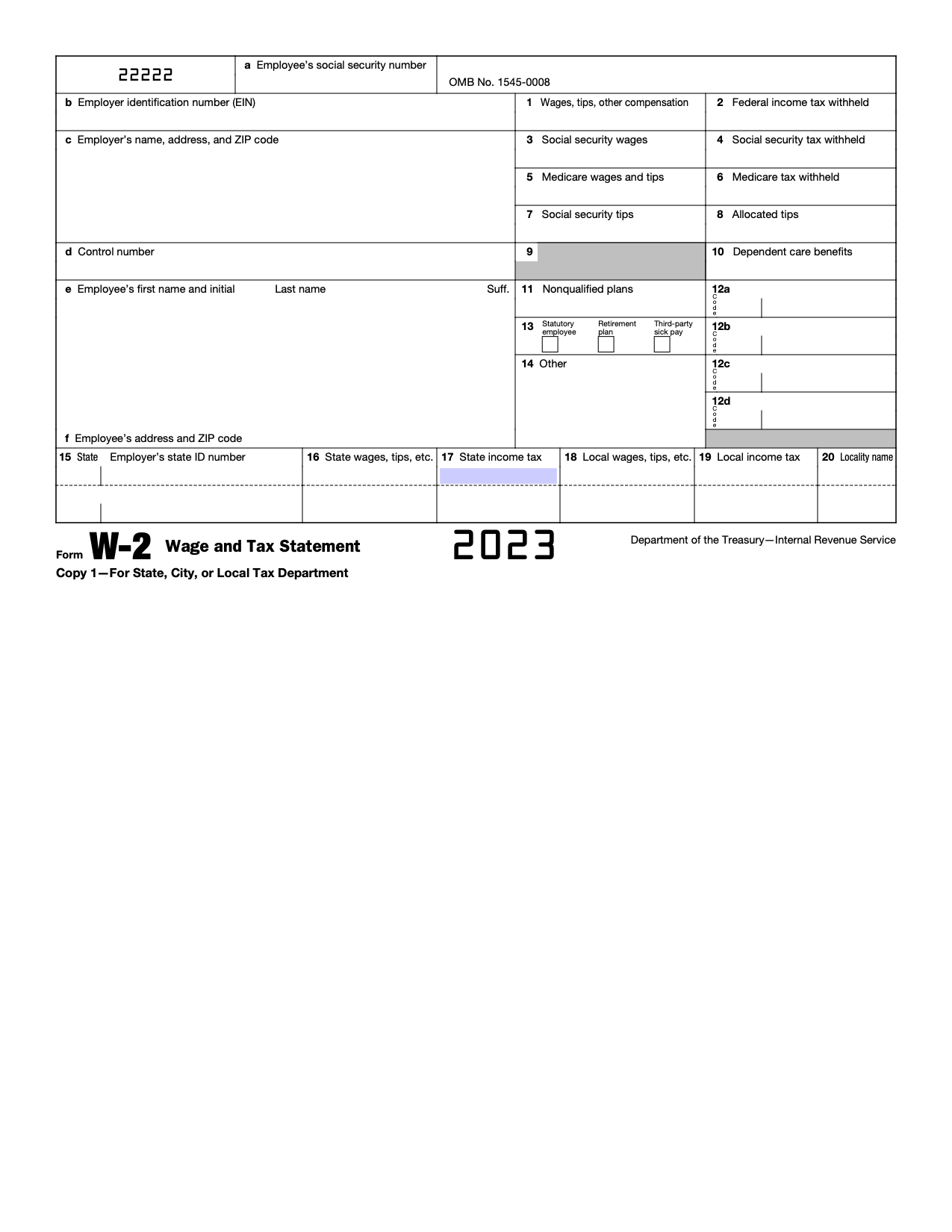

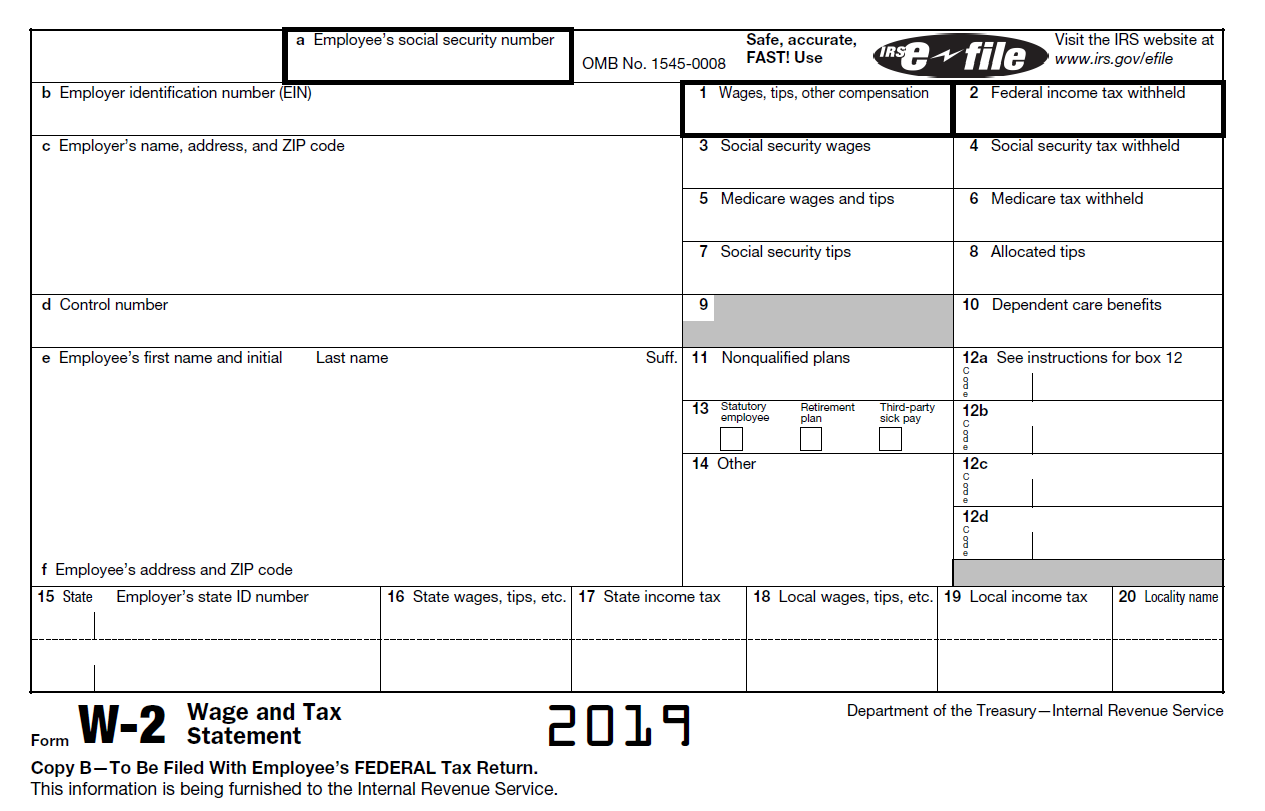

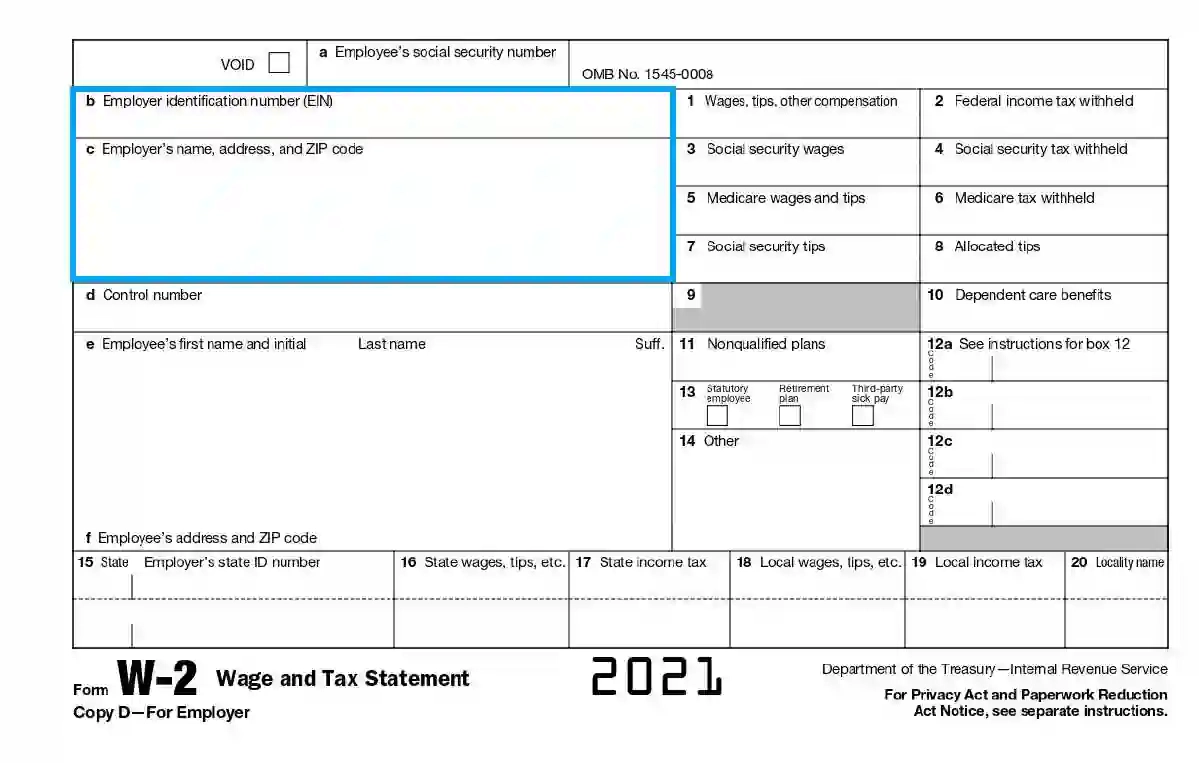

Blank W2 Forms – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Exciting News: Blank W2 Forms Are Here!

Hey there, tax enthusiasts! The moment you’ve all been waiting for has arrived – blank W2 forms are now available for you to grab and fill out. It’s like a blank canvas just waiting for you to unleash your creativity… well, maybe not creativity, but definitely your attention to detail! Whether you’re a seasoned tax pro or a first-timer, there’s something exciting about seeing those fresh, clean forms waiting to be filled in with all your important financial information.

But wait, before you start panicking about all the numbers and calculations, take a deep breath and remember that you’ve got this! With a positive attitude and a little bit of time and effort, you’ll have those W2 forms filled out in no time. So go ahead, grab a cup of coffee, put on your favorite playlist, and get ready to tackle those blank spaces with confidence.

Time to Get Organized: Fill in Those Blanks!

Now that you’ve got your blank W2 forms in hand, it’s time to get organized and start filling in those blanks. Make sure you have all your necessary documents and information handy, such as your social security number, income statements, and any deductions or credits you may be eligible for. Take it step by step, starting with your personal information and moving on to your income and tax withholdings.

Don’t forget to double-check your work and ensure that all the information you’ve entered is accurate and up to date. Remember, even the smallest mistake can cause delays or issues with your tax return, so it’s important to take your time and pay attention to detail. And if you’re feeling overwhelmed, don’t hesitate to reach out to a tax professional for assistance – they’re here to help you navigate the process and ensure everything is done correctly.

In Conclusion

So there you have it, tax warriors – blank W2 forms are here, and it’s time to roll up your sleeves and get to work filling in those blanks. Remember, while tax season may seem daunting, with a positive attitude and a little bit of organization, you can conquer those forms like a pro. So put on your best tax-filing hat, grab your favorite pen, and get ready to tackle those W2 forms with confidence and ease. Happy filing!

Below are some images related to Blank W2 Forms

blank w2 form 2021, blank w2 forms, blank w2 forms 2023, blank w2 forms 2024, blank w2 forms for quickbooks, , Blank W2 Forms.

blank w2 form 2021, blank w2 forms, blank w2 forms 2023, blank w2 forms 2024, blank w2 forms for quickbooks, , Blank W2 Forms.