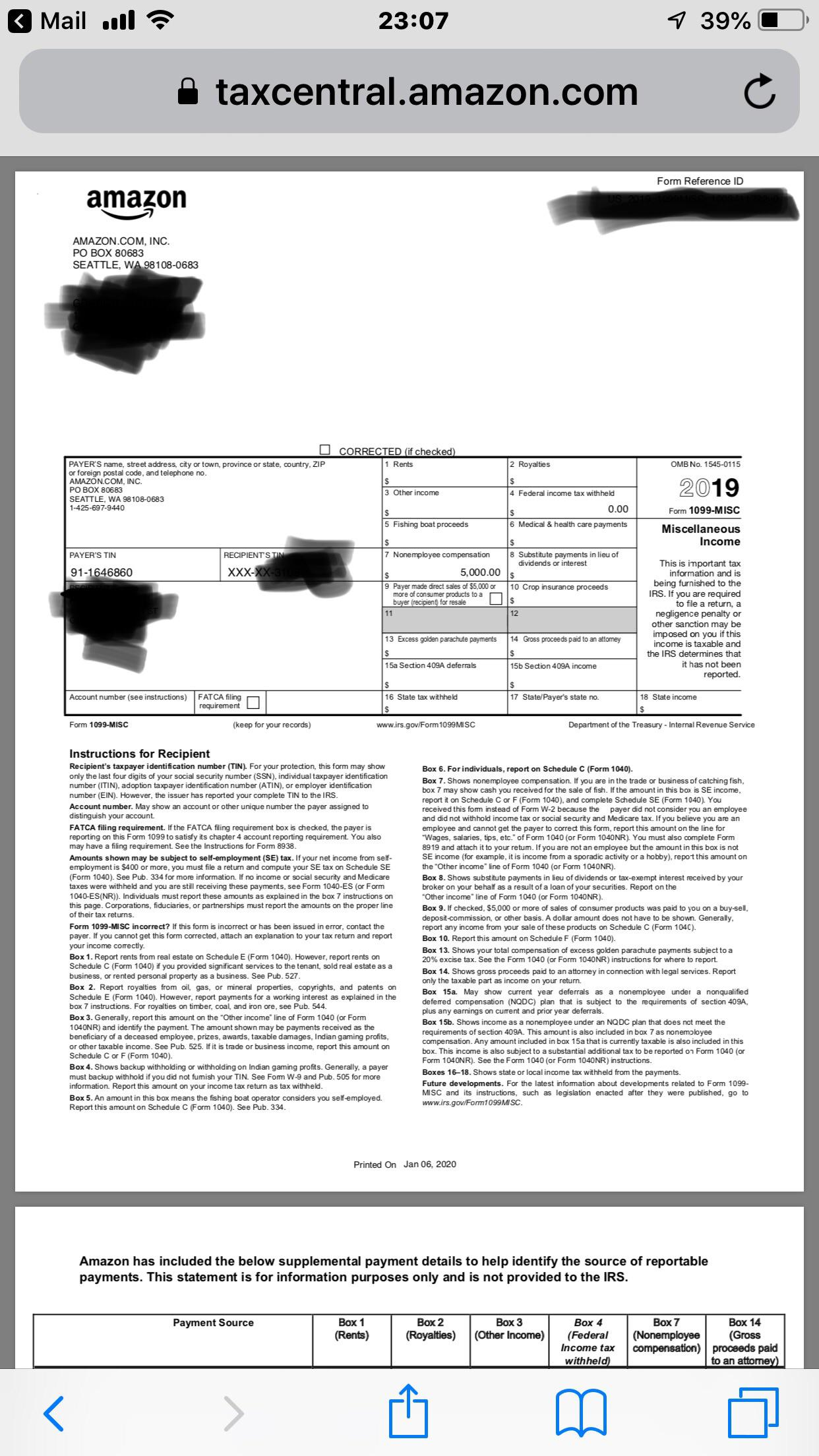

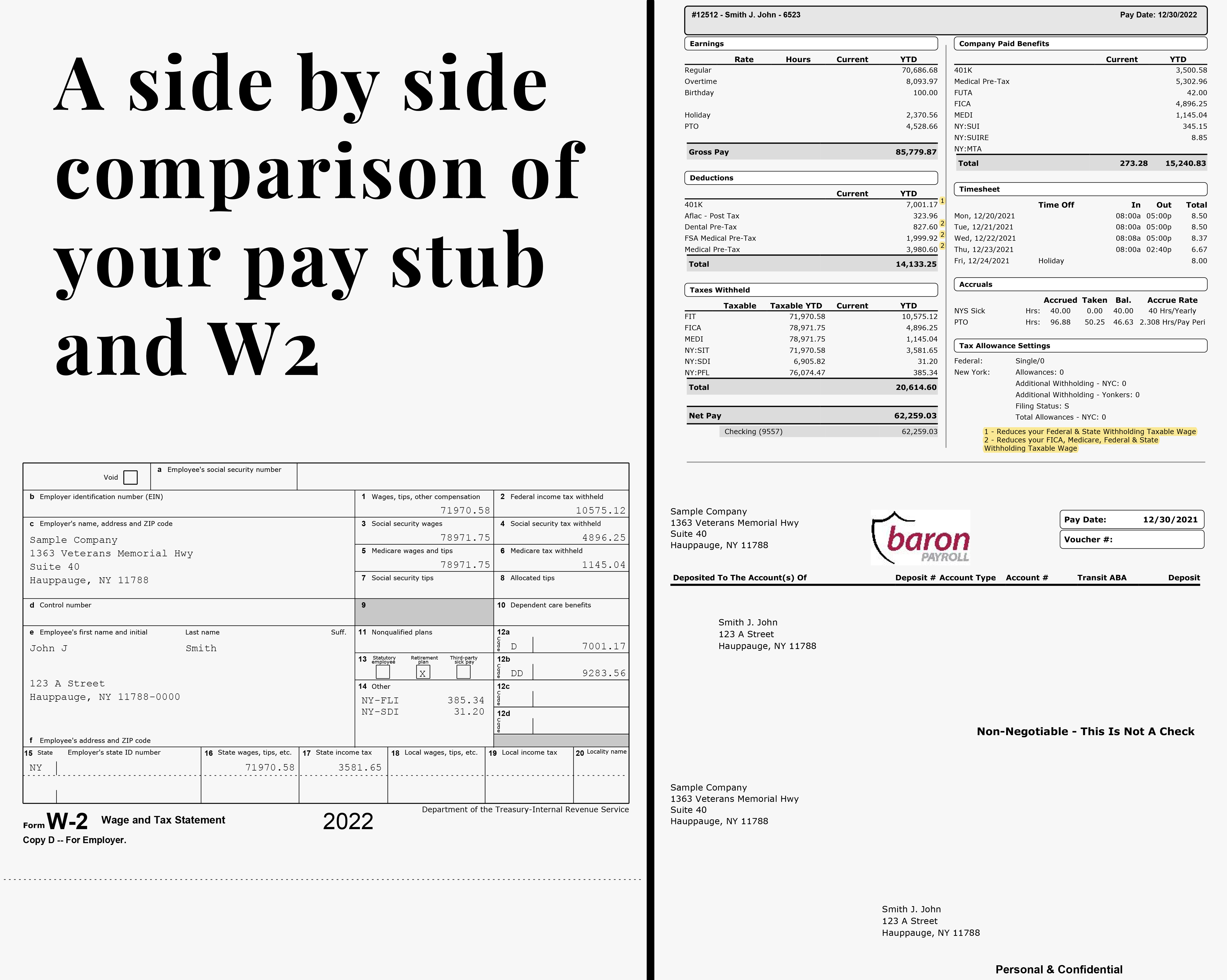

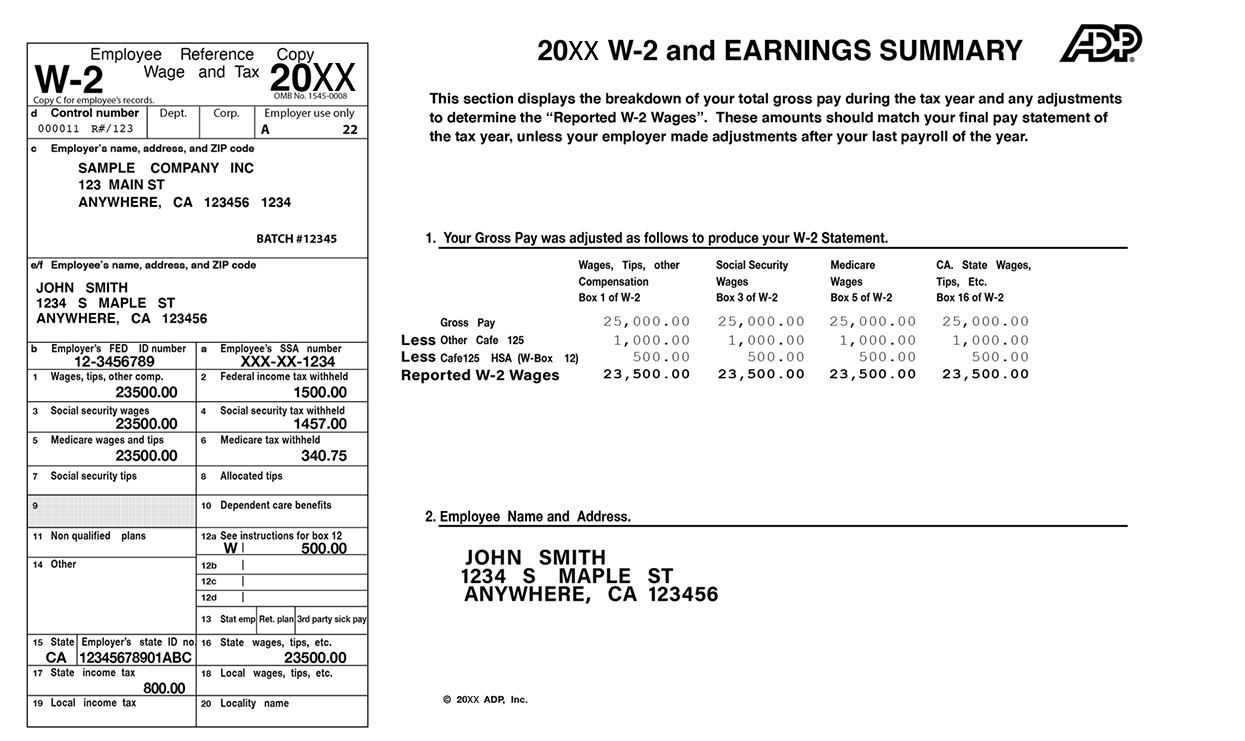

Amazon W2 Form After Quitting – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Moving On: Your Guide to Amazon W2s After Leaving

Leaving a job at Amazon can be a bittersweet experience. While it’s exciting to move on to new opportunities, there may be some confusion about what to do with your W2s after departure. Don’t worry, we’ve got you covered! In this guide, we’ll show you how to unleash your freedom and start fresh when it comes to managing your Amazon W2s.

Unleash Your Freedom: Post-Amazon W2 Liberation

Once you’ve left Amazon, it’s time to take control of your financial future and unleash your freedom. The first step is to ensure that you receive your W2 form from Amazon. This important document details your earnings and tax withholdings from your time at the company. You should receive your W2 by mail or electronically by January 31st of the following year. If you haven’t received it by then, be sure to reach out to Amazon’s HR department to request a copy.

Next, it’s time to review your W2 for accuracy. Check that your personal information, earnings, and tax withholdings are all correct. If you notice any discrepancies, you may need to reach out to Amazon’s HR department to request corrections. Once you’ve confirmed that everything is in order, it’s time to file your taxes. Whether you choose to do it yourself or hire a professional, having your W2 handy will make the process much smoother.

Start Fresh: Navigating Amazon W2s After Departure

Now that you’ve received, reviewed, and filed your Amazon W2, it’s time to start fresh and move forward with confidence. Consider updating your financial information with your new employer if you’ve already started a new job. Keep your W2 in a safe place, as you may need it for future reference or if you’re ever audited by the IRS. And most importantly, celebrate this new chapter in your life! Leaving Amazon is a big step, but it’s also an opportunity for growth and new beginnings. Embrace the change and look forward to all the exciting possibilities that lie ahead.

Below are some images related to Amazon W2 Form After Quitting

amazon w2 form after quitting, how do i get my w2 after i quit, how do i get my w2 from a job i quit, how to get w2 from amazon after quitting, how to get your w2 after you quit, , Amazon W2 Form After Quitting.

amazon w2 form after quitting, how do i get my w2 after i quit, how do i get my w2 from a job i quit, how to get w2 from amazon after quitting, how to get your w2 after you quit, , Amazon W2 Form After Quitting.