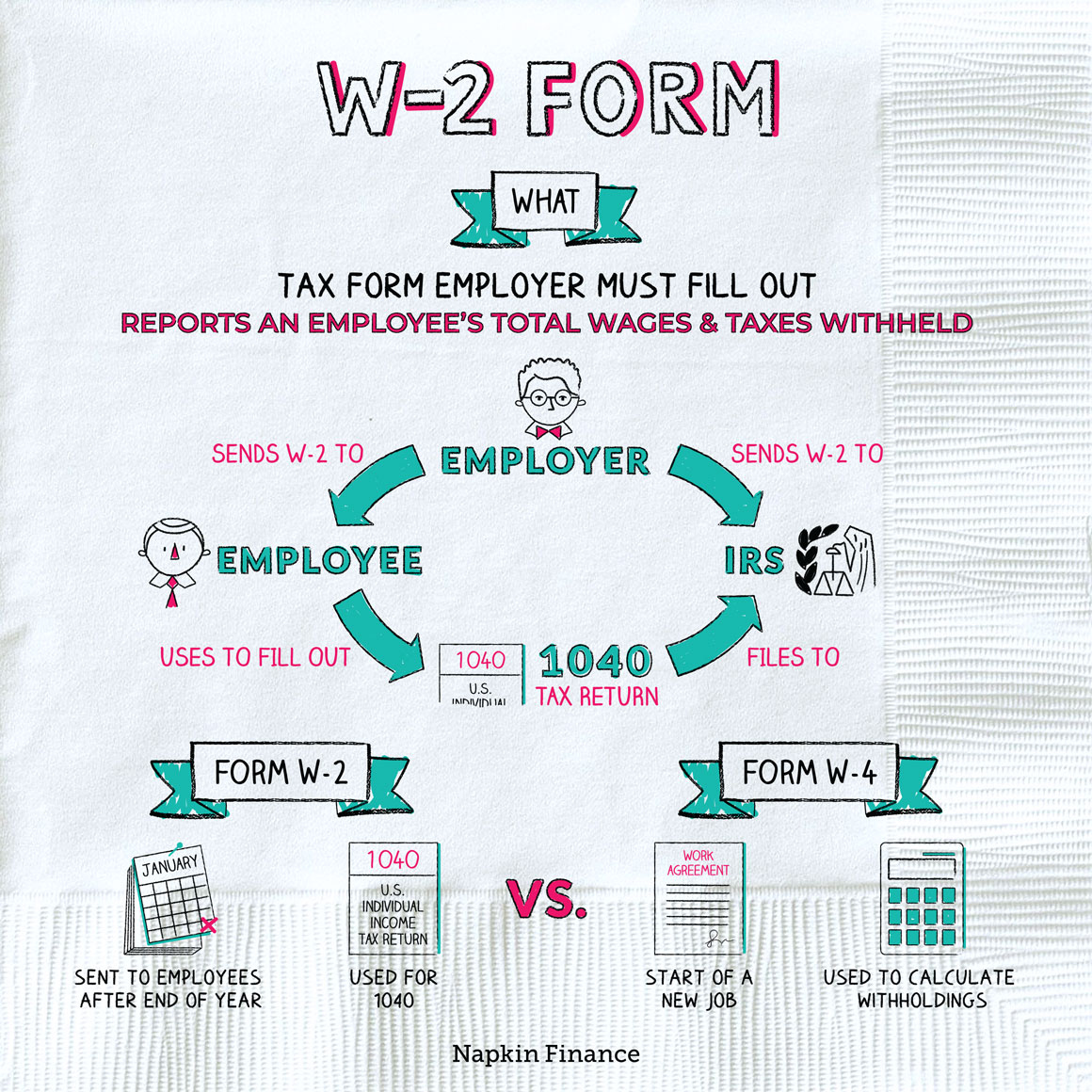

1040 Form W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

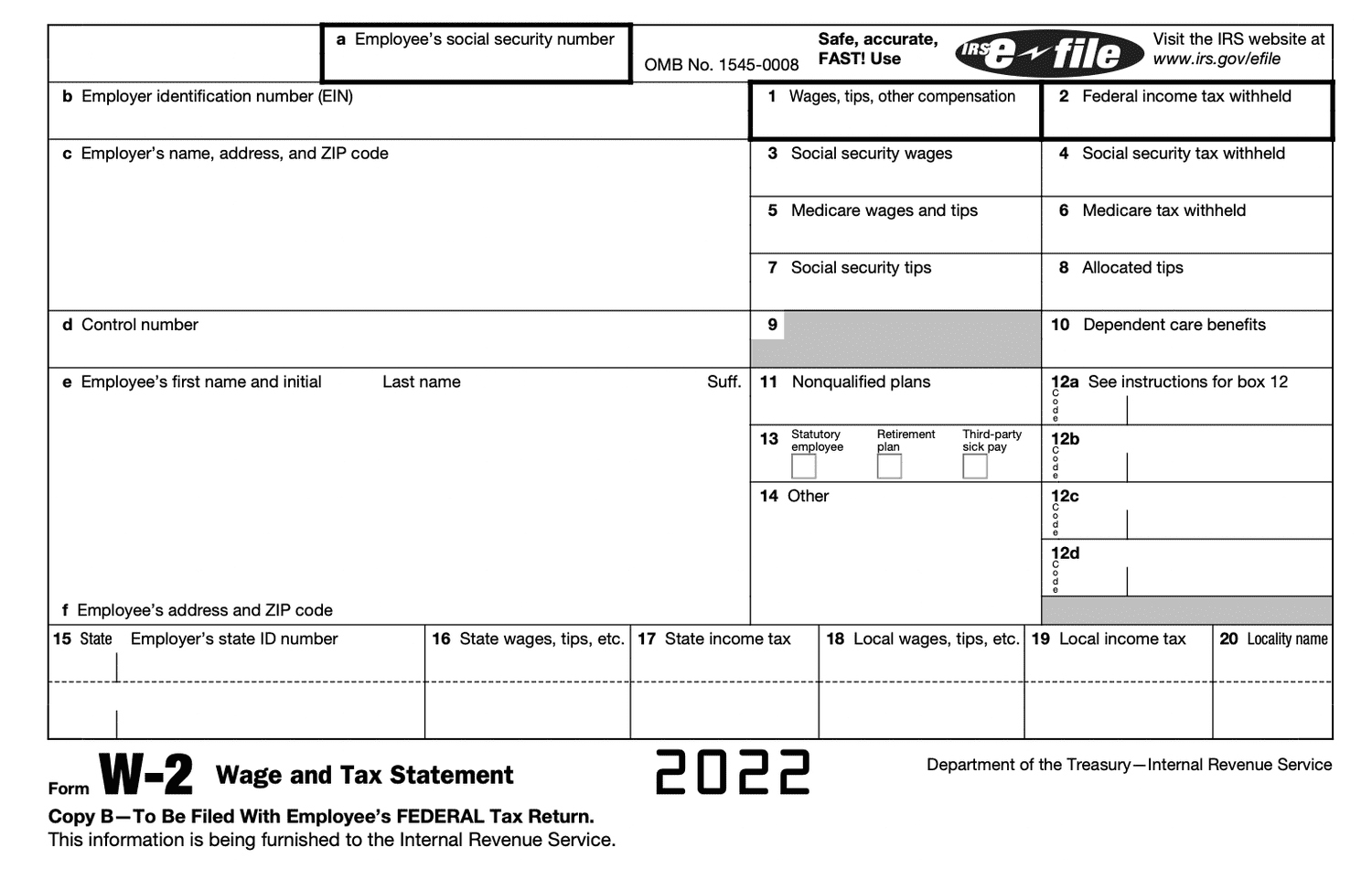

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Celebrate Tax Season with the 1040 Form W2!

Oh, tax season is here again, and while some may dread it, there’s no reason not to embrace the joy of filing taxes with the trusty 1040 Form W2 in hand! This little piece of paper holds the key to unlocking potential refunds or even just the satisfaction of being a responsible citizen. So, why not turn tax time into a celebration? Break out the confetti and party hats, because filling out your 1040 Form W2 can be an exciting experience!

As you gather your paperwork and start filling out your 1040 Form W2, think of it as a puzzle waiting to be solved. Each box you fill in brings you one step closer to completing the picture of your financial year. And let’s not forget the potential for a tax refund at the end of it all! With a little bit of organization and a positive attitude, tax time can be a fun and rewarding experience. So, put on your favorite music, grab a cup of coffee, and get ready to tackle that 1040 Form W2 with enthusiasm!

Completing your 1040 Form W2 not only allows you to fulfill your civic duty but also gives you a chance to reflect on your financial habits and goals. It’s a time to take stock of your income, deductions, and credits, and see where you stand financially. Plus, by properly filing your taxes, you can avoid any potential audits or penalties down the line. So, instead of viewing tax season as a chore, see it as an opportunity to gain a better understanding of your finances and take control of your financial future.

Embrace the Joy of Filing Taxes with W2s on Hand!

With your W2s in hand, it’s time to dive into the world of tax deductions and credits! As you start filling out your 1040 Form W2, take a moment to appreciate the wealth of information it provides. Your W2 not only shows how much you earned but also how much you contributed to retirement accounts, health savings accounts, and more. This information can lead to valuable tax deductions and credits that could lower your tax bill or increase your refund.

Filing your taxes with your W2s on hand is like putting together a financial jigsaw puzzle. Each piece of information fits together to create a complete picture of your financial year. And when you finally submit your taxes and hit that send button, there’s a sense of accomplishment and relief that comes with knowing you’ve completed another tax season. So, embrace the joy of tax time with your W2s in hand, and revel in the satisfaction of being on top of your finances.

As you gather your W2s and dive into the world of tax preparation, remember that you’re not alone in this journey. There are countless resources available to help you navigate the complex world of tax filing, from tax software to professional tax preparers. So, don’t be afraid to reach out for help if you need it. And most importantly, remember that tax time doesn’t have to be a dreaded chore – it can be a time to celebrate your financial responsibility and take control of your financial future.

Conclusion

Tax time doesn’t have to be a dreaded chore – it can be a time to celebrate your financial responsibility and take control of your financial future. So, grab your 1040 Form W2, put on some music, and get ready to tackle tax season with enthusiasm! With a positive attitude and a little bit of organization, you can turn tax time into a fun and rewarding experience. Embrace the joy of filing taxes with W2s on hand, and revel in the satisfaction of being on top of your finances.

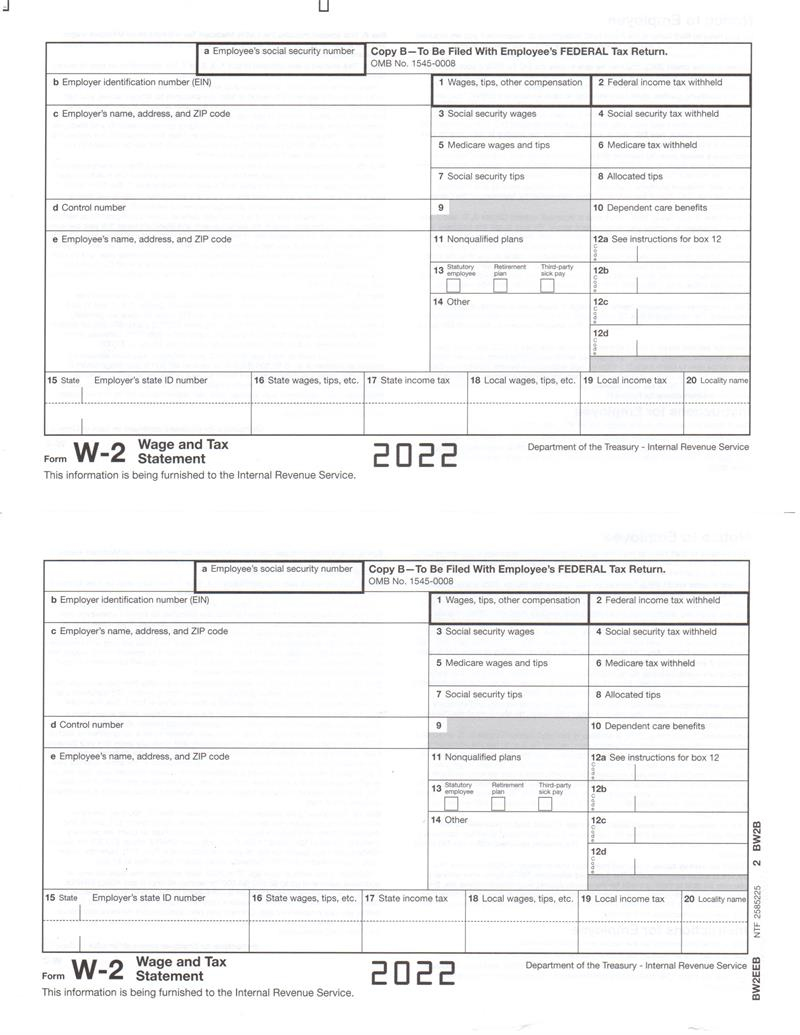

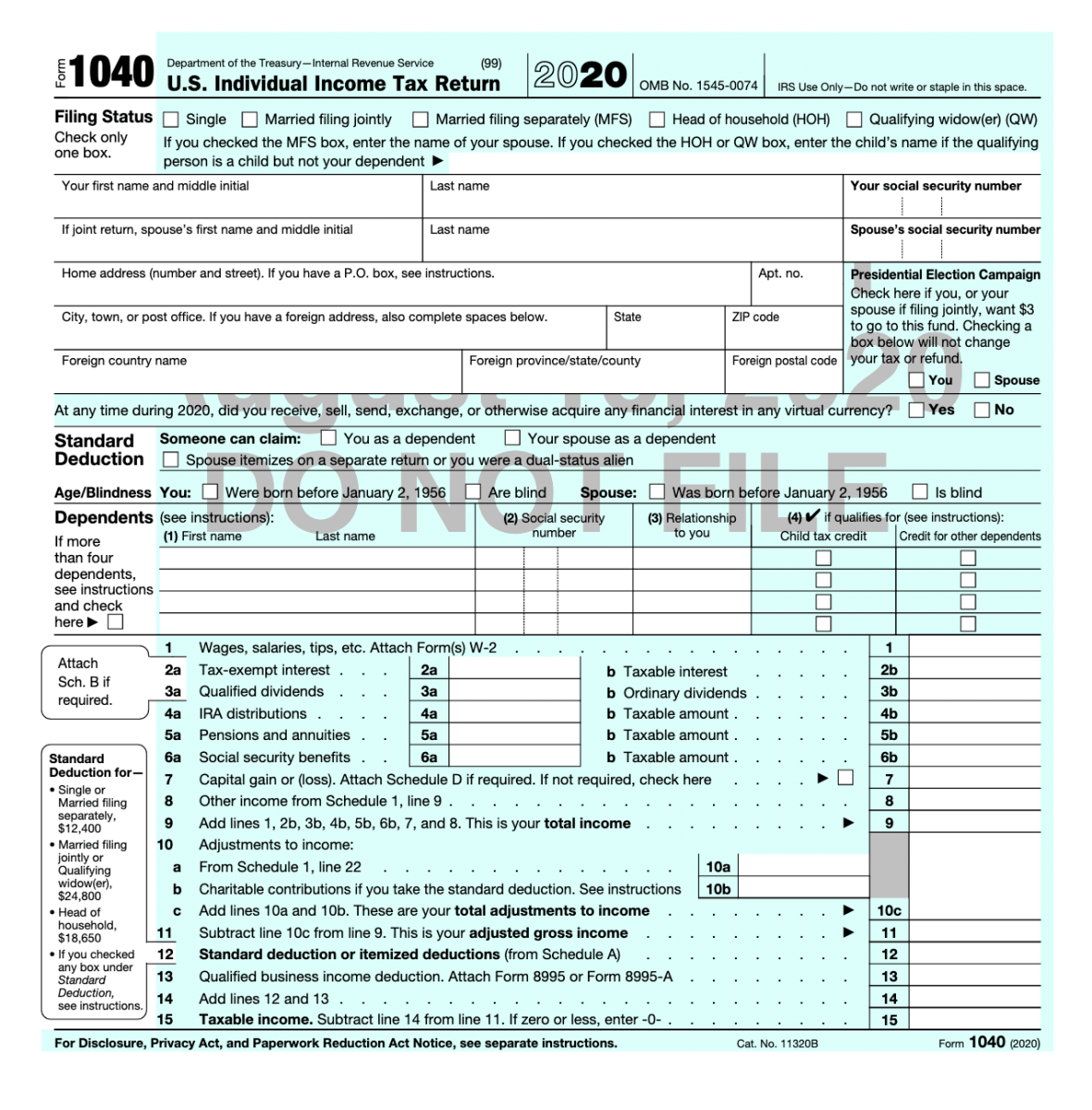

Below are some images related to 1040 Form W2

1040 form and w2 the same, 1040 form attach w2, 1040 form different than w2, 1040 form vs w2, 1040 form w2, , 1040 Form W2.

1040 form and w2 the same, 1040 form attach w2, 1040 form different than w2, 1040 form vs w2, 1040 form w2, , 1040 Form W2.