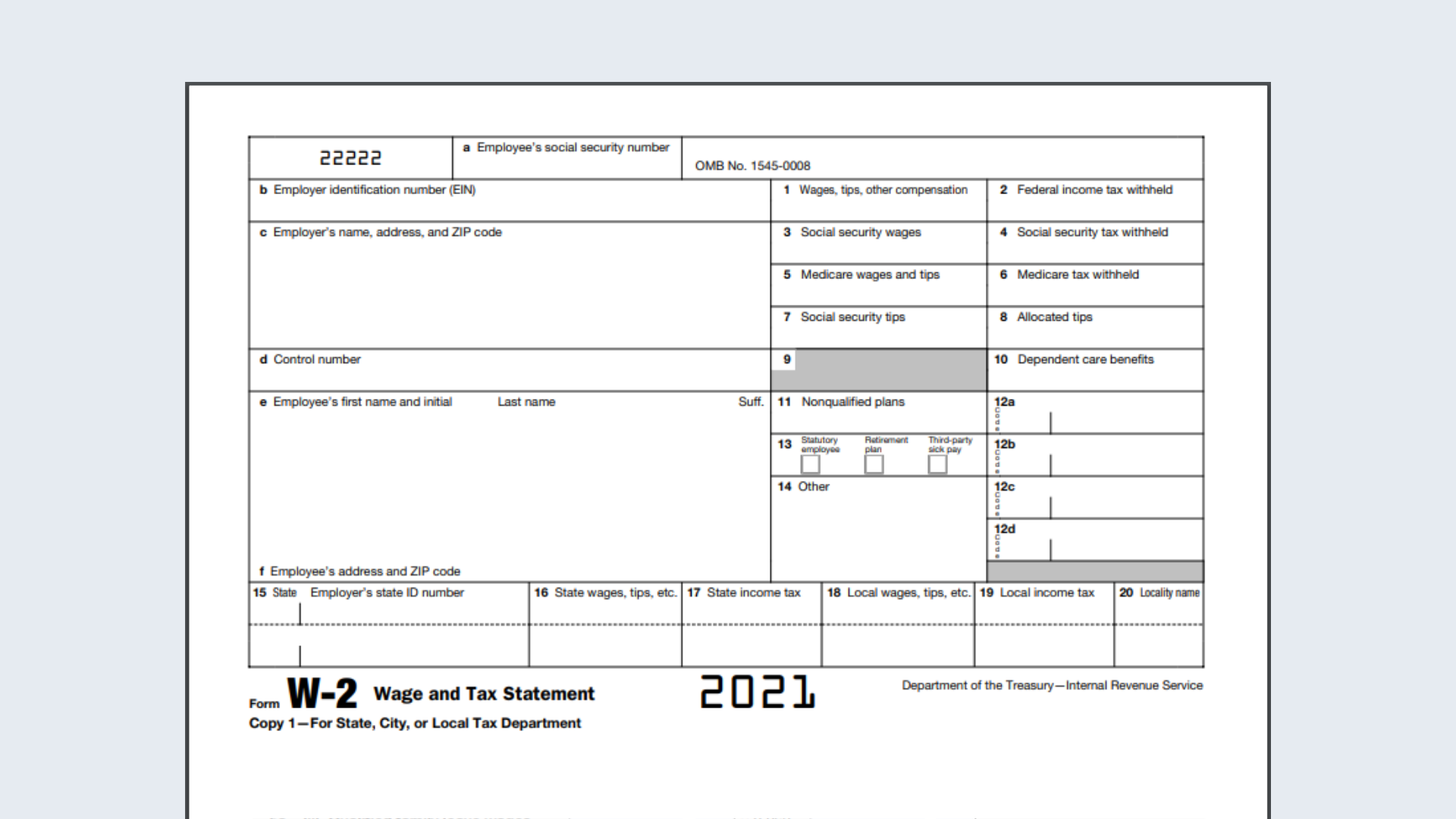

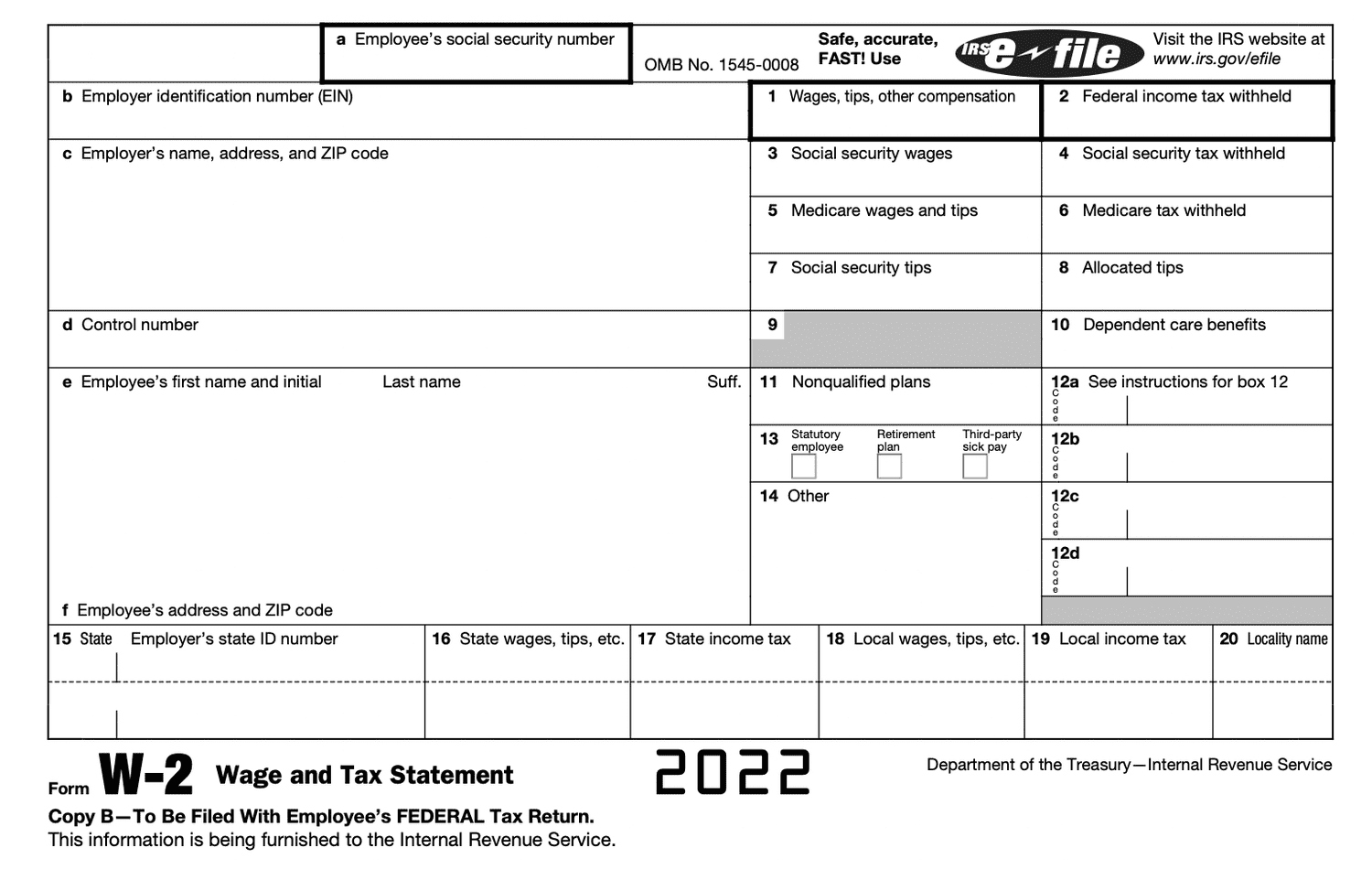

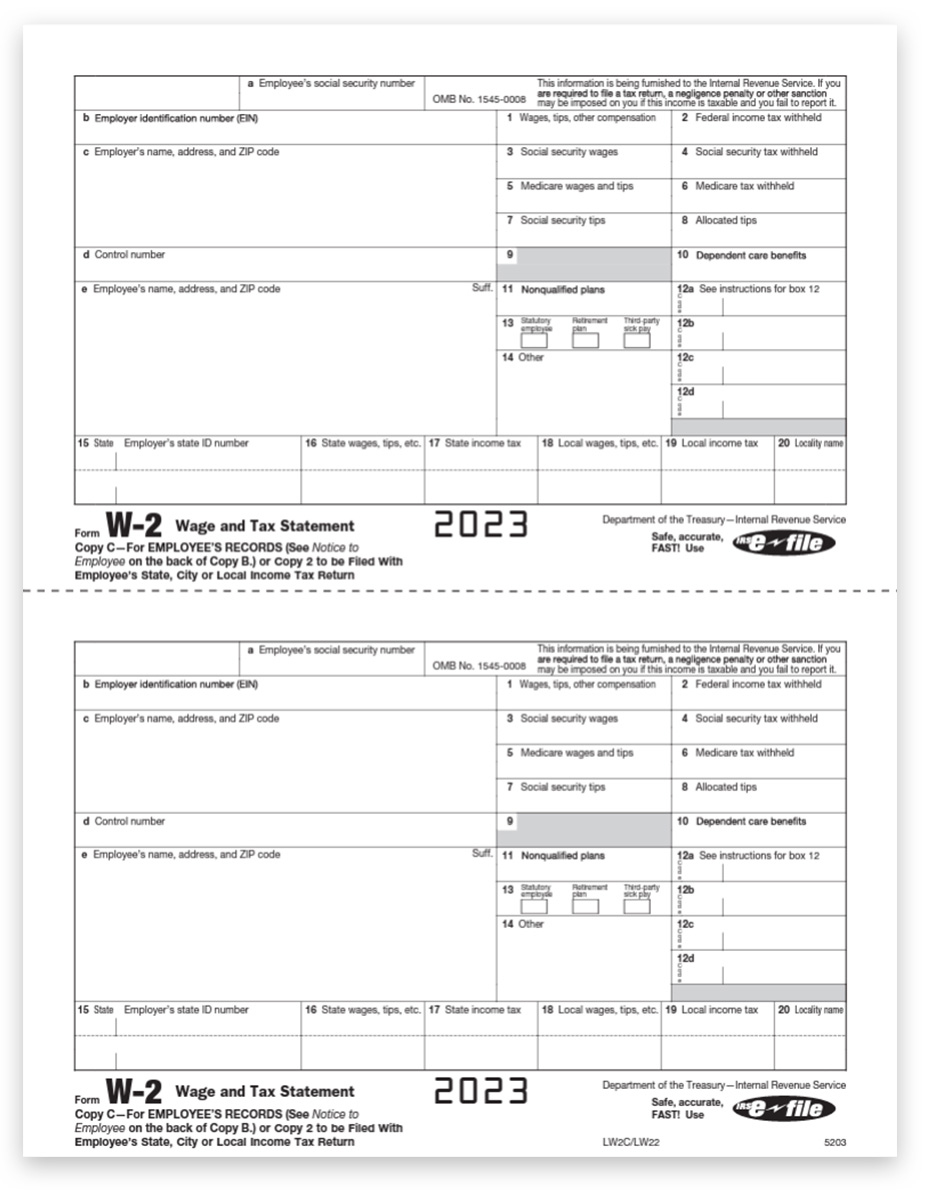

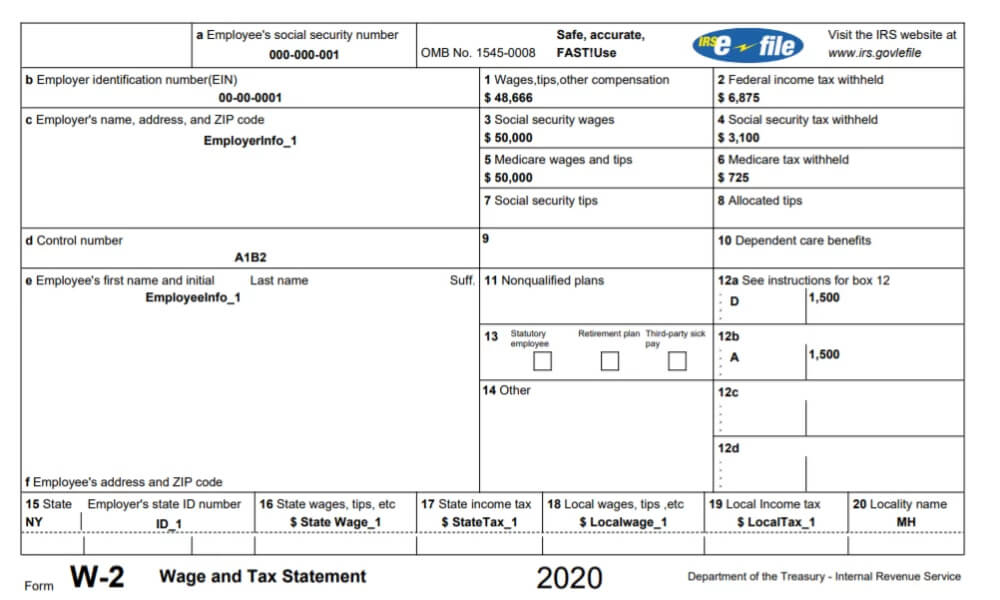

W2 New Employee Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Ahoy, New Team Member!

Welcome aboard to our fantastic team! We are thrilled to have you join us on this exciting journey. As you embark on your new role, one important aspect to get acquainted with is the W2 new employee form. Don’t worry, we’ve got you covered with all the information you need to navigate this form smoothly.

Setting Sail with the W2 Form

The W2 form is a crucial document that you will need to fill out as a new employee. This form provides important information to both you and the government for tax purposes. It includes details such as your personal information, filing status, and withholding allowances. Make sure to fill out the form accurately to avoid any issues later on.

When filling out the W2 form, be sure to double-check all the information you provide. Accuracy is key to ensuring that your taxes are processed correctly. If you have any questions or need clarification on any part of the form, don’t hesitate to reach out to our HR team. We are here to assist you every step of the way and ensure that you have a smooth sailing experience with your W2 form.

Once you have completed and submitted your W2 form, you can sit back, relax, and focus on settling into your new role. Your W2 form will play a crucial role in ensuring that your taxes are processed accurately and that you receive the appropriate tax refunds. So, welcome aboard once again, and enjoy your journey with us as a valued member of our team!

Below are some images related to W2 New Employee Form

new employee w2 form 2022, new employee w2 form 2023, w2 new employee form, w2 new hire form, where do i get w2 forms for my employees, , W2 New Employee Form.

new employee w2 form 2022, new employee w2 form 2023, w2 new employee form, w2 new hire form, where do i get w2 forms for my employees, , W2 New Employee Form.