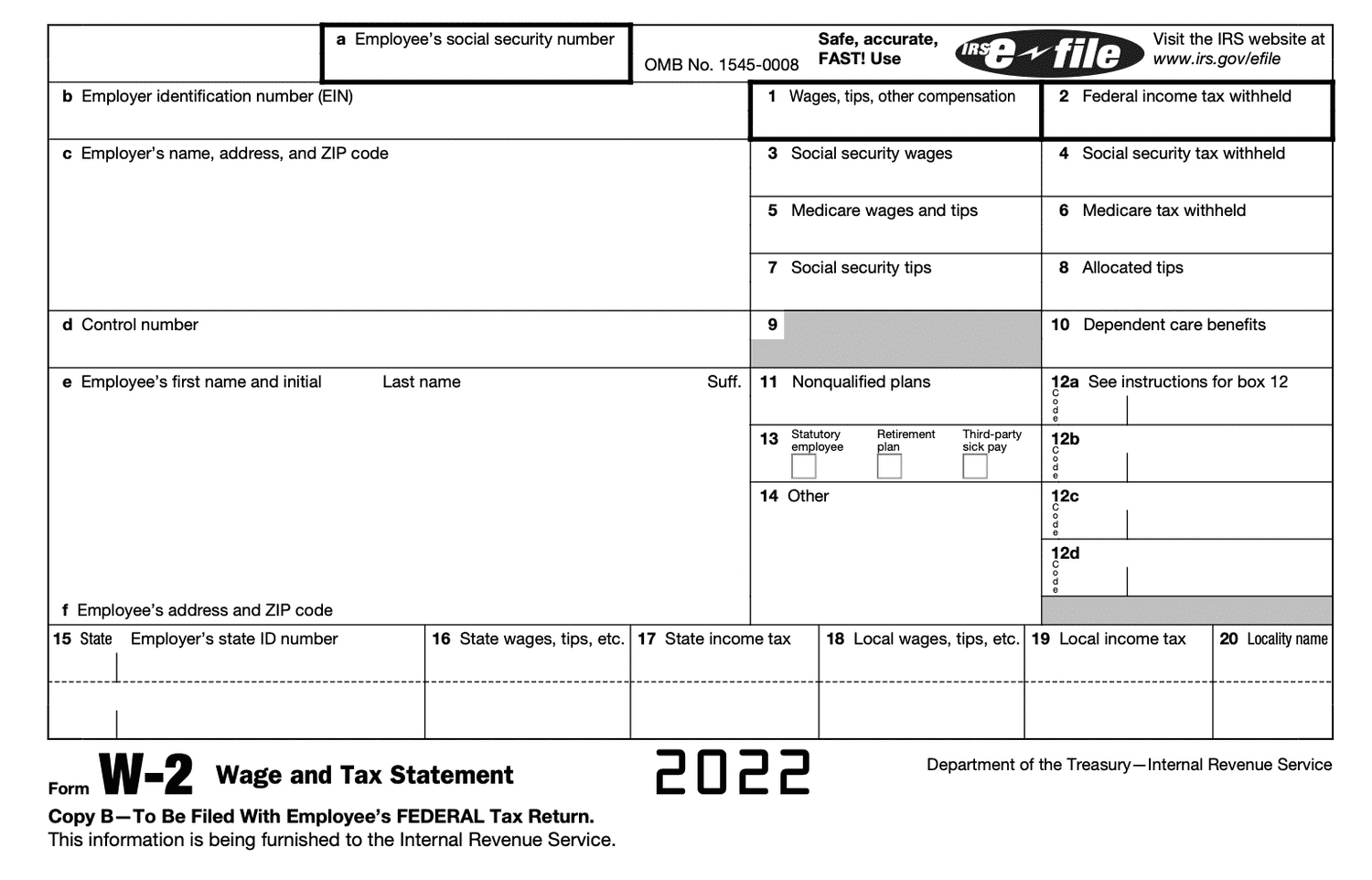

W2 Form Tax Return – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Maximizing Your Refund: Unleash the Power of Your W2 Form!

Are you ready to turbocharge your tax return and unlock hidden savings? Look no further than your trusty W2 form! This seemingly ordinary piece of paper holds the key to maximizing your refund and keeping more money in your pocket. With a few simple hacks and tricks, you can harness the power of your W2 form and take control of your financial future.

Turbocharge Your Tax Return with These W2 Hacks!

Did you know that your W2 form is more than just a summary of your earnings for the year? It’s a roadmap to potential tax savings! One of the easiest ways to maximize your refund is to ensure that all of your information is correct on your W2 form. Double-check your name, social security number, and income amounts to avoid any costly errors. Additionally, be on the lookout for any deductions or credits that you may have missed, such as student loan interest or retirement contributions. By taking the time to review your W2 form thoroughly, you can ensure that you’re not leaving any money on the table.

Another way to supercharge your tax return is to take advantage of any pre-tax benefits offered by your employer. Things like health savings accounts, flexible spending accounts, and retirement contributions can all help lower your taxable income and increase your refund. Make sure to review your W2 form for any pre-tax deductions that you may have overlooked, as they can make a significant difference in the amount of money you get back at tax time.

Unlock Hidden Savings: Master Your W2 Form Today!

Ready to unlock even more savings? Consider adjusting your tax withholding on your W2 form to better align with your financial goals. By withholding the right amount of taxes throughout the year, you can prevent overpaying and receiving a large refund or underpaying and owing money come tax time. Use the IRS withholding calculator to determine the optimal withholding for your situation, and update your W2 form accordingly. This simple step can help you keep more of your hard-earned money throughout the year, rather than waiting for a refund in the spring.

Lastly, don’t forget to explore any additional tax credits or deductions that you may be eligible for based on your income level, family size, or other factors. By understanding the tax code and how it applies to your unique situation, you can maximize your refund and minimize your tax liability. Whether it’s the Earned Income Tax Credit, the Child Tax Credit, or education-related deductions, there are plenty of opportunities to save money if you know where to look. Take the time to educate yourself on potential tax breaks and credits, and make sure to include them on your W2 form to reap the benefits at tax time.

Conclusion

Your W2 form is a powerful tool that can help you maximize your refund and keep more money in your pocket. By following these simple hacks and tips, you can unlock hidden savings and take control of your financial future. Don’t let tax season stress you out – unleash the power of your W2 form and watch your refund soar!

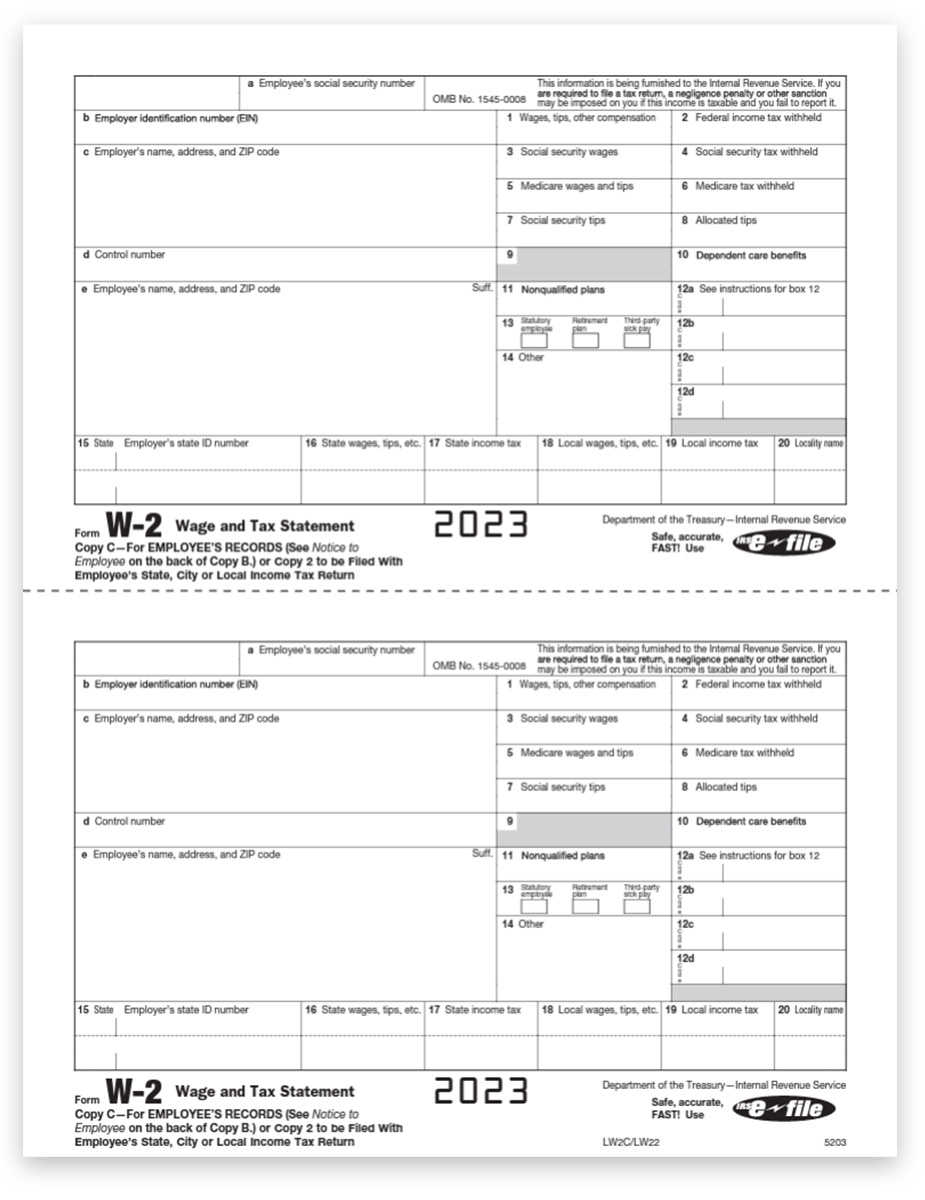

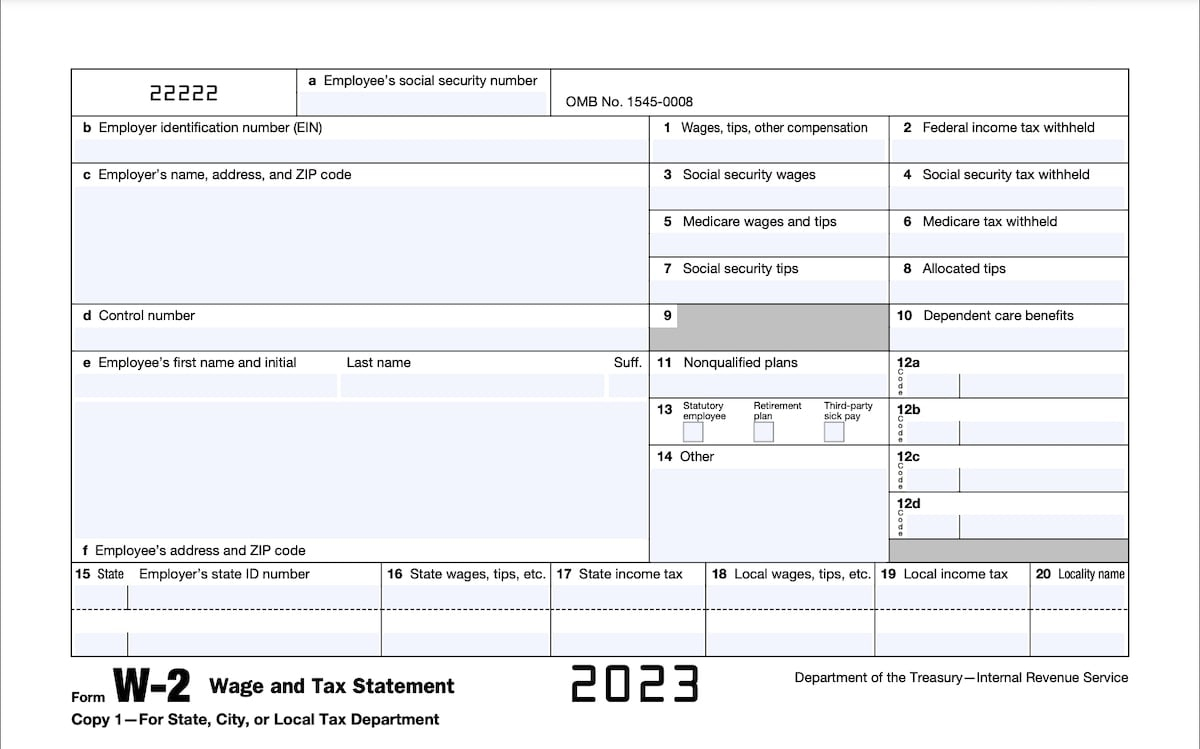

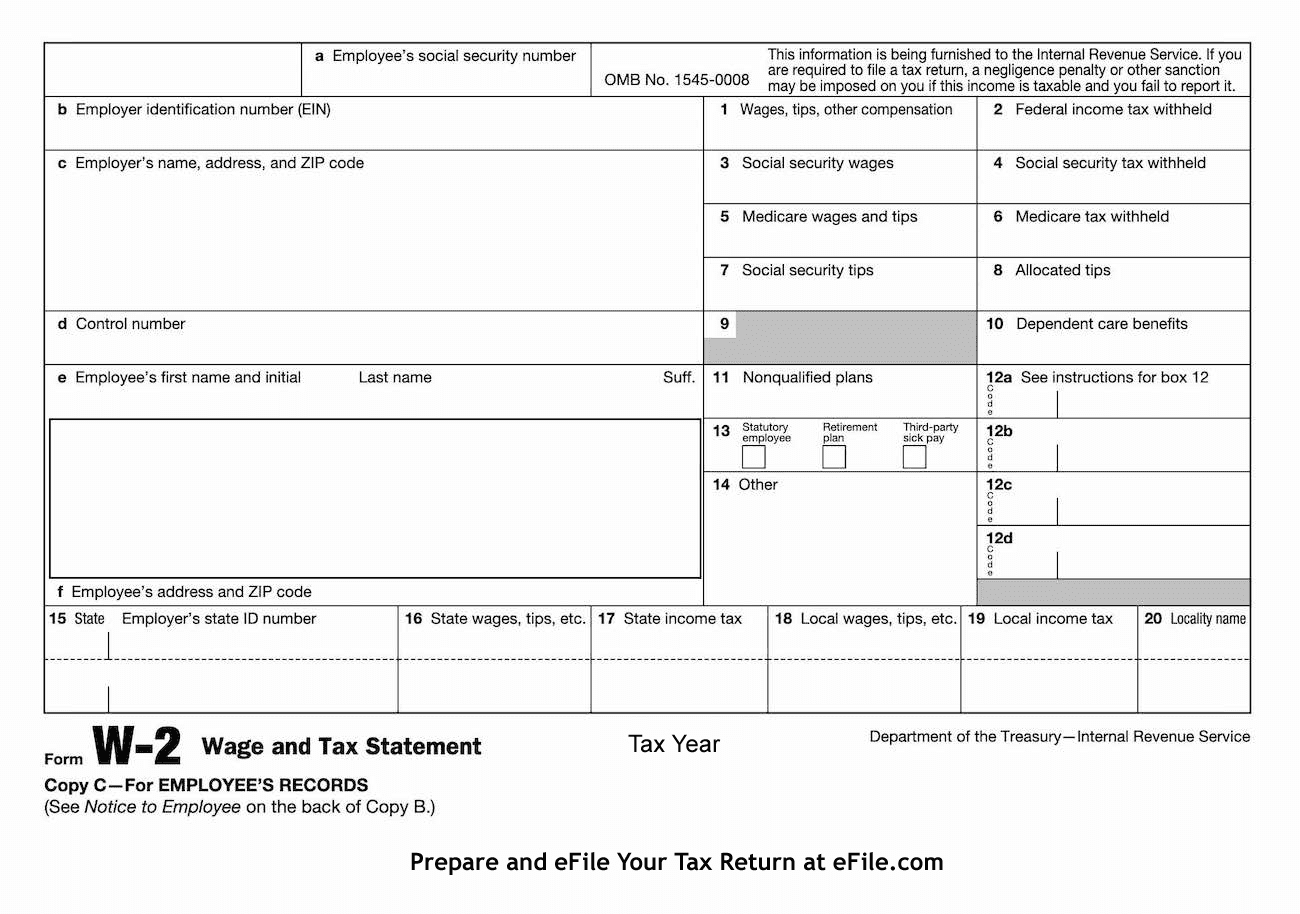

Below are some images related to W2 Form Tax Return

how to attach w-2 form to tax return, is w2 your tax return, w-2 form tax refund, w2 and tax return- form 1040, w2 form tax refund amount, , W2 Form Tax Return.

how to attach w-2 form to tax return, is w2 your tax return, w-2 form tax refund, w2 and tax return- form 1040, w2 form tax refund amount, , W2 Form Tax Return.