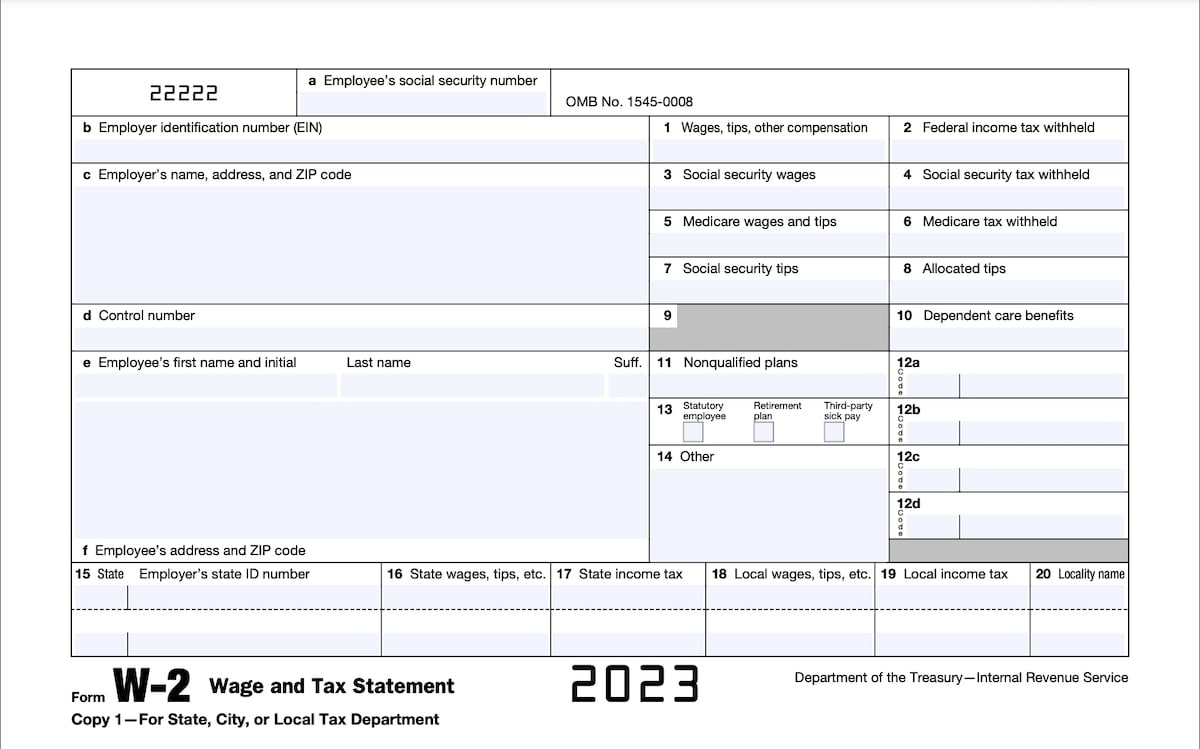

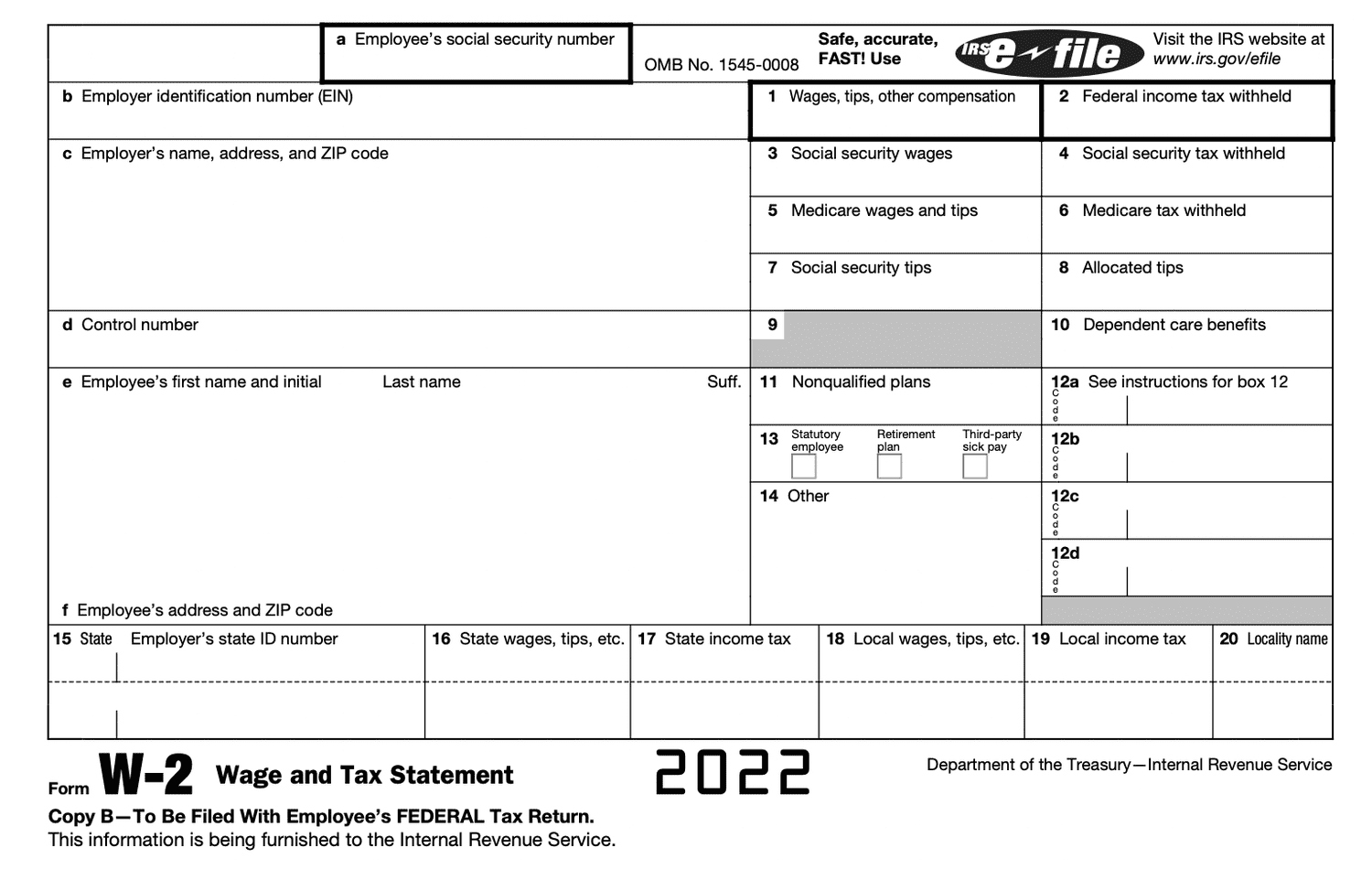

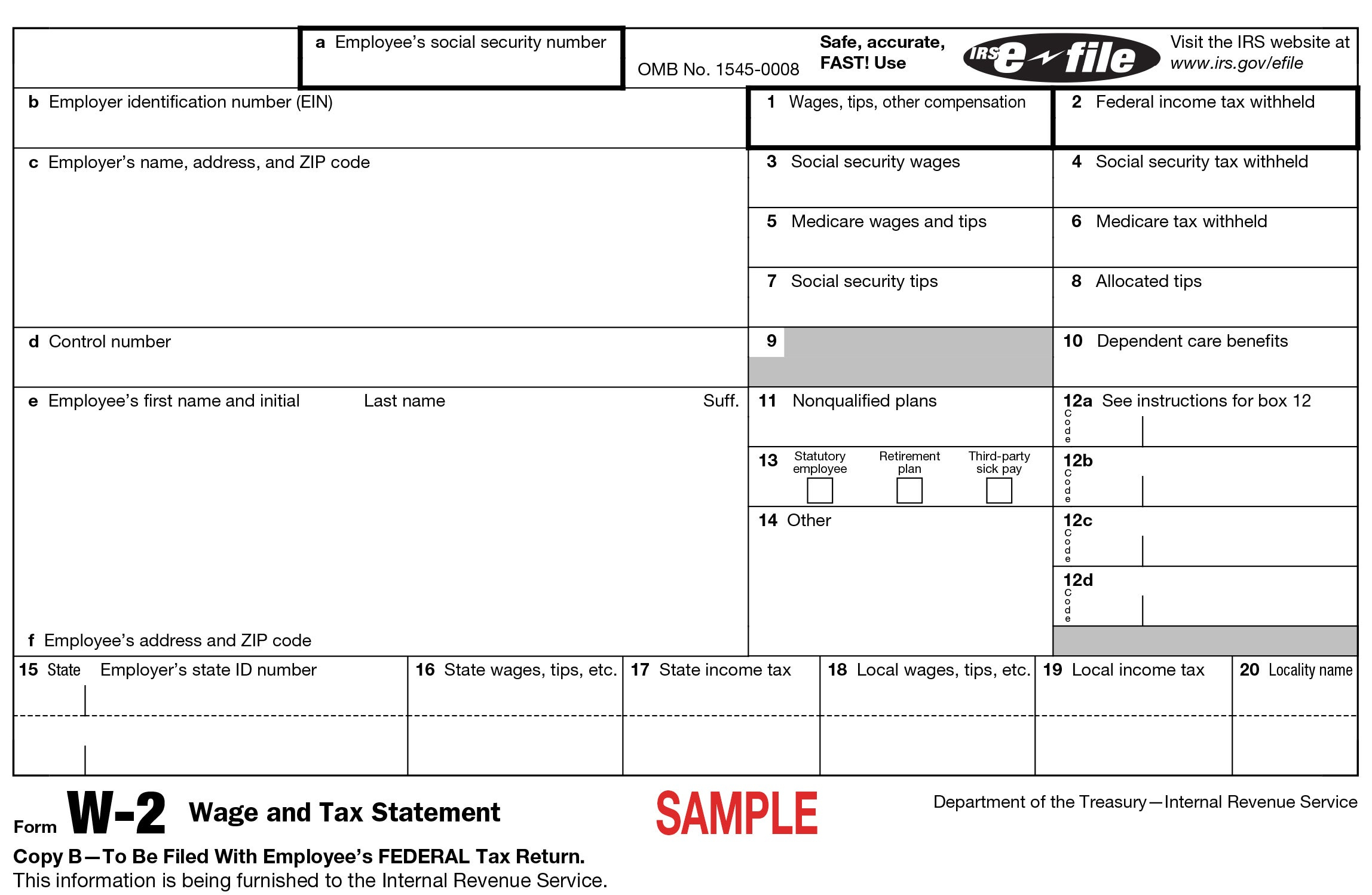

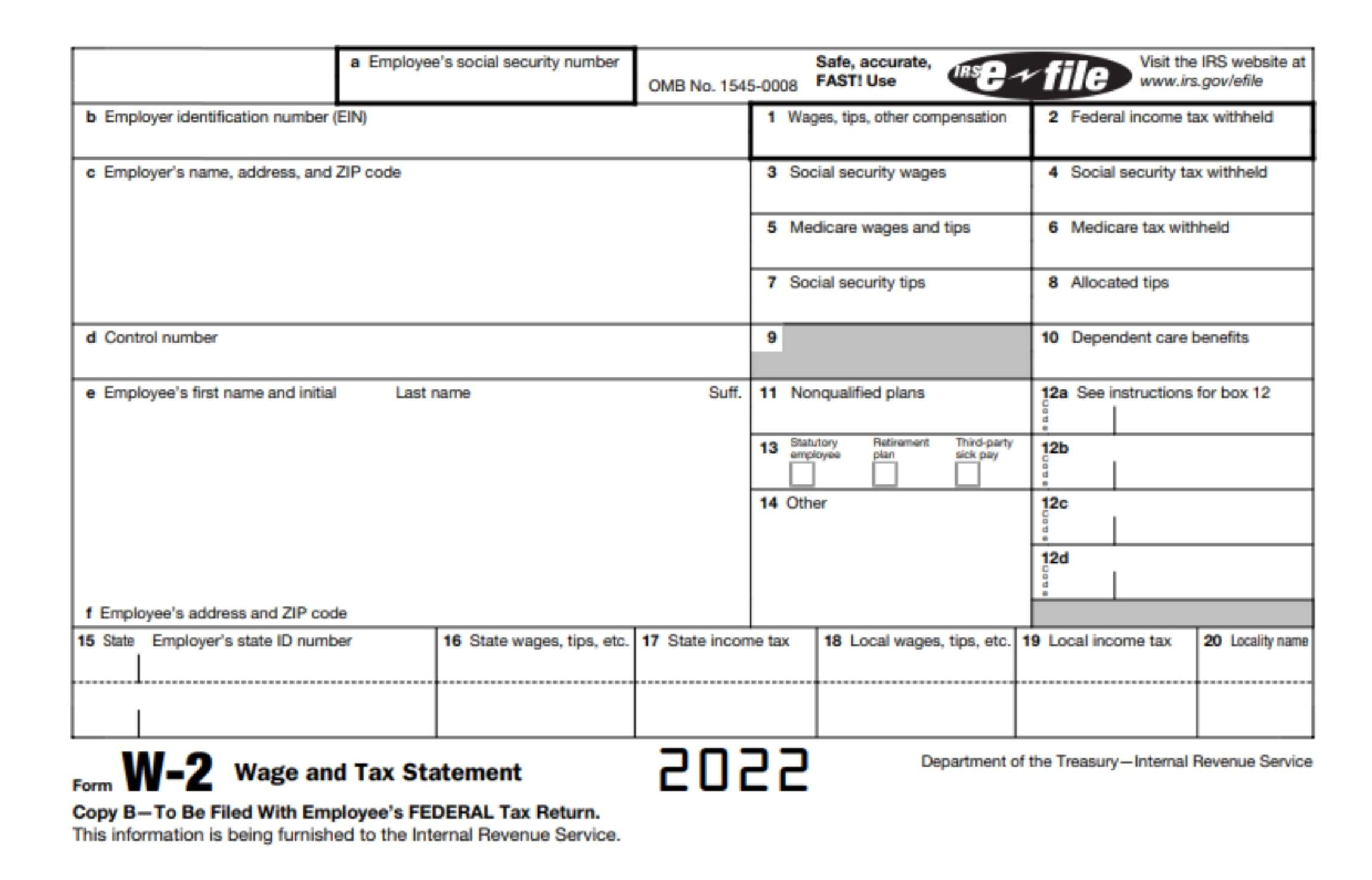

W2 Form State Income Tax – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Get Ready to Unwrap Your W2 Form!

Ah, it’s that time of year again – tax season! As you eagerly await the arrival of your W2 form in the mail, it’s important to prepare yourself for the task ahead. Your W2 form is like a treasure map, leading you to potential tax refunds or obligations. Before you dive into the world of state income tax, take a deep breath and get ready to unwrap your W2 form with excitement and anticipation!

First things first, locate your W2 form among the mound of envelopes in your mailbox. Once you have it in your hands, grab a cup of coffee, find a cozy spot, and get ready to unravel the mysteries within. Your W2 form contains vital information about your earnings, taxes withheld, and other important details that will determine your state income tax liability. As you carefully examine each section, take note of any discrepancies or questions you may have – it’s better to address them now rather than later.

Now that you’ve familiarized yourself with the contents of your W2 form, it’s time to roll up your sleeves and navigate the murky waters of state income tax like a pro. Armed with your trusty W2 form and a positive attitude, you can tackle this task with confidence and ease. Remember to research any tax credits or deductions you may be eligible for in your state, as they can significantly reduce your tax liability. With a little bit of patience and perseverance, you’ll soon be on your way to mastering the art of state income tax and maximizing your potential refund. Happy tax season!

In conclusion, unwrapping your W2 form doesn’t have to be a daunting task. With the right mindset and a bit of preparation, you can tackle state income tax like a seasoned pro. Take the time to carefully review your W2 form, explore potential tax credits and deductions, and seek assistance if needed. By following these simple steps, you’ll be well on your way to mastering the ins and outs of state income tax and making the most of your tax return. So, go ahead and unwrap your W2 form with confidence – you’ve got this!

Below are some images related to W2 Form State Income Tax

are state taxes on w2, do you need a w2 for state taxes, w2 form box 17 state income tax, w2 form state income tax, what is state income tax on w2, , W2 Form State Income Tax.

are state taxes on w2, do you need a w2 for state taxes, w2 form box 17 state income tax, w2 form state income tax, what is state income tax on w2, , W2 Form State Income Tax.