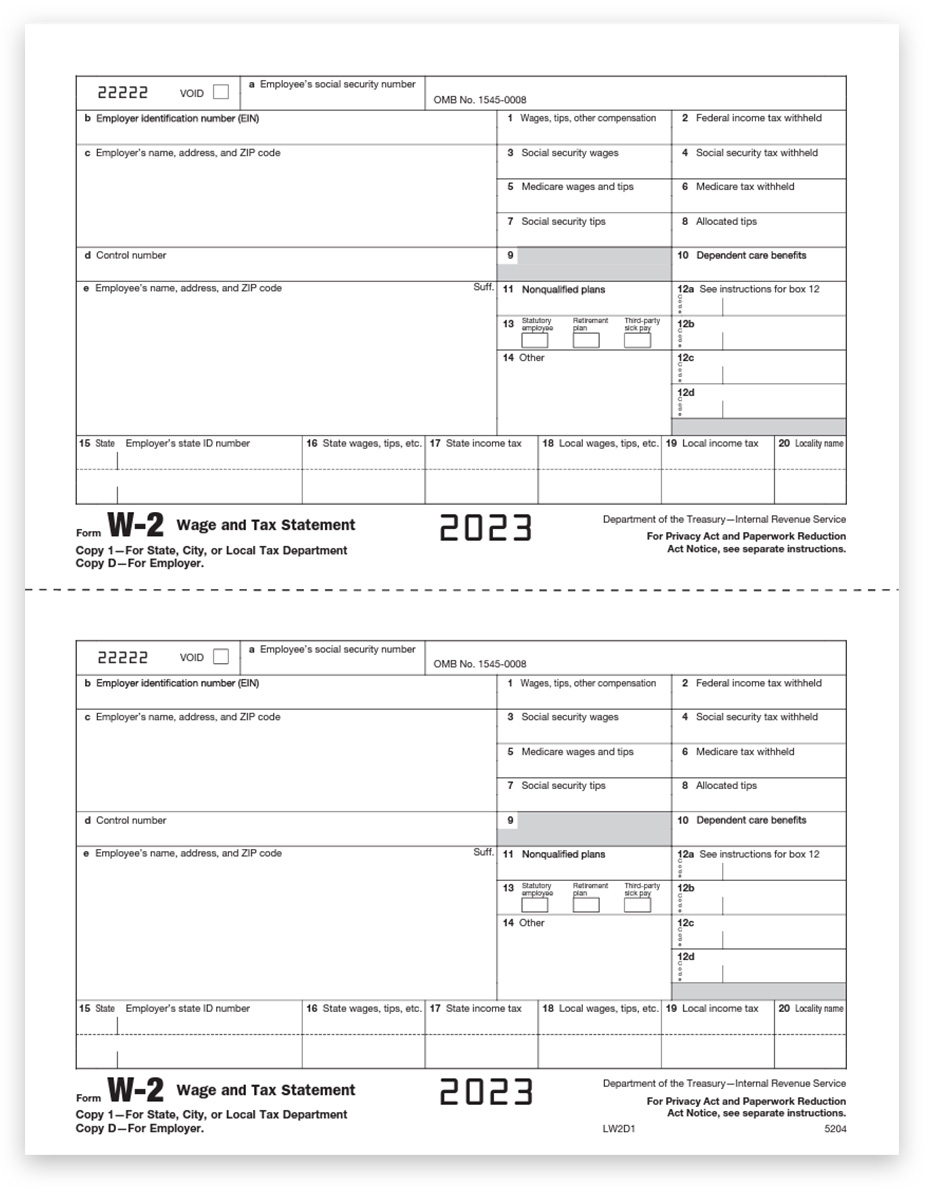

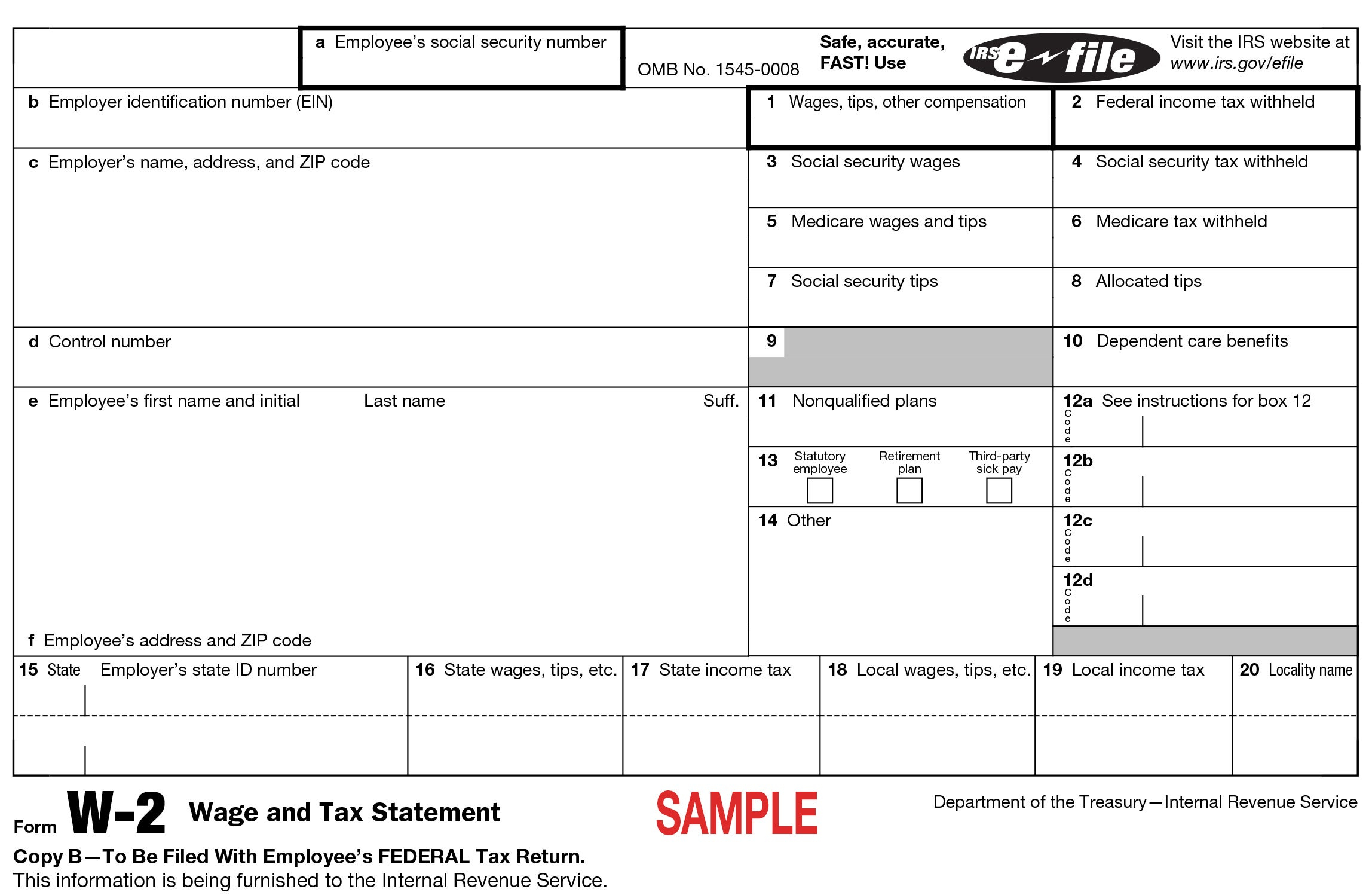

W2 Form Colorado – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Simplifying Your Tax Season: W2 Form Colorado!

Are you ready to tackle tax season with ease? Say goodbye to stress and confusion with the simplified process of filing your W2 Form in Colorado! This essential document summarizes your earnings and taxes withheld throughout the year, making it a crucial component of your tax return. By following a few easy steps, you can ensure a seamless filing process and potentially maximize your tax refund. So, let’s dive in and get ready to file your W2 Form Colorado simplified!

Easy Steps to Prepare and File Your W2 Form!

Preparing and filing your W2 Form in Colorado doesn’t have to be a daunting task. Start by gathering all your necessary documents, including your W2 Form, any additional income statements, and receipts for deductions. Next, carefully review your W2 Form to confirm that all the information is accurate and matches your records. If you notice any discrepancies, reach out to your employer for corrections before proceeding. Once you have verified the details, you can proceed to file your taxes confidently.

When it comes to filing your W2 Form in Colorado, there are various options available to you. You can choose to file online through reputable tax software or seek assistance from a professional tax preparer. Whichever method you choose, make sure to input all the required information accurately to avoid any delays or errors in processing. Additionally, take advantage of any deductions or credits you may be eligible for to potentially reduce your tax liability. With a little organization and attention to detail, you can breeze through the process and set yourself up for a smooth tax season.

In conclusion, filing your W2 Form in Colorado can be a stress-free and straightforward process when approached with the right mindset and preparation. By following the easy steps outlined above, you can navigate through tax season with confidence and ease. Remember to stay organized, verify your information, and explore all available options to maximize your tax refund. So, get ready to file your W2 Form Colorado simplified and make the most of this tax season!

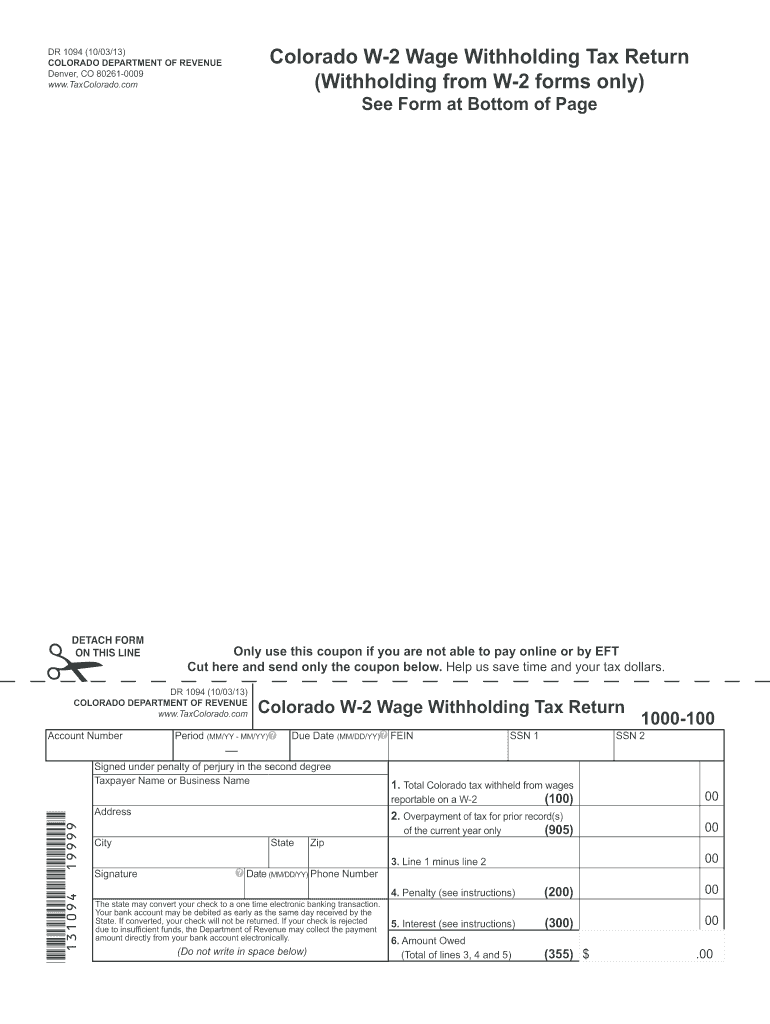

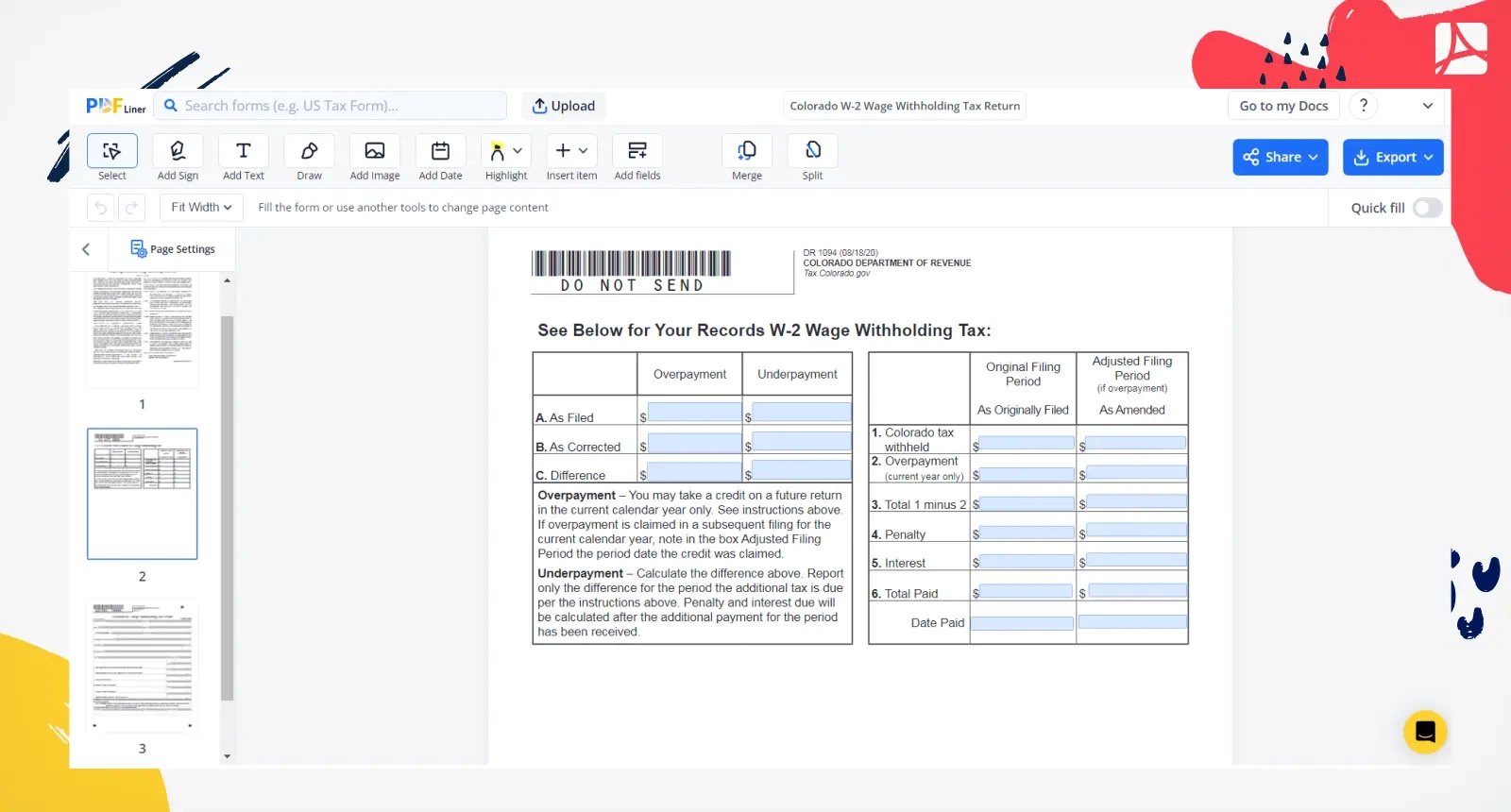

Below are some images related to W2 Form Colorado

colorado tax forms and instructions, colorado w2 form 2022, does colorado have state income tax form, how do i get my w2 from colorado unemployment, how to submit w2 to colorado, , W2 Form Colorado.

colorado tax forms and instructions, colorado w2 form 2022, does colorado have state income tax form, how do i get my w2 from colorado unemployment, how to submit w2 to colorado, , W2 Form Colorado.