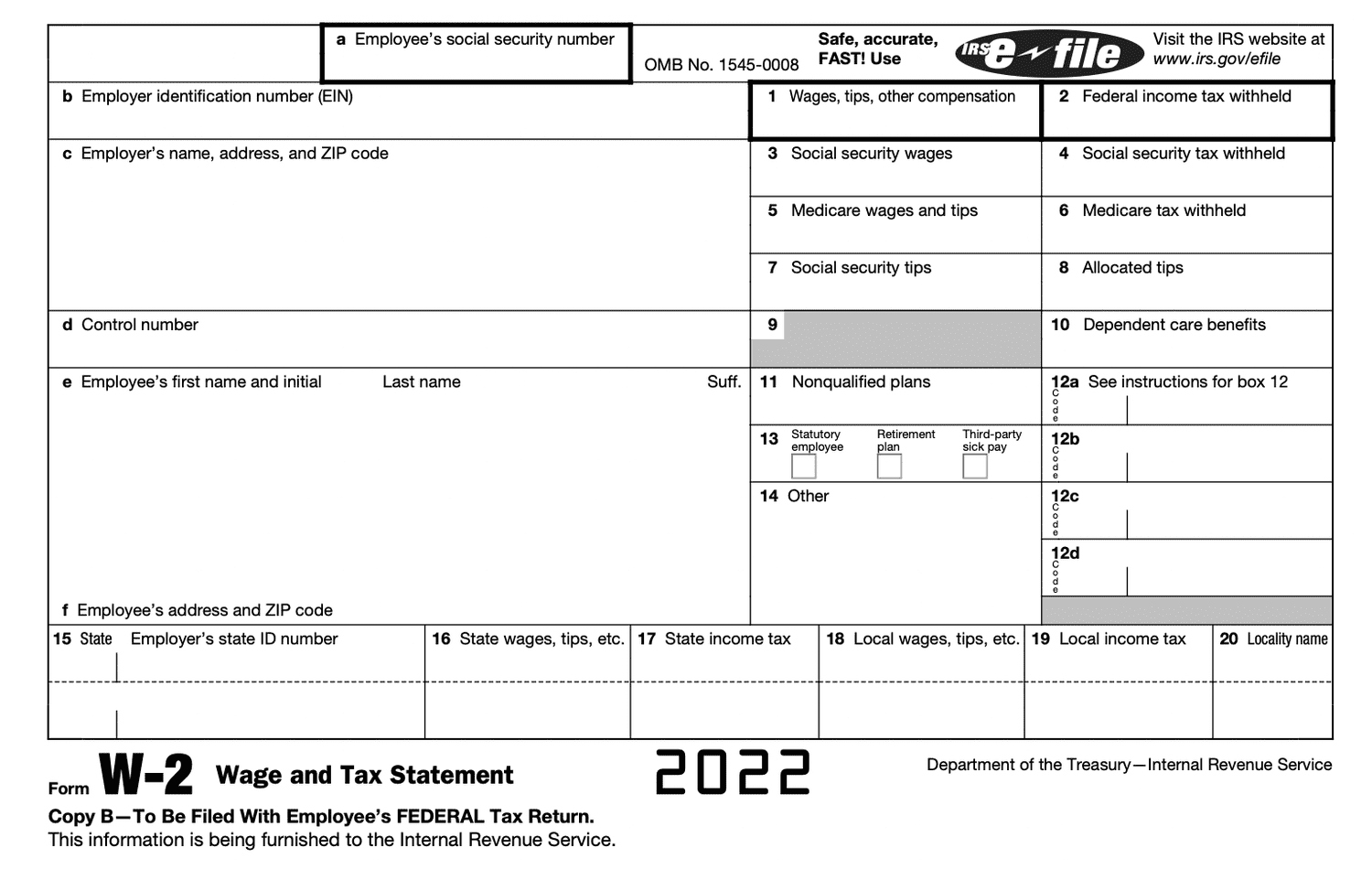

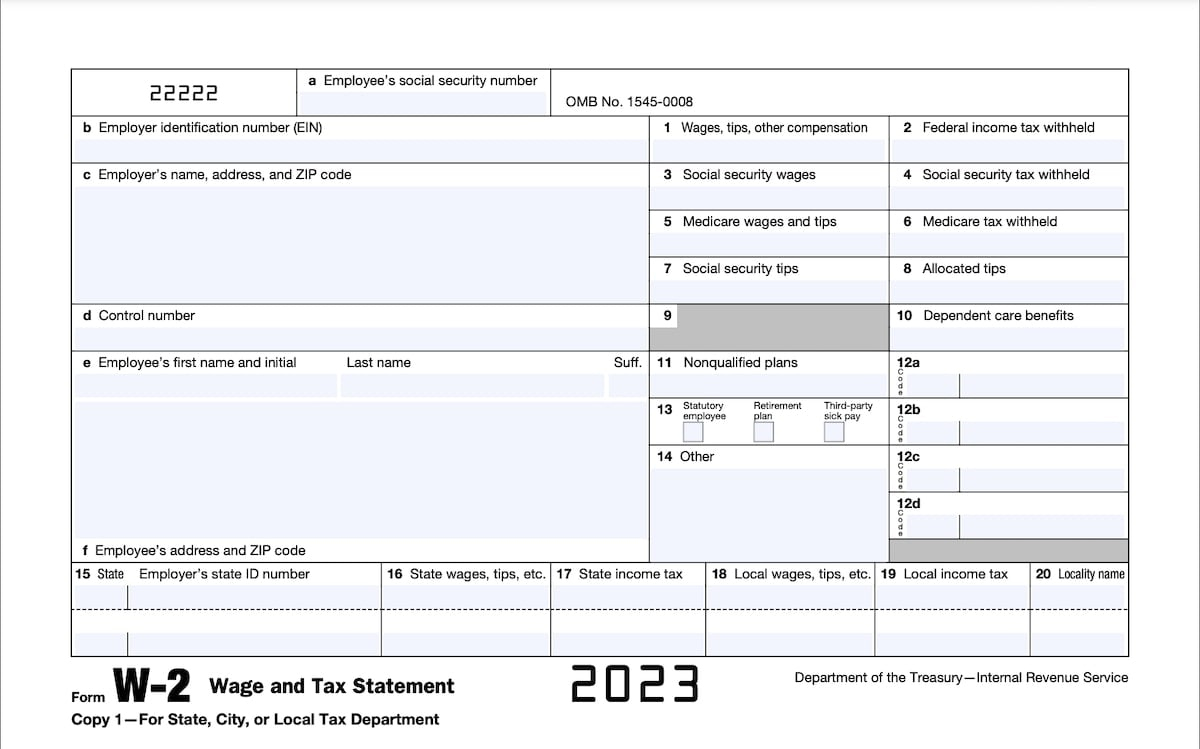

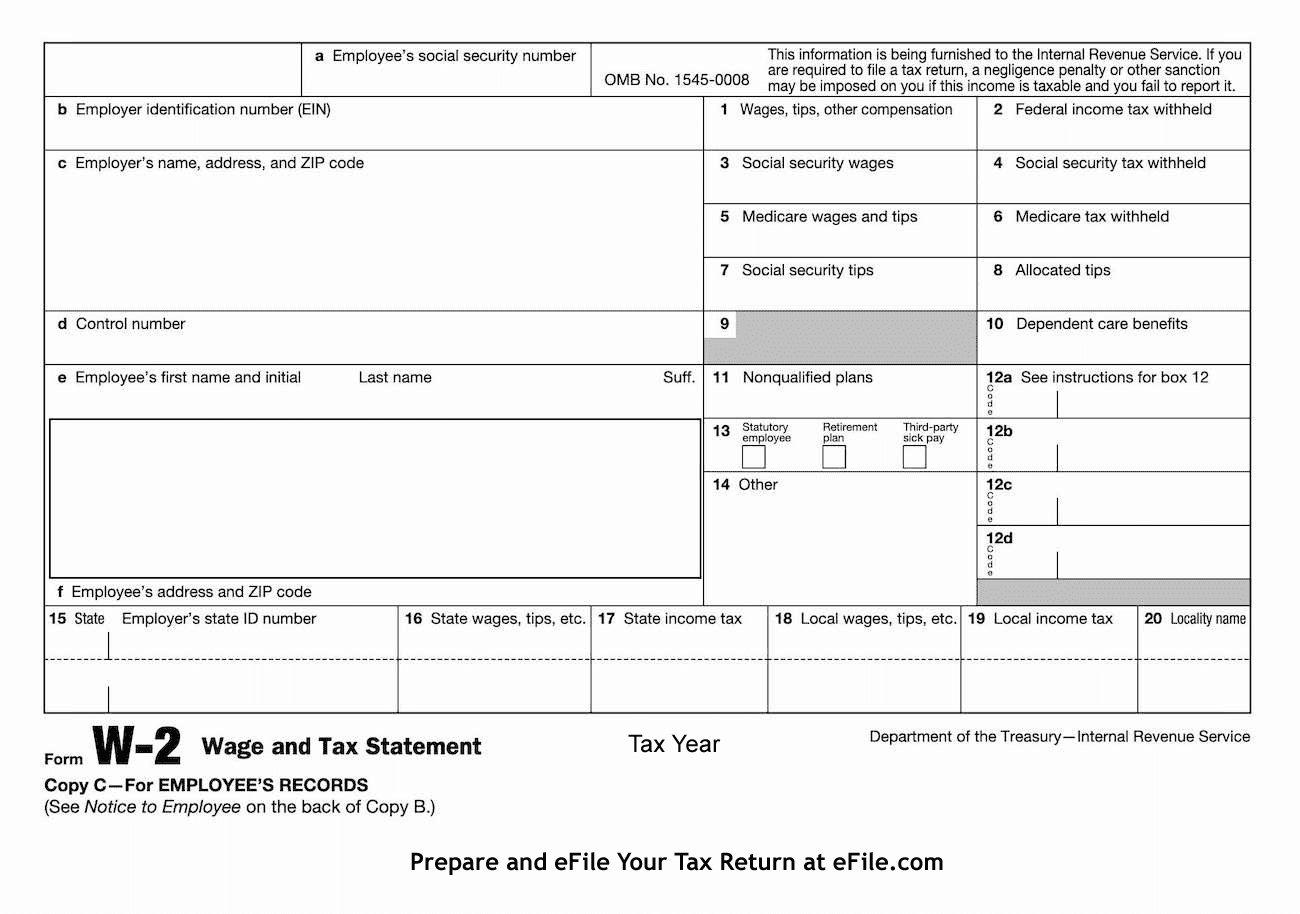

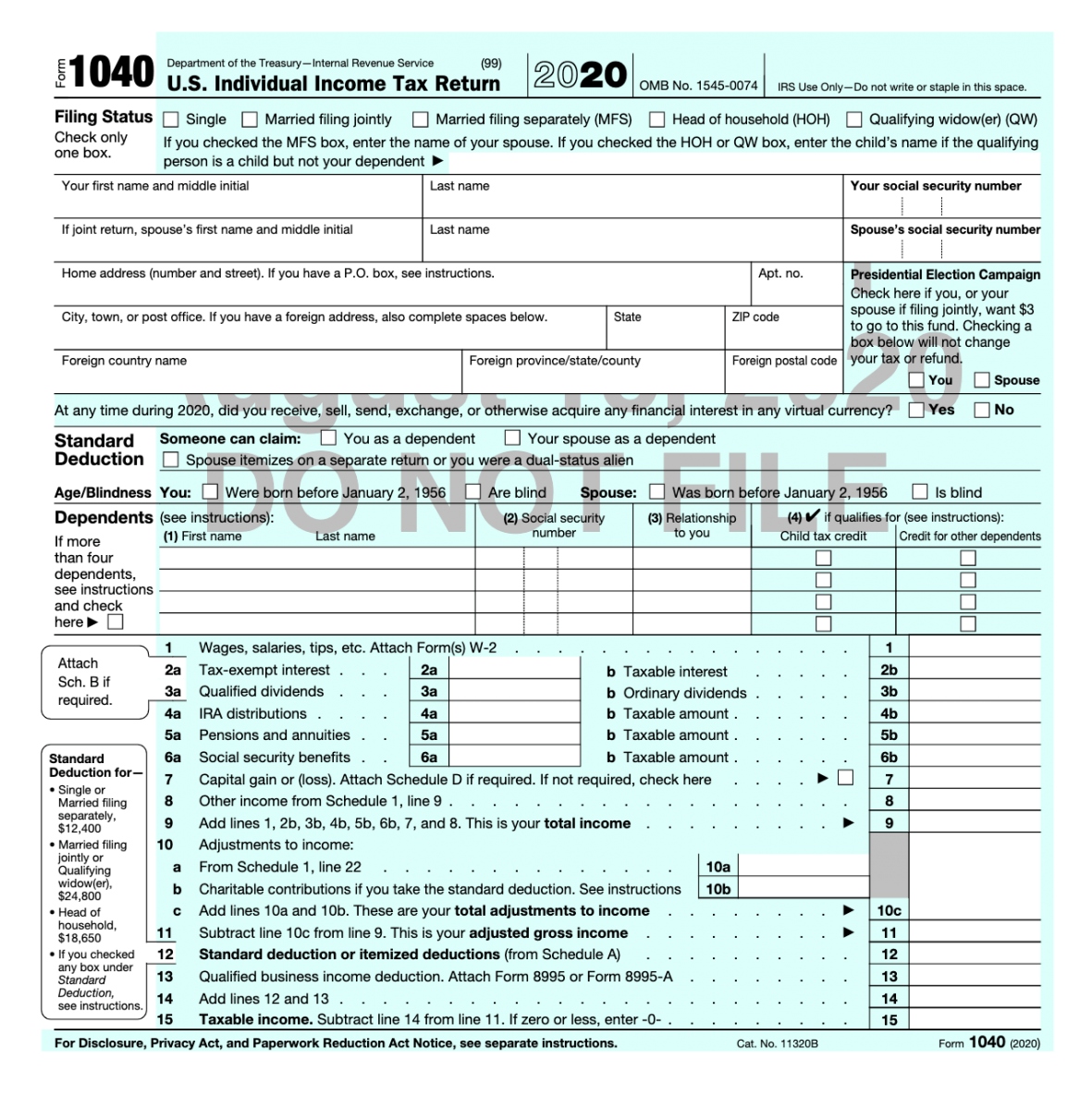

W2 Form 1040 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unwrapping the Magic of W2 Form 1040!

Are you ready to embark on a journey into the enchanting world of W2 Form 1040? Buckle up and get ready to discover the secrets behind this mystical document that holds the key to your financial well-being. From deciphering codes to unlocking hidden treasures, the W2 Form 1040 is sure to dazzle and delight you with its magic.

The Enchanting World of W2 Form 1040!

As you unwrap your W2 Form 1040, you are transported into a world of numbers, figures, and symbols that may seem daunting at first. But fear not, for with a little guidance, you will soon find yourself navigating through this mystical realm with ease. Each section of the form holds a piece of the puzzle that is your financial story, from your earnings to your deductions, painting a vivid picture of your financial health.

The W2 Form 1040 is like a map that guides you through the maze of tax season, helping you navigate through the complexities of filing your taxes. It lays out all the information you need to accurately report your income, deductions, and tax credits, ensuring that you stay on the right path towards maximizing your tax refund. So grab your magnifying glass and get ready to uncover the hidden gems buried within the W2 Form 1040.

Discover the Secrets Behind W2 Form 1040!

Behind the seemingly mundane numbers and boxes on the W2 Form 1040 lie the secrets to unlocking your financial destiny. By carefully examining each line and column, you can gain valuable insights into your financial situation and make informed decisions about your taxes. The W2 Form 1040 is not just a piece of paper, but a powerful tool that empowers you to take control of your financial future.

So, the next time you receive your W2 Form 1040, don’t just toss it aside. Embrace the magic it holds and embark on a journey of self-discovery and financial empowerment. With a little bit of patience and a sprinkle of curiosity, you can unravel the mysteries of the W2 Form 1040 and harness its power to achieve your financial goals. Happy filing!

Below are some images related to W2 Form 1040

form 1040 w2 worksheet, is my w2 a 1040, w2 form 1040, w2 form same as 1040, w2 form vs 1040, , W2 Form 1040.

form 1040 w2 worksheet, is my w2 a 1040, w2 form 1040, w2 form same as 1040, w2 form vs 1040, , W2 Form 1040.