Tk88 ⭐️ Link Không Chặn | Trang Chủ Nhà Cái Tk88 Casino

Tk88 – Tk88.ca là một trong những nền tảng cá cược trực tuyến được ưa chuộng, mang đến đa dạng các dịch vụ giải trí từ cá cược thể thao, casino trực tuyến, game bài cho đến các trò chơi nổ hũ và lô đề. Với giao diện hiện đại, thân thiện và dễ sử dụng, Tk88 giúp người chơi nhanh chóng làm quen và tham gia các sản phẩm mà không gặp trở ngại.

Một trong những điểm mạnh của nhà cái Tk88 là việc cung cấp tỷ lệ cược cạnh tranh, hấp dẫn và cập nhật liên tục, giúp người chơi dễ dàng lựa chọn kèo tốt nhất. Nền tảng này cũng đảm bảo tính bảo mật và an toàn trong mọi giao dịch, từ nạp tiền đến rút tiền, thông qua các phương thức thanh toán đa dạng và an toàn.

Ngoài ra, Tk88 casino còn nổi bật với các chương trình khuyến mãi, ưu đãi hấp dẫn, mang đến nhiều lợi ích và cơ hội gia tăng lợi nhuận cho người chơi. Đội ngũ chăm sóc khách hàng của Tk88 hoạt động 24/7, luôn sẵn sàng hỗ trợ và giải đáp mọi thắc mắc một cách nhanh chóng, tận tâm. Với những ưu điểm vượt trội, Tk88.com đang ngày càng khẳng định vị thế của mình trong cộng đồng người chơi cá cược trực tuyến.

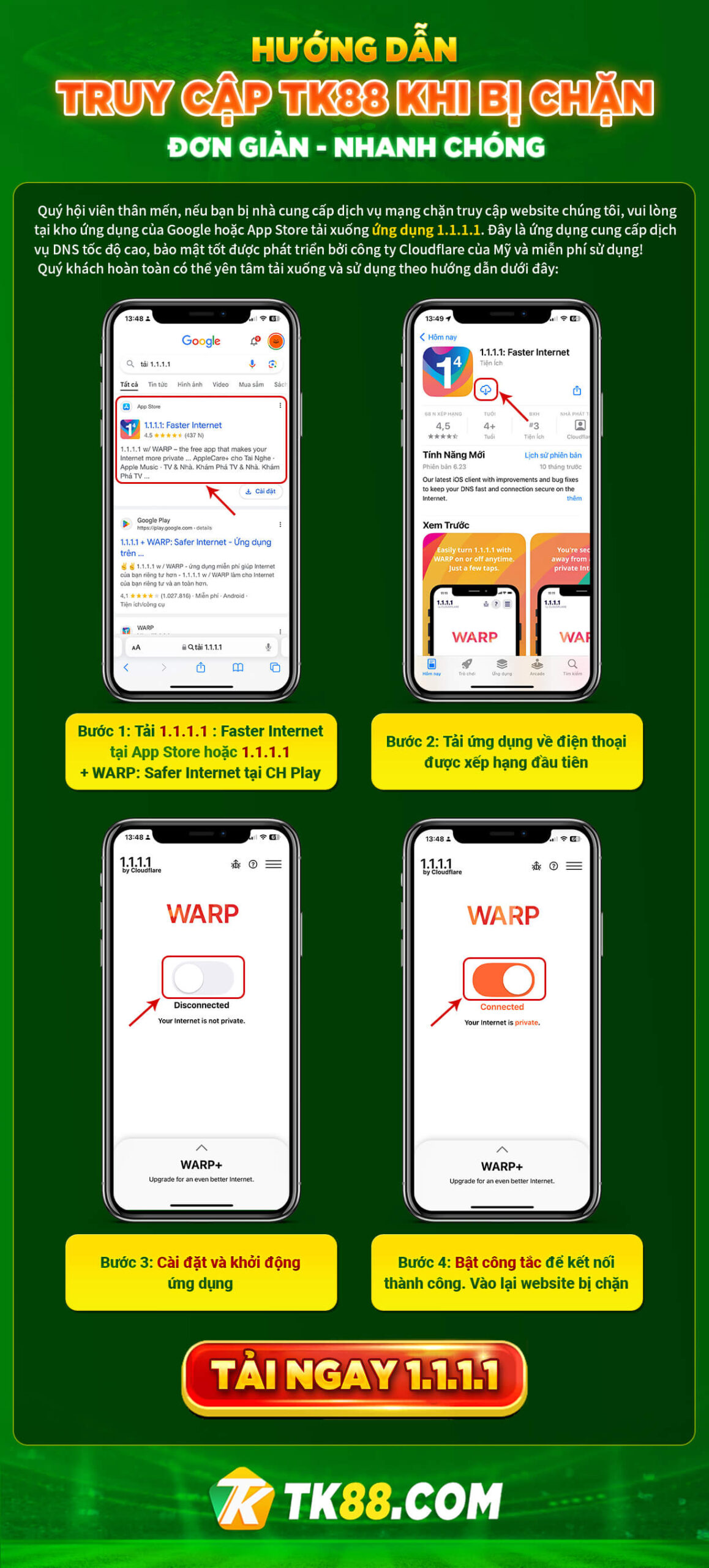

KHÁCH HÀNG LƯU Ý KHI TRUY CẬP BỊ CHẶN: App nhà cái hoặc website khi bị chặn thì mẹo truy cập dễ dàng và không bị điêu tra đánh bạc online thì các bạn nên cài đặt cho mình APP 1.1.1.1 này nhé và truy cập bất cứ khi nào bạn muốn.