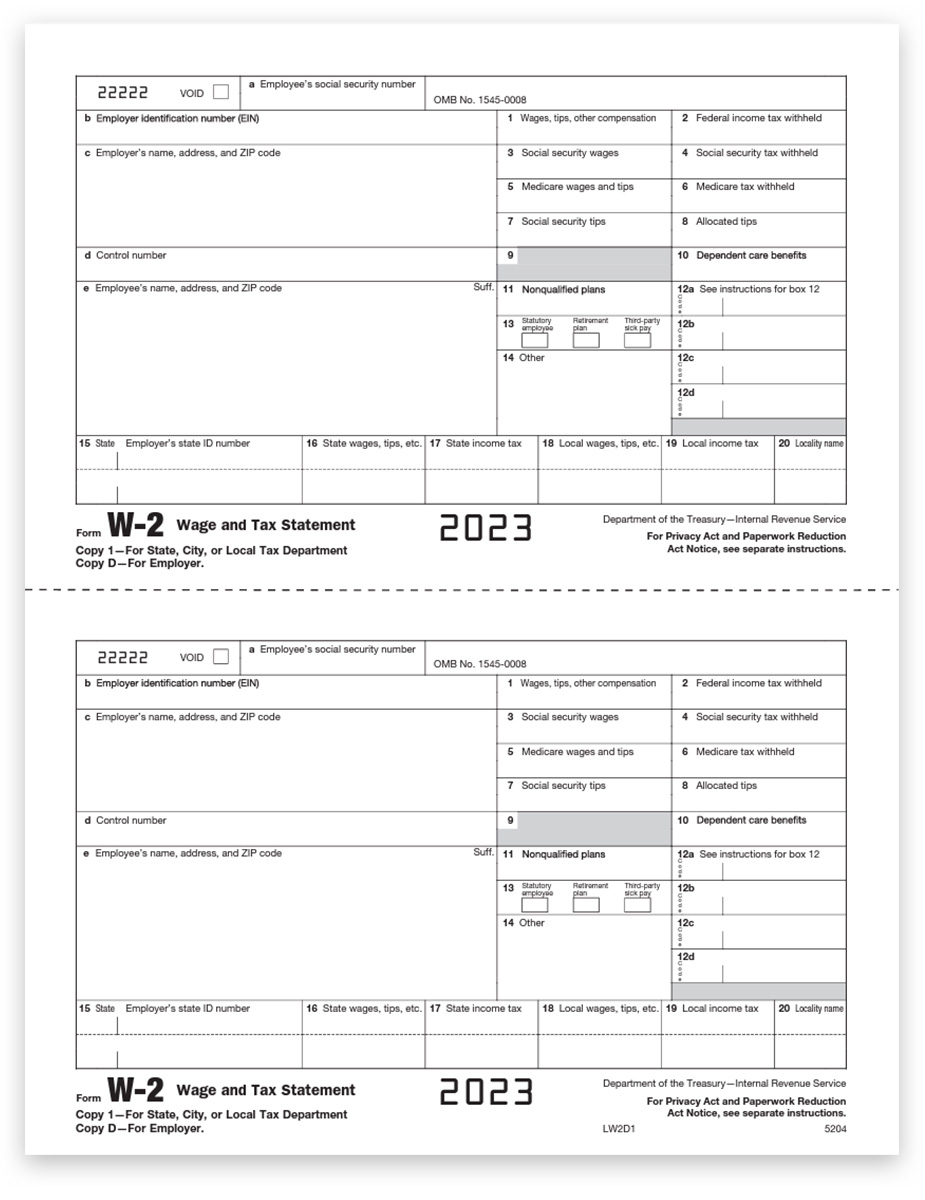

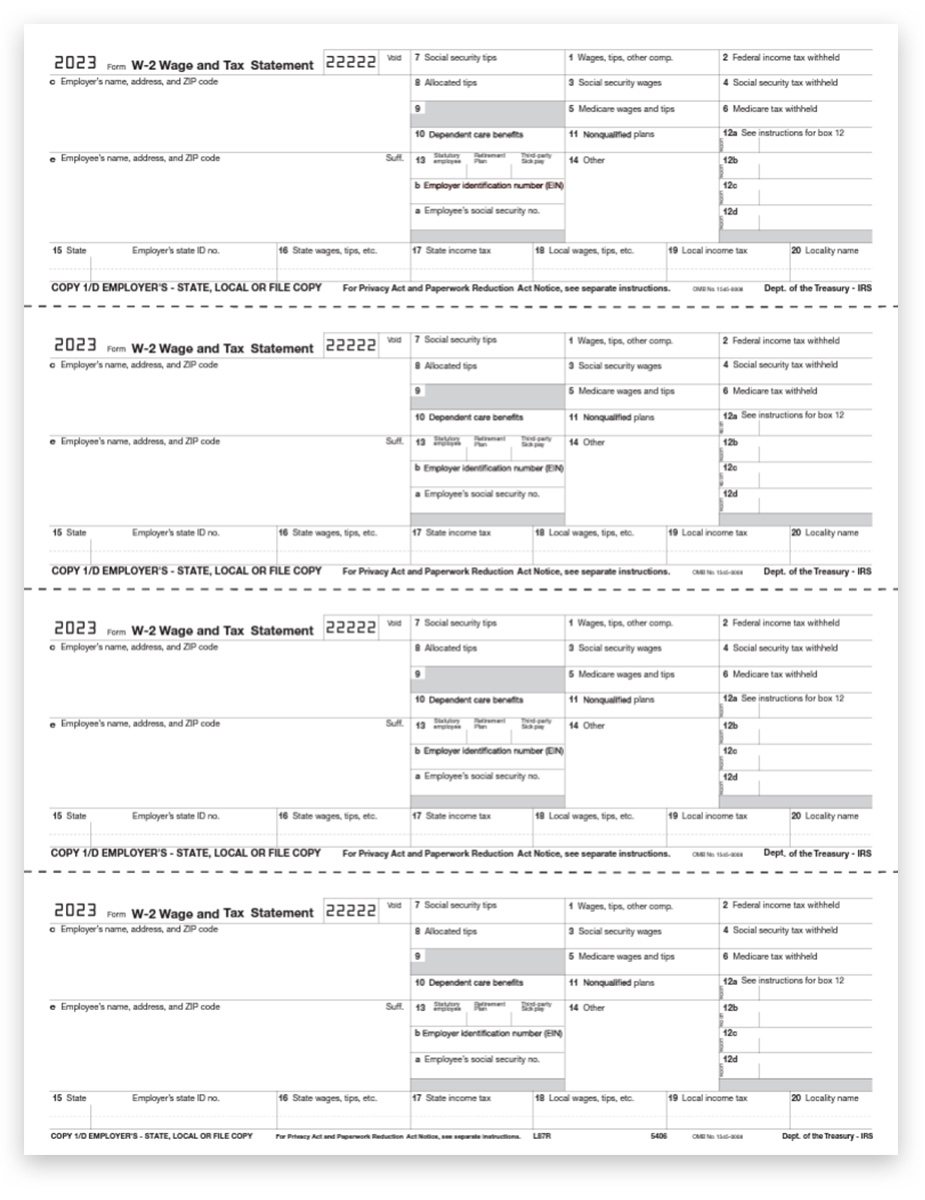

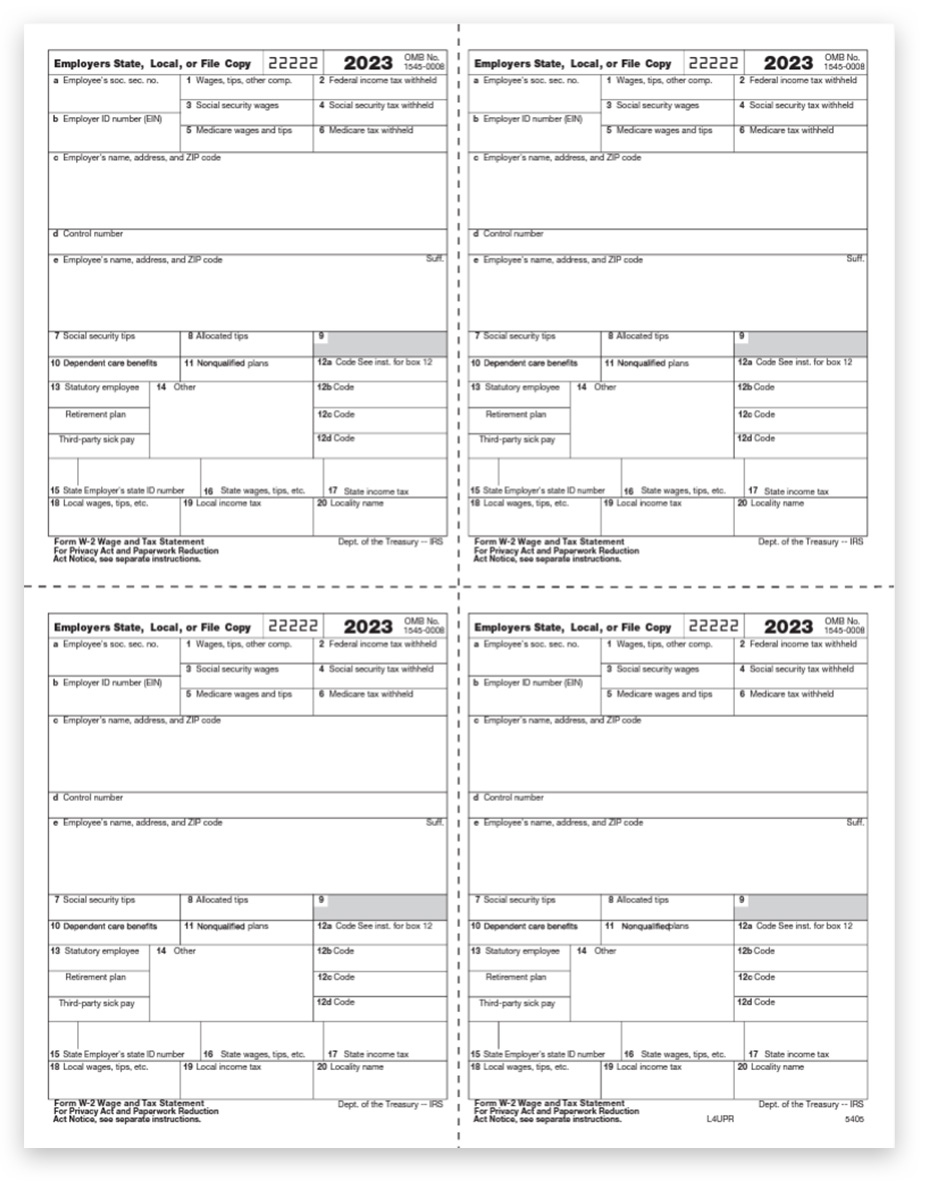

Multiple W2 Forms From Different Employers – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Double the Fun: Juggling Multiple W2 Forms!

Are you ready for double the excitement this tax season? Juggling multiple W2 forms may seem daunting at first, but with the right mindset and a little bit of organization, you can turn this task into a fun challenge! Whether you have multiple jobs, freelance gigs, or side hustles, mastering the art of handling multiple W2 forms can be a rewarding experience that leads to a deeper understanding of your financial situation.

Mastering Multiple W2s with Ease and Fun

To make the process of juggling multiple W2 forms more manageable and enjoyable, start by creating a dedicated folder or digital file for each of your W2 forms. This will help you keep track of each form and avoid any mix-ups or confusion when it’s time to file your taxes. Additionally, consider creating a spreadsheet or document that lists all of your sources of income, along with the corresponding W2 form information. This will make it easier to cross-reference and ensure that you don’t miss any important details.

Next, approach the task of handling multiple W2 forms with a positive attitude and a sense of curiosity. Instead of viewing it as a chore, see it as an opportunity to learn more about your income sources and financial habits. Take the time to review each W2 form carefully, noting any discrepancies or inconsistencies that may require further investigation. By approaching this task with a spirit of fun and adventure, you can turn what could be a stressful experience into a rewarding opportunity for personal growth and financial empowerment.

In conclusion, juggling multiple W2 forms doesn’t have to be a tedious or overwhelming task. With the right mindset, organization, and a sprinkle of creativity, you can turn this process into an enjoyable challenge that helps you better understand your financial situation. So embrace the excitement of handling multiple W2 forms and see it as an opportunity to take control of your finances with confidence and ease!

Below are some images related to Multiple W2 Forms From Different Employers

i have two w2 forms from different employers do i have to file both, multiple w2 forms from different employers, multiple w2 forms from different employers turbotax, what if i have multiple w2 forms, what if i have two w2 forms from different employers, , Multiple W2 Forms From Different Employers.

i have two w2 forms from different employers do i have to file both, multiple w2 forms from different employers, multiple w2 forms from different employers turbotax, what if i have multiple w2 forms, what if i have two w2 forms from different employers, , Multiple W2 Forms From Different Employers.