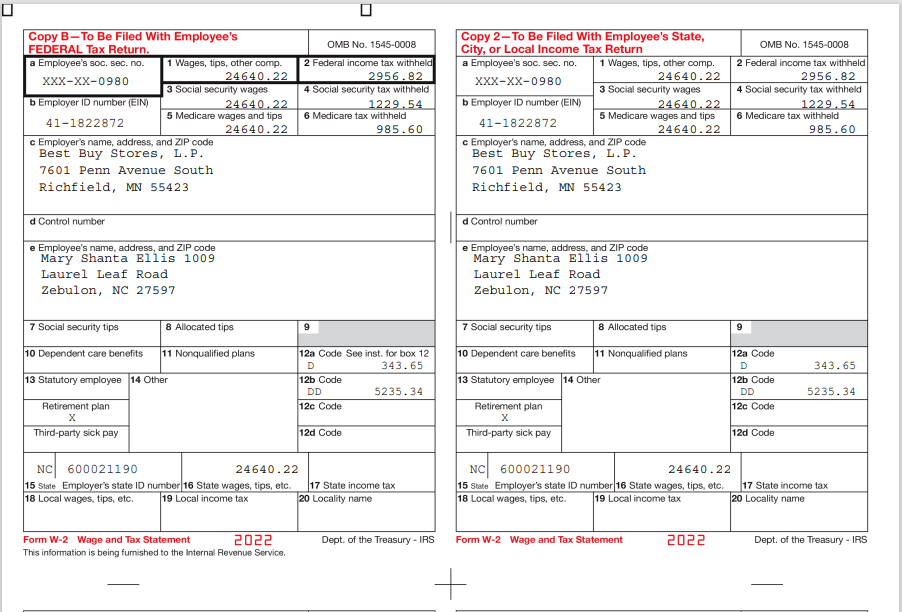

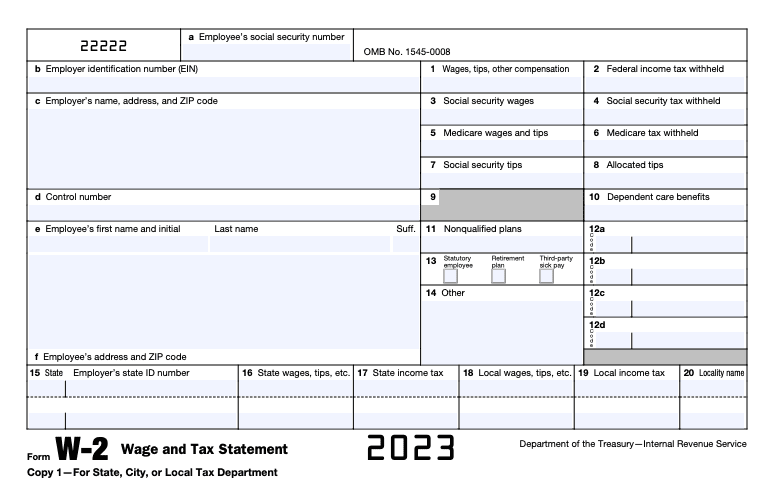

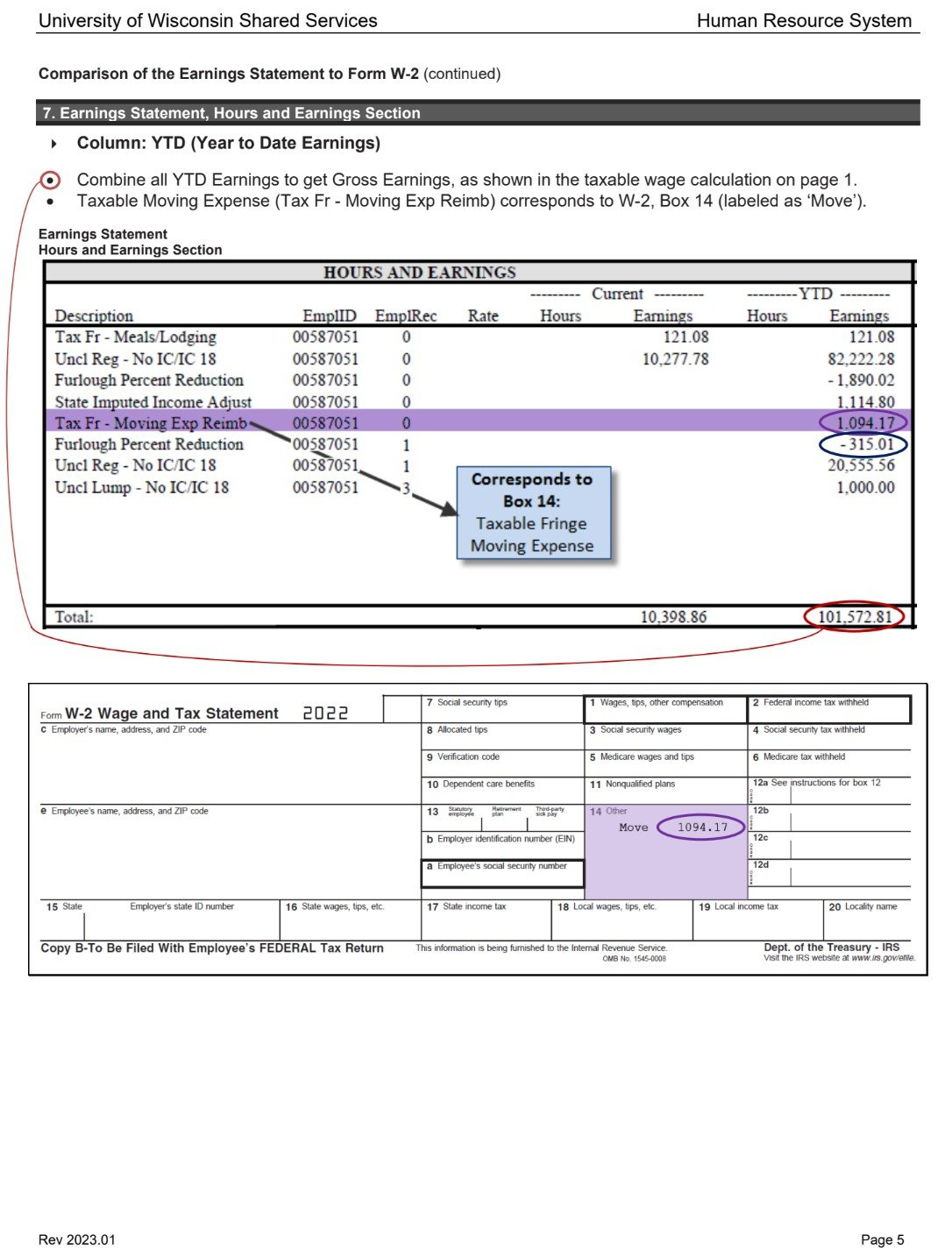

Mit W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Discover the Enchantment of the Mit W2 Form!

Have you ever received your Mit W2 Form and felt overwhelmed by all the numbers and codes on it? Fear not, for behind that seemingly confusing document lies a world of magic waiting to be discovered! Your Mit W2 Form holds the key to unlocking important information about your earnings and taxes, helping you understand your financial situation better. Let’s dive in and unravel the mysteries of this enchanted document together!

When you first lay eyes on your Mit W2 Form, it may look like a jumble of numbers and letters, but each piece of information is like a piece of a puzzle waiting to be solved. From your total earnings to the amount of taxes withheld, every detail on your Mit W2 Form plays a crucial role in painting a picture of your financial health. By taking the time to decode and understand each section of the form, you can gain valuable insights into your income and tax obligations, empowering you to make informed decisions about your finances.

As you delve deeper into the world of your Mit W2 Form, you’ll begin to see the magic unfold before your eyes. You’ll discover how your earnings are broken down into different categories, such as wages, tips, and bonuses, giving you a clearer picture of where your money is coming from. You’ll also uncover the secrets behind the various codes and boxes on the form, each holding a clue to understanding your tax obligations and potential refunds. So, don’t be afraid to embrace the magic of your Mit W2 Form – it’s not just a piece of paper, but a window into your financial world waiting to be explored!

Unlocking the Secrets Behind Your Mit W2 Form!

Now that you’ve embarked on the journey of unwrapping the magic of your Mit W2 Form, it’s time to unlock the hidden secrets held within its pages. From deciphering your employer’s information to understanding your tax deductions, each section of the form offers valuable insights into your financial standing. By peeling back the layers of your Mit W2 Form, you’ll gain a deeper understanding of how your earnings are taxed and how you can make the most of your tax return.

One of the most important sections of your Mit W2 Form is Box 1, which shows your total wages for the year. This number serves as the foundation for calculating your tax liability, so it’s crucial to ensure its accuracy. Additionally, Box 2 reveals the federal income tax withheld from your paychecks throughout the year, giving you an idea of how much you’ve already paid towards your tax bill. By comparing these numbers to your total income, you can determine whether you owe additional taxes or are eligible for a refund – unlocking the potential for financial peace of mind.

As you continue to explore the secrets hidden within your Mit W2 Form, you’ll uncover a treasure trove of information that can help you make informed decisions about your finances. From understanding your tax obligations to maximizing your tax deductions, each detail on the form plays a vital role in shaping your financial future. So, don’t be afraid to dig deep and unravel the mysteries of your Mit W2 Form – for within its pages lies the key to unlocking a world of financial possibilities!

In conclusion, the Mit W2 Form may seem like a daunting document at first glance, but by taking the time to explore its contents, you can discover a wealth of valuable information about your earnings and taxes. From decoding your total wages to understanding your tax deductions, each section of the form offers insights that can help you make informed financial decisions. So, embrace the magic of your Mit W2 Form and unlock the secrets it holds – for within its pages lies the key to financial empowerment and peace of mind!

Below are some images related to Mit W2 Form

mit w2 former employee, mit w2 forms, where do i get my w2 forms, who sends out w2 forms, , Mit W2 Form.

mit w2 former employee, mit w2 forms, where do i get my w2 forms, who sends out w2 forms, , Mit W2 Form.