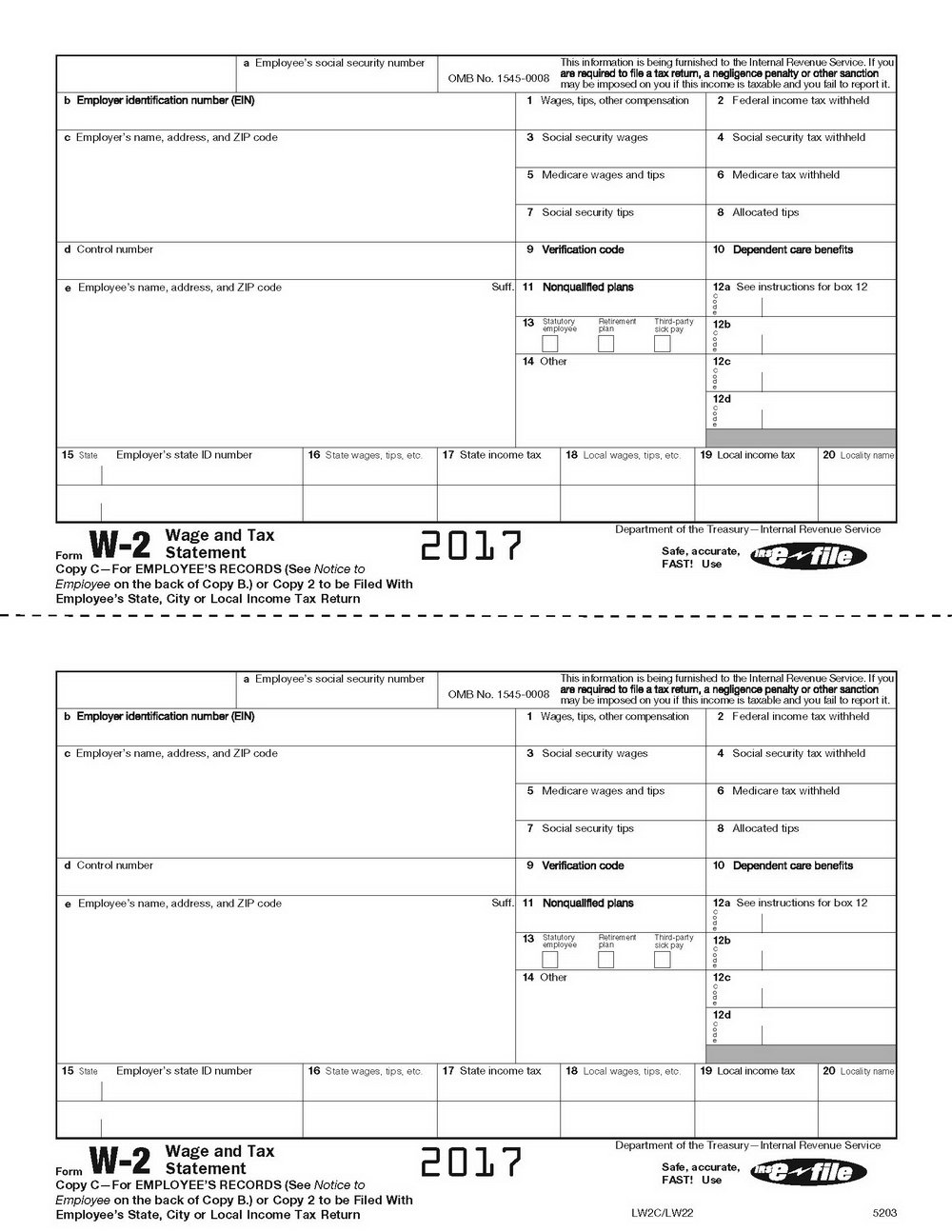

Macy’s W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unwrapping the Magic: Macy’s W2 Form Explained

Are you ready to unlock the mystery behind your Macy’s W2 form? As the holiday season fades into a distant memory, it’s time to dive into the world of tax forms and unravel the secrets hidden within. Don’t let the numbers and codes intimidate you – with a little guidance, you’ll soon be able to decode the magic of your W2 form with ease.

Unlocking the Mystery: Demystifying Your Macy’s W2 Form

When you first glance at your Macy’s W2 form, it may seem like a jumble of numbers and letters. However, each section has a specific purpose and provides valuable information about your earnings and taxes withheld throughout the year. The top section of the form will include your personal information, such as your name, address, and Social Security number. This is crucial for ensuring that your taxes are filed correctly and that you receive any potential refunds in a timely manner.

Moving down the form, you’ll encounter a breakdown of your earnings and taxes withheld. This includes your total wages, tips, and other compensation, as well as any federal and state income taxes that have been deducted from your paycheck. Understanding these figures is essential for accurately reporting your income and determining whether you are owed a refund or if you owe additional taxes. By taking the time to review each section of your W2 form, you can ensure that your tax return is filed correctly and that you receive any refunds you are entitled to.

A Closer Look: Decoding the Magic of Macy’s W2 Form

One of the most important sections of your Macy’s W2 form is Box 12, which contains codes that correspond to various types of compensation and benefits you may have received throughout the year. These codes can include information about retirement plan contributions, health insurance premiums, and other perks provided by your employer. Understanding these codes can help you make informed decisions about your taxes and ensure that you are taking full advantage of any benefits offered by Macy’s.

In addition to Box 12, it’s essential to pay attention to Box 14 on your W2 form. This section may include additional information such as union dues, employer-sponsored educational assistance, or other types of compensation not covered in the standard sections of the form. By carefully reviewing this section, you can ensure that you are not missing out on any valuable deductions or credits when filing your taxes. Overall, by taking the time to decode the magic of your Macy’s W2 form, you can navigate the world of taxes with confidence and ease.

In conclusion, don’t let the complexity of your Macy’s W2 form overwhelm you. By taking a closer look and understanding the information provided, you can unlock the magic hidden within and ensure that your taxes are filed accurately. So grab a cup of coffee, settle in with your W2 form, and get ready to demystify the numbers and codes that make up this essential tax document. With a little patience and a dash of curiosity, you’ll soon be a pro at deciphering your W2 form and making the most of your tax return.

Below are some images related to Macy’s W2 Form

, Macy’s W2 Form.

, Macy’s W2 Form.