Can A Former Employer Withhold Your W2 – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

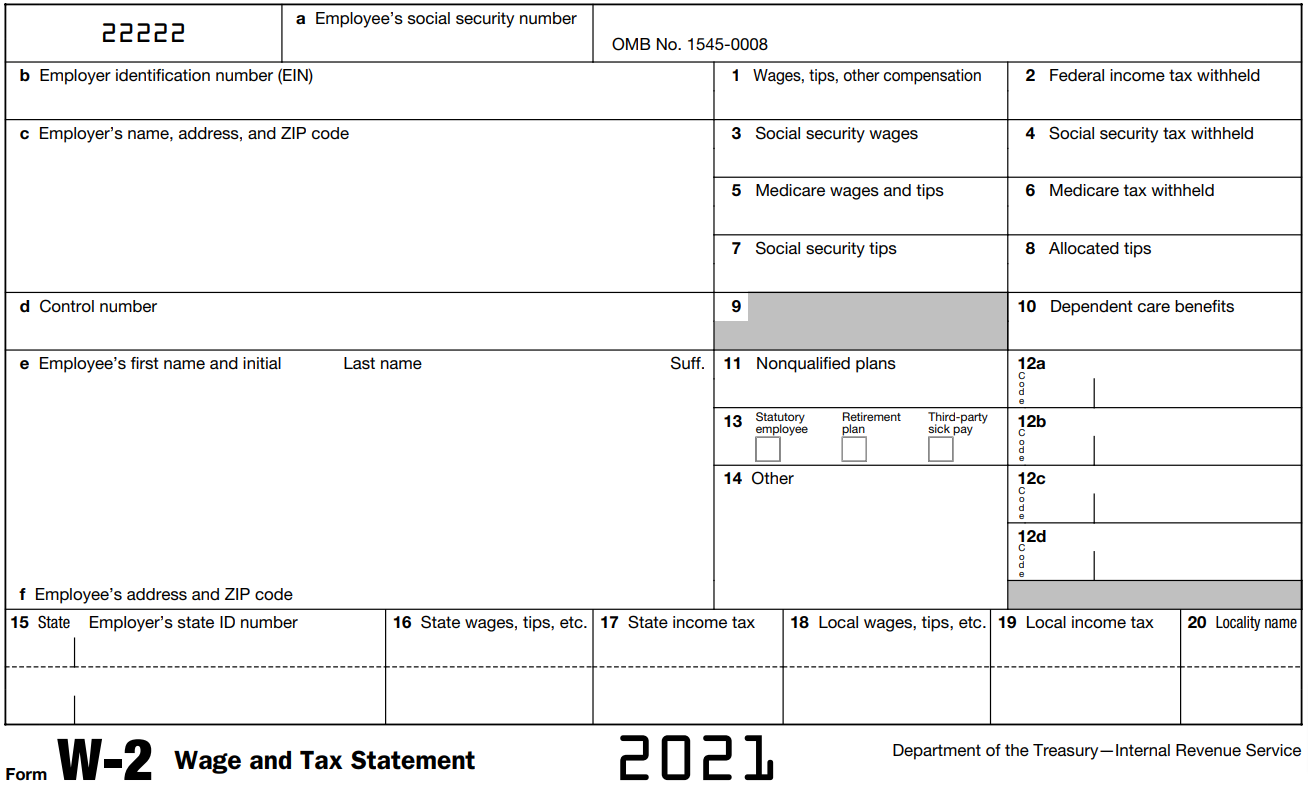

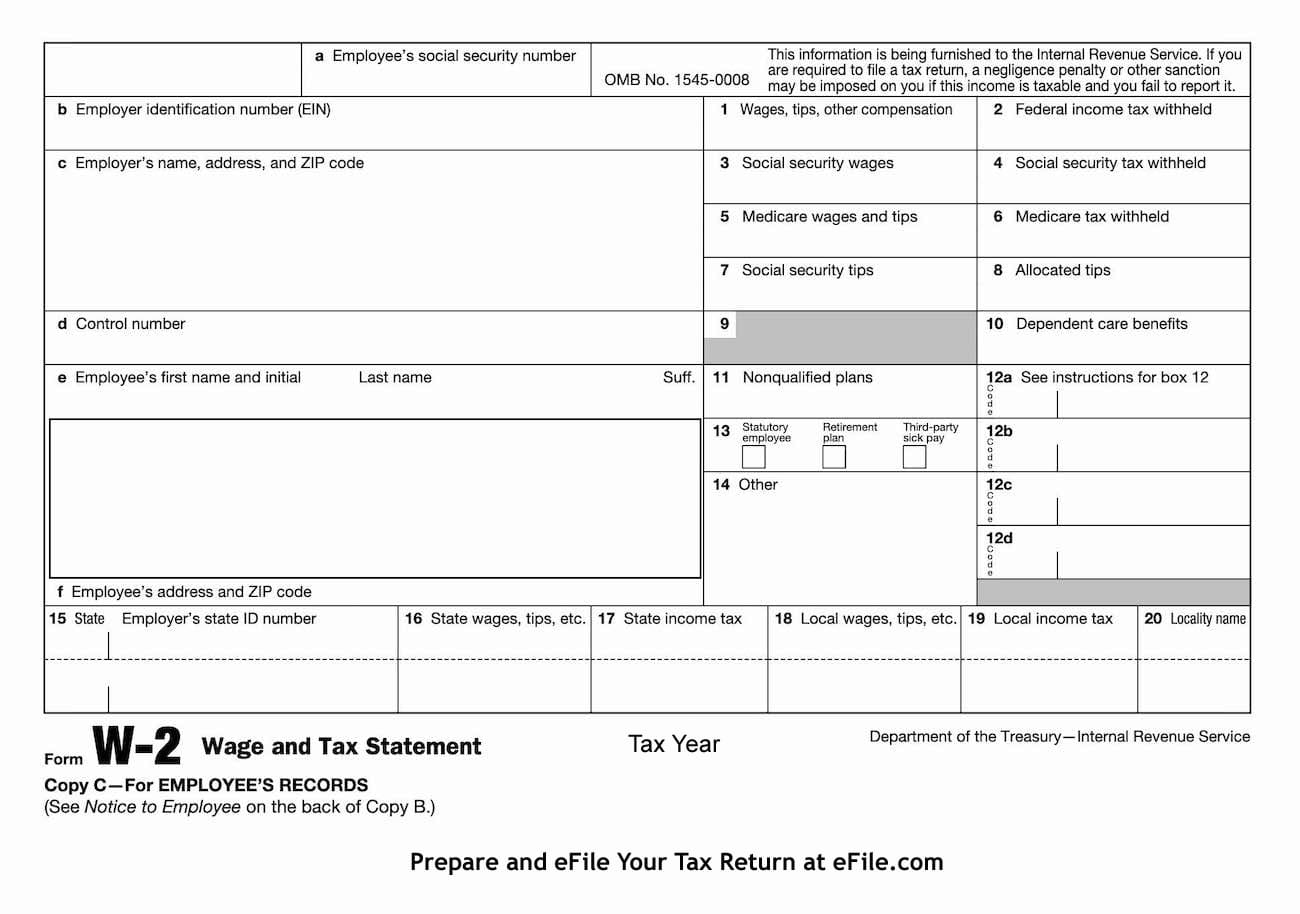

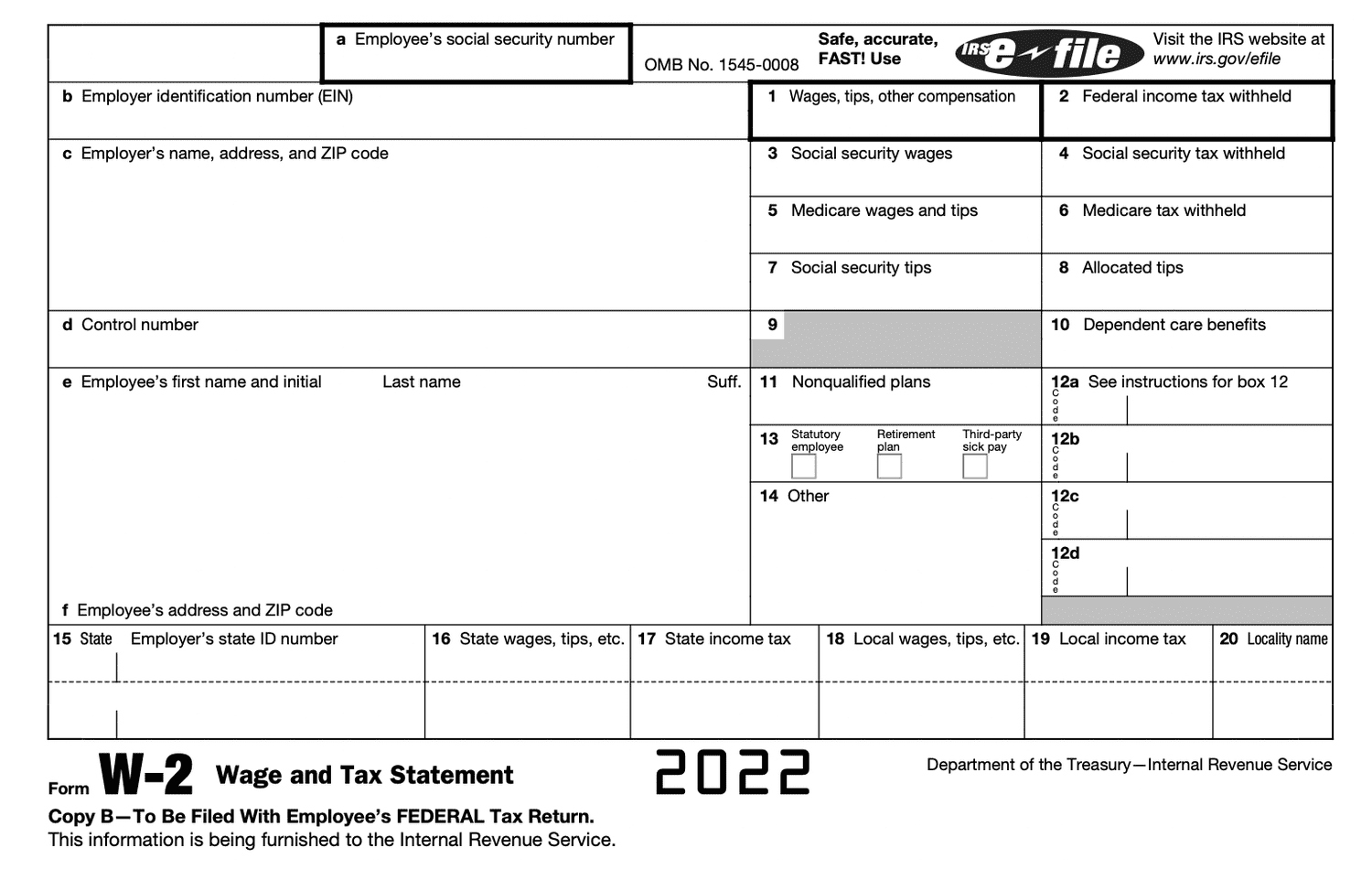

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Tax Time Troubles: Can Your Ex-Employer Hog Your W2?

Are you anxiously waiting for your W2 form from your former employer so you can file your taxes on time? It can be frustrating when your ex-boss seems to be dragging their feet on sending you this important document. But can they actually keep your W2 from you? Let’s dive into this common tax time dilemma.

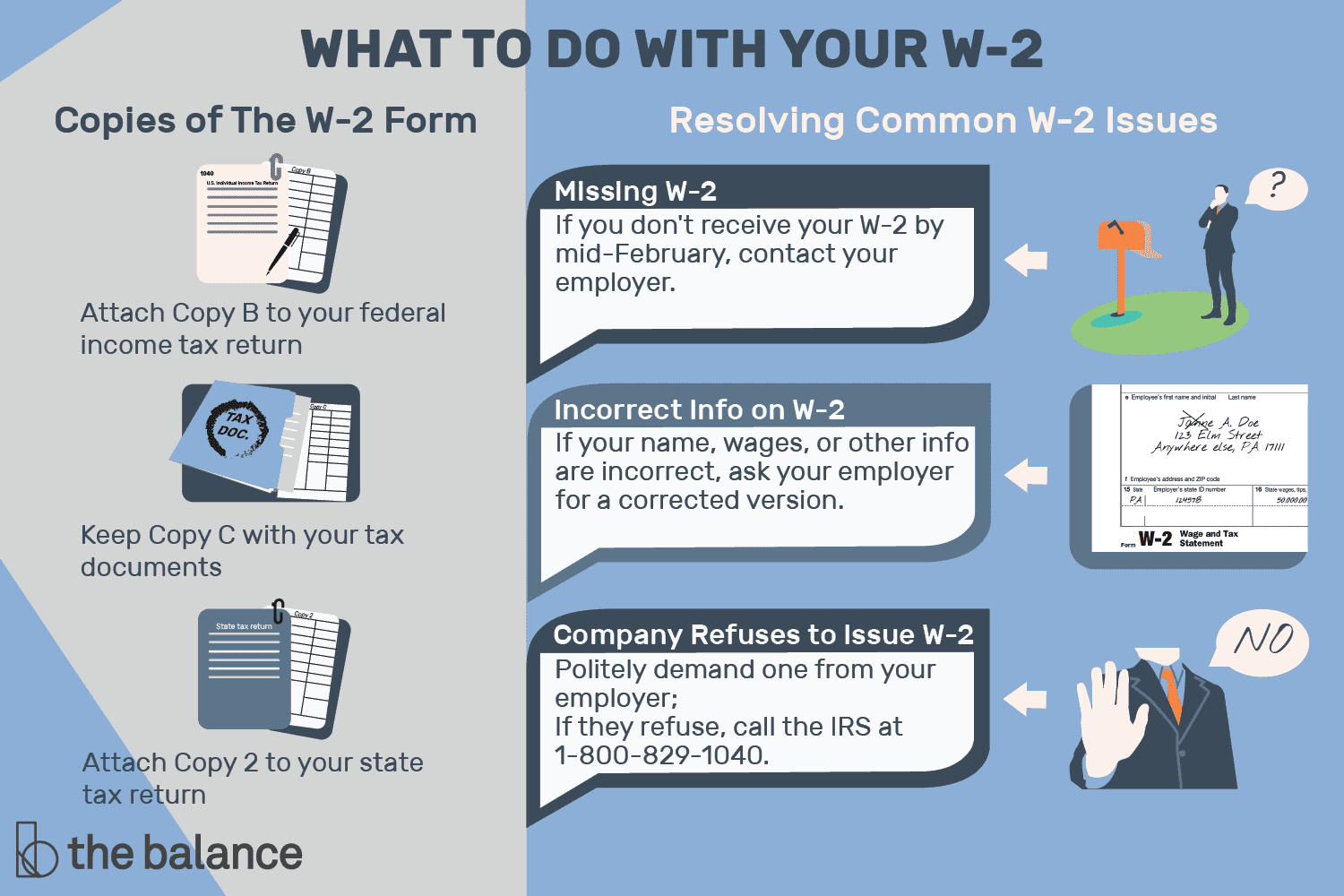

If you’re no longer working for a company, your ex-employer is legally required to provide you with your W2 form by January 31st. This form details your earnings and taxes withheld during the previous year, crucial information for filing your taxes accurately. So if your former boss is holding onto your W2, they could be breaking the law and causing you unnecessary stress during tax season. But fear not, there are steps you can take to ensure you receive your tax documents in a timely manner.

It’s important to know your rights when it comes to your tax documents. If your ex-boss is refusing to provide you with your W2, you can first try reaching out to them directly to request the form. If they continue to withhold it, you can contact the IRS for assistance. The IRS can send a letter to your former employer reminding them of their legal obligation to provide you with your W2. Remember, your tax documents belong to you, and you have the right to access them to fulfill your tax obligations without unnecessary delays. Don’t let your ex-employer hold your tax docs hostage – take action to ensure you receive them promptly.

Know Your Rights: Don’t Let Your Boss Hold Your Tax Docs Hostage

As tax season approaches, it’s essential to be aware of your rights regarding your tax documents. Your W2 form is a crucial piece of information needed to accurately file your taxes, and your ex-employer is obligated to provide it to you in a timely manner. If you find yourself in a situation where your former boss is withholding your W2, don’t panic. Knowing your rights and taking appropriate steps can help you resolve this issue and file your taxes without any unnecessary delays.

One way to prevent your ex-employer from keeping your tax docs hostage is to ensure you have updated contact information on file with them. Make sure they have your current address and contact details so they can easily send you your tax documents. Additionally, it’s a good idea to follow up with your former employer if you haven’t received your W2 by the end of January. Politely remind them of their legal obligation to provide you with this important form and request it promptly. By staying informed and proactive, you can avoid any potential delays or complications in filing your taxes.

In conclusion, don’t let tax time troubles with your ex-boss dampen your spirits. Remember that you have the right to access your tax documents, including your W2 form, and take action if necessary to ensure you receive them on time. Stay informed, be proactive, and don’t hesitate to reach out to the IRS for assistance if needed. With a little knowledge and persistence, you can navigate this tax season with confidence and peace of mind. Happy filing!

Below are some images related to Can A Former Employer Withhold Your W2

can a employer withhold your paycheck, can a former employer hold your last paycheck, can a former employer withhold your w2, can a payroll company withhold your w2, can a previous employer hold your w2, , Can A Former Employer Withhold Your W2.

can a employer withhold your paycheck, can a former employer hold your last paycheck, can a former employer withhold your w2, can a payroll company withhold your w2, can a previous employer hold your w2, , Can A Former Employer Withhold Your W2.