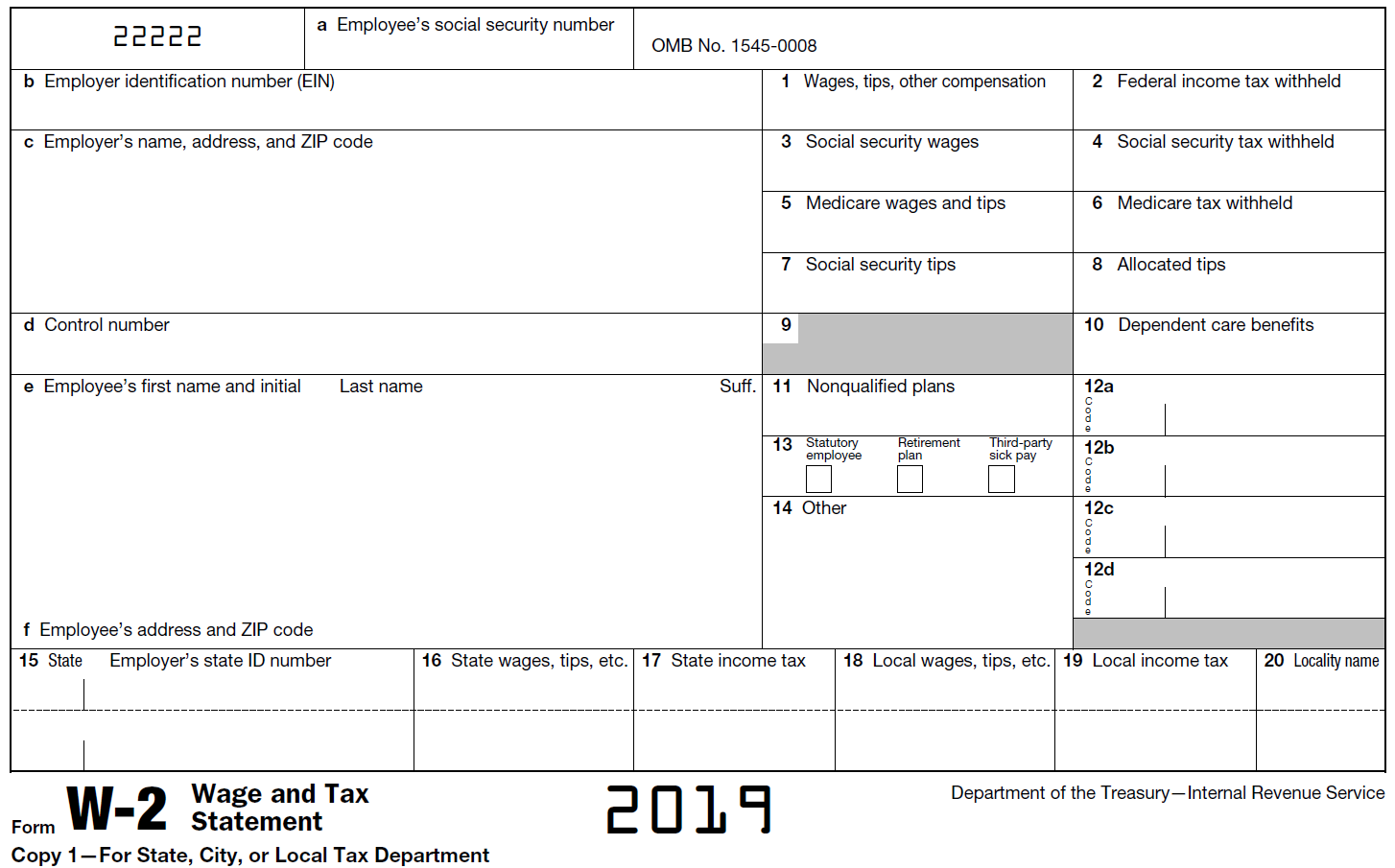

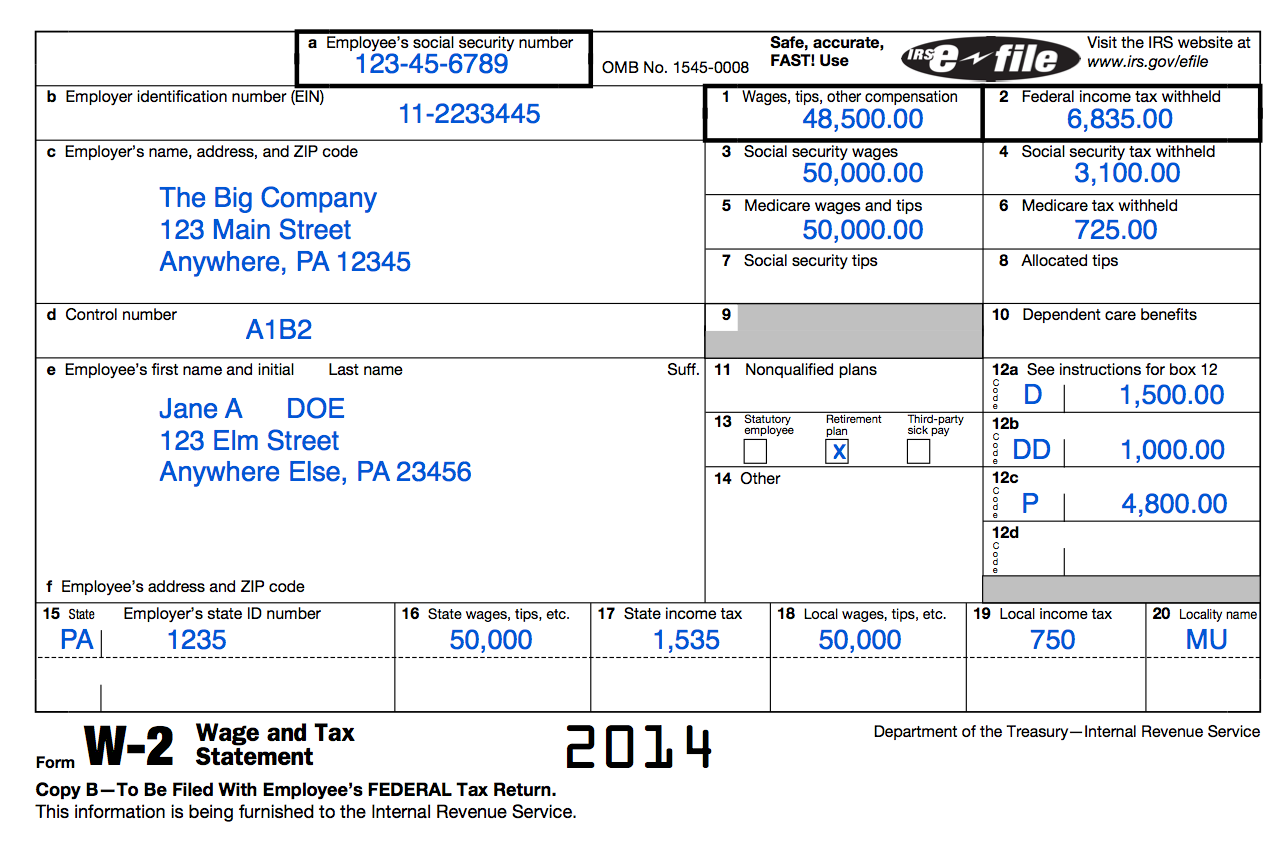

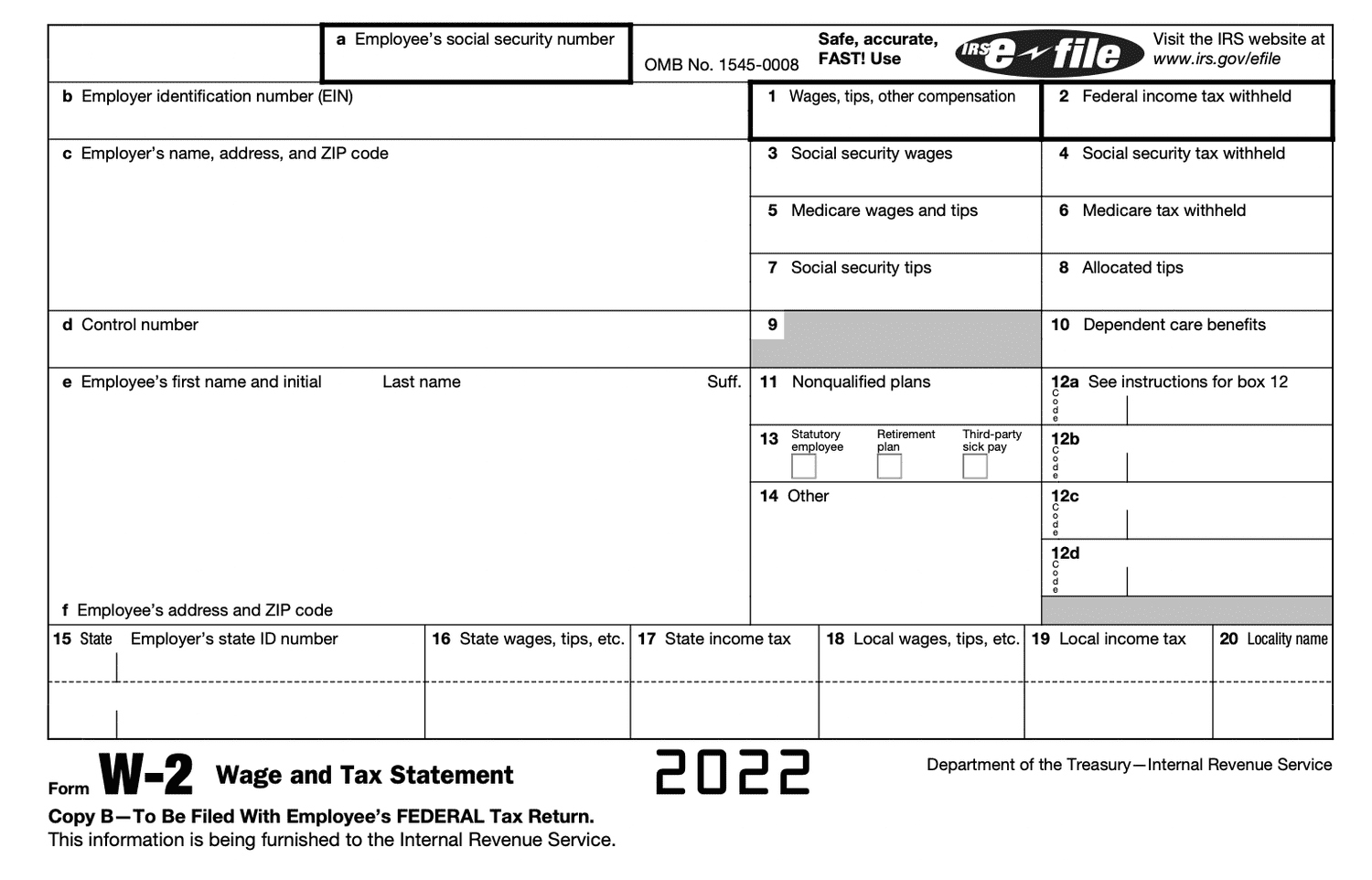

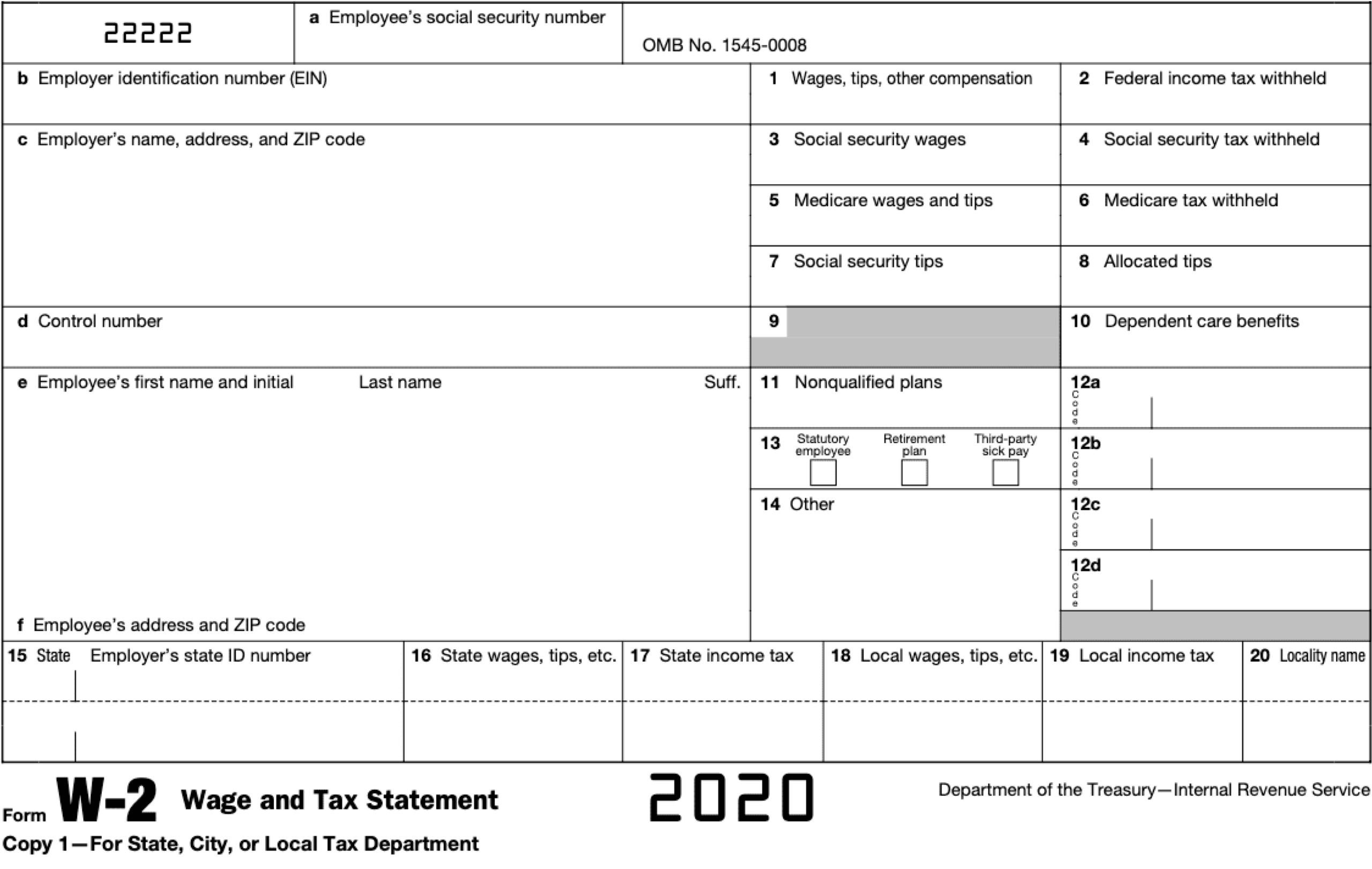

Box 1 On W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Decoding Box 1: Your Gateway to Tax Refunds!

Are you ready to unlock the secrets of Box 1 on your tax forms? This seemingly mysterious box holds the key to maximizing your tax refunds and getting the most out of your hard-earned money. By understanding how to decode Box 1, you can take control of your finances and ensure you receive the refund you deserve. So let’s dive in and unravel the magic behind Box 1!

Unveiling the Mystery: Box 1 and Your Tax Refunds!

Box 1 on your tax forms may seem like just a random number, but it actually represents the total amount of wages, tips, and other compensation that you’ve earned throughout the year. This number is crucial in determining your tax liability and ultimately, your tax refund. By carefully reviewing the information in Box 1 and ensuring its accuracy, you can ensure that you’re not missing out on any potential refunds.

But how exactly does Box 1 impact your tax refunds? The higher the number in Box 1, the more taxes have been withheld from your paycheck throughout the year. This means that you may be eligible for a larger refund when you file your taxes. By understanding how Box 1 influences your refund amount, you can take steps to maximize your refund and make the most of your money.

Crack the Code: How to Maximize Your Tax Refunds with Box 1!

To make the most of Box 1 and increase your chances of a larger tax refund, it’s important to keep track of any deductions and credits that you may be eligible for. By reducing your taxable income through deductions such as student loan interest, mortgage interest, or charitable contributions, you can lower the amount of taxes you owe and potentially increase your refund amount. Additionally, staying informed about any tax credits available to you, such as the Earned Income Tax Credit or the Child Tax Credit, can further boost your refund.

Another key strategy for maximizing your tax refunds is to file your taxes accurately and on time. By double-checking the information in Box 1 and ensuring that all your deductions and credits are properly claimed, you can avoid any potential errors that may delay your refund. Additionally, filing your taxes early can help you get your refund sooner and avoid the last-minute rush. By following these tips and cracking the code of Box 1, you can take control of your tax refunds and make the most of your money.

In conclusion, Box 1 on your tax forms may hold the key to unlocking a larger tax refund and maximizing your financial success. By understanding how to decode Box 1 and taking advantage of deductions and credits, you can ensure that you’re getting the refund you deserve. So don’t let Box 1 remain a mystery any longer – empower yourself with knowledge and take control of your tax refunds today!

Below are some images related to Box 1 On W2 Form

box 1 on w2 form, does box 1 on w2 include taxes, how does quickbooks calculate box 1 on the w-2 form, how to get box 1 on w2, what does box 1 on w2 represent, , Box 1 On W2 Form.

box 1 on w2 form, does box 1 on w2 include taxes, how does quickbooks calculate box 1 on the w-2 form, how to get box 1 on w2, what does box 1 on w2 represent, , Box 1 On W2 Form.