Allowances On W2 Form – The W-2 form, officially known as the “Wage and Tax Statement,” is a document that employers in the United States are required to send to each of their employees and the Internal Revenue Service (IRS) at the end of each year. It reports the employee’s annual wages and the amount of taxes withheld from their paycheck. The information on the W-2 form is used by employees to prepare their annual tax returns.

The W-2 form includes information such as:

- The employee’s Social Security Number (SSN) and personal details.

- The employer’s identification number (EIN) and address.

- The total wages, tips, and other compensation paid to the employee during the tax year.

- The amount of federal income tax withheld.

- Social Security and Medicare wages and taxes withheld.

- Contributions to retirement plans, and other benefits and deductions.

Employees typically receive their W-2 form by the end of January of the following year, giving them ample time to file their income tax returns by the April 15 deadline. If an employee does not receive their W-2, they should contact their employer or the IRS for assistance.

DOWNLOAD HERE: ALL VERSION IRS W-2 FORMS.

RELATED FORM…

Unlock Your Financial Freedom: Maximizing Allowances on Your W2!

Are you tired of living paycheck to paycheck? Do you want to take control of your finances and finally achieve financial freedom? Well, it’s time to say goodbye to money stress and start maximizing your W2 allowances today! By learning how to properly adjust your W2 allowances, you can keep more money in your pocket each month and start working towards your financial goals.

Say Goodbye to Money Stress!

Imagine a life where you no longer have to worry about paying your bills or making ends meet. By maximizing your W2 allowances, you can take a huge step towards achieving that financial freedom. With a few simple adjustments, you can increase your take-home pay and have more flexibility in your budget. Say goodbye to money stress and hello to a brighter financial future!

Not sure where to start? Don’t worry, we’ve got you covered! By understanding the ins and outs of your W2 allowances, you can make informed decisions that will benefit your financial well-being. Whether you’re saving for a big purchase, building an emergency fund, or planning for retirement, maximizing your W2 allowances can help you reach your goals faster and with less stress. Take the first step towards financial freedom today!

Learn How to Maximize Your W2 Allowances Today!

It’s time to take control of your finances and unlock your full potential. Learning how to maximize your W2 allowances is a key step towards achieving financial freedom. By adjusting your allowances to reflect your financial situation accurately, you can ensure that you’re not overpaying in taxes and keeping more of your hard-earned money. Don’t let money stress hold you back any longer – start maximizing your W2 allowances today and pave the way towards a brighter financial future!

Ready to take the next step towards financial freedom? Reach out to a financial advisor or tax professional for guidance on maximizing your W2 allowances. With their expertise and support, you can make the most of your allowances and set yourself up for success. Say goodbye to money stress and hello to a brighter financial future – start maximizing your W2 allowances today and unlock your financial freedom!

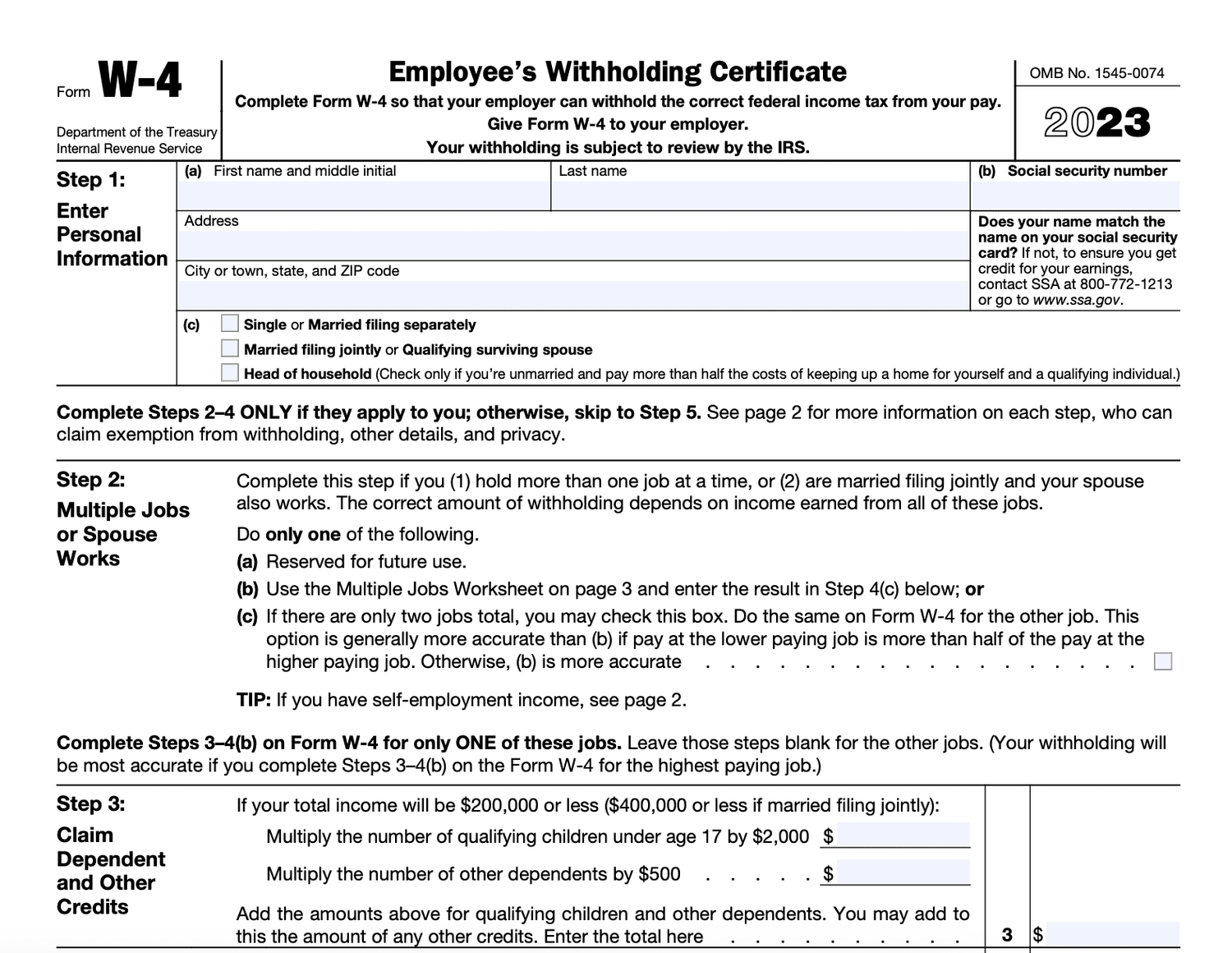

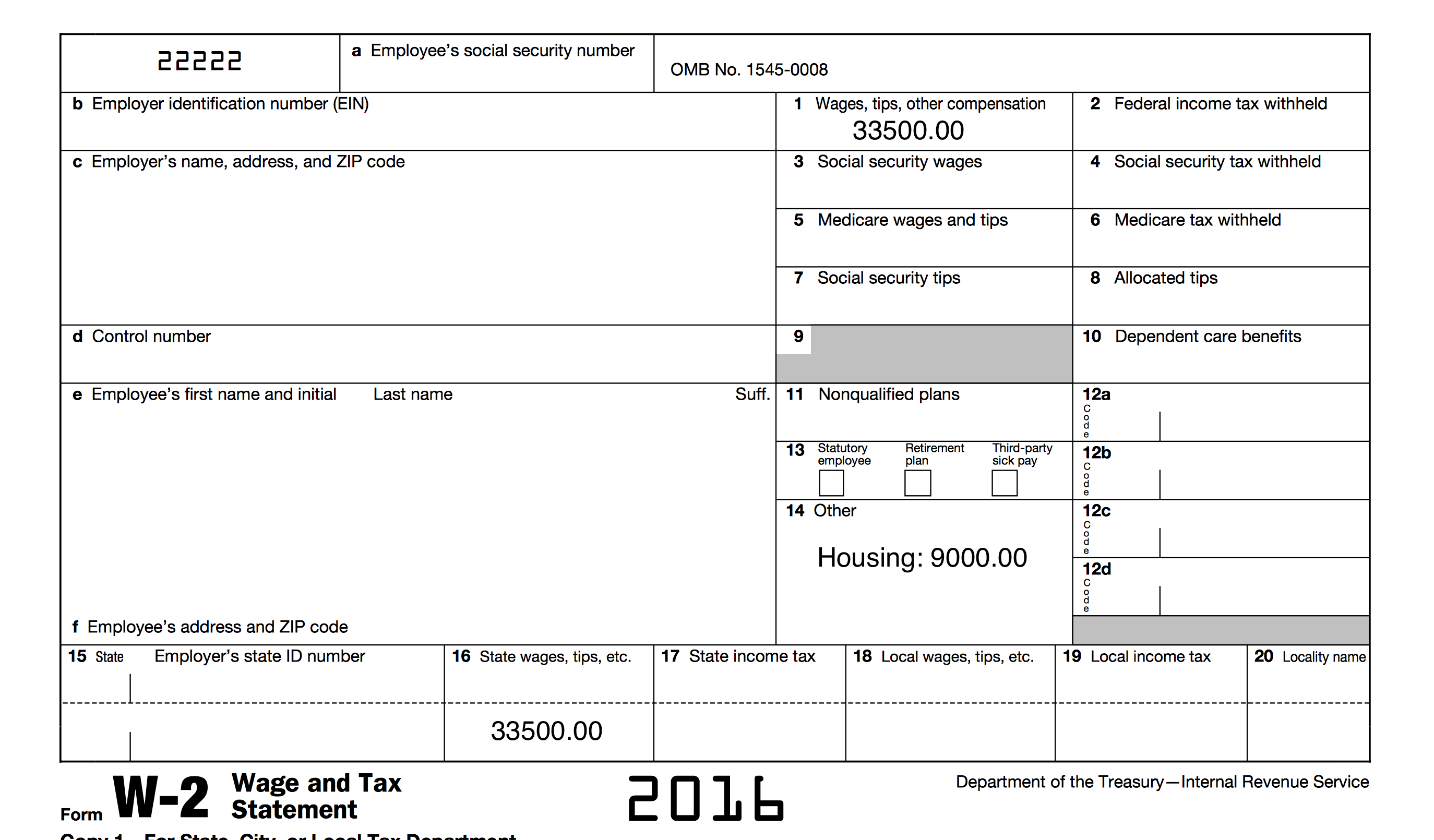

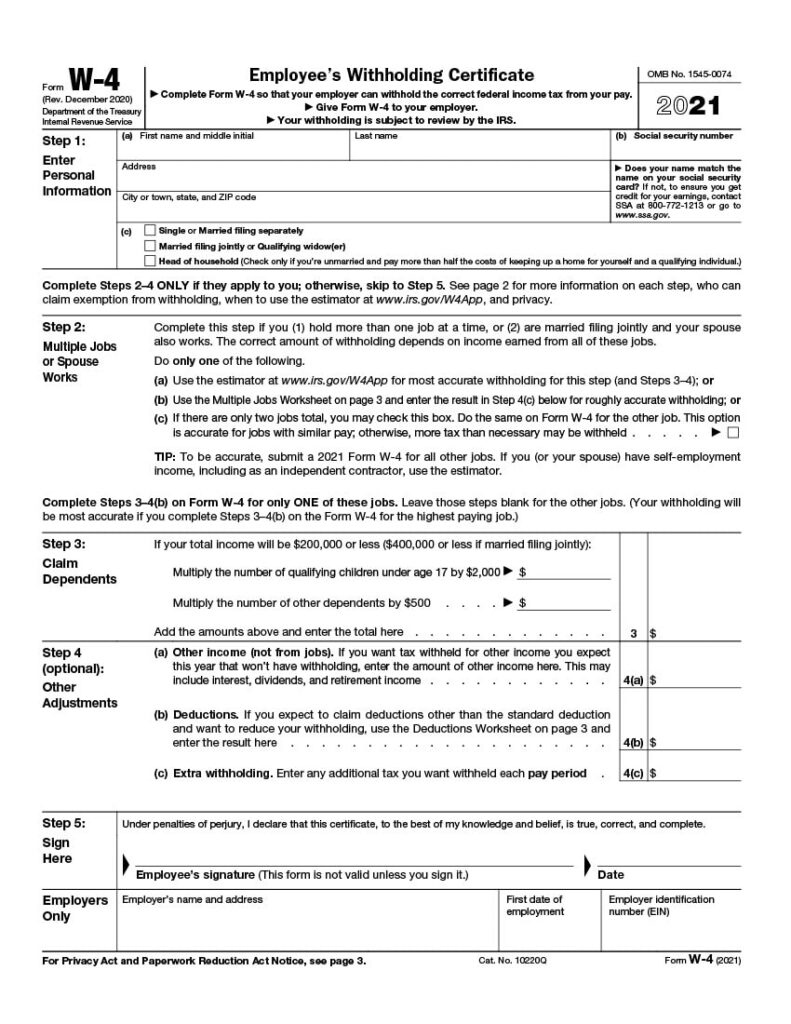

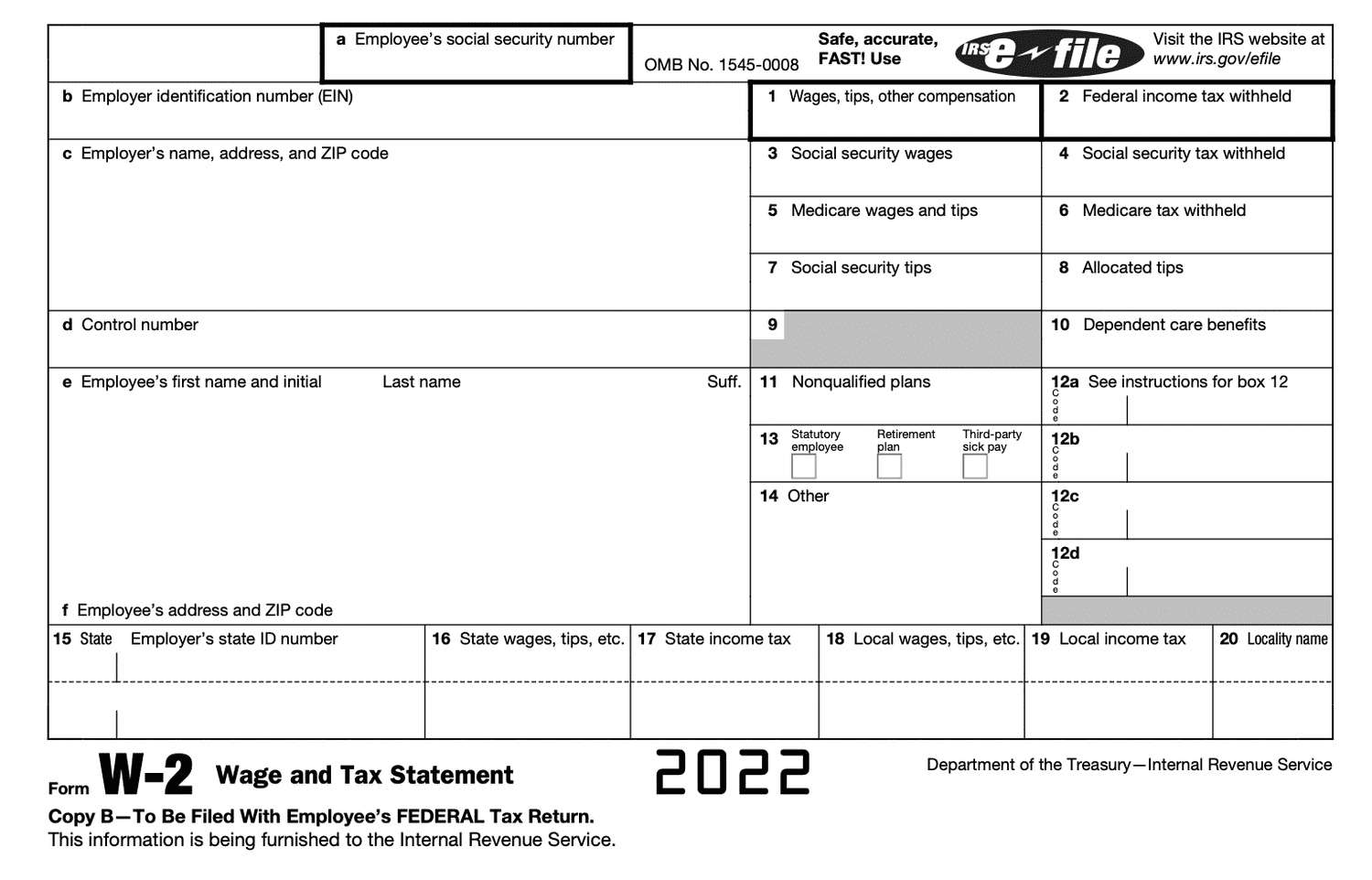

Below are some images related to Allowances On W2 Form

2 allowances on w2, allowances on w2 form, tax exemptions on w2 form, what are allowances on w2, what do i put for allowances on my w2, , Allowances On W2 Form.

2 allowances on w2, allowances on w2 form, tax exemptions on w2 form, what are allowances on w2, what do i put for allowances on my w2, , Allowances On W2 Form.